The markets clocked their first half and second quarter report cards last Thursday and the results were dismal. US stocks were badly hit, with the Dow and S&P having their worst quarter since the first quarter of 2020 during the COVID crash. The tech-heavy Nasdaq lost 22.4% for the second quarter in its worst quarterly performance since 2008, while the S&P posted its worst first half of the year since 1970.

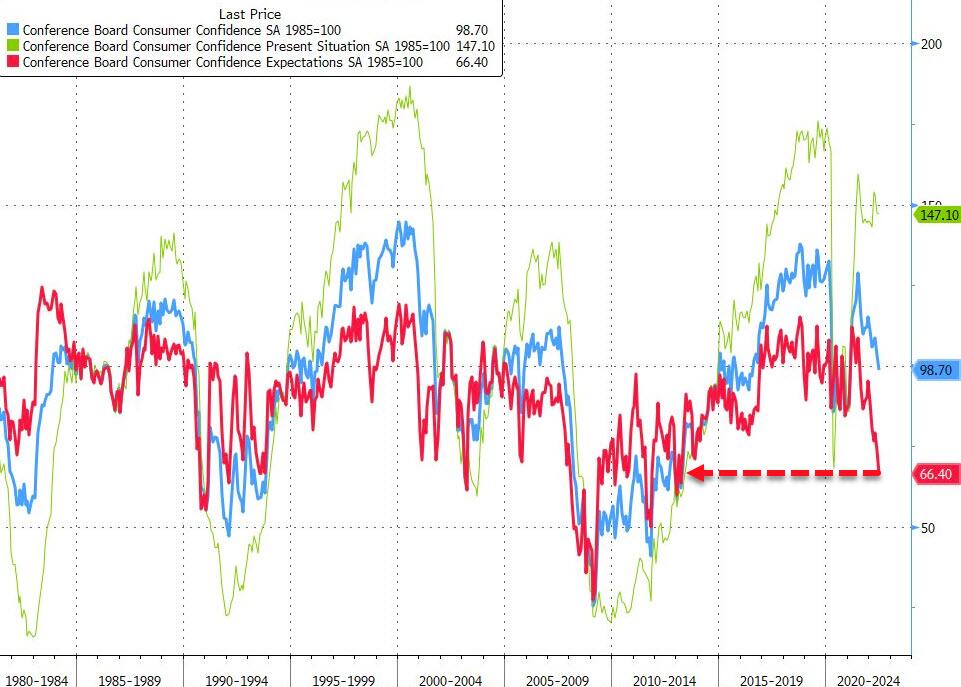

Even as we headed into the second quarter end, selling pressure was seen at every step of the way, with the main indices ending negative everyday despite many failed attempts to climb higher. The consumer confidence index released on Tuesday aptly reflected the extent of the pessimism, tumbling beyond analysts’ expectation of 100. The headline fell from 103.2 last month to 98.7 from 103.2, largely driven by a collapse in ‘expectations’ from 73.7 to 66.4.

Even Fed Chair Powell’s various attempts to ease investor fears by saying that the US economy is in good shape during his speech at the ECB conference did not gather any positive reaction from investors, who continued to sell into any small bounce in the stock market. Traders did not react positively to the slightly better Core PCE numbers released on Thursday as well. The Fed’s favourite inflation gauge rose 4.7% from a year ago, slightly less than expected.

