You may have heard about Cardano, touted as an “Ethereum-killer.” Cardano’s blockchain is considered far superior to the original Ethereum blockchain, but as time goes on, it appears that Ethereum is catching back up. ADA tokens, the token used on the Cardano network, are known for their fast transaction time

How many Cardano coins are there?

As of early 2022, there are a total of 33.55 billion ADA in circulation, out of a complete and total supply of 45 billion. This is one of Cardano’s most significant advantages and should be paid close attention to. ADA’s value has not reflected its scarcity.

Does ADA Have a Limit?

Cardano has a limit of 45 billion coins minted. By keeping the amount of ADA down to 45 billion, the idea is to keep the coin liquid but not inflationary over the long term. Coins that do not have a limit are considered inflationary as the market can be flooded with supply. Some traders will not hold a coin unless there is a maximum supply cap.

Facts and Numbers on the Cardano Cryptocurrency

Is ADA Supply Centralized?

No, Cardano is not centralized. It’s a decentralized proof of state blockchain touted as a more efficient alternative to proof of work networks. This is the short answer. However, when you look at the wallet addresses that hold Cardano, as of early 2020, over 70% of the total supply of ADA was found in the top 1.28% of all Cardano addresses.

Is there a limit to how many Cardano coins can be mined in a day?

The answer to this question is not straightforward. In epoch 242, each block mined produced 750 ADA. In previous epochs, more coins were produced. In other words, less is being produced each day.

How is ADA mined? Is it easy to mine Cardano?

Cardano is a proof-of-stake network, meaning there is no mining when producing more ADA. When you own ADA, you verify payouts and generate new blocks. Anyone that holds the coin can become a participant in this process. The POS system is considered beneficial because it eliminates competition between miners to solve complex equations, also referred to as mining. It ensures a smoother and more stable process of blockchain development.

To “mine” ADA would be impossible. However, you can stake the coin by keeping it in your wallet online, and in turn, you receive a percentage of your already owned ADA coins as payment. The network confirms transactions via already existing ADA coins rather than using hardware. This makes a much more smooth and more efficient network.

You do not have to worry about mining methods; there’s nothing else to do but click a few buttons to turn on staking. You can also join staking pools directly, but most wallets offer the ability to do it without much thought. In fact, ADA is by far one of the simplest coins to stake.

How is Cardano primarily used?

ADA tokens are used to pay for services on the underlying blockchain network, which in the future will allow people to carry out complex transactions without the costs imposed by traditional networks such as banks or brokers. Most buyers of ADA tokens currently speculate on growth and demand rising, treating the tokens as an investment, not necessarily for use.

Cardano

Cardano is developed by the co-founder of Ethereum, Charles Hoskinson. A well-known leader in the crypto industry, he has attracted quite a bit of attention for his project. It distinguishes itself from other blockchains because it is peer-reviewed by top-level research providers.

How many tokens do the top investors own?

Unfortunately, over 70% of the total supply of ADA is controlled by less than 1.5% of all wallets. This does take some of the idea of decentralization out of this market and, therefore, is something to pay close attention to.

The future of Cardano (in short)

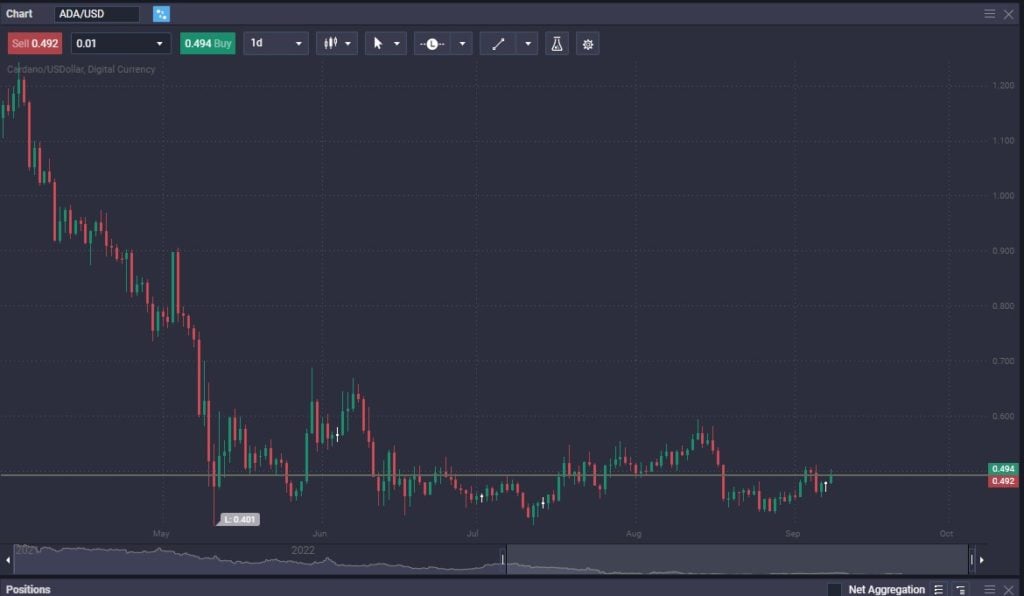

ADA/USD chart on PrimeXBT platform

Cardano hopes to develop into a decentralized application development platform with a multi-asset ledger and verified smart contracts. The project itself has been a bit slower than others because it is so heavily peer-reviewed by academics.

Cardano hopes to be the platform of choice for large-scale mission-critical DApps (decentralized applications) that will underpin the future economy. That being said, Cardano finds itself in the sea of competitors for the future. One of the biggest complaints about the ecosystem is how long it’s taking to get to where it’s trying to go.

Quite frankly, it appears that most of the inroads that Cardano has made into the real world have been in various African countries, as it could very well end up being a way for smaller and poorer countries to engage in banking. As with everything crypto-related, the future is murky at best. ADA’s current trading value has taken a hit along with the rest of cryptocurrency. Once the maximum supply is achieved, it will come down to whether or not demand picks up. Until then, Cardano analysis is sometimes complicated because most crypto moves in the same direction due to external factors such as risk appetite.

How many Cardano are in circulation?

At the beginning of 2022, there were 33 billion ADA in circulation. There will be a total of 45 billion once all are produced.

How many ADA tokens are left?

There are just over 11 billion ADA tokens left to be released.

Who owns the most ADA?

Unfortunately, the top 10 coin holders control just under 7% of the supply. The top 100 holders own just under 20%.

How many ADA are mined per day?

The amount of tokens created daily fluctuates because it is not a “proof of work” situation like Bitcoin. ADA is a “proof of stake” network. In other words, blocks are solved, and the reward amount changes over time. Currently, roughly 750 ADA for each block is produced, but just a couple of years ago it was over 1200.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.