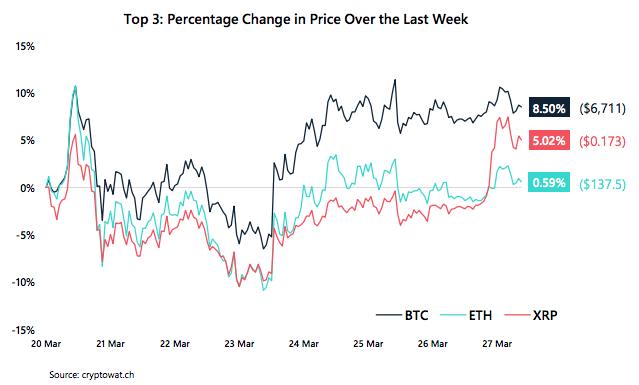

The price of Bitcoin has shown some fight this week as it has finished higher than it was this time last week, but the path to its 8.5 percent gains has been a rollercoaster one in seven days. Volatility is still extremely high for the recovering asset as it tries to decide which way it will be moving following its market collapse two weeks back.

The Covid-19 induced financial crisis is still wreaking havoc with the traditional markets but all this activity has spurred Bitcoin and other cryptocurrencies into a flurry of activity. Some altcoins have returned to the price they saw themselves sitting at before the bloodshed, but in general, Bitcoin is still top dog with its dominance growing once again.

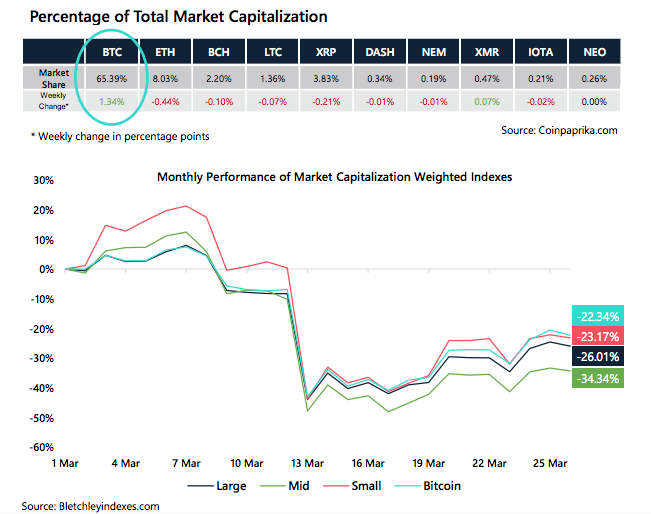

This has a lot to do with Bitcoin’s monthly performance in the market cap stakes as it outweighs small, mid, and large-cap altcoins despite the market being one racked with fear and the volume of the major coin dipping significantly.

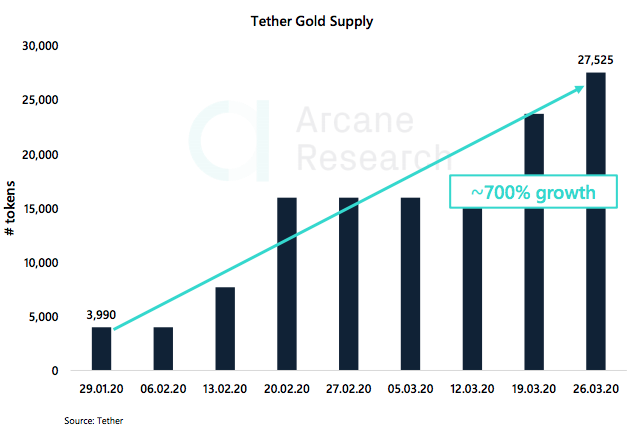

There is also a notable demand for commodity-backed gold tokens — such as Tether’s recently launched XAUT, with many understanding the important role that gold plays in times of a financial crisis. More so, there has been a boom for stablecoins as they were immune to the sickening drop the market felt two weeks ago.