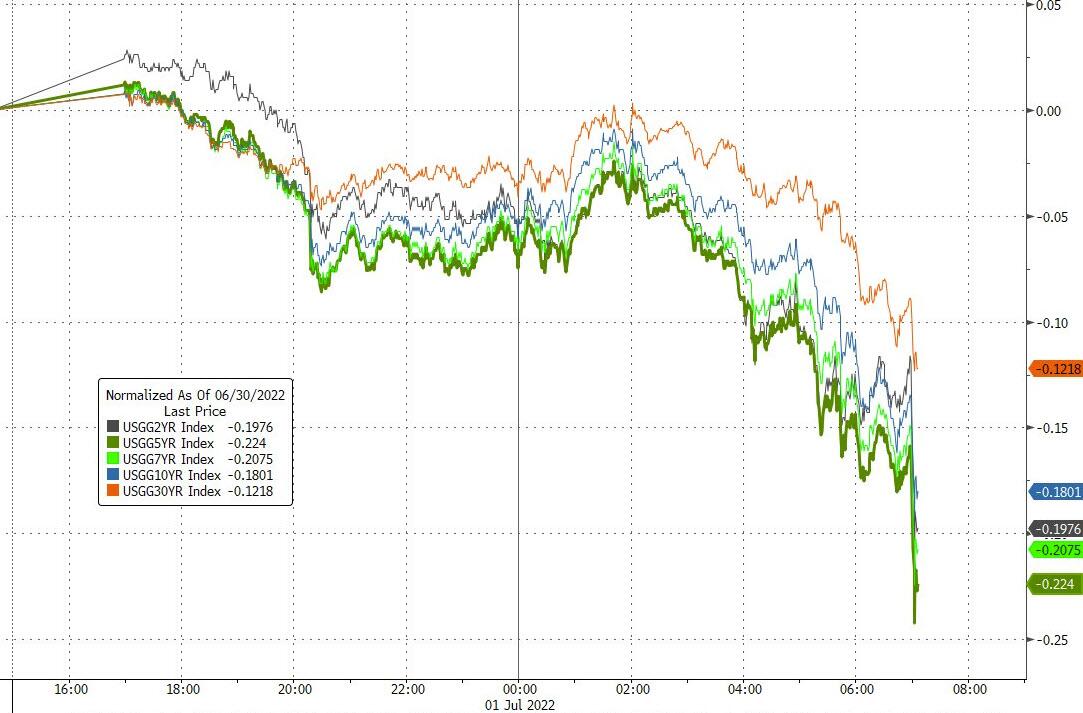

For the week, the Dow was down 1.3%, the S&P lost 2.2%, and the Nasdaq finished lower by 4.1%. Bond yields dropping was the key driver of the market stress, as US Treasuries on all maturities fell significantly on Friday morning due to escalating jitters after a series of companies dished out profit warnings.

The benchmark 10-year US Treasury fell below 3% to 2.8% at one point before finally settling the week at 2.894%.

To add to the negative sentiment, the Institute for Supply Management (ISM) said manufacturing activity in June was weaker than expected. Its index of national factory activity dropped to 53 for the month, the lowest reading since June 2020. ISM’s new orders index also fell to 49.2 from 55.1, showing contraction for the first time since May 2020.

The situation is not any better in Europe. Data released on Friday showed that inflation within the Eurozone reached a new record high in June even as GDP has been guided lower. Headline inflation came in at 8.6% year-on-year for last month, which exceeded a prediction of 8.4% in a Reuters poll of economists. The rate had reached 8.1% in May which means the cost of living is continuing to surge across the euro zone nations even as the economies are slowing down.

Impending recession often leads to deflation in asset prices, and this has already started to show. Gold fell through $1,800 at one point on Friday but managed to crawl back above the psychological support and finished the week down 1.7% at $1,810. News that the G7 agreed to ban Russian gold imports uncharacteristically had a negative impact on the price of Gold, while Silver, as an industrial metal, was hammered heavily amid recession fears and dropped 7.6% to close below $20, at $19.87. Both metals are starting the new week unchanged.

Oil went on a roundabout in another volatile week, with gains made last Monday given up mid-week on the recession-fear led selloff but recovered some lost ground on Friday as supply outages in Libya and expected shutdowns in Norway outweighed worries that an economic slowdown could dent demand. The OPEC+ meeting on Thursday turned out to be a non-event as expected as OPEC+ rubberstamped the expected 648,000 bpd production increase. Brent Crude fell 1.3% while the WTI rose 0.8% last week and are opening the new week down by about 0.3%.

Cryptocurrencies continued to come under pressure from news of the LUNA contagion spreading to other crypto service providers. As the impending bankruptcy of Three Arrows Capital and Celsius unfolds, the price of crypto grinded lower as more crypto lenders and wallets are revealed to be badly affected. However, despite the fall in prices, no new lows have been made yet as dip buying action appears to be supporting prices.

Hedge downside risk with leverageMore Bad News But Crypto Market Holds Firm

Voyager Digital LLC has issued a notice of default to Three Arrows Capital for failure to make the required payments on its previously disclosed loan of 15,250 BTC and $350 million USDC. Voyager intends to pursue recovery from Three Arrows Capital, which has applied for liquidation in the BVI where the company was set up. Furthermore, the Singapore central bank, where the firm is licenced to operate as a hedge fund, has issued a public reprimand of the firm for providing the authorities with false information. The troubles of the renowned hedge fund have been making crypto headlines and creating an unsettling effect on many crypto players. The latest instalment is that the firm has applied for Chapter 15 bankruptcy protection in the USA to safeguard its US assets from creditors, even as the founder of the company, Zhu Su, unabashedly made a claim as a creditor against the very company he managed and collapsed.

