Passive income in the context of cryptocurrency refers to earning income from digital assets without actively trading or participating in day-to-day activities. It involves leveraging various strategies like staking, lending, yield farming, or participating in decentralized finance (DeFi) platforms to generate returns. By utilizing these methods, individuals can earn regular income or potential capital appreciation from their cryptocurrency holdings, providing an opportunity for wealth accumulation and financial growth.

In this article, we will look at the top ten ways crypto investors earn passive income, and some of the tools and case studies surrounding this financial market.

Understanding Crypto Passive Income

The term “crypto passive income” describes revenues from cryptocurrencies that are obtained without actively participating in day-to-day trading or investment activity. It entails utilizing a number of strategies to use one’s crypto holdings as a reliable source of income.

Due to the potential advantages it offers, as well as the distinctive opportunities and problems it presents, this notion has grown in popularity.

The possibility for larger returns than those offered by conventional investment vehicles is one of the main advantages of passive income from cryptocurrencies. People can profit from the significant price growth that cryptocurrency has experienced over time by engaging in passive income techniques.

The crypto market is highly volatile, and prices can experience significant fluctuations. This volatility can impact the value of the assets generating passive income, leading to potential losses or reduced earnings.

There are numerous developments worth highlighting in the area of emerging trends for passive income generated by cryptocurrencies:

Real-World Asset Tokenization: As asset tokenization platforms have grown in popularity, investors can now generate passive income by fractionalizing ownership of real-world assets like real estate or works of art. With the help of these platforms, anyone can invest in typically illiquid assets and earn money from rental payments or profits.

Automated Portfolio Management: As decentralized finance expands, tools for automated portfolio management are being created. These platforms optimize investment methods using algorithms and smart contracts, enabling users to generate passive income from diversified cryptocurrency portfolios.

DeFi Opportunity Expansion: As the DeFi ecosystem develops, more opportunities for making money are appearing. These include of derivatives that are novel, decentralized lending and borrowing, and liquidity mining. By using these platforms, investors can increase their passive income and support the development of decentralized finance.

Top 10 Crypto Passive Income Strategies

While the crypto space offers various opportunities to earn passive income, it’s important to note that the market is dynamic, and the profitability of different methods can change over time. Nonetheless, here are ten popular ways to earn income in crypto:

- Staking: Holding and staking specific cryptocurrencies to support network operations and earn staking rewards.

- Yield Farming: Providing liquidity to decentralized finance (DeFi) protocols and earning rewards in the form of additional tokens or fees.

- Lending and Borrowing: Participating in lending platforms to earn interest on crypto assets or borrowing against one’s holdings.

- Dividend Payments: Owning specific cryptocurrencies that distribute regular dividends to token holders.

- Masternodes: Operating dedicated servers (masternodes) to support the operations of certain cryptocurrencies and earning rewards for doing so.

- Tokenized Real Estate: Investing in platforms that allow fractional ownership and rental income from real estate properties through tokenization.

- Crypto Savings Accounts: Depositing cryptocurrencies into dedicated savings accounts that offer interest on the holdings.

- Automated Trading Bots: Utilizing automated trading bots to execute trading strategies and generate passive income from the crypto market.

- Proof-of-Work Mining: Participating in the process of validating transactions and adding them to the blockchain, primarily in cryptocurrencies that utilize a proof-of-work consensus mechanism.

- Decentralized Passive Income Platforms: Engaging with platforms specifically designed to provide passive income opportunities in the crypto space, often combining different methods like staking, yield farming, and lending.

1. Staking Cryptocurrencies (Beginner Friendly)

- Staking is a way to generate passive income using cryptocurrencies. In order to sustain the operation of a blockchain network, it entails holding and “staking” particular cryptocurrencies in a wallet or on an authorized platform. Individuals are rewarded with extra tokens or fees produced by the network in exchange for staking.

- Case Study: The Tezos blockchain is one effective staking case study. Token holders can stake their Tezos (XTZ) tokens to become network validators in Tezos’ proof-of-stake (PoS) consensus method. Validators ensure network security, validate transactions, and take part in consensus. Validators receive XTZ rewards for their staked work. Tezos has become well-known for its effective use of staking and its encouragement of network activity.

