The cryptocurrency market was mostly muted this week once again, albeit with more action than the previous week. However, Bitcoin and Ethereum continue to consolidate below resistance and without a significant setback in price. Bitcoin failed to move above $29,000 despite several attempts, while altcoins bled into BTC via cryptocurrency trading pairs.

US stocks responded more favorably this week, following a softer than expected PCE report. The Personal Consumption Expenditures price index came in at 0.3%, slightly under the 0.4% expectations and well below January 2023’s 0.5% increase. Investors and traders interpreted the reduction in one of the key inflation gauges the Fed uses as bullish. Thus, the S&P 500 added 3.30% on the week, the Dow Jones Industrial Average clocked in an additional 3.23%, and the Nasdaq increased by 2.97%.

Elsewhere in the global financial landscape, the de-dollarization narrative is strengthening. China and Brazil have struck an agreement to drop USD and rely on the yuan to settle bilateral trade transactions. China also settled its first LNG deal with France settled in yuan, which involved 65,000 tons of Emirati liquified natural gas. During all this, BRICS nations, Brazil, Russia, India, China, and South Africa, announced the development of a new currency.

The DXY Dollar Currency Index sank by -0.51% as a result, compounding the slump in USD sentiment. Gold saw a similar decline of -0.49%, while Silver seemingly decoupled with a 3.72% gain on the week. Gold is still struggling with resistance at $2,000, and Silver remains locked in the $20-24 range, however.

Oil prices continue to hold above 2023 lows, due to an increased forecast in demand in China throughout the next 12 months. Furthermore, Saudi Arabia speculated that a supply shortage could materialize in the latter half of the year and beyond that could fuel rapid price appreciation. WTI Crude closed March -1.52% lower, while Brent Crude added -4.07% in downside to the recent downtrend.

April: The Most Bullish Month In Bitcoin History

With the first quarter of 2023 now behind us and finishing much more positive for crypto than most anticipated, Bitcoin is positioned well ahead of its most bullish month of the year historically-speaking.

April is by far the month where BTC/USD shows the best overall monthly performance. According to seasonal serial correlation statistics, Bitcoin returns have been more than 20% in April on average. Will this trend continue?

It isn’t unusual for financial assets to exhibit seasonal or serial recurrence in price action. For example, Bitcoin has peaked in the November through the December timeframe in each major bull cycle. This time-based phenomenon is precisely where phrases like “sell in May, and go away” come from.

From Bottom Discovery To Re-Accumulation With Limited Supply

The Bitcoin Accumulation Trend Score has reached a level, according to the below Glassnode heat map, that suggests accumulation is aggressively taking place. With BTC/USD up nearly 80% from 2022 lows, buying pressure is more indicative of re-accumulation.

The heat map shows this behavior only occurs either when BTC is most bullish, or when investors are heavily buying the dip before big crashes, as is seen in late 2021 and throughout 2022.

Importantly, there are key similarities with the 2018 low and 2019 rally. In addition, both major rallies began in April, further adding credence to the potential seasonality outlined in the previous section.

