The week in Crypto started with MicroStrategy announcing that it has completed the purchase of an additional 9,245 BTC for $623 million using the proceeds from the said convertible notes & excess cash offering that had been announced the week prior for $67,382 per coin. After this purchase, MSTR now holds 214,246 BTC acquired for $7.53 billion at an average price of $35,160 per coin.

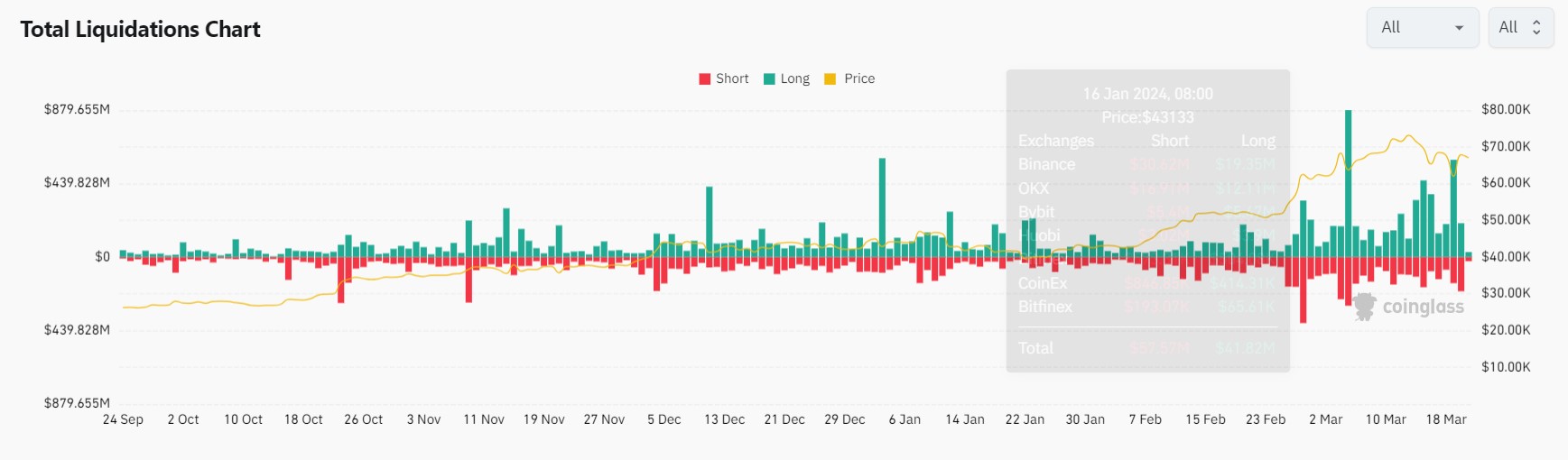

While the news was positive, the price of BTC did not respond and continued to drop lower, falling to a low of $60,800 after the BOJ raised rates. The sharp 10% intra-day drop in the price of BTC on Tuesday, which dragged down the price of altcoins by an even bigger magnitude, liquidated around $700 million worth of long positions by the time of the FED meeting, resetting the very high funding rate that had been in the market for the past weeks back to neutral territory.

With funding rates reset, it was easy for prices to rise on Wednesday after the FED’s more dovish than expected assurance that three rate cuts will be on the way this year. The price of BTC very quickly jumped from $61,000 to above $67,000 in a matter of hours post Powell’s comments, pulling the prices of altcoins higher as well.

The prices of several older proof-of-work altcoins moved higher after news that Coinbase had filed for futures ETF for three such altcoins, namely, DOGE, LTC and BCH. DOGE in particular, saw interest spike as DOGE whales accumulated more than 30 million DOGE during the past week upon the Coinbase Futures ETF news. If approved, the three futures ETFs will start trading at Coinbase Derivatives Exchange from 1 April. These will be monthly cash settled contracts.

Other than the PoW coins, coins in the RWA narrative also saw a huge pump, with ONDO rising more than 200% last week.

