Earlier this week, the Bank of Japan (BoJ) announced that it would pause further interest rate hikes during such heightened market volatility periods. This decision brought optimism into the markets, prompting a strong rebound across global markets. As a result, many were able to recover most of the losses suffered during Black Monday, when a broad sell-off wiped out much of the gains accumulated earlier in the year.

The BoJ has become a focal point of criticism this week as everyone looked to point fingers at them on Monday after the significant drop in prices across all markets. The BoJ signalling that they will no longer hike interest rates further this year suggested that there were further external pressures to make an announcement of sorts to protect the Carry Trade, which many traders have become greatly fond of recently.

This announcement brought great strength back to the Dollar, where we saw price reject 102.358, a key area that was marked out in the market research report sent through earlier this week.

DOLLAR (DXY):

The dollar’s renewed strength also led to a resurgence in weakness against the Yen (USDJPY). During this period, we saw price sweep liquidity at the lows of 146.484, having previously dipped as low as 141.684. It then rebounded to a high of 147.250, marking an almost 4% increase in just a few days.

DOLLAR VERSUS YEN (USDJPY):

The Volatility Index (VIX) has also stabilised, returning to its previous weekly levels and currently resting at 23%. This suggests that the reaction to Black Monday may have been an overreaction to the previous week’s NFP data release miss.

THE VOLATILITY INDEX (VIX):

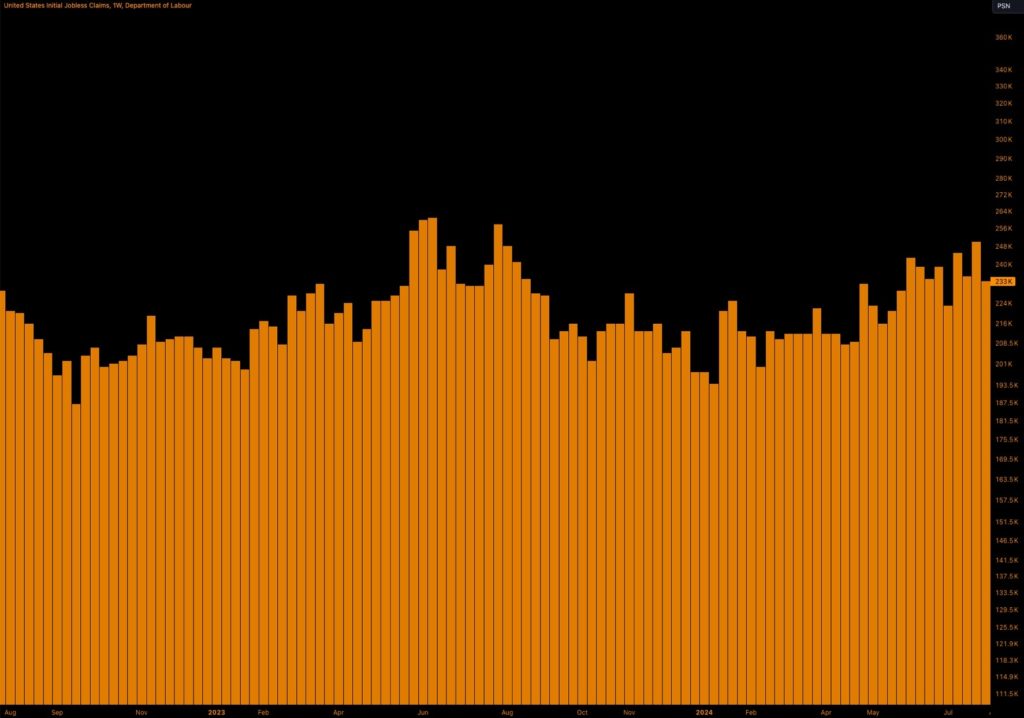

Yesterday provided further evidence that the stock market sell-off earlier this week was indeed somewhat of an overreaction. New data revealed that jobless claims were lower than expected. The primary cause of Monday’s market crash was last Friday’s concerning US unemployment figures, which had fueled widespread fears of a potential recession.

Jobless Claims data results release brings calmness to global markets

According to the latest Labour Department report, initial jobless claims for state unemployment benefits fell by 17,000 this was a crucial data point that the market had been eagerly anticipating this week. Expectations were especially high because the Federal Reserve had yet to respond to last week’s miss in Non-Farm Payroll (NFP) data. Economists had forecasted the claims to decrease to 233,000 from the previous month’s 249,000, marking the largest decline in the past 11 months. However, the data release suggests that the job market in the U.S. is not as weak as previously feared, and that concerns about the labour market unravelling were overstated.

JOBLESS CLAIMS DATA:

Yesterday’s release of jobless claims data appears to have eased concerns, leading to some notable market moves. Following the release, the S&P 500 surged nearly 2% by the end of the day.

S&P500 (SPX):

Rebounds just over 3.5% since the lows of Monday morning

NASDAQ (NDX):

Bounces back, over 5% gain since the lows early Monday morning

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.