After Bitcoin came into existence, several cryptocurrency projects came to life. Most came to carve out their own path, but some came to attempt to improve Bitcoin and its uses. The cryptocurrency world grew rapidly, with such contenders as Litecoin, Ripple, and Feathercoin jumping into the fray.

However, Ethereum was different from the others as it wasn’t just built for payments but could be considered a supercomputer that allows for smart contracts to be utilized. This allows the developers to build decentralized applications, as there is no need to monitor counterparty risk. The smart contract fulfills whatever conditions are agreed on automatically.

Ethereum is a Layer-1 solution, meaning that it has its own blockchain. Furthermore, several other projects have been built on top of it, from decentralized finance applications to nonfungible token projects. Because so many ecosystems are built on top of Ethereum, the demand for ETH, the native token, is typically quite high. ERC-20 tokens, or ones built on the Ethereum blockchain, are quite common in cryptocurrency.

While many of the original competitors to Bitcoin are worthless today, Ethereum has consistently been the second most valuable cryptocurrency in the world. This guide aims to walk you through the reasons why Ethereum is a good investment, how you can invest in Ethereum, how to buy Ethereum and make profits on short-term fluctuations, explain all the pros and cons of Ethereum investing, and more.

Ethereum Investing: What Is It?

Ethereum investment is investing in the future finance, as Ethereum is a smart contract platform with lofty goals. One of its goals includes replacing Wall Street and has already started to see company shares and bonds tokenized on the network as part of some business transactions.

Ethereum’s potential is much more remarkable than even Bitcoin’s. This is because it acts as a platform for developers to build and innovate through continuing research. The recent DeFi trend is one area worth watching as it allows for a new way to approach banking.

DeFi will allow permissionless lending and borrowing instead of dealing with a traditional bank. The smart contract allows various agreements without counterparty risk, unlike the traditional banking system. This also allows the ability to lend and borrow without third-party costs or interference.

The NFT explosion, or non fungible tokens, is also an essential part of the Ethereum price growth as most of them are built on some type of Ethereum smart contract standard. ETH is used to pay gas fees for Ethereum and other Layer-2 solutions. Additionally, the Ethereum network which allows the development and deployment of projects that use smart contracts can also fuel the price.

Is Ethereum a good investment? How it performed in 2023

2023 was a strong year for Ethereum, as it started the year around $2500 as the markets once again entered a cool down period that started in 2022. The DeFi expansion continued and as 2023 ended, ETH went from highs to highs.

At same time NFT marketplaces started losing both the support and confidence they once had. The Ethereum 2.0 update rolled out moving the network to a proof-of-stake from a proof-of-work. The update sought to increase scalability, accessability and throughput of transactions.

Investing in Ethereum in 2025? Is it a good idea?

2022 has been brutal on most crypto markets, but 2023 brought some optimism back to markets. Ethereum has been volatile due to many issues, the closure of one of the biggest and well known Crypto exchanges FTX the most significant amongst them. Risk appetite has slowly returned, and hence crypto seems to have started to recover. Which inevitably will make traders wonder is Ethereum a good investment?

However, it should be noted that massive selloffs are nothing new in crypto, with recoveries following shortly.

But is this a signal to buy Ethereum?

Nearly 25% of all ETH in circulation is locked up in smart contracts, with a significant share of that relegated to the ETH 2.0 staking address.

An update dubbed EIP 1559 should theoretically cause ETH supply to be much scarcer over time. The ability for Ethereum to be so many things over the long term has Wall Street taking notice, thereby bringing institutional money into the market.

That being said, Ethereum, and the crypto market at large, have shown themselves to have a high correlation with risk appetite assets such as stocks and some futures markets.

Ethereum Fundamental Analysis

DeFi is a trend that has helped Ethereum continue to strengthen its use case, moving more traders to buy Ethereum. The Ethereum Foundation has been growing for some time, as the ability to work with smart contracts has a lot of investors excited about the future of the network.

Most metrics of the Ethereum network have grown, especially the number of Ethereum wallet addresses. The Ethereum 2.0 upgrade is being implemented to fight network congestion, one of the biggest complaints about Ethereum.