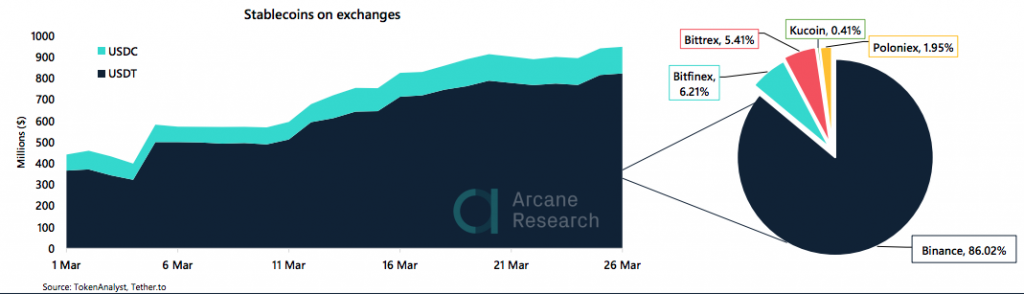

Exchanges have been continually adding newly minted stablecoins to the market to the tune of $1 billion. This is a 60 percent increase from the some $400 million in stablecoins that was available on the market at the beginning of March.

Bitcoin’s Rollercoaster Week

While Bitcoin finished the week eight percent better than it began it, the coin has struggled to decide where it should go. There have been instances where it lost double digits from its March 20 price — falling to a week low at the end of the 23rd of March, but two days later it was 10 percent better than it began, representing a 20 percent swing.

It has become clear that Bitcoin’s price bears a stronger correlation to the stock-market than previously thought — especially in times of financial uncertainty — and so when the stock market took a respite from its collapsing this week, the coin had a chance to rebound.

This, however, sets the cryptocurrency market up for an interesting few days as external factors need to be watched. If the stock market continues dropping as the Covid-19 virus maintains its spread, crypto could be in danger. But, if the economic stimulus program halts the drops — but devalues the dollar — Bitcoin could react favorably.

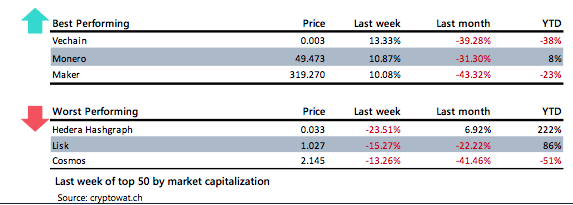

Apart from Bitcoin making steady, if not rocky, gains, there have been a few coins to point out who have recovered extraordinarily well since the market fall. Monero, for example, is up nearly 100 percent since the fall began, and 31 percent of those gains have come through this week. More so, VeChain is reacting to some positive news for the coin and is the second-best performing coin with a rise in just under 40 percent while Maker takes the cake with a huge 43 percent rise in price.

Despite the few odd coins posting impressive gains in the week, it has not helped the overall dominance of the altcoin market as Bitcoin has picked up a 1.34 percent increase in its market dominance, leaving it at 65 percent dominant. This increase in dominance also comes as Bitcoin becomes the best performing having ‘only lost’ 22 percent since March 1.

Small market cap coins are slightly behind with a 23 percent loss and then comes large market cap coins who are down 26 percent. It is the medium cap coins that are struggling the most with the backlash of the market collapse being grouped together with an aggregate loss of 34 percent.