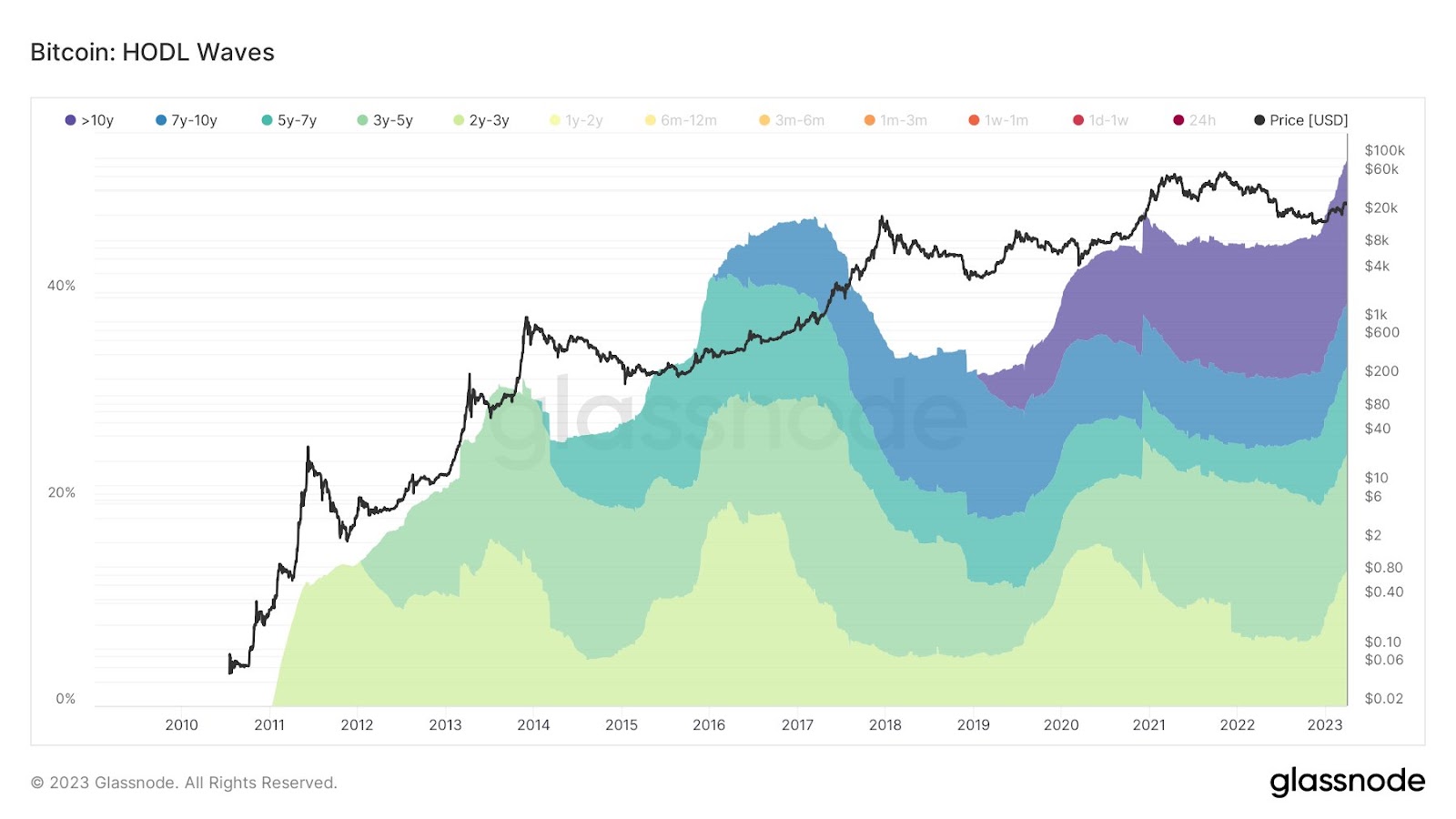

Unlike anything else in BTC history is unfolding, however. The 2022 to 2023 crypto winter is the first instance where the majority of coins have not moved in two years or more. This translates to an incredibly scarce supply amid the beginning of increasing demand.

Digital Silver: Litecoin Labeled A Commodity Per CFTC Lawsuit

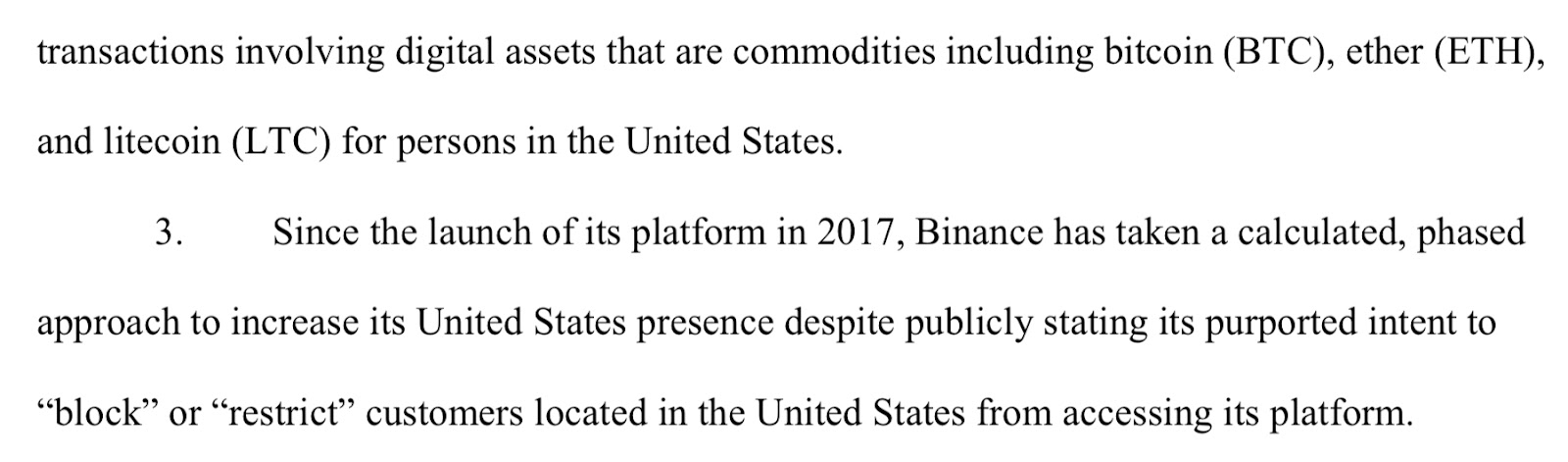

The cryptocurrency market suffered an early week correction as the CFTC revealed a lawsuit against Binance and its founder. However, the negative news had several silver linings.

