What Makes EUR/USD the Most Traded Currency Pair?

The EUR/USD currency pair is the most actively traded pair in the Forex market, accounting for the highest liquidity and volume worldwide. It serves as a benchmark for the US dollar’s performance and a key indicator of global economic stability. Traders prefer EUR/USD due to its tight spreads, predictable trends, and broad market participation.

Key Factors That Influence EUR/USD Price Movements

- Monetary Policies: The Federal Reserve (USD) and the European Central Bank (EUR) play a crucial role in setting interest rates that impact currency strength.

- Macroeconomic Indicators: Employment data, GDP growth, and inflation rates affect EUR/USD valuation.

- Political & Geopolitical Events: Elections, economic policies, and geopolitical tensions influence market sentiment.

- Risk Sentiment: Traders use EUR/USD as a measure of global risk appetite, as the USD is often a safe-haven currency.

How to Trade EUR/USD: A Step-by-Step Guide

1. Understanding Market Hours

- The EUR/USD pair is most active during the London and New York sessions, offering high liquidity and tight spreads.

2. Analyzing Market Trends

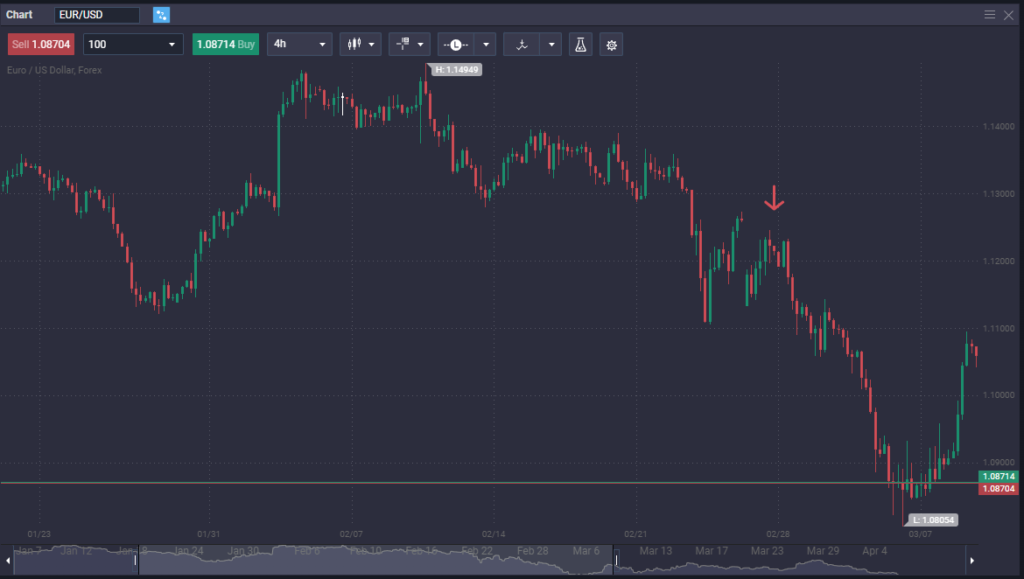

- Technical analysis: Utilize indicators like Moving Averages, RSI, and Fibonacci levels.

- Fundamental analysis: Monitor central bank announcements, employment reports, and inflation data.

3. Choosing your Trading Style

Trading styles define how a trader interacts with the market in terms of trade duration and frequency:

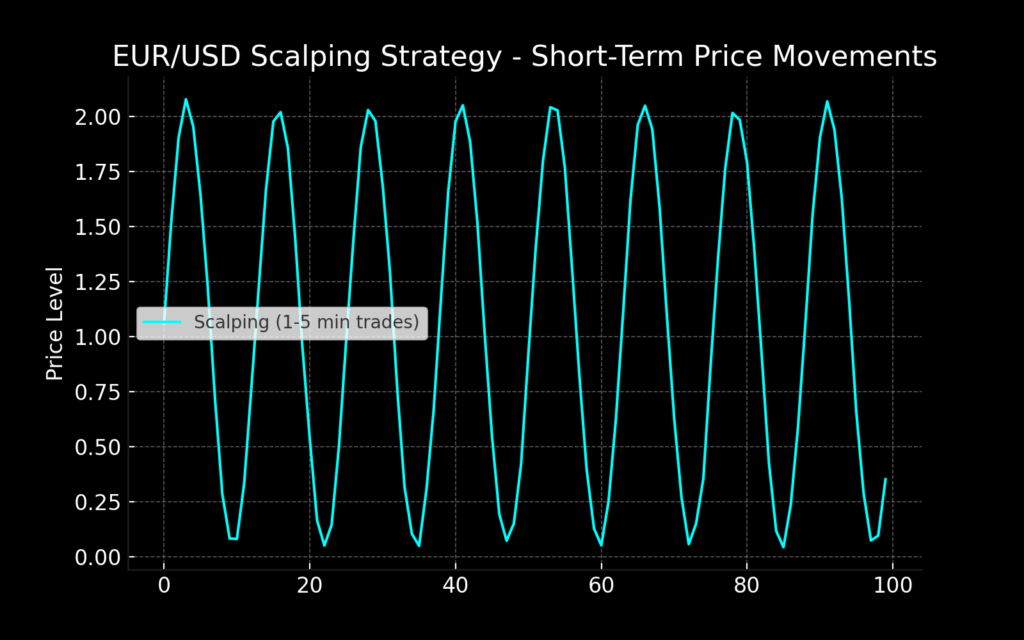

Scalping EUR/USD

- Focuses on quick, small trades within short timeframes (1-5 minutes per trade).

- Requires tight stop-losses and a high-frequency trading approach.

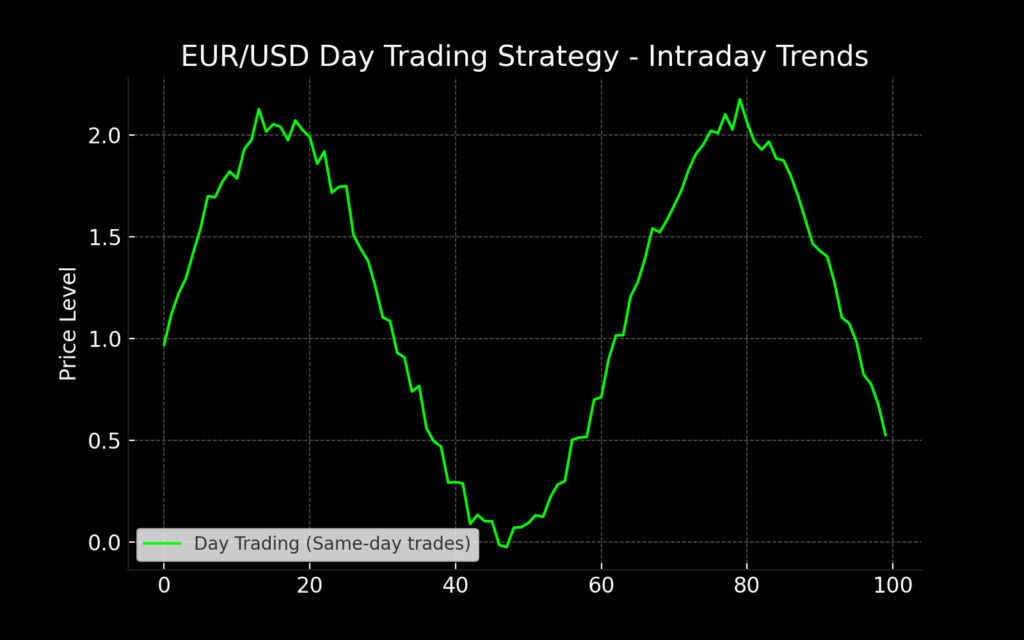

Day Trading EUR/USD

- Positions are opened and closed within the same trading session.

- Relies on technical indicators and price action for trade execution.