This should drive down the gas fee and expand the use case scenario. The amount of ETH held on exchanges has fallen, suggesting many are willing to hold onto Ethereum.

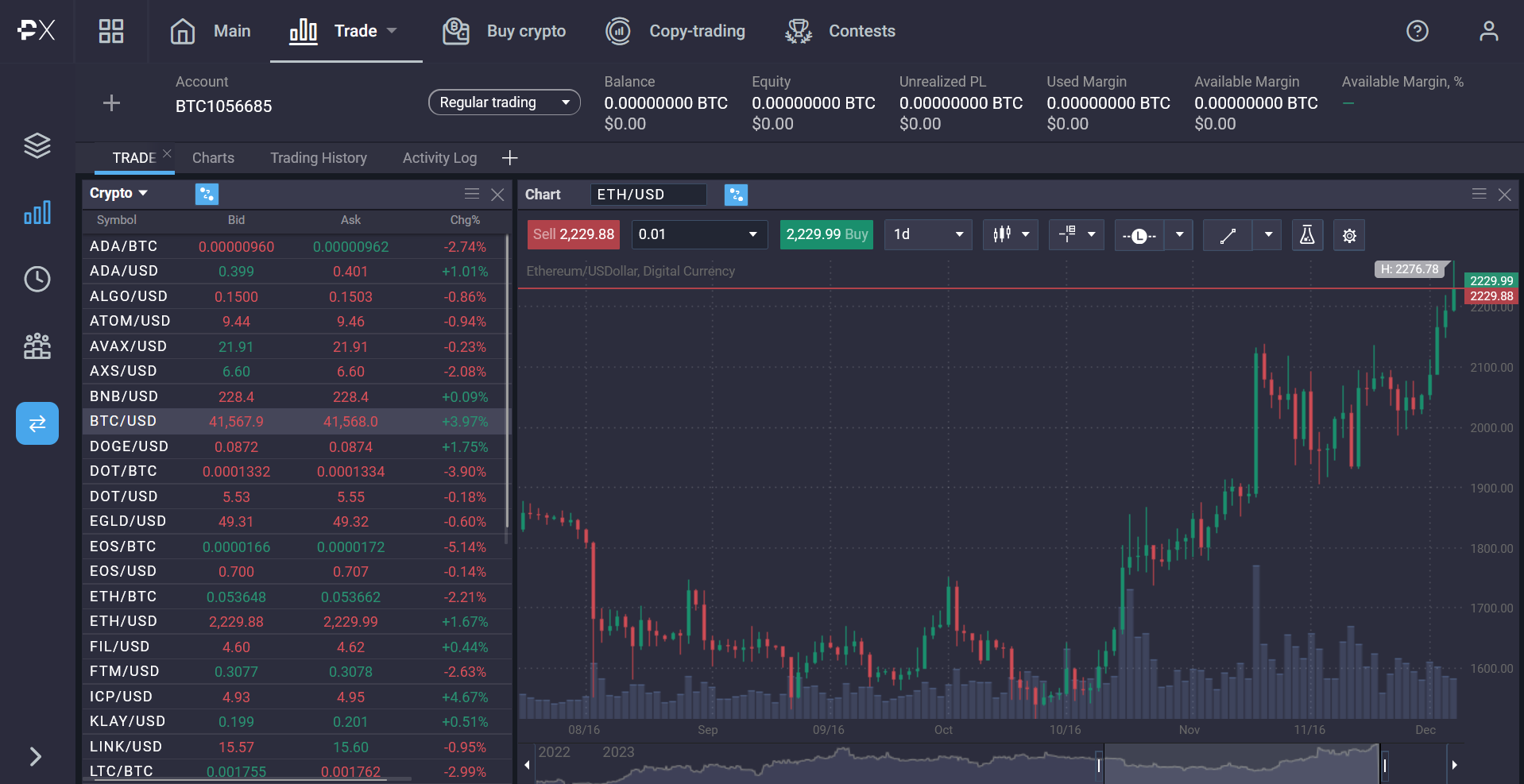

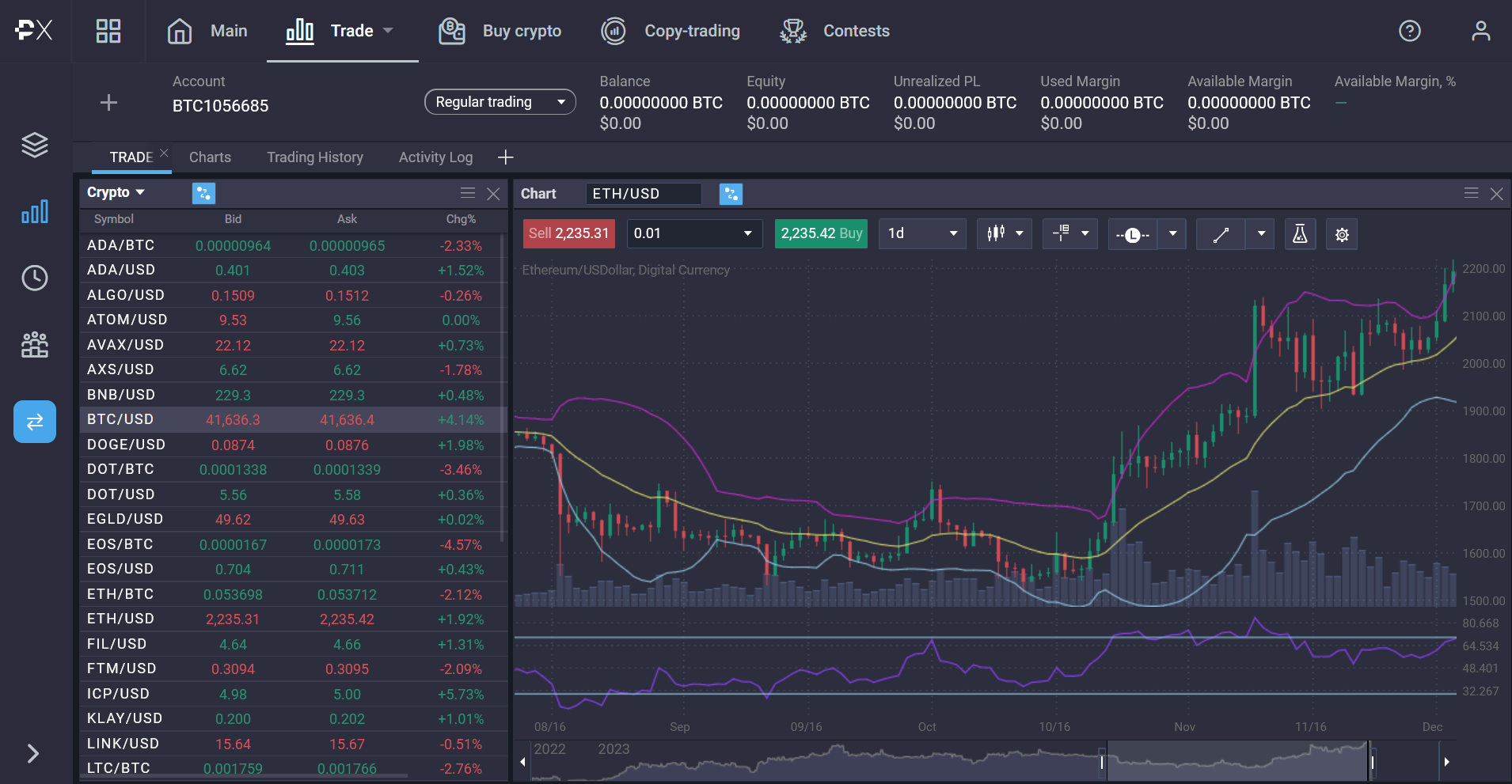

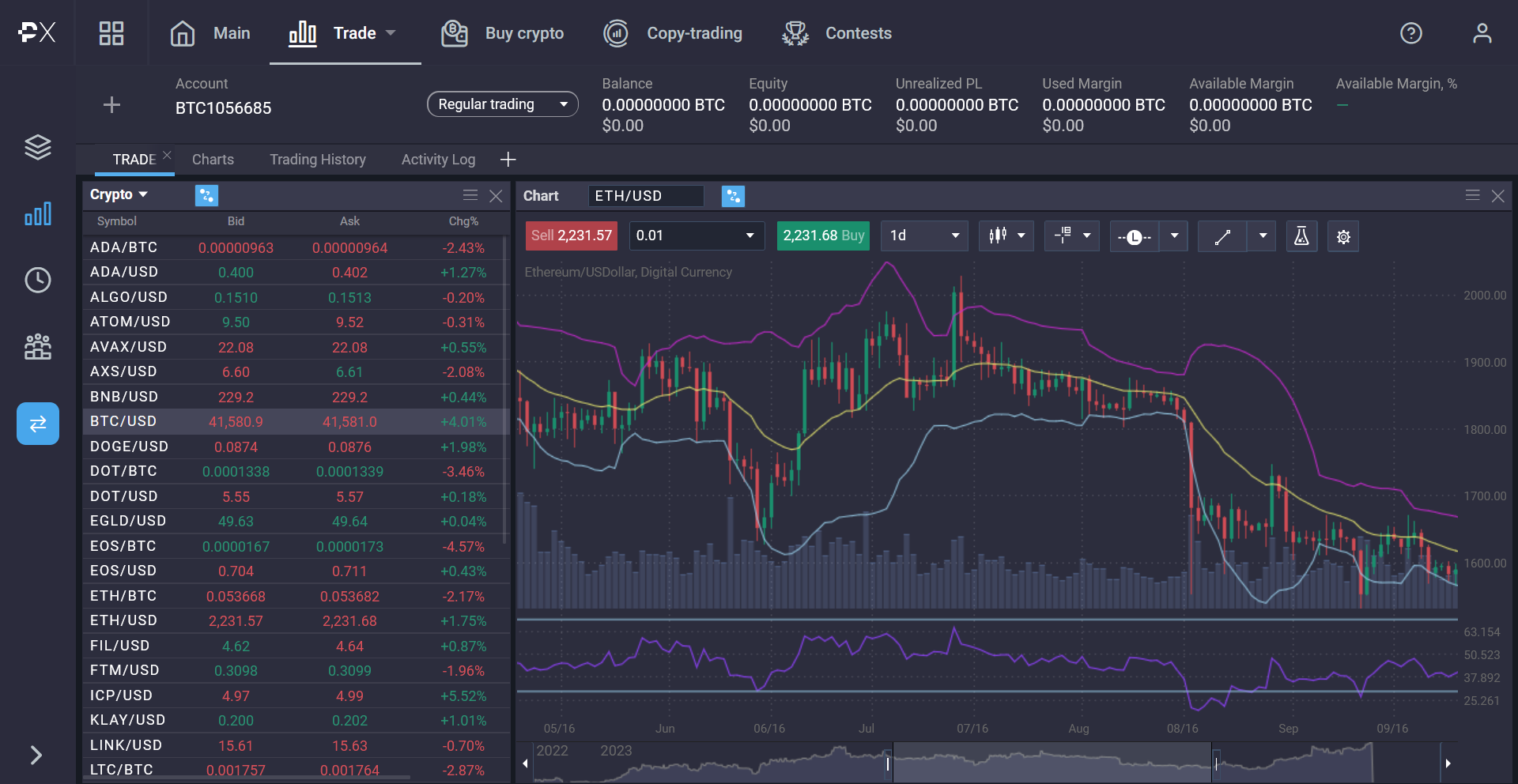