Firstly, bad news is having far less of an impact on crypto prices, which could suggest the tides are turning. Secondly, the CFTC appears to have marked its territory in light of ongoing SEC scrutiny across crypto, by naming BTC, ETH, and LTC as digital commodities.

Litecoin getting a sudden green light from the CFTC could be a blessing for the cryptocurrency that since the 2017 bull market has fallen out of favor. Both Bitcoin and Ether futures are featured on the Chicago Mercantile Exchange and Litecoin could ultimately see the same outcome with the stamp of approval.

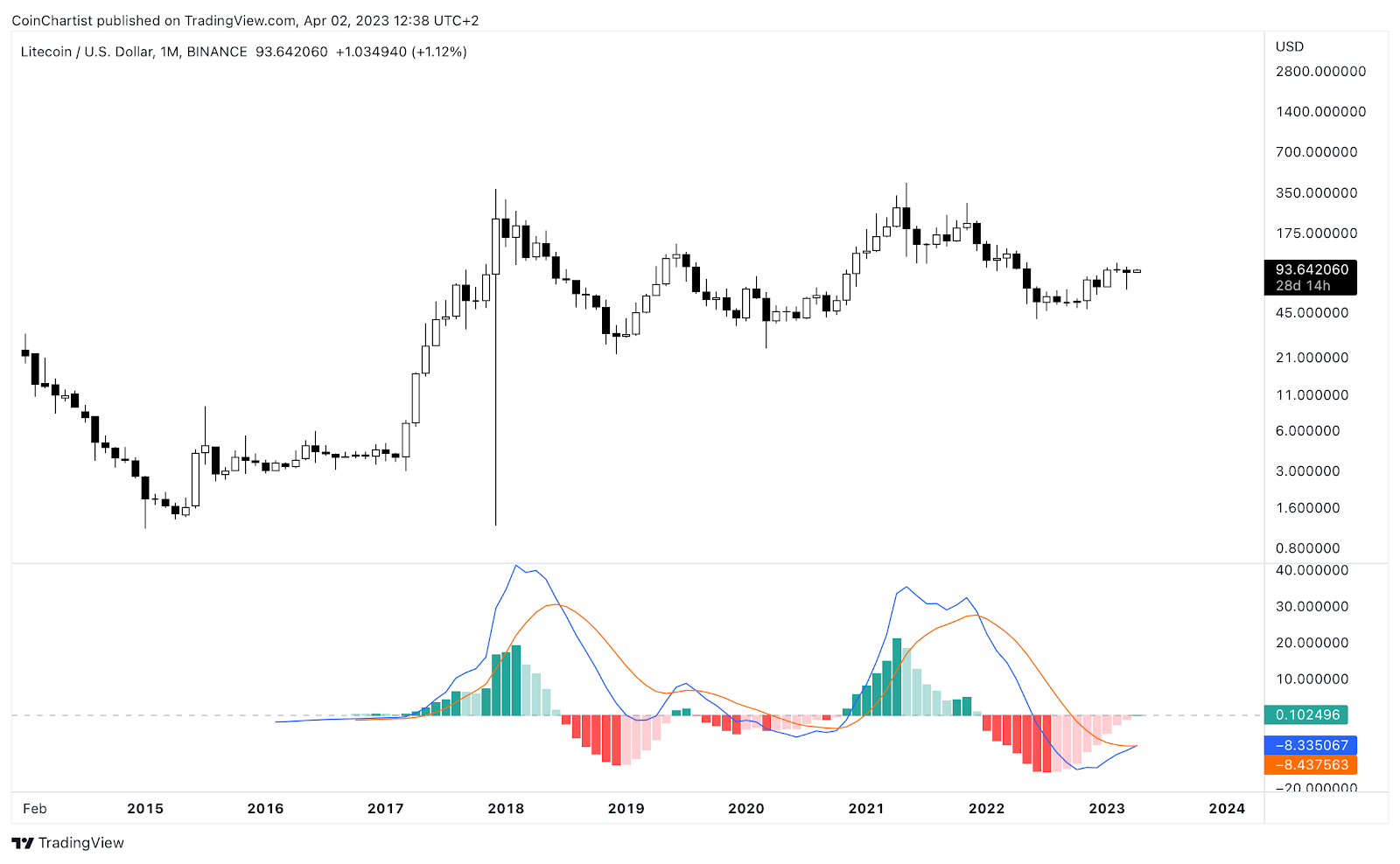

Bitcoin is also enjoying a revival of the Digital Gold narrative as the cryptocurrency and precious metal counterpart have risen amidst the recent banking crisis. Silver has been weak by comparison, yet has handily outperformed Gold this past week. With LTC now named a commodity like Silver, could a Digital Silver soon materialize?

Litecoin technicals support a possible trend change, with the monthly MACD (Moving Average Convergence Divergence indicator) crossing bullish for the first time since 2021. The last crossover yielded more than 490% ROI. LTC/USD must maintain current levels or climb higher by the end of April to confirm the signal. Notably, neither Bitcoin not Ethereum are as close to a confirmed momentum change.

Tether Supply Sharply Increases, But Rapidly Losing Dominance

Another positive sign that the outlook in the crypto market is becoming increasingly optimistic, is the supply of Tether actively growing. USDT supply ballooning correlates highly with sizable increases in Bitcoin price. Tether supply decreasing in mid-2022 led to some of the sharpest declines in crypto valuations.