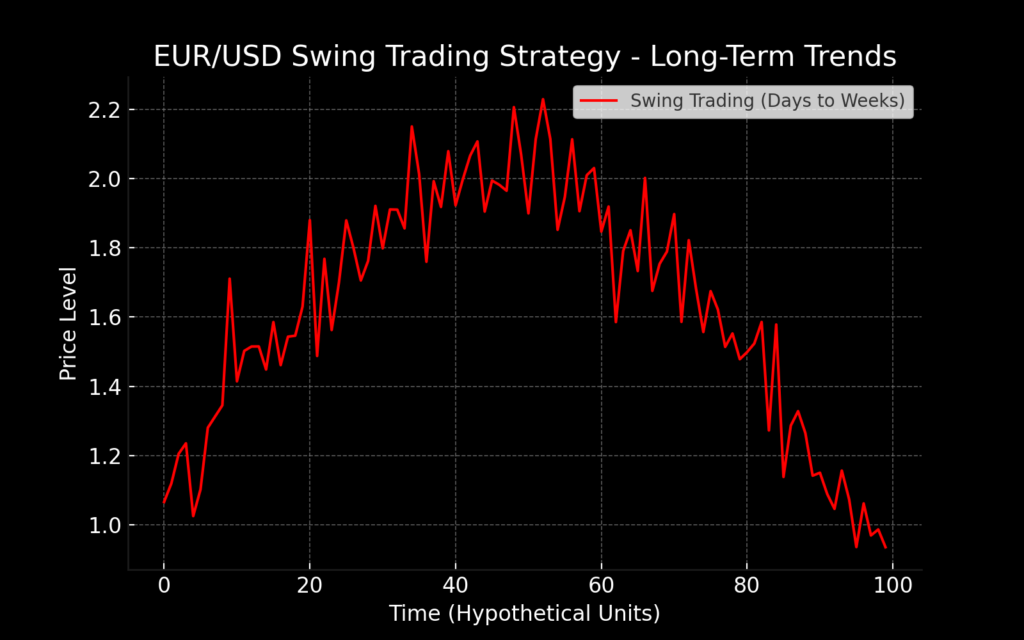

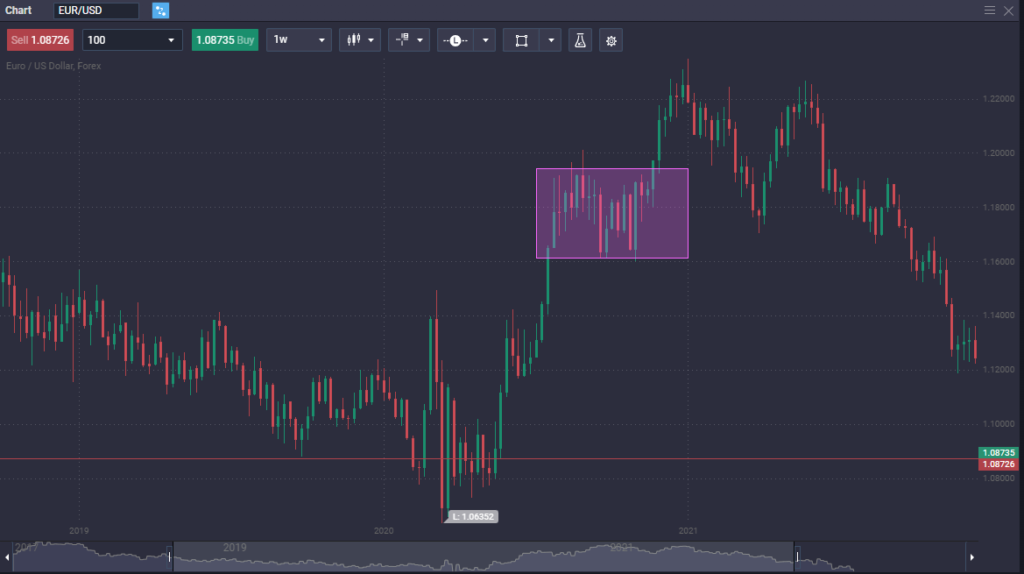

Swing Trading EUR/USD

- Trades last from a few days to weeks, capitalizing on larger price movements.

- Combines fundamental analysis with technical setups.

Each trading style requires different risk tolerance, time commitment, and execution discipline but is not a strategy by itself. Instead, traders apply specific strategies within these styles.

4- Choosing your Trading Strategy

Pullback Trading

- Identifies temporary retracements in an overall trend to enter at better prices.

- Uses Fibonacci retracements, candlestick patterns, or support levels to time entries.

- Works well for both intraday and longer-term strategies.

Breakout Trading

- Focuses on identifying consolidation zones and trading the breakout when momentum increases.

- Suitable for high-volatility trading sessions.

- Can be applied to multiple timeframes, from scalping to swing trading.

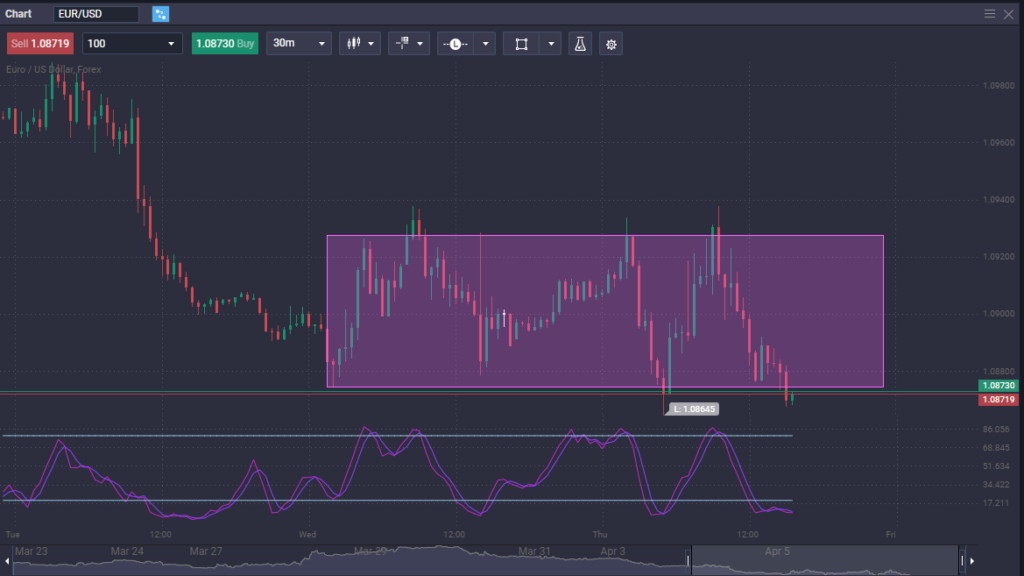

Range-Bound Trading

- Utilizes well-defined support and resistance zones to trade within a range.