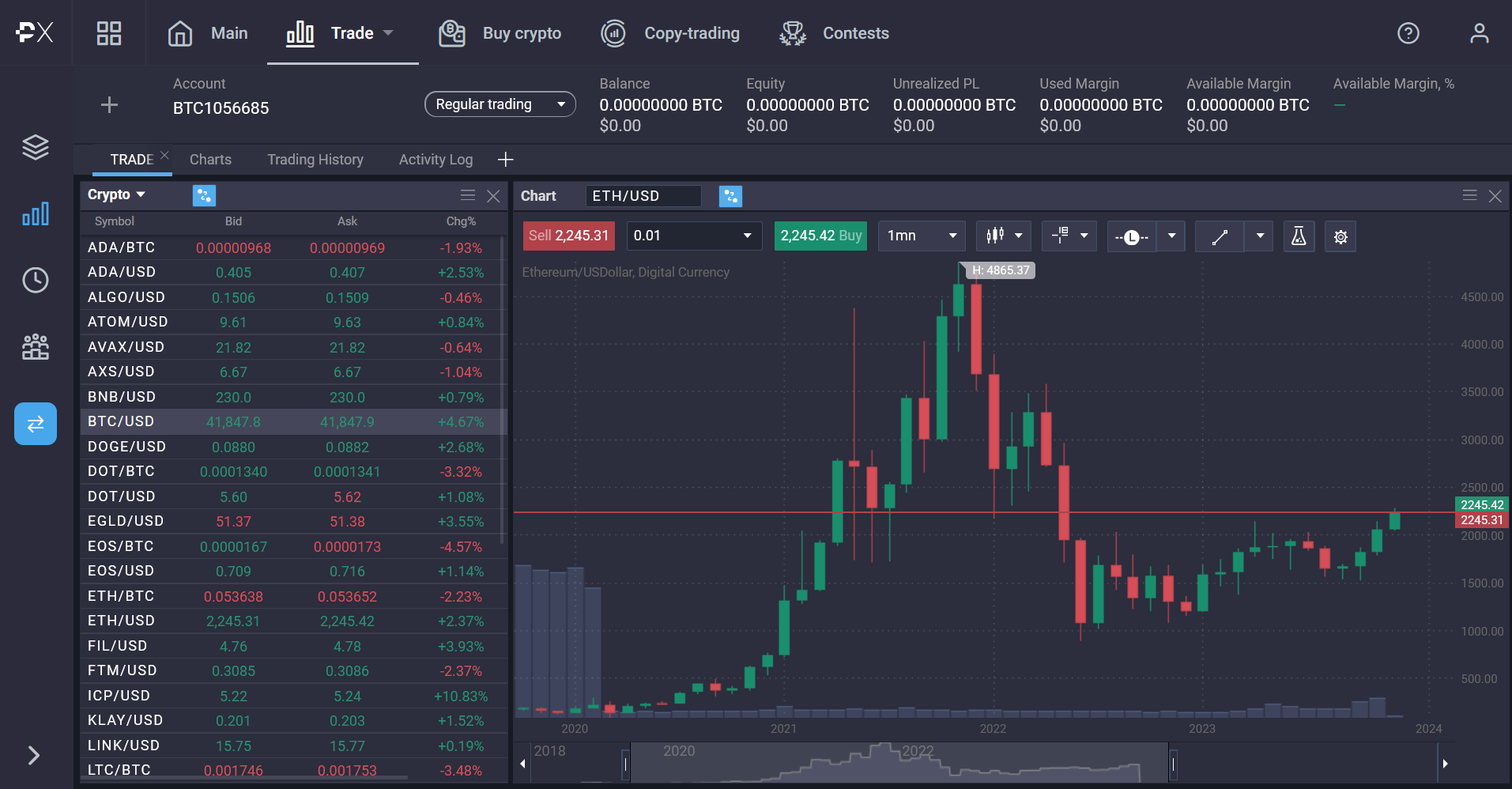

Ethereum technical analysis

Crypto markets, and by extension Ethereum, are highly influenced by technical analysis. The picture for Ethereum and the rest of the cryptocurrency world looks much more positive then a couple of years ago.

However, this is nothing new for Ethereum, and it has seen a willingness to continue to climb, even after a couple of “crypto winters.” This is when the price of crypto seemingly goes nowhere after a significant fall.

This is a new investment area that should be kept in mind when you look at charts. There are going to be a few growing pains along the way.

Therefore, you need to decide whether you will trade or invest. Many of the more successful crypto enthusiasts can do both. They will hold some in a wallet and trade other coins, perhaps on a CFD platform like PrimeXBT. This allows for pure price speculation without taking custody.

