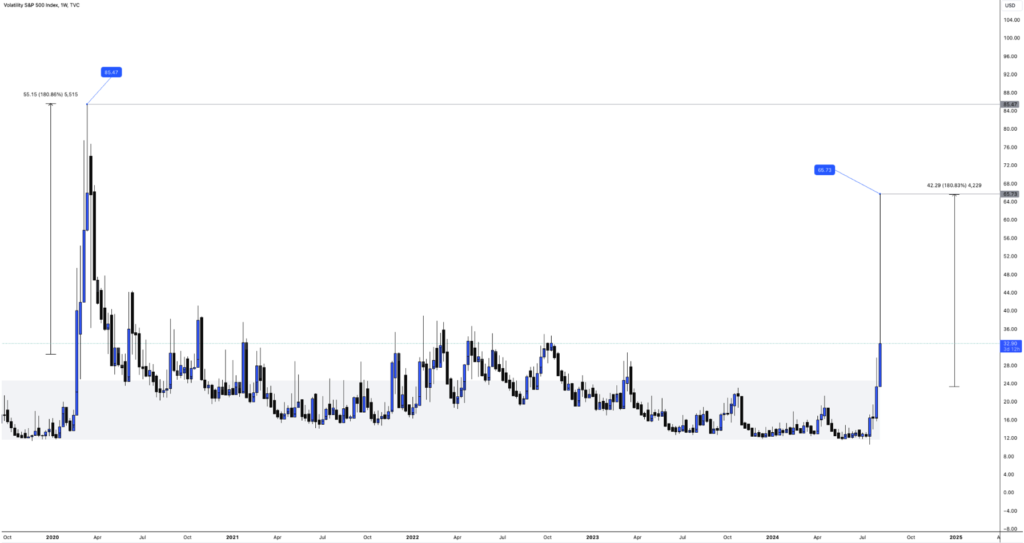

Early Monday morning during the Asian market session, the Volatility Index (VIX) surged to 65.73%. The last time the market experienced such high volatility was in 2020 during the COVID-19 pandemic when volatility peaked at 85.47%. This spike came amid fears that the Federal Reserve had delayed too long in cutting interest rates, having recently left them unchanged. Consequently, investors are speculating that a global recession might be imminent.

Early Tuesday morning, we have already seen the VIX normalise to levels similar to those of the previous week, currently at 32.92%.

So what actually happened, and how did everything unravel so quickly?

In the recent market research report, we highlighted three key interest rate decisions from last week by the FED, BoE, and BoJ, as well as the NFP jobs data results. The FED maintained interest rates at 5.5%, while the BoE cut rates to 5%. However, the pivotal move was the BoJ hiking rates from 0.1% to 0.25%, marking only the second increase in 17 years. This, coupled with the lower-than-expected NFP data, 176,000 jobs forecasted versus 114,000 actual jobs created led to one of the biggest panic sell-offs in recent years as carry trade investors unwound their positions.

