- SEC delays BlackRock’s Ethereum ETF decision, showing caution in evaluating Ethereum Exchange Traded Fund proposals.

- Fidelity’s Ethereum ETF application is also delayed, indicating a careful regulatory approach.

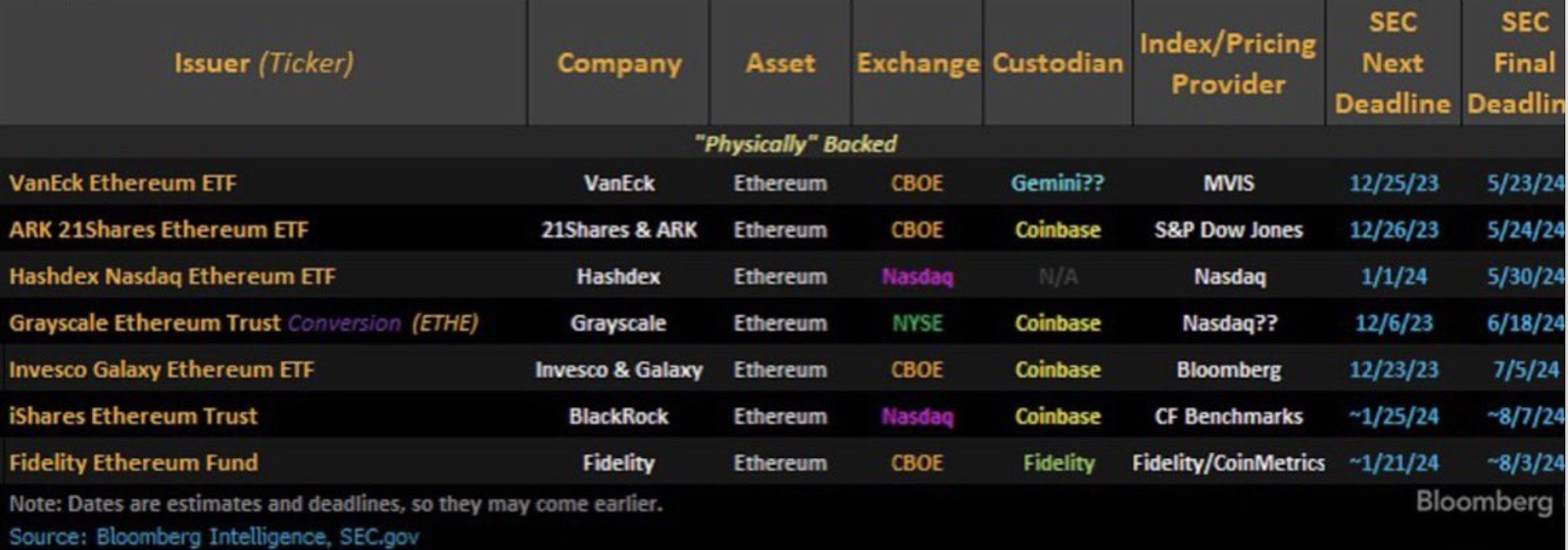

- Potential delays in spot Ethereum ETF approval may extend to May 23, with a final deadline for BlackRock’s application on August 7.

- SEC’s cautious stance persists, despite optimism following the approval of a spot Bitcoin ETF.

Hot on the heels of the spot-Bitcoin ETF approval, attention is turning to a spot-Ethereum ETF as the Securities and Exchange Commission (SEC) evaluates Ethereum Exchange Traded Fund proposals from Blackrock, Ark Invest, Fidelity, and VanEck. While there is optimism that the SEC will follow the precedent set with the spot Bitcoin ETF, the regulator is showing that it will proceed very cautiously, extending deadlines.

SEC delays Blackrock ETH ETF

In November 2023, Blackrock applied to convert its Ethereum Trust into an ETF called iShare Ethereum Trust. On Wednesday, January 24, the SEC delayed its decision on Blackrock’s proposed spot Ethereum ETF, saying it wants more time to consider the proposal. According to last week’s filing:

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.”

This delay marks the first of several delays the regulator can impose before announcing a final decision on the spot-ETH EFT, which must come within 240 days of the SEC opening comments on the applications. The next deadline is March 10, when the SEC may approve, disapprove, or delay proceedings further.

The move came after the SEC also delayed Fidelity’s application for the Fidelity Ethereum Fund last week, and the Grayscale’s application highlighted the cautious approach the SEC is taking.

Dates to watch for ETH-ETF approval

There is a good chance that the SEC will continue to delay the ETH-ETF approval, with the final decision possibly coming on May 23. This is the earliest final deadline when the SEC could approve all ETH-ETF applications at once in a similar way that it did with the BTC-ETF approving all applications once. However, the SEC has until August 7 to reach a final verdict on Blackrock’s application.

Spot Ethereum ETFs have been getting increasing attention following the spot-Bitcoin ETF approval, where Blackrock and Fidelity are the top-performing ETFs. Following the approval earlier this month, ETH/USD outperformed BTC/USD, rising over 10% on January 10, on optimism that it could be next in line. Although it has since pared those gains.

If approved, the Ethereum ETF would give an institutional and retail investor exposure to the world’s second-largest cryptocurrency market by market capitalization. The approval could also signal improved regulatory standards in the US.

Not a done deal

However, this is by no means a done deal, and there are still some doubts over the approval of a spot-ETH ETF after the SEC Chair Gary Genseler played down the likelihood of the approval. He was clear that the approval of Bitcoin’s ETF was not an endorsement of crypto assets.

“As I said two weeks ago, that which we did with regard to bitcoin exchange-traded products is cabined to this one commodity non-security and shouldn’t be read to be anything other than that.”

The SEC can sometimes behave in an unpredictable way, which can make forecasting a decision outcome challenging. However, the decision could still be helped by the BTC-ETF precedent.

Sources

Saini, M. (2024, January 25). US SEC delays decision on Grayscale, BlackRock’s spot Ethereum ETFs. Reuters. https://www.reuters.com/technology/us-sec-delays-decision-grayscale-blackrocks-spot-ethereum-etfs-2024-01-25/

Kaplan, T. (2024, January 25). SEC pushes back BlackRock’s spot ether ETF decision: CNBC Crypto World. CNBC. https://www.cnbc.com/video/2024/01/25/sec-pushes-back-blackrock-spot-ether-etf-decision-cnbc-crypto-world.html

Abidemi, G. (2024, January 25). BlackRock Ethereum ETF Joins the Wait as SEC Delays Decision. Dailycoin. https://dailycoin.com/blackrock-ethereum-etf-joins-the-wait-as-sec-delays-decision/

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.