Volume Dips As Volatility Rises

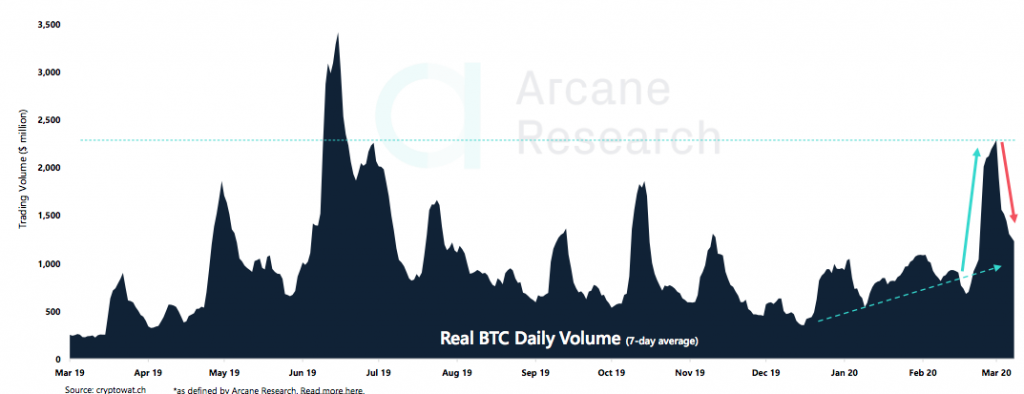

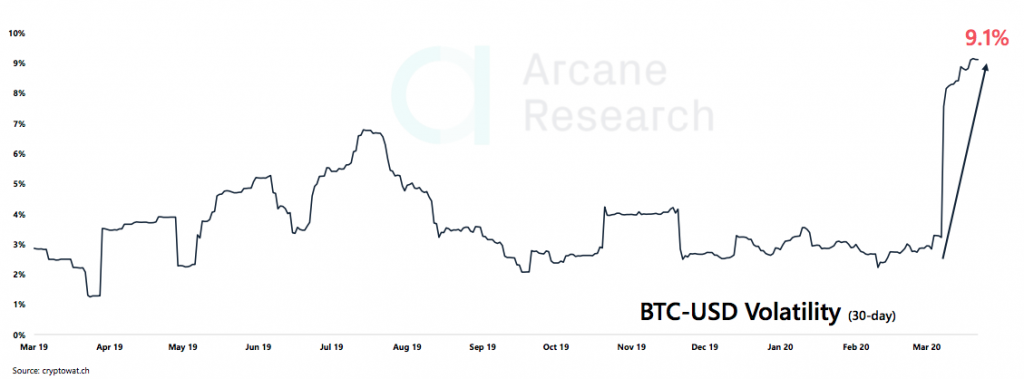

While the overall picture for the Bitcoin market appears to be a positive one, there are some concerning metrics worth highlighting. These pertain mostly to its volatility — which is at least in an upward trajectory, for now — as well as the volume.

Bitcoin’s volume is often seen as an important metric as it shows the coin is in use and active. However, the seven-day real trading volume has fallen back sharply after the last two weeks of heavy transacting — but mostly in regards to panic selling. Increasing prices but with a decreasing volume are usually warning signs of bad to come, but in general, the average is still at a higher point than seen earlier in 2020 when things looked promising.

Bitcoin’s volatility is famed, and part of the reason such an interest was taken in it by mainstream media. However, it has also often proved to be its undoing as many feel it is too volatile of an asset.

As things stand, Bitcoin’s volatility is helping it bounce back from a low of $3,800, but it is still concerning, although not out of place. With the current financial uncertainty and turmoil rocking the stock markets, Bitcoin’s volatility has climbed up above nine percent. This level has not been seen in the last 12 months with the highest before this coming in July last year where it just crossed six percent.

Growing Interest In Gold Tokens And Stablecoins

One part of the market which was not impacted negatively in any respect was the stablecoins. These coins, tied often to fiat currencies, such as the US dollar, managed to grow in value organically, in regards to their market cap.

More so, it was identified by a number of exchanges who have their own stablecoins that the injection of more stablecoin into the market can help prop up the entire ecosystem. This additional injection of stablecoins can even be likened to the Federal Reserve injecting and printing more cash to prop up the economy.

Many of the investors in the cryptocurrency market would have sought out stablecoins amid the market fall, and as such, the makers of these coins rushed to meet demand. Tether, one of the biggest producers of stablecoins, increased its store to $1 billion since March 12 making that an increase of 21 percent over the last two weeks.

In total, the stablecoin market has gone from around $400 million worth at the start of the match to top $1 billion. The majority of these coins can be found on Binance — as much as 86 percent, while Bitfinex and Bittrex pick up the next two spots.

If it wasn’t stablecoins that investors were looking into to mitigate the losses seen in the cryptocurrency market, it might have been gold — or at least gold tokens. Unsurprisingly, the demand for gold has grown in the past few weeks as people look towards the traditional safe-haven asset.

In terms of the mining of the precious metal, there have been issues there because of the stay at home orders affecting operations; there was even a shutdown in Switzerland that caused a dislocation between the spot price and the New York Price of gold as banks struggled to deliver the metal.