To add to the bad news, the owner of a popular crypto exchange and leading figurehead in the crypto space, Sam Bankman-Fried, warned in a Forbes interview that some third-tier crypto exchanges are already “secretly insolvent”.

Another impactful bad news was that on Monday, the US SEC Chairman Gary Gensler said in a CNBC interview that he views BTC as the only cryptocurrency that is a commodity. He however did not mention that there would be any action taken against all the other cryptocurrencies, which is a much-needed consolation for many crypto investors.

Further up north in Canada, investment firm Cypherpunk Holdings announced on Tuesday that it has dumped all its BTC and ETH holdings to ride out the current market risks. The company sold 205.8209 ETH for $227,000 and 214.7203 BTC for about $4.7 million and now holds about $14.1 million of cash and stablecoins on hand, adding it also has about $1.5 million allocated to structured products with 30 days redemption notice. Their sale could come on the back of more aggressive regulatory actions by the Canadian government which led to a 50% drop in the AUM of the Purpose BTC ETF Fund the week before.

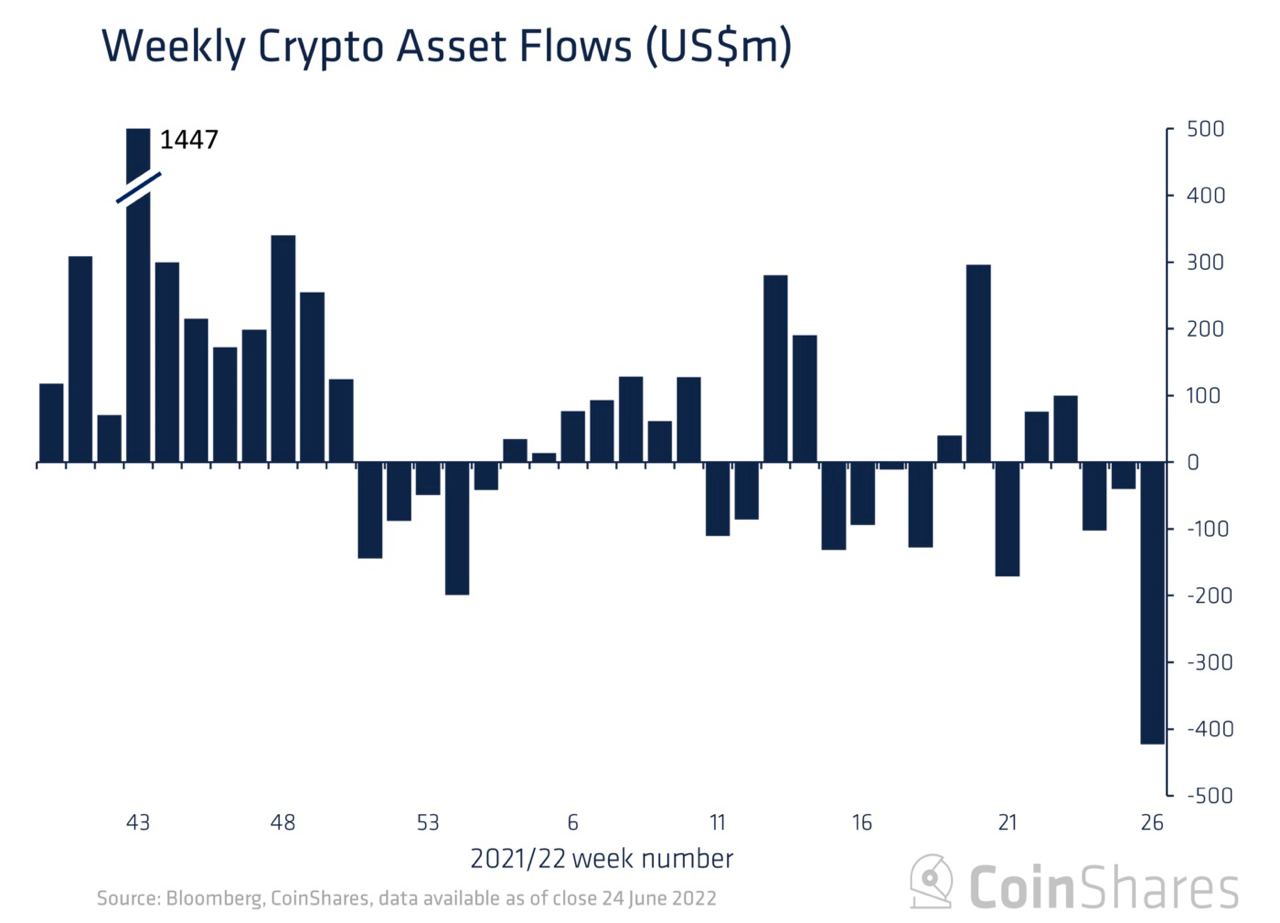

On top of these Canadian investors, crypto fund products also saw outflows totalling $423 million since mid-June, the largest since records began by a wide margin.

The outflows occurred on 17 June but were reflected late due to trade reporting lags, and was likely partly responsible for BTC’s decline to $17,760 that weekend.

However, despite the series of bad news, crypto prices merely drifted towards the previous lows made last month and have not broken lower yet at the time of writing.

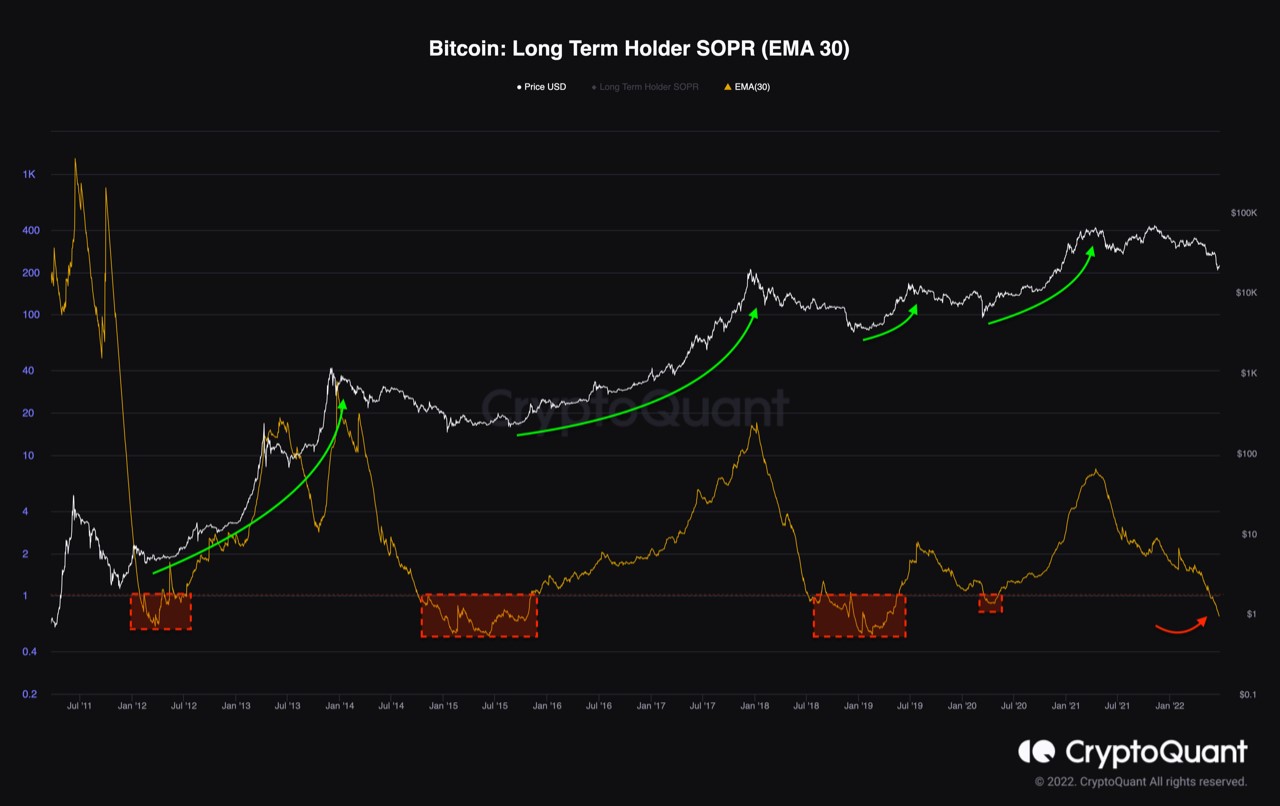

Other than dip buyers supporting prices, seller exhaustion could be another factor as can be seen by some BTC metrics.

