The Ichimoku Kinkō Hyō is a technical analysis indicator designed by Japanese journalist Goichi Hosoda in the late 1930s. Hosoda was known as Ichimoku Sanjin, which translates to “what a man in the mountain sees.” He is said to have spent 30 years perfecting the technique before releasing it to the public. It’s known as Ichimoku cloud, or just Ichimoku, for short.

Ichimoku Definition

The Ichimoku technical analysis indicator was created to give traders an instant look at the overall balance on an asset’s price chart so that decisions can be made based on the big picture. Even Ichimoku Kinko Hyo by definition translates to “one glance equilibrium chart.”

Why The Ichimoku Matters

Chart pattern formations and candlestick structures are helpful, profit-generating tools in any successful trading system, but more is needed for traders requiring additional data. Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages.

Ichimoku is popular among Japanese forex traders and is part of Time Theory, Target Price Theory, and Wave Movement Theory. Unlike other indicators, Ichimoku takes time into consideration and not just price, similar to some of the more popular theories first popularized by legendary trader William Delbert Gann. This gives traders an edge to make a lot of money by regularly implementing a winning trading strategy.

How the Ichimoku Works

The Ichimoku technical analysis indicator is among the few indicators that can often be used as a standalone indicator due to how many different factors it takes into account, giving it its “at a glance” naming convention. And while it is designed the offer the trader so much at once glance, it can often be intimidating and overly complex at first. However, once each aspect of the Ichimoku indicator is explained, it can become second nature and an extremely useful tool.

How the Ichimoku is Calculated

There are many aspects of the Ichimoku indicator, each with its own unique formula for calculation. Here are the names of each key element of the indicator as well as to how they are calculated:

- Tenkan-sen: [previous 9 periods highest high + previous 9 periods highest low]/2

- Kijun-sen: [previous 26 periods highest high + previous 26 periods lowest low]/2

- Senkou Span A: [tenkan-sen + kijun-sen]/2, and then forward-plotting the result by 26 periods

- Senkou Span B: [previous 52 periods highest high + previous 52 periods lowest low)/2, and then forward-plotting the result by 26 periods

- Chikou Span: price close back-plotted 26 periods.

How to Read the Ichimoku

Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide.

- Tenkan-sen: Also called the conversion line or the turning line. It can be used to signal where reversals may take place, as well as where support and resistance may lie.

- Kijun-sen: Known as the base line or confirmation line, it can be used for setting stop losses or to determine future price movements.

- Senkou Span A: Also called the leading span A or leading span 1, Senkou Span A. The line forms one edge of the Kumo.

- Senkou Span B: Also called the leading span B or leading span 2, Senkou Span B. The line forms the other edge of the Kumo.

- Kumo: Also called the cloud or Kumo cloud, is the space between Senkou span A and B.

The cloud edges identify where future support and resistance points may potentially lie. The height of the cloud is based on the asset’s price volatility, with more powerful movements causing larger clouds, and therefore creating stronger support or resistance to overcome.

When clouds thin out, support or resistance is weak, potentially signaling a breakout ahead.

Kumo twists occur when markets change from uptrends to downtrends and are signaled when Senkou Span A and Senkou Span B line crossover one another.

Clouds may also indicate the strength of a trend by the slope of the cloud.

- Chikou Span: Also called the lagging span, it is used to depict where possible areas of support and resistance may lie.