Recommendations for Software or Hardware:

- Coinbase: A well-known cryptocurrency exchange that provides staking services for several cryptocurrencies is Coinbase. On the Coinbase platform, users can directly stake their assets and receive staking incentives. For those new to staking, Coinbase offers a user-friendly interface that makes it suitable.

- Binance: Another well-known cryptocurrency exchange that provides staking services for many supported coins is Binance. On Binance, users can stake their assets and receive stake incentives. Binance offers a complete staking infrastructure with a number of staking alternatives.

2. Yield Farming

- Providing liquidity to different protocols in exchange for rewards is a practice known as yield farming, also referred to as liquidity mining, in the world of decentralized finance (DeFi). To enable trading on decentralized exchanges (DEXs) or lending platforms, it entails putting cryptocurrency into liquidity pools. Users are rewarded with more tokens, often in the form of the protocol’s native tokens, in exchange for providing liquidity.

- Case Study: The Compound procedure is a well-known illustration of yield farming. The loan and borrowing platform Compound was created using the Ethereum network. Users can earn interest on their holdings by adding their cryptocurrencies to the liquidity pools of the protocol. The COMP token, which is given to users who borrow and lend on the network, was also introduced by Compound.

Recommendations for Software or Hardware:

- Aave: Aave is a decentralized platform for lending and borrowing that allows users to earn interest on their deposited assets. In exchange for supplying the protocol with liquidity, users can get tokens that reflect their portion of the pool. These tokens provide a stream of passive income by continuously accumulating interest.

- Uniswap: Uniswap is a well-known Ethereum-based decentralized exchange (DEX). Users can exchange tokens right from their wallets using this feature. Additionally, Uniswap offers liquidity pools where users can add token deposits to provide liquidity. In exchange, they get liquidity provider (LP) tokens, which can be staked to get a share of the protocol’s trading fees.

- Yearn Finance: The DeFi protocol Yearn Finance automates yield farming techniques on several platforms. Users can deposit money into Yearn Finance, and the protocol will distribute it to different farming possibilities with the highest potential yields. Yearn Finance streamlines the yield farming process and assists users in maximizing their profits.

- It’s critical to remember that farming for yield entails inherent complexity and hazards. Yield farming’s strong profits are frequently accompanied by higher vulnerability to market volatility, smart contract weaknesses, impermanent loss (a potential loss due to price movements), and potential frauds or “rug pulls” within the DeFi area. Users should carefully investigate and comprehend the protocols they use, including reviewing the code, weighing the dangers, and using reliable platforms and tools.

3. Lending and Borrowing:

- Lending and borrowing can be a passive income method. Staking is a popular form of lending where individuals lock up their digital assets to earn rewards. Ethereum 2.0 is a successful staking platform. Tools/platforms for staking: Rocket Pool, Lido Finance, Coinbase, staking wallets (Ledger, Trezor), and DeFi platforms like Aave and Compound. Thoroughly research before choosing a platform. Staking is an opportunity to earn income by supporting networks and lending assets.

- Case study: To stake Ethereum, an individual needs to hold a certain amount of Ether (ETH), the native cryptocurrency of the Ethereum network. By locking up their ETH in a staking contract, they contribute to the validation and consensus process of the network. In return, they receive rewards in the form of additional ETH. The more ETH a person stakes, the higher their potential rewards.

4. Dividend Payments:

- Dividend payments serve as a method for earning passive income. Companies distribute a portion of their profits to shareholders as dividends. By investing in dividend-paying stocks, individuals can generate income through regular dividend payments.

- Case study: Now let’s explore a brief case study of successful staking. One prominent example is Cardano (ADA). Cardano is a blockchain platform that utilizes a proof-of-stake (PoS) consensus mechanism. By staking ADA, individuals can participate in securing the network and earn rewards in the form of additional ADA coins. This is essentially the same thing as staking.

5. Masternodes:

- Masternodes serve as a method for earning income in certain blockchain networks. A masternode is a dedicated server that supports the operations of a blockchain network. By running a masternode and staking a certain amount of the network’s native cryptocurrency, individuals can receive regular rewards in return for their contribution to network maintenance and governance.