BTC Metrics Falling Into ‘Buy Zone’

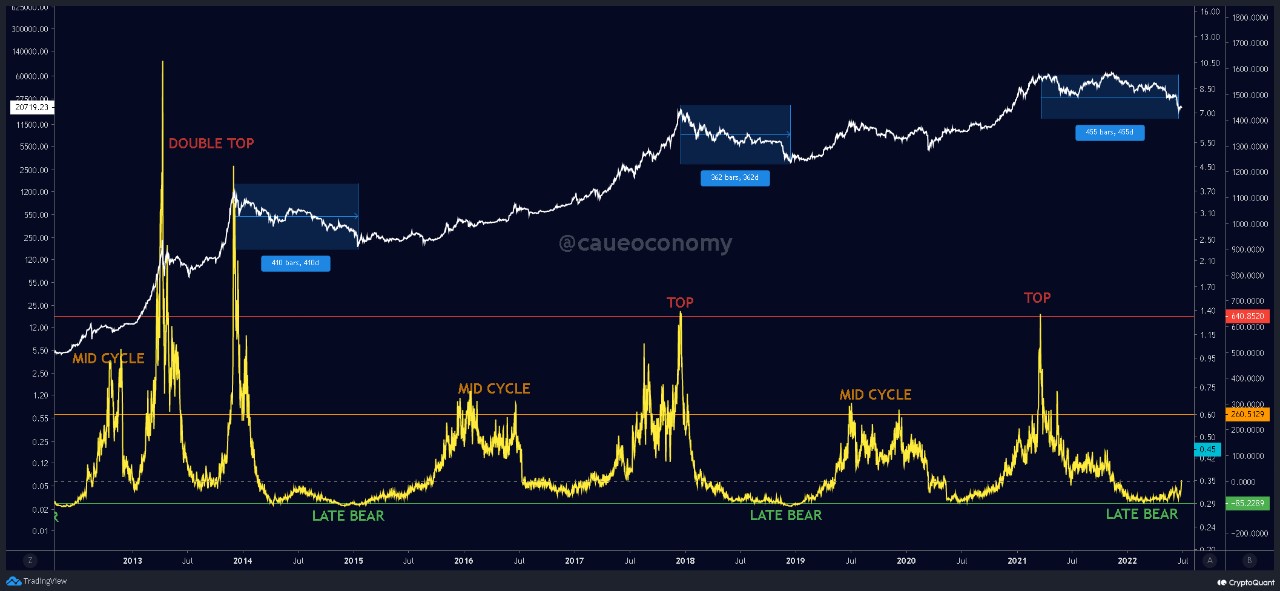

The BTC LTH SOPR is moving deeper into the “opportunity” zone of a less than 1 reading, a sign that LTHs are selling more coins. According to past experiences as can be seen in the chart, BTC could remain in this zone between 6 to 12 months before it moves into an uptrend, where the price of BTC would follow in tandem. A reading of between 0.5 and 0.6 has historically indicated the bottom and while we are not there yet, we are getting very close.

To get a more in depth look on the stage of the bear market we are at, we have looked at the rate of change of the Puell Multiple, which shows miners rate of selling their mined BTC.

According to the chart diagram below, we could have just passed the stage of miners’ capitulation where miners indiscriminately dump their mined BTC. However, even though the selling pressure from miners is reducing as the rate of change is showing an uptick, this rate of change often falls back down a second time after recovering to create a double bottom before a new bull market starts. Thus, referencing the historical pattern observed in the chart could suggest a gradual recovery in BTC’s price before the final dump comes months later. According to the chart, this final dump may not necessarily create a new low but could revisit near the low made in this first bottom.

BTC Advocates Buy More BTC

The chief corporate BTC advocate, MicroStrategy, announced that it has added another 480 BTC during the period between May 3 and June 28 at an average price of approximately $20,817 per coin, inclusive of fees and expenses. In total, the firm, together with its subsidiaries, now own approximately 129,699 BTC bought at an average price of $30,664 per BTC. The firm went on further to dispel the rumour that it may be facing a margin call on a BTC-backed loan from Silvergate Bank.

The first country to make BTC legal tender also backed up their commitment. El Salvador also revealed that it has added another 80 BTC at $19,000 each and has further boosted its BTC mining facilities.