How to Use the Ichimoku

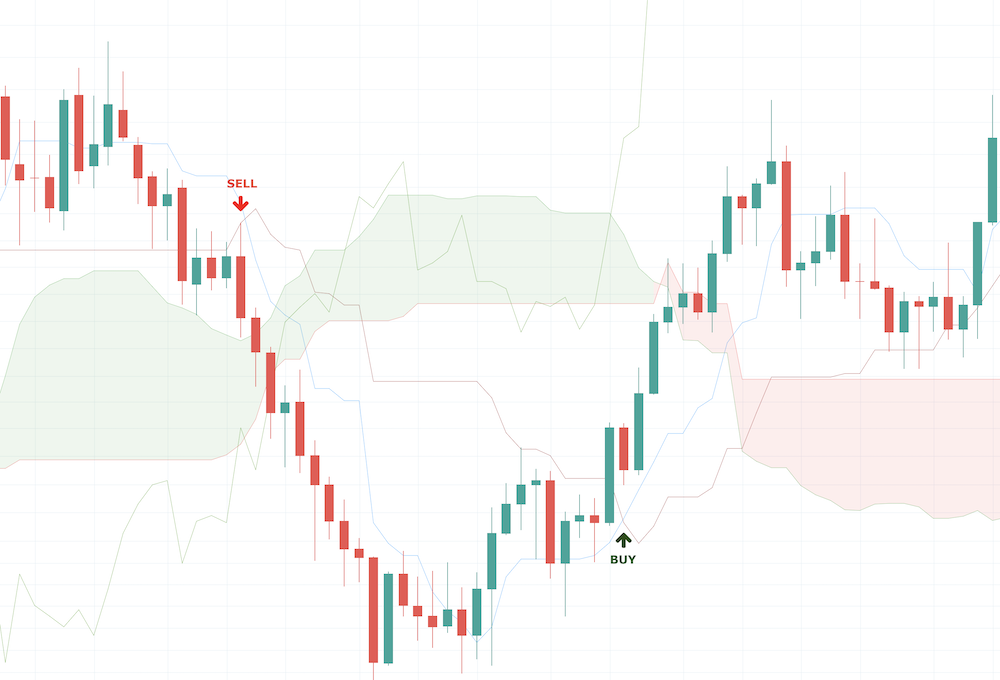

Because the Ichimoku is so varied and complex, there are many ways to use the indicator to trade, indicating trading trend changes by watching for Kumo twists, or selling into cloud resistance or buying into cloud support. The Chikou Span crossing price up or down can also be used as a buy signal. The Tenkan-sen and Kijun-sen can be used to find resistance and support levels, both current and future.

The Best Ichimoku Trading Strategy

The Ichimoku technical analysis indicator was designed to give traders an at a glance look at many aspects of the market in one price chart. Because of this, there are many ways to use each of the various lines and features of the Ichimoku indicator to form winning trading strategies. Here are some of the most popular, useful, and best Ichimoku trading strategies.

Trading Kumo Breakouts Using Kijun-Sen

The Kumo, or cloud, acts as support or resistance and can contain price within it, providing a strong signal to trade on when price breaks out of the cloud or through it. But knowing when to close the trade is the next step in any successful trading strategy. Following a breakout of the cloud, a trader should watch for the asset’s price to break through the blue Kijun-Sen line to exit the winning trade.

Using Chikou Span To Plot Support and Resistance

Ichimoku takes into account time into its calculations, helping to provide traders with a look at the past, present, and potential future key areas on a chart to watch. The Chikou Span, is a lagging span, plotted back a full 26-periods, and can be used to plot support or resistance lines that can be used to take positions or plan exits.

Buy and Sell Signals With Kumo Breakouts

A breakout through the Kumo or cloud is often a powerful buy or sell signal for traders to take action. Once the asset has broken through the cloud, traders can ride the trend until the asset’s price once again breaks back below the cloud.

Exit Strategy Using Chikou Span and Tenkan-Sen

Cloud breakouts are strong buy or sell signals, depending on which direction the breakout occurs in. Due to this, sometimes waiting for a break back below the cloud can leave too much profit on the table. Traders looking to take profit at peak levels should watch for the green Chikou Span to cross below the red Tenkan-Sen line, signaling a trade should be closed and that a trend is running out of steam.

Trading Strategy Using Senkou Span Crossovers

In addition to some of the Ichimoku’s more complex strategies, a simple and straightforward trading strategy can be derived from using only a crossover of the two Senkou Spans. When Senkou Span A crosses above Senkou Span B, the price action is considered bullish. And when the Senkou Span A crosses below Senkou Span B the price action is bearish. Buying or selling these crossovers can result in a repeatedly successful trading strategy.

Spotting Reversals With Kumo Twists

Using the cloud, spotting reversals is easy with Kumo twists. Clouds are depicted in red or green depending on the bullish or bearish trend, and the cloud grows depending on the strength of a trend. As trends begin to weaken, the cloud thins out, oftentimes leading to a twist from green to red, or red to green, depending on which way the trend is reversing. These signals can be used to open a buy or sell order.

Tips for Traders And Common Mistakes

Don’t get overwhelmed if the Ichimoku indicator at first appears to be too much at one glance or beyond one’s limitations. It’s designed to be jam-packed with usable data that traders can apply to any positions they take, but it can certainly be a surprise to a new trader when a chart is suddenly filled with red and green clouds.

Spend time to learn what each individual element of the Ichimoku does to take advantage of its unique attributes and signals.

The default settings of 9-26-52 can be adjusted to suit a 5-day workweek at 8-22-44. Other popular settings include 9-30-60, or 12-24-120 for trending markets.

Conclusion

By gaining an “at a glance” look at the entire market, you can easily become a profitable day trader using all of the tools provided by PrimeXBT. PrimeXBT offers built-in charting software, along with helpful and effective profit-generating indicators such as the Ichimoku, MACD, RSI, Bollinger Bands, and many more.

Combined with technical analysis such as chart patterns and other oscillators, the Ichimoku can be used to develop a successful trading strategy traders can apply to grow their capital quickly and easily, using up to 1000x leverage on PrimeXBT.

The PrimeXBT trading platform offers exposure to a variety of markets including stock indices, forex currencies, digital currencies, and commodities. Sign up is free, fast, and easy. Register today and try your hand at day trading using the Ichimoku indicator!

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.