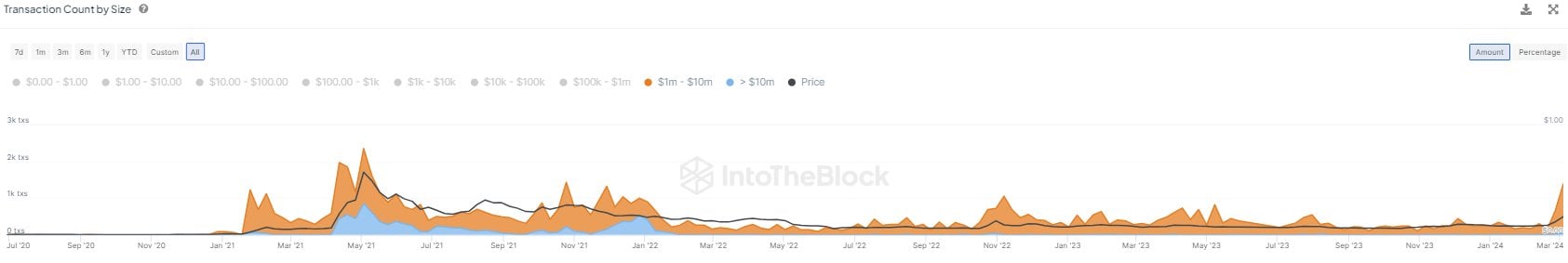

Surge in whale transactions bullish for DOGE

While LTC and BCH both saw notable price increases, the standout from them is DOGE, which has seen the number of large transactions rise to levels not seen since 2021 when its price went up multiple-folds. With an impending futures ETF on the way, which many market participants view as a precursor to an eventual spot ETF, there may be a good chance that the price of DOGE could revisit the heights of its magnificent 2021 run again.

Seasonal factors could plague Crypto prices

While cheers have returned to the market with Crypto prices rebounding off the huge drawdown from $73,000, seasonal factors suggest that we may need to plough more cautiously as we head into the traditionally duller Q2 from next week onwards.

As can be seen in the below diagram, while the period between January to March for the last three years have been very bullish, the period between April to September have been generally a period of retracements and pullbacks.

While altcoins are presenting their respective bullish price actions, the price action of BTC has been rather lacklustre, perhaps due to the weaning of the pent up demand for BTC in the initial stages of the spot ETF. The recent slowdown in the spot ETFs inflows are testament to this. For the price of BTC to pick up strongly again, we may either need to see a new catalyst, or for the price of BTC to fall to a lower price level to entice new buyers again. As such, in the coming months, the price of altcoins could start to outperform that of BTC.

Stocks rose after FED reiterates three cuts

On Tuesday, the BOJ delivered its first rate hike in 17 years as expected, which did not cause much volatility in the markets as the move had already been well-telegraphed beforehand. As a result, traders expected the FED to be more hawkish in response to the BOJ and the latest hotter inflation numbers. However, that did not happen and Powell reiterated that the FED was still on track to cut rates three times this year, which cheered the investor mood greatly.

Stocks rose to yet another ATH after Powell’s dovish comments – all three major US stock averages notched gains, with the S&P 500 rising about 2.3%. The Dow was up just shy of 2% for its best week since December, while the Nasdaq was the outperformer, jumping nearly 2.9%.

While stocks jumped, Powell’s effect on other asset classes was less pronounced, as geo-political tensions in the middle east still put a bid on the dollar, while Gold and Silver were pretty much flat for the week. Other countries’ even more dovish monetary policies managed to carve out a gain for the DXY as it rose around 1%.

Firstly, the Swiss National Bank surprised with a 25-bps rate cut to 1.50%, while the UK kept rates unchanged but leaned towards a more dovish tone as inflation in the UK has been falling more than anticipated, thereby causing their currencies to fall against the dollar.

This week should be quieter in the second part of the week as the Good Friday and Easter Monday holidays will be taking place. The US economic calendar is pretty quiet early in the week, with the US GDP figure to be released on Thursday, and for the FED’s favoured inflation gauge, the PCI index for the month of February, to be released on Friday. Furthermore, FED chair Powell will be speaking at a monetary policy conference in San Francisco late Friday morning.

With clashes between Israel and Hamas intensifying in the lead up to the holy holidays of both the Jews, Christians and Muslims between 29 March and 12 April, and the Russia-Ukraine war also heating up post the terror attack on Moscow late last week, the markets could potentially see some upheavals should some unexpected black swan event occur.