Another positive news came from the Bank of International Settlements, which surprisingly, is allowing banks to hold up to 1% of their reserves in BTC.

Further on crypto regulations, the EU has finally agreed on landmark anti-money laundering rules for crypto transactions on Wednesday, despite industry concerns over the law harming privacy and innovation. The final proposals will need customer identity verification for even the smallest crypto transfers, if it is between two regulated digital wallet providers. However, payments to unhosted private wallets will be exempted, which is a positive for peer-to-peer transactions between individuals.

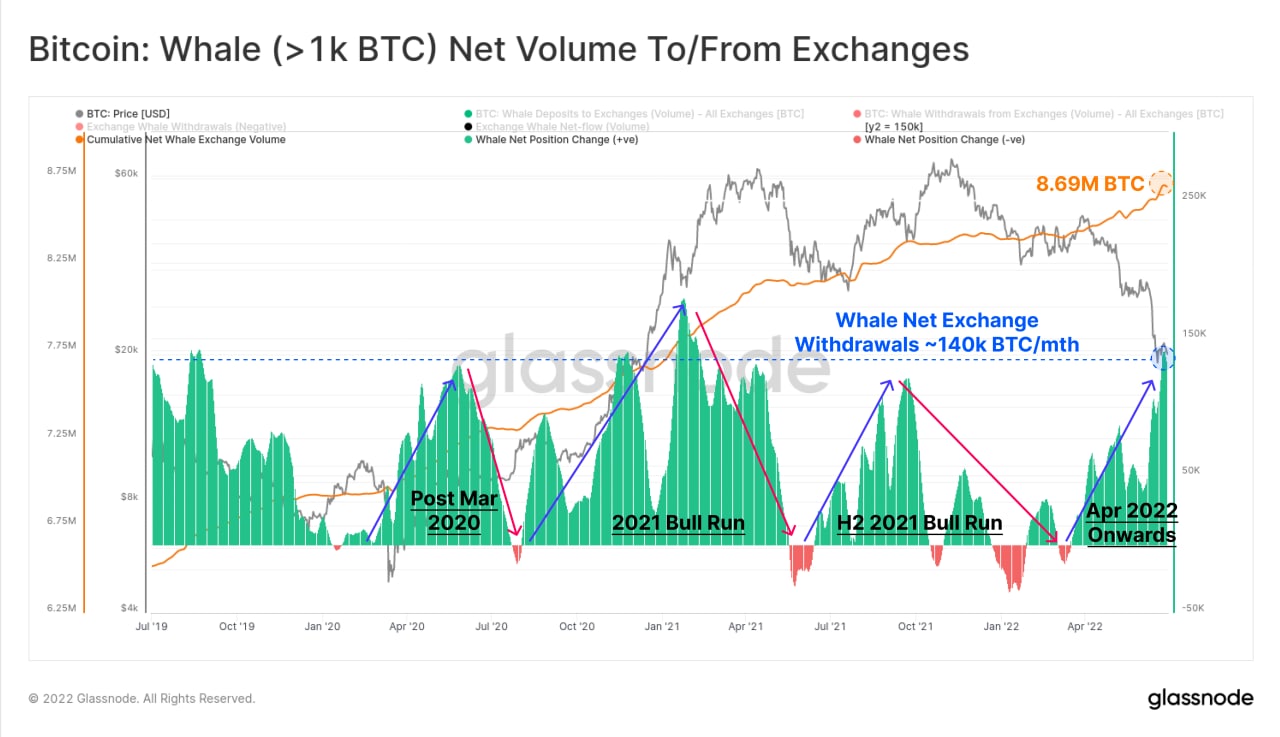

The news comes amid large whale withdrawals of BTC, which has seen more than 140,000 BTC removed from exchanges.

While in the case of this downturn, large BTC withdrawals from exchanges could be due to concerns of exchange bankruptcies, typically, such large exchange withdrawals were a result of new whales moving in to acquire BTC and putting them to cold storage. Historically, such moves often preceded a rise in the price of BTC.

Also, the diagram above shows that collectively, large whales with more than 1,000 BTC now own a total of 8.69 million units of BTC, which is a whopping 45.6% of total supply. This further reinforces the long-term bullish view for the price of BTC as more supply gets removed from circulation by large whales with holding power.