- Case study: To illustrate this, let’s consider the case of Dash (DASH). Dash is a decentralized digital currency that utilizes a two-tier network structure, with masternodes playing a crucial role. Masternode operators provide enhanced functionality to the Dash network and are rewarded for their services.Running a Dash masternode requires staking a specific amount of DASH coins as collateral. This collateral ensures the masternode operator has a vested interest in the network’s well-being. In return, masternode operators earn a portion of the block rewards generated by the Dash network. This requires a substaintial upfront investment.

6. Tokenized Real Estate:

- Tokenized real estate offers a method for earning passive income by investing in fractional ownership of real estate properties through blockchain-based tokens. These tokens represent a share of the property’s value and provide investors with benefits such as rental income and potential capital appreciation.

- Case study: A case study of successful staking is the RealT platform. RealT enables investors to purchase fractional ownership in U.S. properties, allowing them to earn passive income from rental profits. Investors can stake their tokens and receive regular dividends based on the property’s rental income.

7.Crypto Savings Account:

- Interest Bearing Crypto Accounts provide a method for earning passive income by depositing cryptocurrencies into interest-bearing accounts. These accounts allow individuals to earn interest on their crypto holdings, similar to traditional savings accounts but with potentially higher yields.

- Case study: A case study of successful staking is Celsius Network. Celsius offers a crypto savings account where users can deposit their cryptocurrencies and earn interest on their holdings. The platform utilizes lending and borrowing activities to generate returns, which are then distributed to account holders as interest payments so holders can earn passive crypto income.

8.Automated Trading Bots:

- Automated trading bots can be used as a way to generate income by using algorithmic trading algorithms to carry out deals for users. These bots can evaluate market data, spot trading opportunities, and place trades automatically, all while needing the user to put up the least amount of work possible.

- Case Study: The HaasOnline Trade Server (HTS) is a case study of effective staking. HTS is a platform for automated trading that enables users to build and employ trading bots on several cryptocurrency exchanges. Users can personalize their trading plans and let the bots execute trades on their behalf in an effort to profit passively from the cryptocurrency markets.

9.Proof-ofWork Mining:

- Proof of Work (PoW) is a consensus mechanism used by blockchain networks, such as Bitcoin, to secure and validate transactions. It involves crypto mining, solving complex mathematical puzzles to add new blocks to the blockchain. While PoW itself is not a direct method for earning passive income, individuals can earn passive income by participating in mining pools that utilize PoW, gaining from transaction fees.

- Case study: A case study of successful staking is the crypto mining pool called F2Pool. F2Pool is one of the largest and most renowned mining pools, allowing individuals to contribute their computing power to mine cryptocurrencies like Bitcoin. Miners earn rewards in the form of newly minted coins and transaction fees.

10.Decentralized Passive Income Platforms:

- Decentralized passive income platforms offer a method for earning passive income by participating in decentralized finance (DeFi) activities. These platforms leverage smart contracts and blockchain technology to provide various opportunities for users to earn passive income, such as liquidity provision, lending, and staking.

- Case study: A case study of a successful staking platform is Aave. Aave is a decentralized lending and borrowing protocol built on the Ethereum blockchain. Users can stake their assets in the Aave protocol, providing liquidity to the platform and earning passive income through interest generated by borrowers.

