- SEC approved Spot BTC ETF on Thursday, 11th January

- Most ETFs saw significant inflows in the first week

- Grayscale Bitcoin ETF experienced a fall in Assets Under Management

- Fed rate cut bets have been pushed back

- BTC/USD fell 10% but could rise longer-term

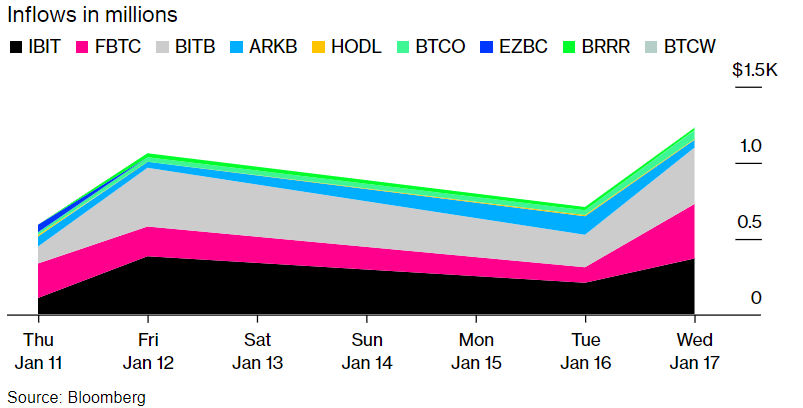

The US Securities and Exchange regulator approved spot Bitcoin ETF just over a week ago. Since then, flows into spot Bitcoin ETFs have risen to over $3 billion while BTC/USD dropped close to 10% from the approval date to the end of last week in what appears to have been a buy the rumour sell the news event.

How have spot BTC ETFs performed so far?

The spot ETFs have set off to a strong start, with the newly launched funds seeing significantly higher inflows than most new ETF offerings.

Blackrock’s iShare Bitcoin Trust (IBIT) received $1 billion in investor inflows in the first week, while Fidelity Investment’s Bitcoin Fund (FBTC) saw $880 million. The two firms have seen 68% of all inflows across the nine news ETFs.

Meanwhile, the Grayscale Bitcoin fund has seen heavy outflows since it started trading as an ETF. However, these outflows were anticipated as the SEC’s approval allowed GBTC holders, who had bought into the fund with a significant discount to Net Asset Value (NAV), to convert and redeem their shares for Bitcoins at a profit. Funds under management at GBTC went from $28.6 billion just before approval to $23.7 billion one week later, putting pressure on BTC/USD.

The real success of spot BTC ETF will be more apparent in the coming months. For now, pent-up demand and euphoria have driven strong inflows into these ETFs. What happens next will be more telling. A continued steady rise in AUM could add to the sector’s legitimacy.

What does this mean for the Bitcoin price?

The approval of Bitcoin ETFs by the SEC could be a huge validation moment for the cryptocurrency, boosting its legitimacy within the financial system. This should, in turn, help to lift confidence in Bitcoin, raising the price over the longer term.

However, the initial price reaction was not bullish and was instead a correction that sent Bitcoin to its lowest price since December 18, 2023.

It’s important to put this price reaction into context, as the selloff has come after Bitcoin surged 157% last year in anticipation of the launch of spot Bitcoin ETFs. After such an impressive run-up, it’s not unusual for Bitcoin to see a correction and some profit-taking. Furthermore, the fall of 2.3% so far this year is minimal compared to 2023’s gains.

Away from the ETF approval narrative, the USD also strengthened last week after solid data saw the market dial back Federal Reserve rate cut bets. A stronger USD can pull BTC/USD lower.

BTC/USD forecast

Despite near-term profit-taking and pressure from a stronger USD, the spot-ETF approval is expected to be a bullish driver for BTC/USD in the longer term. That said, the $50,000 level will likely be a formidable barrier

Despite near-term profit-taking and pressure from a stronger USD, the spot-ETF approval is expected to be a bullish driver for the BTC/USD longer term prognosis. That said, the $50,000 level will likely be a formidable barrier.

Sources

- Nicholson-Messmer, E. N.-M., & Greifeld, K. (2024, January 18). Bloomberg – BlackRock’s Bitcoin ETF Is First to Cross $1 Billion Threshold in Inflows. https://www.bloomberg.com/news/articles/2024-01-18/blackrock-s-bitcoin-etf-is-first-to-cross-1-billion-threshold

- SEC.gov | Statement on the Approval of Spot Bitcoin Exchange-Traded Products. (2024, January 10). https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.