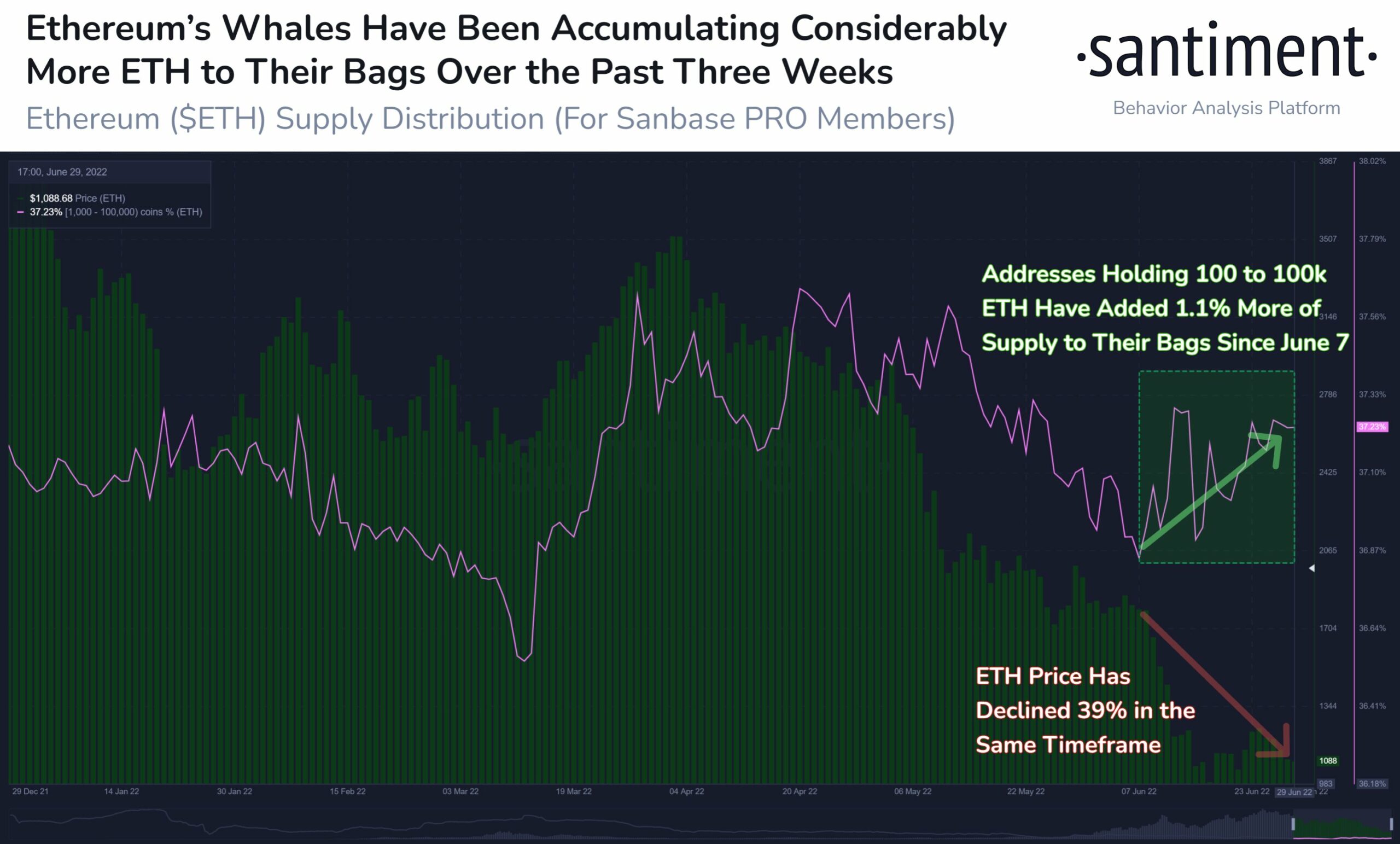

ETH and XRP Whales Accumulate Stealthily on the Dip

While more news headlines about crypto firms’ insolvency have put the price of ETH under pressure over the past few weeks, whales had been quietly accumulating the dip. As price tumbled by around 40%, ETH whale addresses have added 1.1% to their bags since 7 June. Historically, whale accumulation on ETH has often had a positive impact on its subsequent price action.

