As Bitcoin continues to grow, the anxiety of missing out on the chance to invest in the world’s largest cryptocurrency at an advantageous price grows daily. At the end of November 2020, for the first time since December 2017, Bitcoin went over the $18,000 mark, which is approximately 10% less than its record maximum value of $20,000.

Some analysts are confident that the anticipated threshold of $20,000 is just the start of an anticipated blast to the price of $1 trillion; it is possible that it is not too late to add BTC to our investment portfolios. Bitcoin is pricey, to say the least, but if you don’t have much capital, you don’t need to buy an entire coin. You can start buying parts of it – for example, for $15 – which will be equal to the current price of 0.0008 BTC. Getting started with investing in Bitcoin is not as hard as you think. This article will explain how to invest in BTC and give you some useful tips along the way.

Open free accountSome BTC History

The history of Bitcoin began in 2008 when an anonymous developer under the pseudonym Satoshi Nakamoto published the principles of an electronic payment system based on mathematical calculations. It is still unknown who was hiding under a pseudonym and how many people worked on the project.

The mechanism proposed by Nakamoto has several advantages over ordinary money – cryptographic protection, transparency of transactions, the anonymity of transfers, independence from government regulators, and a known issue size in advance. A decreasing geometric progression limits the algorithm for creating new blocks. The total volume of cryptocurrency cannot exceed 21 million bitcoins, the last of which will be mined in 2140.

Due to the lack of material support, the Bitcoin rate jumped and, in February 2011, equaled one dollar for the first time. Cryptocurrency is starting to gain popularity – Bitcoin is gradually pouring into the digital economy, and there is a lot of talk about it. During this period, the first altcoins appeared.

In 2012, Bitcoin’s price exceeded $100, and after just a year, it rose to $1,000. Bitcoin became the most popular and recognizable cryptocurrency and continued to grow. Here the basic principle of Bitcoin worked – the more people are involved in the process, the higher its value becomes.

In March 2013, the capitalization of BTC exceeded $1 billion, but in December, one of the largest crypto exchanges, BTC China, closed. China banned the use of cryptocurrency entirely. Following China, BTC was banned by Norway.

For the first time, however, large companies began to take cryptocurrency seriously. Microsoft announced the start of accepting payments in digital currency – a decision that was key in the approval of BTC by corporations.

In 2017, everyone started talking about crypto, and Bitcoin took the top place in the list of the most popular words. In August, there was a hard fork; that is, a new rule was introduced in the cryptocurrency protocol, which led to the emergence of a new independent virtual unit – Bitcoin Cash. China unexpectedly declared cryptocurrency exchanges illegal. On the other hand, Japan began to recognize BTC as a legitimate currency.

Dreams of easy and quick earnings have attracted many new users, inexperienced investors, and speculators. Big players also did not want to miss the chance to earn extra money on the general hype. Throughout 2017, the Bitcoin rate went up – in December, its value approached a record $20,000, but the explosive growth could not continue forever. In late December 2017, South Korea announced its intention to fight speculation in the cryptocurrency market. The BTC rate then was $11,000 but slowly growing.

Bitcoin continued to fall in 2018. It was challenging for those who hoped for further growth of the cryptocurrency. The owners sold their savings en masse, which only accelerated the fall in the exchange rate. However, the hackers continued to attack major exchanges. In April 2018, they attacked the popular Poloniex exchange. Cryptocurrency-related hacks are widespread. This was followed by a loud attack on the Binance exchange, the loss from which exceeded $40 million.

Corporations have again changed their attitude towards cryptocurrencies. Facebook had banned Bitcoin ads. Google and Twitter soon followed suit. The Bitcoin rate was in a fever throughout the year, and in December, it settled at a minimum annual level of $3,200. In 2019, growth began again.

In December 2020, the exchange rate neared $20,000 USD

Is it Too Late to Invest in Bitcoin in 2021?

FOMO (fear of missing out) is common in trading, especially when dealing with highly volatile assets such as Bitcoin. A main feature of BTC is unexpected surges. The most recent one started in October 2020 and led to a new all-time high (ATH) in December.

It might seem as if you have missed your chance to buy low and sell high. We want to assure you that is not the case. Many investors believe that Bitcoin will continue growing.