The market fell precipitously from late 2021 to mid-2022. However, it is worth noting that this has happened before, only to see the market make even higher levels once the dust settles and we are likely seeing that happen right now.

Ethereum sentiment analysis

With the explosion of DeFi and the wide adaptation of smart contracts, Ethereum sentiment took off in 2023. However, Ethereum will also be susceptible to external issues, including monetary policy and inflation.

While crypto is still an area that should continue to expand over the long term, the reality is that in 2021 a lot of institutional money came into the market, but risked off in 2022. Because of this, sentiment analysis is a bit different than it used to be.

This has highlighted the switch of drivers for the market, as institutions are much more likely to invest in bonds or even US dollars when there is uncertainty.

In a sense, part of “growing up” for crypto has been that the behavior of the market has switched to a much more traditional correlation. As risk appetite increases, so will the price of Ethereum, and vice versa.

One way to measure sentiment analysis in the future will be a combination of watching interest rates, currency markets, and stock markets. In general, the approach has been:

- Interest rates: As interest rates rise in the US and other major economies, it drives money into yield-bearing instruments such as bonds.

- Currency markets: FX rates correlate with risk appetite. The most important currency to watch is the US dollar. If the US dollar is falling, it typically means that people are willing to invest in “riskier markets.”

- Stock markets: Stock markets such as the S&P 500 can also be an excellent sentiment tool. After all, the institutions that push the market around will decide whether they are willing to step into other markets. The higher the S&P 500 is going, the more likely it is.

Ethereum’s Price History

From 2015 it was the first Ethereum blockchain technology that proved the value of high risk.

Anthony SaSsano, a prominent Ethereum expert and founder from the Daily Gwei, describes Ethereum’s volatility over the past decade and says that the price has seen huge appreciations as well as significant losses.

The price dropped nearly 70% between 2017 and 2018 with another devastating 94% fall in 2018 before the second half. After the drop seen in 2022, Ethereum seems on track to grow into 2024. Ethereum price history is not based solely on declines. Sassino reminds me of another side of the coin.

What factors determine the price of Ethereum and its potential?

Decentralized Finance (DeFi)

Ethereum has many potential applications that will allow decentralized banking and e-commerce to be incorporated into the blockchain.

The best crypto2.0 coins have participated in the growing DeFi market, increasingly popular among those looking to substitute for a centralised centralized system.

Many DeFi platform developers have built on the Ethereum blockchain, which allows automated loans, token exchanges, and yield harvesting.

De Fi protocols typically have low fees and minimal entry barriers thereby providing a simple service for everyone, regardless if they’re in another location.

Smart Contracts

Agreements that both parties may self-exercate after a certain period is fulfilled. With smart contracts, it is impossible to have any third-parties perform trustworthy transactions.

It also works because this technology is supported by blockchains and is distributed through an open source system.

Expert expectations and Ethereum price predictions

The most accurate prediction to date has been the managing director of Digital Capital Management Ben Ritchie, which expects ETH to close at $2500, which it is already close to.

Gov Capital has a much more ambitious, but longer term target of $7200 by 2025.

The most bullish seems to be VanEck a global investment fund house, which believes ETH is a triple point asset that is a both a consumer and capital asset but even a store of value.

5 Reasons why Ethereum is a good investment

It is generally expected that Ethereum will have a promising future. However, predicting the future price of Ethereum is challenging, as multiple internal and external factors come into play.

For example, even though Ethereum 2.0 addresses a lot of the growing pains of Ethereum, it has been somewhat slow to roll out.

Global markets have struggled in 2022 and have been felt throughout the crypto industry. There have been several stablecoins and DeFi lenders collapsing, which has a certain “knock-on effect” on the price of Ethereum, as it does all cryptocurrencies.

In this environment, estimates are all over the place. However, but we’ve seen prices rise over the long term and Ethereum remains an appealing asset.

Bloomberg intelligence analyst Mike McGlone has it ending the year between $4,000-$4,500 and rising into 2023, although current performance is much more conservative, the recovery has still been impressive.