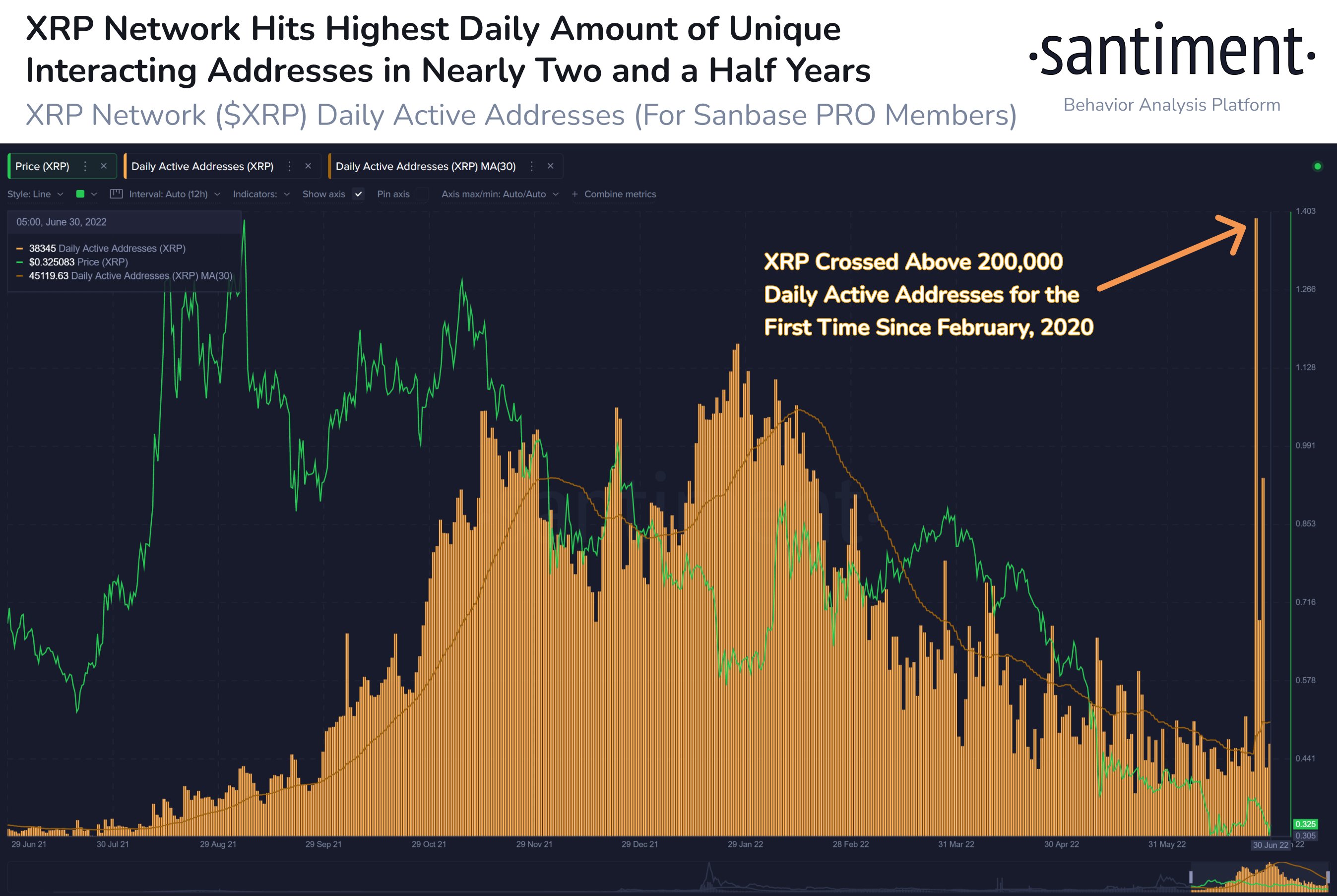

Other than on ETH, whale action has also been spotted on another previously popular token, XRP.

The number of unique addresses interacting with XRP jumped last week, exceeding 200,000 for the first time since February 2020. While there has been no notable news flow from Ripple nor with regards to the lawsuit with the SEC, this is worth keeping note on as in previous cases, a big surge in the number of addresses always led to a large jump in the price of XRP.

As the US market takes a pause for the 4 July Independence Day holiday, action in the crypto market remains uneventful, with prices consolidating near the lows made last month. Funding rate has started to move into the positive territory over the weekend, which means that traders are generally taking more long than short positions. Could this then imply that prices may finally breach the lows, or will prices see a bounce higher due to the charts showing a double bottom? As the market makes up its mind about where to go, heightened volatility could occur this week since any break or bounce from this significant support could bring about swift moves in prices.