Analyst Lark Davis drew attention to the results of BTC’s technical analysis.

Opportunities for positive movement of cryptocurrency in the future, in his opinion, will soon visually “level” the sharp jump in the Bitcoin rate of 2017 with other peaks. To clarify his point of view, he asked the readers of the microblog to pay attention to how insignificant the growth of BTC in 2011 and 2013 seems today.

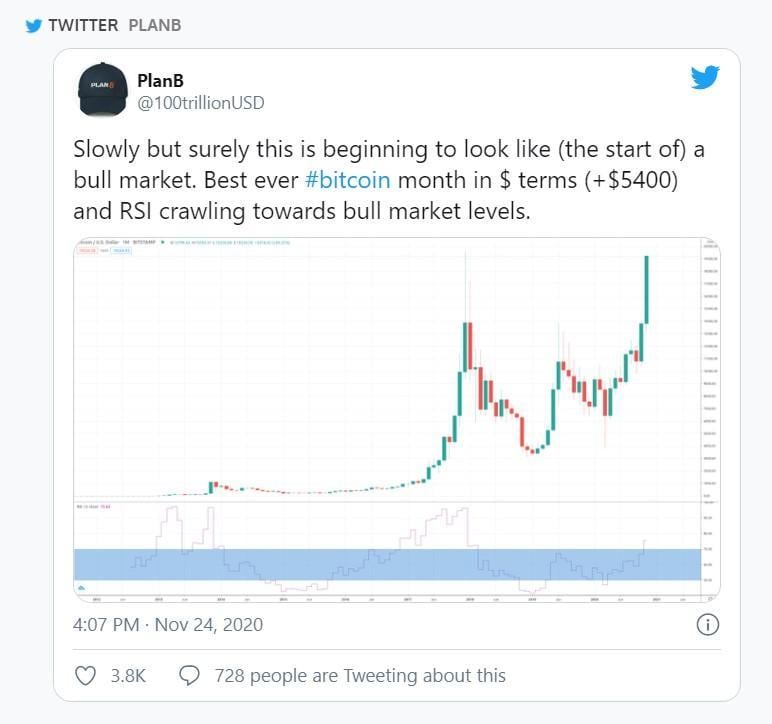

Another famous analyst in the crypto community – PlanB – also noted the prospects for Bitcoin’s further positive movement, based on the achievements already realized by the digital asset.

Three BTC Investing Strategies

Those who have freshly entered the cryptocurrency market tend to lose money on it. There may be various reasons for this. Emotionally, newbies can act illogically and make errors in pursuit of hasty profits. The incapability to manage risks also leads to substantial losses. You can dodge counterproductive trading by using simple (beginner) strategies.

1 – Buy & Forget

Perhaps the simplest strategy is to buy BTC and keep it as an investment for a long time. In this case, money is invested in the asset that will not be needed in the near future. Otherwise, if the coin’s value falls, you will have to sell it at a loss.

This strategy involves long-term investments- for example, BTC – in anticipation of the price increase in the coming years. Even when buying Bitcoin for a long time, it is crucial to choose the right moment. The following strategy – averaging – can help to find the right moment.

2 – Averaging

Finding a textbook moment to buy Bitcoin is impossible. At whatever price the trader buys the asset, it will likely decline before entering the long-term growth phase. Therefore, some investors use the averaging strategy: the user splits their capital into several parts and buys Bitcoin with them over time. Thus, if the price of an asset drops, they can use this as an opportunity and buy more coins. In this case, the average BTC purchase price will decrease. Each user can decide for himself how many parts he will divide the capital. The more there are, the more average the price will be. The best option here is to invest in BTC for a small amount every day.

You can start with this strategy right now – in positive news, BTC’s halving, and the policy of central banks that print money, thereby depreciating it, speak in favor of the rise in the price of the cryptocurrency. However, it is essential always to have capital if the BTC price drops by half or more.

3 – Diversification

You can invest in other coins, too, you know? By dividing your capital between BTC and other cryptocurrencies, higher returns can be generated. However, the risks, in this case, also increase due to volatility. Relative to their value, altcoins can have significantly higher return rates than the leading digital coin.