In addressing this demand, Tether, and its newly created gold-backed stable coin XAUT has seen its supply increase by nearly 700 percent after two months. It began with 4000 tokens and now has over 27,500. This represents a backing of $44.5 million worth of gold.

A Big Floor

Bitcoin is ending the week at a price level between $6,600 and $6,800 which has been a relatively safe spot for it a number of times this year, and it is a level that has offered good support in past times. However, this also shows that the coin is struggling to break past the important $7,000 mark which would indicate a much more bullish outlook.

But, in general, and with a little bit of a longer lens, the technical analysis for this week does not look all that different from last week despite the massively volatile last seven days. Bitcoin closed last week below the resistance level mentioned and is now testing this area once again.

Looking ahead to more bullish sentiment, there is not much positivity in predicting big moves for the coin in an upwards direction even with the Bitcoin halving mere months away. The probability of Bitcoin growing significantly, to a level of around $10,000 by June remains low — and even by extending the time period to September, there is not much more hope.

Looking at Options price, they show a 16 percent belief that Bitcoin will reach 10,000 by June and in terms of crossing the coin’s all-time high of $20,000 — the chances are nearly zero.

Mining Near the Halving

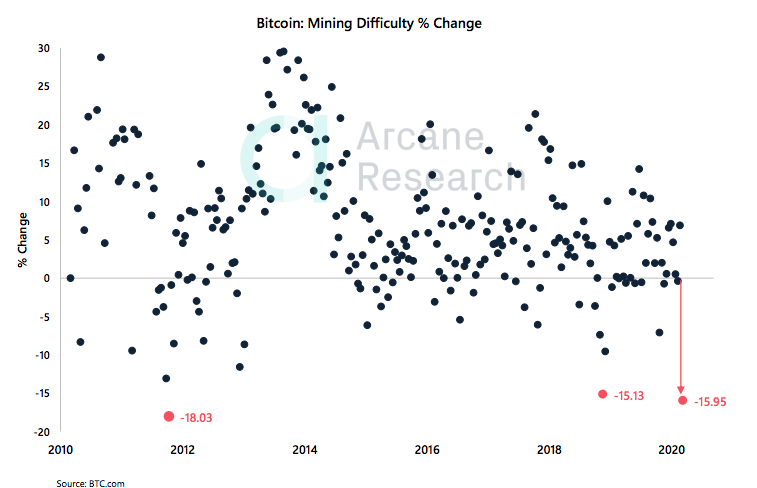

The Bitcoin mining reward halving which is due to take place in May was touted as a defining event on the calendar of the coin as investors believed it could renew the price action and send the coin skyrocketing. As the year began, and Bitcoin grew in value, people started to cite the halving as the reason, but this ‘black swan’ event of the Covid-19 outbreak has damaged the chance of renewed price action.

More so, it has directly impacted the mining community as in the month where Bitcoin’s network showed a new all-time high for hash rate, the mining difficulty is now set for its second-largest drop in difficulty.

The Bitcoin mining difficulty adjusts to make things easier when mining power eases off, and mining power usually eases off when profits are cut for miners following price drops. This week, mining difficulty has dropped by 16 percent and is only beaten by Bitcoin’s largest mining difficulty drop which happened on October 31, 2011, and was 18 percent.

In The News

Revolut Launches In The US With Its Crypto-Friendly Approach

Mobile bank Revolut, based in the UK, has expanded its market to cover the USA as it looks to provide more efficient banking services as well as integrate its cryptocurrency services for this new market. On Tuesday, the firm announced that it would be opening its doors for US-based customers and that they could sign up and receive a new payment card.

Guidance On The Delivery Of Digital Currencies By The CFTC

The U.S. Commodity Futures Trading Commission (CFTC), this week, in a publication, outlined its guidelines on what it believes the actual delivery of digital assets looks like. This cleared up a debate on whether or not crypto can be delivered from one party to another.

Digital Dollar Plans Scrapped As The USA Tackles Covid-19 Relief Bill

The notion of a digital dollar was presented as a way in which the US government could effectively deliver aid to its citizens in a time of Covid-19 panic and help stimulate the economy, but the final draft of this bill had that notion cut out from it.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.