- Best used when the market lacks strong trends.

- Often combined with oscillators like RSI and Stochastics.

4. Managing Risk & Optimizing Entries

- Set Stop-Loss & Take-Profit Levels: Essential for limiting downside risk.

- Leverage Control: Avoid excessive leverage to minimize exposure.

- Monitor Market Correlations: EUR/USD often moves inversely to USD/JPY and in tandem with EUR/GBP.

Common Pitfalls and Risk Management for EUR/USD Traders

1. Ignoring Economic Events

- Major news releases, such as ECB statements or NFP (Non-Farm Payrolls), can cause sudden price swings.

2. Over-Leveraging Trades

- Higher leverage increases risk; disciplined position sizing is crucial.

3. Emotional Trading

- Fear and greed lead to poor decision-making. A solid trading plan mitigates this risk.

Why Liquidity and Spreads Matter in EUR/USD Trading

- Tight spreads mean lower transaction costs, improving profitability.

- High liquidity allows for efficient trade execution, even during volatile periods.

Top Tips for EUR/USD Trading: What You Need to Know

There are multiple factors to consider when trading the EUR/USD pair. While it is one of the most liquid pairs in the world, there are some nuances that you need to be aware of.

- Test your system – Make sure to test your system in the EUR/USD pair, either through a demo account or historical data to make sure that it has a positive expectancy.

- Listen to Federal Reserve – You need to pay special attention to the Federal Reserve and its announcements, as well as speeches made by members, as they set monetary policy for the United States.

- Listen to the ECB – You also need to pay special attention to the European Central Bank and its announcements, as well as speeches made by members, as they set monetary policy for the European Union.

- Watch interest rate differential – Watch the interest rate differential between major European economies and the United States, by monitoring the 10-year bond markets for the various economies, with a special eye on the German 10-year yield.

Conclusion: Why EUR/USD is Ideal for Beginners and Pros

Trading the EUR/USD is a great place for beginning traders to learn how to navigate the currency markets. This is because the spread in this pair is typically very tight, so it allows traders to get used to trading in the currency market without having to overcome huge gaps between entry and profitability. Furthermore, it is the most liquid currency pair in the world, so it allows for trading at any time of the day.

It is also worth noting that the two currencies are the two biggest in the world, so therefore financial information and analysis are easy to find online. The Euro is considered to be the “anti-dollar”, therefore if one currency is going fairly well in the world of Forex, the other one typically suffers.

Most traders start trading the EUR/USD before other pairs, as it does tend to move predictably over the longer term. That being said, it operates like any other market in the sense that the analysis is the same, but as it is such a highly traded market, it takes much longer for the trend to change, thereby making it a great place to trade.

What time can I trade EUR/USD?

The EUR/USD pair can be traded 24 hours a day during weekdays. The best trading hours typically align with the overlap between the US and European sessions, from 8:00 am to 11:00 am EST, due to high liquidity and volatility.

Is EUR/USD a good pair?

Yes, EUR/USD is an excellent pair for both beginners and experienced traders due to its high liquidity, tight spreads, and predictable long-term trends

How do you analyze EUR/USD?

You can analyze EUR/USD using a combination of technical analysis, such as support/resistance levels and RSI, and fundamental analysis, including interest rates, geopolitical events, and economic data from the US and Eurozone

What affects the EUR/USD exchange rate the most?

The EUR/USD exchange rate is influenced by:

Interest rate differentials between the Eurozone and the US.

Geopolitical events, especially within Europe and the US.

Economic data like GDP, inflation, and unemployment figures.

Global risk sentiment and commodity price fluctuations

What is the best strategy for trading EUR/USD?

The best strategies depend on your trading style. Scalping suits short-term traders, while swing trading is ideal for those focusing on long-term trends. Pullback and breakout strategies are commonly used in both scenarios

Why is EUR/USD so liquid?

EUR/USD is the most liquid pair because it represents the two largest economies in the world, the US and the Eurozone. The volume of global trade and financial transactions involving these currencies ensures constant market activity

Can I trade EUR/USD with a small account?

Yes, you can trade EUR/USD with a small account using leverage offered by platforms like PrimeXBT. Proper risk management is key to maximizing profits and minimizing losses

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.