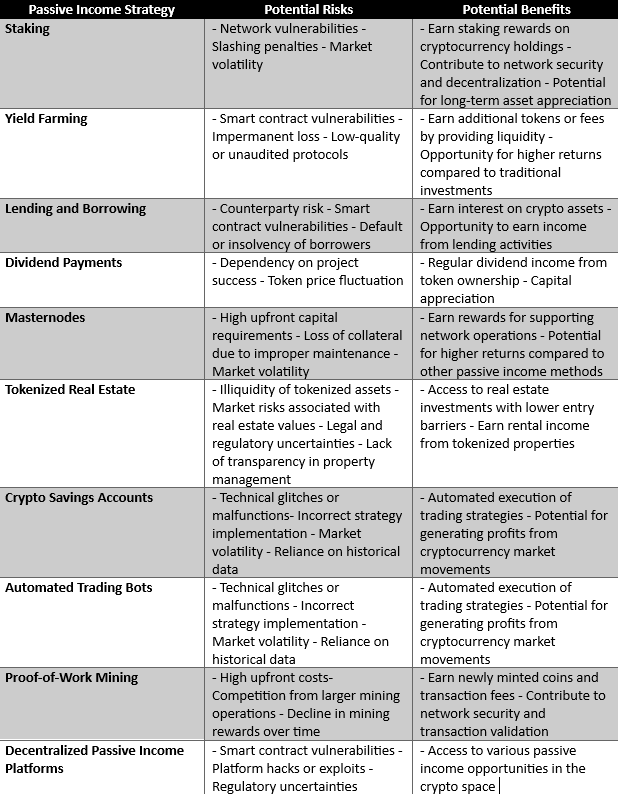

Comparative Analysis: Choosing the Right Strategy for You

Understanding the Risks

Staking: Risks associated with staking include the possibility of losing staked money as a result of network flaws or attacks, reducing the severity of punishments for unethical conduct, and market volatility impacting the value of staked assets.

Yield Farming: Risks include smart contract weaknesses that could be hacked or exploited, temporary losses brought on by erratic asset values, and potential money losses associated with subpar or inadequate methods. Yield farmers can sometimes play a “high risk/high reward” game.

Lending and Borrowing: Risks associated with lending and borrowing include counterparty risk, weaknesses in smart contracts, potential borrower default or insolvency, and market volatility affecting collateral prices.

Dividend Payments: Risks associated with dividend payments include reliance on the viability and success of the project issuing dividends, variation in token prices, and future legislative changes that could affect dividend payouts.

Masternodes: Risks associated with masternodes include significant up-front cash needs, the potential loss of collateral due to poor server maintenance or unavailability, and market volatility that may alter the value of staked assets.

Tokenized Real Estate: Risks include market risks related to real estate valuations, illiquidity of tokenized assets, legal and regulatory uncertainties, and potential lack of transparency in property management.

Crypto Savings Accounts: Risks linked with cryptocurrency savings accounts include weaknesses in smart contracts, possible money losses as a result of platform hacks or other exploitation, changes in interest rates, and market risks related to the underlying cryptocurrencies.

Automated Trading Bots: Risks associated with automated trading bots include technological errors or malfunctions, poor plan execution that results in financial losses, sensitivity to market volatility, and reliance on previous performance data.

Proof-of-Work Mining: Risks linked with proof-of-work mining include costly upfront equipment costs, energy consumption and related environmental issues, rivalry from larger mining operations, and a potential long-term drop in mining rewards.

Decentralized Passive Income Platforms: Risks include those related to smart contract vulnerabilities, potential financial loss as a result of platform hacks or exploits, regulatory uncertainty, and risks related to the platforms’ underlying business models.

Before making any investments or taking part in these tactics, people must carefully examine and comprehend these hazards. To reduce risks, it is also advised to diversify one’s portfolio and seek professional assistance.

Conclusion: The Potential and Future of Crypto Passive Income

In conclusion, cryptocurrency offers various avenues for earning passive income. From staking and lending to yield farming and participating in decentralized finance, individuals can leverage their digital assets to generate regular income or potential capital appreciation. It is important to thoroughly understand the risks and benefits associated with each strategy, conduct due diligence, and seek professional advice when necessary.

By carefully navigating the cryptocurrency landscape, individuals can tap into the potential of passive income and contribute to their long-term financial goals.

FAQ

Can crypto be a source of income?

Yes, it can. There are multiple ways to earn passive cryptocurrency income, as well as earning through price appreciation.

Can I make passive income with crypto?

Yes, there are several different ways to earn passive crypto income, but be aware that there is always risk involved to your investment goals.

Nonetheless, many investors are long-term believers in crypto passive income streams, and are also those who plan on holding crypto for the long-term, therefore making the idea of earning passive crypto income appealing in general.

What are the risks of trying to create passive income with crypto?

Multiple risks are out there, but the most important one in general is going to be the volatility that crypto generally has.

Is staking crypto passive income?

Yes it is. In fact, it is probably the most common way for a crypto investment to earn passive income.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.