Coinpedia, a popular website dedicated to cryptocurrencies, has several analysts that believe Ethereum could see a massive surge in price if the Ethereum 2.0 rollout goes smoothly and is done quickly.

Some higher-end predictions include a $12,000 price target by early 2023.

Tyler and Cameron Winkelvoss, founders behind the crypto exchange Gemini and co-creators of Facebook, have predicted a “Crypto Winter” for the near term. The twins cite macroeconomic uncertainty as the main culprit.

Ethereum co-creator Vitalik Buterin, the face of Ethereum, has warned the stock-to-flow Bitcoin price prediction model “is really not looking good now.” While he was speaking of Bitcoin, the price of Bitcoin influences the price of almost all other coins.

If his observations are correct, it further props up the idea of trading derivatives like CFDs to take advantage of the uncertainty and volatility since you can both buy Ethereum and sell it without the obligation of owning the underlying asset.

Read more Ethereum Price Predictions

Ways to invest in Ethereum

Most traders did not have the chance to buy Ethereum during its token sale, as that is long gone. The enormous return on investment is something that most can only dream about. However, that does not mean that Ethereum can’t still be an excellent investment.

It was challenging to get Ethereum when the initial offering happened, but today it can be bought quite easily with just a few clicks. Here are some of the more common ways to invest in Ethereum:

Buy and Hold

Buy-and-hold is a sound and simple trading strategy, but it is also somewhat risky due to the volatility in the crypto markets.

The explosive price action in crypto can work for and against the holder. For example, Ethereum was worth close to $4800 and then fell to the $1000 region in just eight months. This is the type of volatility that you are forced to sit through.

Ethereum has seen massive growth over the last several years, but the pullbacks have been brutal. If you buy Ethereum at a lower price and you can sit through the type of volatility seen from time to time and add to your overall holdings, this has proven extraordinarily profitable so far.

Trading

But you don’t have to buy Ethereum and wait through huge downtrends, spot traders can sell their Ethereum holdings for cash and avoid losses.

However, there is no way to profit from a downtrend on a spot platform. For example, traders who bought at the 2020 low and sold at the high of roughly $4800 would have made approximately $4,200. However, as they held past that point, they gave up massive gains.

Derivatives allow traders to profit from both uptrends and downtrends on the Crypto market, as traders can “go long” (buy) or “short” (bet on falling prices) in a market. In a derivative market, such as the CFD markets offered by PrimeXBT, traders can leverage their positions.

The example mentioned above could have been a gain of $420,000 instead of $4,200. While it is obvious that CFD markets offer more significant gains, this risk is something that you should approach with strict risk management.

Even more importantly, traders who saw the Ethereum markets fall could have also profited from the price drop. In the CFD market or contract for difference, you are speculating on the market’s price, not worrying about taking custody of the asset itself.

Because of this, it only takes a few clicks on the PrimeXBT platform to benefit from crypto market price moves, be it up or down.

Pros and cons of Ethereum

Remember that the ETH price is highly volatile and based on new technology. The market is constantly threatened by what is to be the next “Ethereum killer,” but no other project has been able to come close to Ethereum in usage or utility.

Pros

- Brand name recognition: Ethereum has a significant presence in the crypto market, as it is one of the original altcoins. It is the hottest token in the crypto market due to both NFT and DeFi uses.

- Smart contract platform: Ethereum is a smart contract platform that is well tested and has the ability for permissionless transactions, which could be the future of finance.

- Ethereum 2.0: Ethereum 2.0 is being rolled out, which should increase transaction speed and use case scenarios.

Cons

- Previous scaling issues: Ethereum has had trouble with scaling due to the strong demand for DeFi use.

- ICO Treasuries: There is still a significant amount of Ethereum held by ICO Treasuries that could dump their tokens one day.

- Competition: Competition exists, with multiple networks vying to become the next “Ethereum killer.” Ultimately, only time will tell if someone succeeds.

- Fees: Fees have been extraordinarily high at times, discouraging investors from transacting on the network and with the token. However, Ethereum 2.0 is supposed to address this issue.

#1 Ethereum could be a world computer

Ethereum’s technology allows its coin to be used for transaction fees on its eponymous network which allows the use of smart contracts.