For example, on March 12-13 this year, the Bitcoin price fell from $8000 to $3800 – by 53%. At the same time, Ethereum fell by 60%, from $213 to $86. Then the altcoin lost more value than BTC, but it has risen in price much more by the current moment. ETH growth since the March collapse was 345%, whereas BTC showed a whopping 250% increase in value.

As such, another smart way to diversify your investment portfolio is to add other asset classes, apart from cryptocurrencies.

How to Purchase BTC

Getting started with investing in Bitcoin is not as hard as you think. Here are some simple but essential steps to purchase BTC.

1 – Choose a Reliable Cryptocurrency Exchange

The first step to buying Bitcoin with ease is to choose the correct cryptocurrency exchange. Perhaps you have already heard of PrimeXBT. When selecting a digital asset exchange, study the trading platform’s reputation, and check whether it provides services to customers from your country. When using tools like PrimeXBT, look at the volumes, as sometimes they talk about the need for a service. Be sure to read the information about the commissions for the transaction, deposit methods, and safety standards.

2 – Register and Create an Account

When you have chosen a cryptocurrency exchange, get ready to create an account. Opening an account for most of the cryptocurrency exchanges is free, but you will need to provide an email address and phone number. Some cryptoexchanges require you to go through the KYC (know your customer) procedure, including giving identifiable personal information, such as your real name, your photograph, a picture of your passport or ID card, living address, etc. On PrimeXBT, you don’t need to provide such information and go through a long KYC procedure, which is a direct advantage of this platform. PrimeXBT has a fast and convenient sign-up procedure, but the front and foremost advantage is the lack of risk of identity theft (such as your passport being leaked to the darknet).

3 – Don’t Forget About 2FA

Use a reliable password for your account, and don’t forget to enable two-factor authentication or 2FA. It significantly reduces the risk of (identity) theft, providing an additional level of security. Google Authenticator is one of the most popular 2FA applications, which offers users two-step phone authentication.

4 – Choose Your Payment Method

There are several ways to buy Bitcoin for fiat currency, for example, USD or EUR. Some cryptocurrencies allow purchasing BTC using a debit or credit card, as well as a bank account. To use one of these methods, you will need to associate a bank account or card to your account on the chosen platform. On separate platforms, the purchase is possible through third-party payment solutions, such as PayPal and others.

5 – Decide on Your Deposit Amount

You need to decide on the amount of capital you are ready to invest. Remember that any investment is paired with risks, so do not put the last of your money into the asset. Experienced investors advise investing in Bitcoin and any other asset, no more than 10% of your savings.

How to Manage Your Bitcoin Investments

If you’re not a very experienced user (yet), make sure to enter the trading and investing business with caution. This involves slowly going into positions and vice-versa. By going the conservative route, you will seriously minimize your risks in the long-run.

From here, it’s all about choosing whether you want to HODL or trade!

- HODLing is easy, because in this case, you buy your crypto and wait for it to go up in value, also called speculation or shorting. This approach has some serious logistical problems (especially for those who go all-in at the top or HODL through all-time highs).

- Trading is more complicated and has more drawbacks to watch out for, but it’ll set you on a path where you will be conditioning yourself to do what you’ll need to do in due course – buying and selling at opportune times and profit over time.

Based on this, we can confidently say that a slightly altered version of HODL is the most beginner-friendly strategy. Still, as you progress in your journey to success, you’re going to want to be able to trade effectively. Thus, it can make sense for even an inexperienced crypto investor to ease into trading slowly.

If you decide to trade, start with small transactions (for instance, 1% of your portfolio per trade and no more than a few trades per week), use stops, and learn about Technical Analysis. Understanding long-term trends is essential for both short-term trading and entering and exiting long-term positions). Do your research!

When you understand the Bitcoin basics, like how to tell a bear market from a bull market and what sort of trends you need to look for to know when to sell or to buy, you will approach a point where shorting, a buy and hold everything strategy, will most likely no longer be your best choice.

The main thing to remember is that people are largely correct when they say HODLing is a better strategy for the inexperienced investor. Still, the claim is somewhat misleading because trading teaches many skills that will assist in finding success with both long-term and short-term investments.

