Ethereum Classic price has risen 6% over the past week and 16% over the past month as attention turns to the hard fork, which is scheduled for January 31. Could this event be a positive driver for momentum? Maybe not if miners and exchanges aren’t prepared.

Key Takeaways:

- Scheduled for January 31, 2024, the “Spiral” upgrade aligns with EVM standards.

- Threefold increase in volumes ahead of the January 31 hard fork.

- Only 13.3% of services are ready, raising worries about potential network splits.

- Despite a price upswing, Ethereum Classic’s unprepared services suggest adoption challenges in the short term.

When will the Ethereum Classic hard fork happen?

Ethereum Classic (ETC) Network is scheduled to undergo a hard fork on January 31, 2024. This latest upgrade, “Spiral,” will activate when block 19,250,000 is achieved.

A hard fork refers to a significant change to the blockchain’s protocol that results in two branches. On the one hand, it can bring beneficial updates or resolve key issues, which could be considered a positive. On the other hand, it can lead to divisions in the community and short-term instability.

Transfer volumes soar, surpassing prior month’s average by threefold

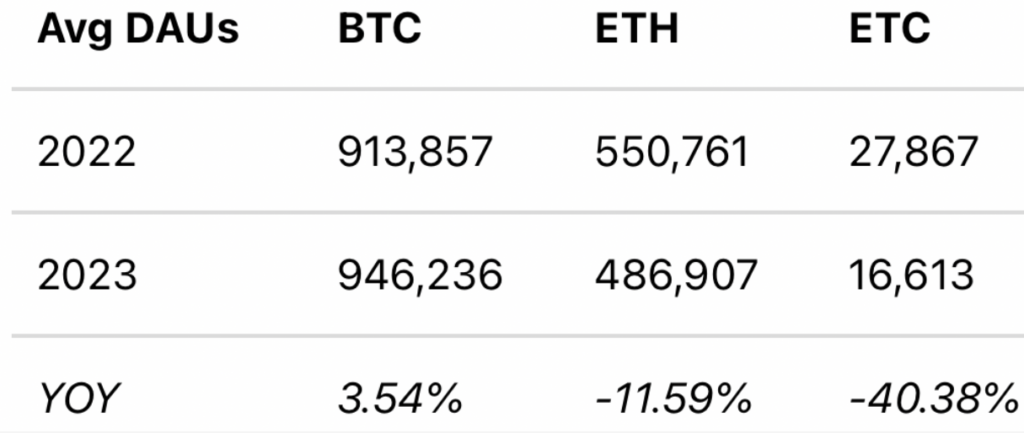

Last week, Ethereum Classic had been averaging weekly real transfer volume of $2.7 billion. This is notable because it is 3 times the average weekly real transfer volume from the prior month and significantly ahead of last summer’s averages. The jump in transfer volume comes as daily active users of the Ethereum Classic Network have fallen dramatically over the last two years.

Source: CoinMetric

The hard fork could be driving increased transfers, which is set to happen on January 31.

What is the Ethereum Classic spiral hard fork?

The Spiral upgrade is a compatibility upgrade, bringing the Ethereum hard fork chain in line with the upstream EVM standards, which in turn will facilitate contract development and migration.

According to the Ethereum Classic website, the upgrade will:

Enable the outstanding Ethereum Foundation Shanghai network protocol upgrades on the Ethereum Classic network in a hard fork code-named Spiral to enable maximum capability.

In theory, this would position Ethereum Classic well if there were ever severe failures on the Ethereum network. Following the spiral upgrade, as an EVM chain, migrating applications from Ethereum to Ethereum Classic would be more straightforward.

(An EVM chain is a blockchain that uses the Ethereum Virtual Machine to execute smart contracts.)