Activities on the Ethereum network impact Ethereum’s price because of the aforemention reason. Ethereum’s technology allows users to develop everything from their own exchange platforms to tokenizing real-world assets.

How much to invest in Ethereum?

Ethereum is much like many other cryptocurrencies, which is extraordinarily volatile.

The market for Ethereum is unique to traditional assets because you can buy small amounts. Because of this, there’s no solid floor in terms of Ethereum investing. It’s important never to invest more than you can afford to lose.

Coins to consider alongside Ethereum

Is Ethereum worth a return? I thought it would be ok to share with you a couple small projects which could offer much bigger returns than Ethereum.

Tokenization of Real-World Assets

Tokenisation refers primarily to convert any tangible asset to a tradable token through the Ethereum blockchain. Some artists might wish to tokenize their artwork, enabling them to buy fractions of their paintings from several investors.

The painter can raise funds and offer people the option to purchase art for only fractional cost. Are ethereum investments worth making? Tokenized tokens offer another opportunity to boost Ethereum’s value. The site offers many services currently but none has yet reached the mainstream, implying it could continue to be a very profitable market.

Is it worth it to invest in Ethereum?

Investing in Ethereum has been very profitable for those who can time the market moves. The Ethereum market is very similar to others, meaning that there are cycles in which the market will enter and exit. That being said, Ethereum seems to be one of the major technologies of the future.

Is it smart to invest in Ethereum?

Ethereum investing can be wise if you are careful with how much you invest and employ strict risk management strategies, including stop losses and money management. If you trade instead of simply holding, you can make much more money.

Is Ethereum a good investment?

Ethereum can be an excellent investment due to both the ease of accessibility for retail traders and the long-term growth potential that the network has.

Not only is Ethereum accessible, but PrimeXBT offers the CFD market, which allows you to easily speculate on price movements without many of the hassles of custodianship

How to invest in Ethereum?

Investing in Ethereum can be done in a multitude of ways. You can buy Ethereum through an exchange and put it in a wallet for a longer-term “buy-and-hold investment,” or you can trade using the CFD market offered at PrimeXBT.

The CFD market will allow you to buy and short Ethereum, getting in and out of the market quickly instead of taking delivery.

Is day trading Crypto profitable?

Day trading crypto can be profitable if you are nimble and knowledgeable. CFD markets allow for both long and short positions and leverage.

The leverage can amplify profits for traders as they can trade in both directions.

Why choose Crypto over traditional investments?

Crypto markets offer extreme volatility, meaning that you can profit from significant price swings in relatively short amounts of time.

Furthermore, crypto is a growing field, so the potential for expansion of price and the use case scenario.

What is the minimum to invest in Ethereum?

If you wish to buy Ethereum, there is no minimum to do so. Some platforms require a minimum purchase, while others require a minimum deposit.

PrimeXBT requires only a 0.001 BTC deposit to start trading Ethereum or any other asset on the platform.

Should I invest in Ethereum now?

If you believe that the research in this article points in the direction of investing in Ethereum, you can do so relatively quickly by joining PrimeXBT.

Once you do your own research and feel it is time to get involved, registration is speedy, deposits start at just 0.001 BTC, and an award-winning platform is available. It should be noted that Ethereum is expected to play a significant role in cryptocurrency going forward, being the number two asset by value.

Where to invest in Ethereum?

There are many ways to get into Ethereum investing, but the simplest way is PrimeXBT. This is because the market can be traded with margin, and PrimeXBT offers multiple markets beyond Ethereum.

Acting as a one-stop-shop for traders looking to build a diverse portfolio, like forex, crypto, commodities, stock indices, and much more are available.

Registration is swift at PrimeXBT, taking one minute or less, and requires only a 0.001 BTC deposit to begin. Furthermore, the fact that PrimeXBT offers CFD, or contract for difference, markets, means that you do not have to worry about storage, custody, or any of the other complexities of the crypto markets and focus solely on price fluctuation.

Unless you plan on holding Ethereum for an extremely long time or even using it on the Ethereum network, CFD markets are superior.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.