HODL might be a better strategy for a novice player, but buying the top and HODL to zero is one of the worst possible strategies out there. The sad reality of this is that most people will get into the crypto market late, and HOLDing will mean exposing themselves to the pressure to sell at the wrong time.

Risk Management and Pay Gains

Whether we like it or not, to become financially successful in the modern world, we have to work two times: the first time to earn money, and the second time to preserve and increase it. Thus, financial and investment planning is no longer a luxury but a vital necessity.

However, there is a time-tested strategy for forming an investment portfolio that allows you to optimize risks and profitability and provide psychological comfort for the investor even during substantial market falls. This strategy is called Asset Allocation. It is based on the postulates of the modern portfolio theory, the founder of which is the American economist and Nobel laureate Harry Markowitz. These are the basic principles of forming an effective portfolio:

- Asset allocation is a key principle in the formation of an investment portfolio. According to a study by The Vanguard Group, class distribution is the distribution of assets to a greater extent (88%) that affects the risk-return ratio. Only 12% – the choice of individual securities, stocks, or the timing of buying.

- Diversification is a way to reduce the risks of investing in a particular cryptocurrency. Risk is the probability of an adverse event (for example, government restrictions, sanctions, fines, hacker attacks on main cryptocurrency exchanges, devaluation of fiat currencies, and others). According to statistics, owning only two shares of different companies eliminates 46% of non-market risks associated with a particular company’s business. Owning shares of 16 different companies reduces this risk by more than 90%. The same logic works with crypto investments.

- Investor psychology and behavior It is important to study the principles of modern portfolio theory in more depth, familiarize yourself with historical data on the ratio of risk and return of various asset classes, and increase your awareness of this issue.

Conclusion

Take it for granted that we cannot influence the profitability of the market in any way. But discipline in the execution of your BTC investment plan, the regularity of portfolio replenishment, compliance with Asset Allocation principles in practice, regardless of the market situation, and a life without debt is entirely our own area of responsibility.

As you can see, the principles of the Asset Allocation strategy are easy to understand. Putting these principles into practice, coupled with disciplined adherence to your investment plan, will lead you to the inevitable creation of capital that you will profit from in the future.

If you found this article interesting and useful, it’s time to start somewhere! A great way to start trading is on PrimeXBT. It’s a secure platform with a convenient interface and instant order execution, low fees, and 24/7 live support. You can get a free account on PrimeXBT in less than a minute.

Raising awareness reduces the risk of developing destructive emotional states such as fear and greed that affect investor behavior. You will learn that crises are statistically inevitable and happen, on average, once every 5-10 years, and portfolio drawdowns are “sales” of assets with discounts. These are excellent chances to buy BTC at lower prices without panic.

Why should I invest or not invest in Bitcoin?

Bitcoin is still considered the main cryptocurrency and the safest cryptocurrency. Currently, Bitcoin is considered "digital gold" and has the biggest market capitalization, proving its reliability. Also, that makes Bitcoin attractive, even for people who do not (yet) know much about it. If the price breaks the level above the previous high, then you should definitely wait for its growth and invest.

Can I make money with Bitcoin?

For sure. If you are interested in long-term investments, you can simply buy the cryptocurrency and wait until its value increases. Although the current rate is high, BTC is anticipated to rise further. Thus, your expenses will pay off. Another option is trading. Trading allows you to get potential profit, both buying and selling the asset. Even if the BTC price goes down, you can sell it and get rewards.

Is Bitcoin worth investing in?

Bitcoin is gradually becoming the digital version of gold. Bloomberg analysts made such a statement in October 2020. They are confident that the coin is beginning to perform the functions of a protective asset, as evidenced by a decrease in exchange rate volatility and an increase in interest in BTC futures.

How do I start investing in Bitcoin?

In case you missed it (it happens to the best of us), check out the “Three ways to Invest in Bitcoin” and “How to purchase BTC” sections of this article. They have all of the answers you’re looking for!

How much should I invest in Bitcoin?

Experienced investors and traders advise investing in Bitcoin, as well as in any new asset, not more than 10% of your savings. And remember, never invest an amount of money you’re not ready to lose forever.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.