Readiness concerns: Only 13.3% prepared for Ethereum Classic hard fork

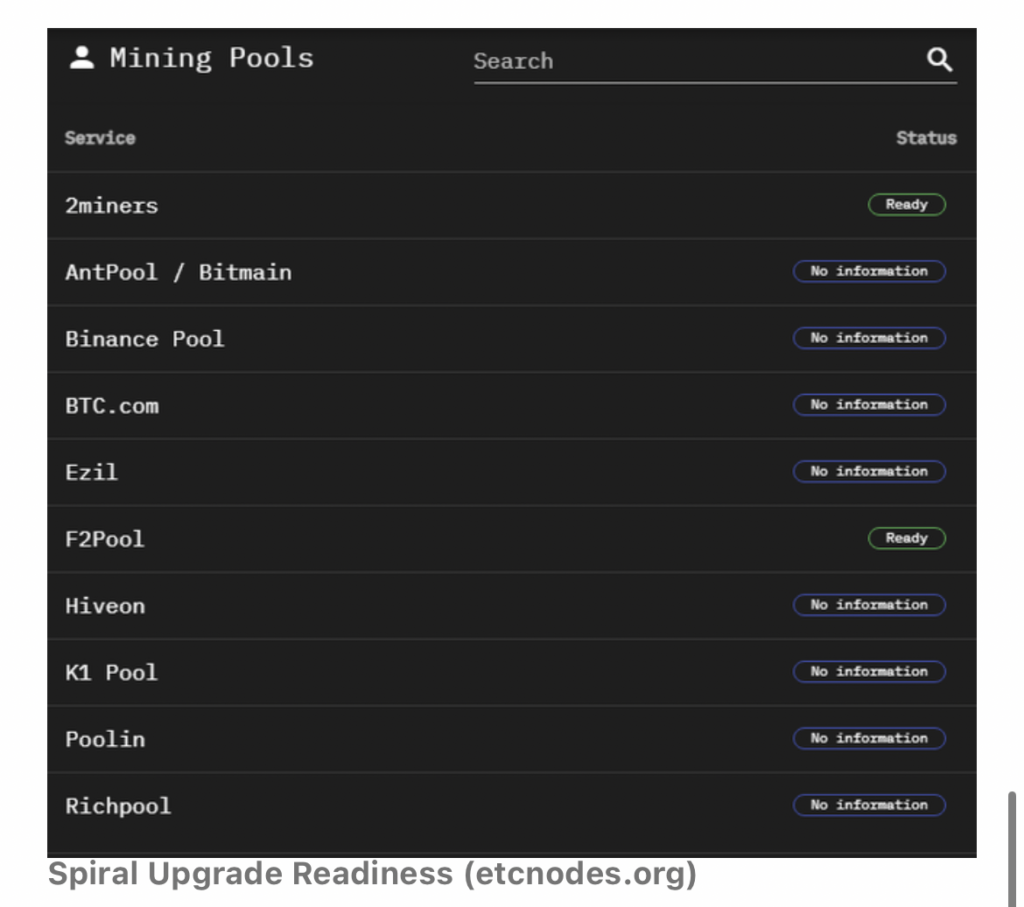

So far, so good. However, there is a problem. Nobody is talking about the hard fork, and services are not ready for the upgrade. According to the chart, just 13.3% of services were prepared before the event.

These concerns were highlighted in a community blog:

“If you are a miner, mining pool, node operator, wallet operator, or other kind of ETC stakeholder, please upgrade your node/s to minimize the risk of network splits.”

Ethereum Classic also posted on X (formerly Twitter), requesting the community to get exchanges to confirm that they are ready for the upgrade.

A few days before the event, no exchanges and only two mining pools had confirmed readiness.

The lack of preparation could indicate that ETC has adoption issues as a network. That said, ETC/USD is still extending its recovery, which is an encouraging sign, at least in the short term.

Sources

Fay, M. (2024, January 26). Grayscale Ethereum Classic Trust: Spiral Upgrade Concerns? Seeking Alpha. https://seekingalpha.com/article/4665221-grayscale-ethereum-classic-trust-spiral-upgrade-concerns

Ziogas, C. (2023, October 5). ECIP 1109: Spiral EVM and Protocol Upgrades. ethereumclassic.org. https://ecips.ethereumclassic.org/ECIPs/ecip-1109

Ethereum Classic to Upgrade Network on January 31st. (n.d.). Coinradar. https://coindar.org/en/event/ethereum-classic-to-upgrade-network-on-january-31st-106549

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.