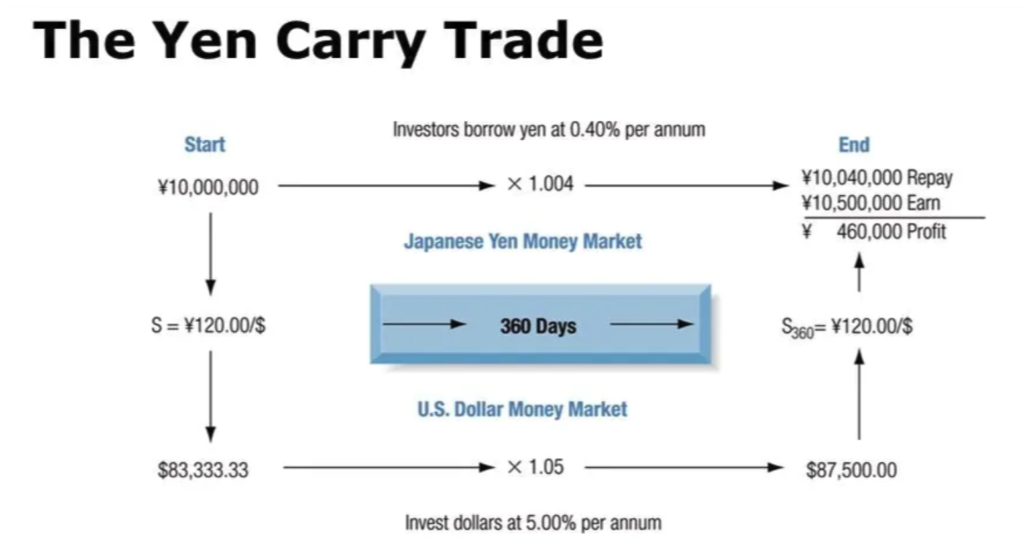

The Carry Trade explained:

Due to the FED keeping interest rates flat at 5% and the BoJ hiking rates to 0.25%, the Yen (JPY) strengthened significantly against the Dollar (USD). For the first time this year, USD/JPY fell below 151.00, reaching a low of 141.684, a decline of just over 5%. This strengthening resulted from traders aggressively unwinding their carry trades. Carry trades involve investors borrowing money from economies with lower interest rates, such as Japan (0.25%) compared to the U.S. (5%), and using this cheaper debt to fund investments in higher-yielding assets elsewhere.

When the BoJ hiked rates and the FED kept rates flat, it triggered a major sell-off early Monday morning in Japanese equities as investors involved in carry trade deals would have to sell off any global investments to repay higher debt repayment terms.. The Japanese Nikkei 225 (NIKKEI) saw a decline of over 18%, the biggest drop in the index since 1987, as investors realised their carry trades were no longer as attractive. This led to a panic sell-off across all asset classes.

Japanese Nikkei 225 (NIKKEI):

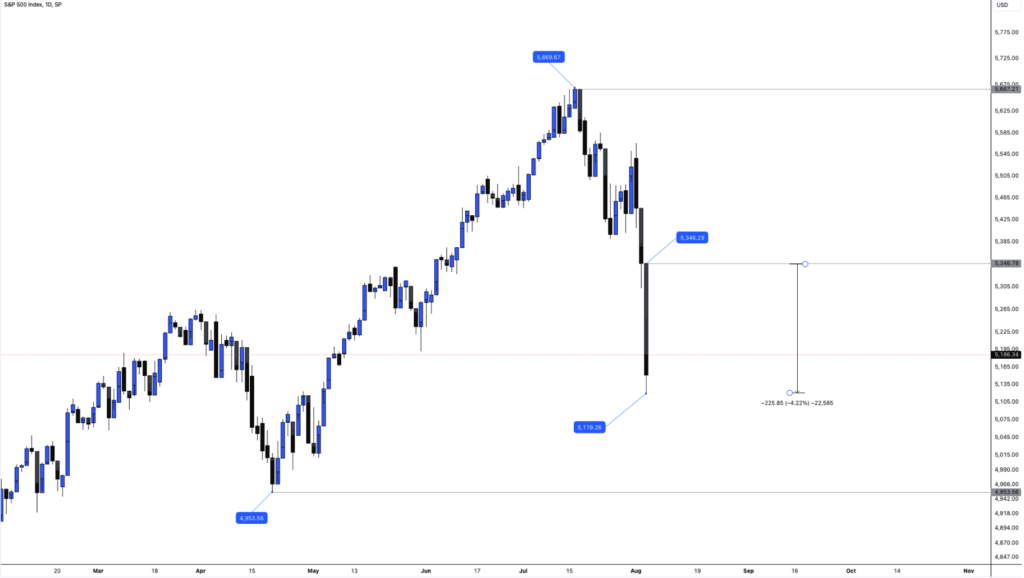

Other notable indices wiping out gains made this year:

NASDAQ: Down over 5%

S&P 500: Down over 4%

Cryptocurrencies bore the brunt of the panic sell-off:

BITCOIN: Down as low as 14.5%

ETHEREUM: Down as low as 21%

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.