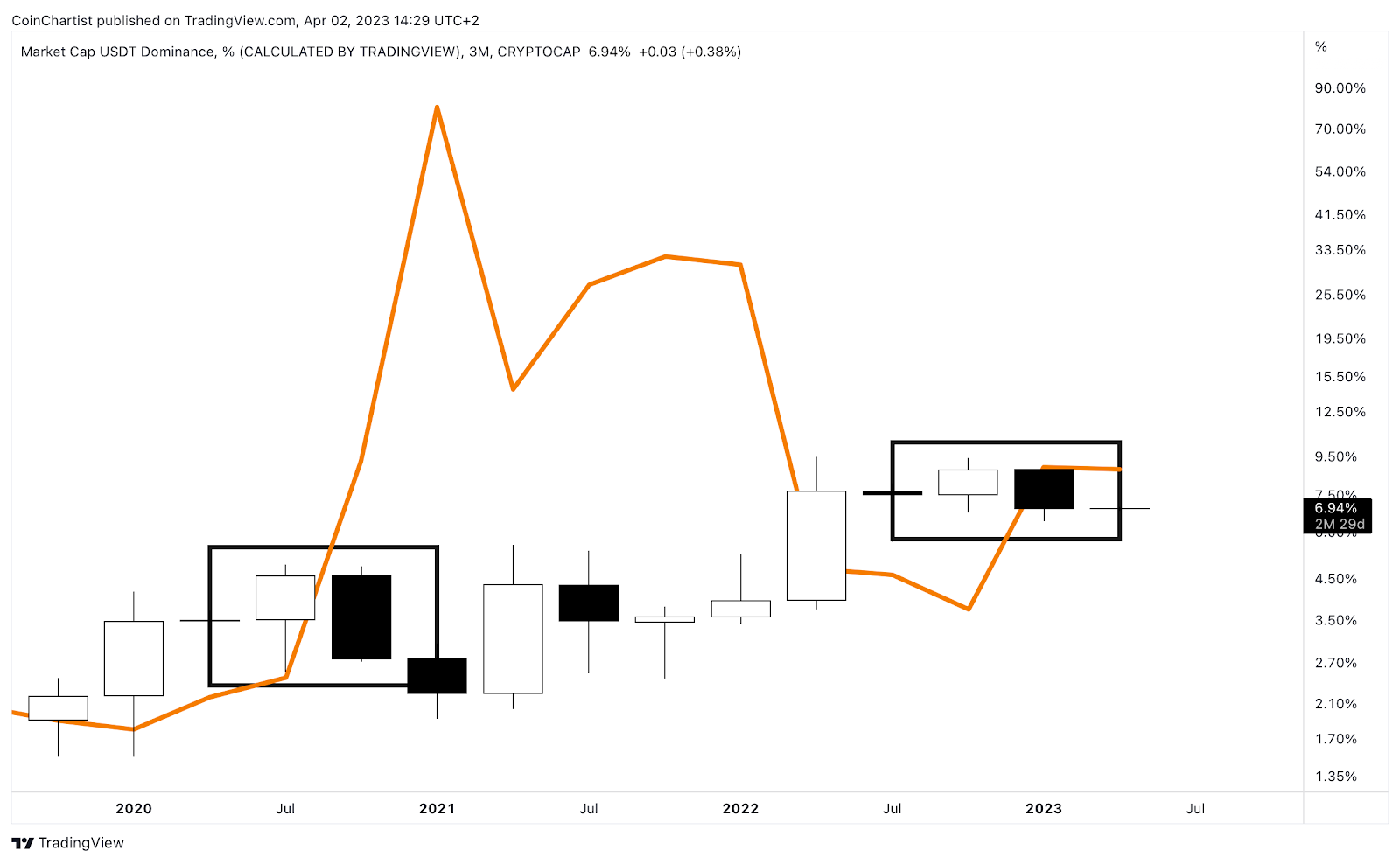

Even more notable, is the fact that despite the rise in Tether supply across crypto, USDT dominance has fallen as Bitcoin, Ethereum, and altcoins appreciate in price. In fact, the USDT.D chart, outlining Tether’s market share compared to the rest of crypto, closed the Q1 candle with a bearish engulfing.

The last time this pattern appeared was in 2020, just before Bitcoin went on a more than 500% rally and set a new all-time high price record in the following quarter. Now the signal is back with a confluence of other positive factors weighing heavily in BTC’s favor. The massive rise in Bitcoin price has been juxtaposed behind the Tether dominance chart above to demonstrate this behavior.

Global Markets Q1 2023 Results, What’s Ahead In Q2

It wasn’t just Bitcoin and the rest of crypto posting successful Q1 results. Major US indices closed the second consecutive quarter with upside returns. The S&P 500 ended the quarter with a 6.56% increase, the Dow barely squeezed out 0.49% positive performance, and the tech-heavy Nasdaq closed the quarter with a substantial over 19% climb.

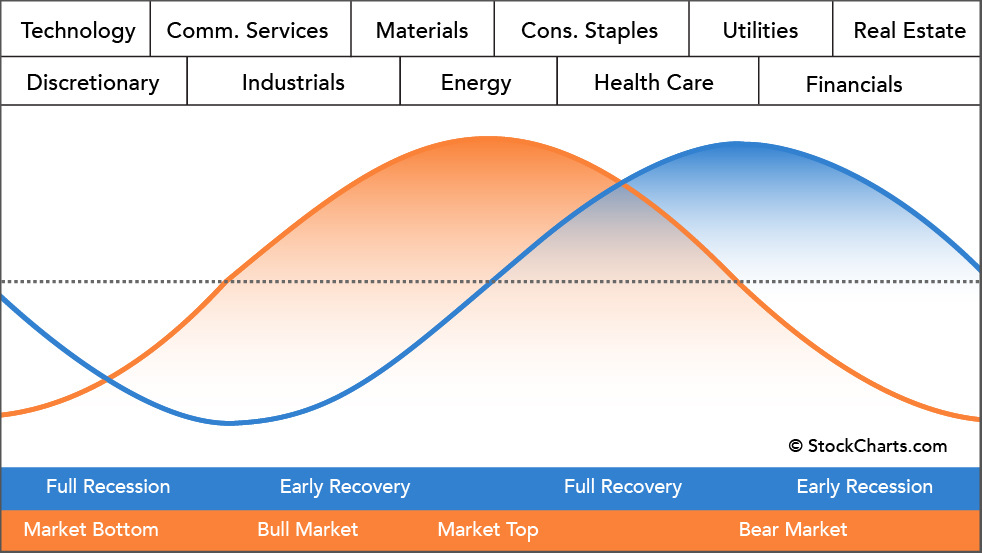

Outperformance in tech and possibly the tech-adjacent crypto market, could be a sign of markets bottoming. According to the study of sector rotation, the tech sector tends to show signs of a recovery and begins to grow again as a recession ends. But still, despite early indications the worst is behind us, the recent banking sector meltdown leaves an ominous cloud lingering.

With uncertainty still prevalent, a flight to Gold helped the precious metal close its second quarter in a row with just under 8% ROI. Silver remained in the positive but fared nowhere near as well as Gold, with only 0.49% for Q1 performance. WTI Crude closed -6% lower in Q1, with Brent right behind it falling -7% in the quarter. Oil prices managed to fend off deeper declines, reaching more than -18% down in a single quarter before bouncing.

In the week ahead, markets could see volatility as US employment data comes in and the stock market, crypto, and other asset classes attempt to hold onto and add to Q1 growth. Several Fed Presidents will also speak this week. What will the rest of Q2 2023 bring to global markets?

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.