Early last week saw yet another flushing out event in the crypto world, with the price of BTC revisiting a double bottom price of around $40,500 and rebounding into $43,000, leading altcoins to an even stronger rebound.

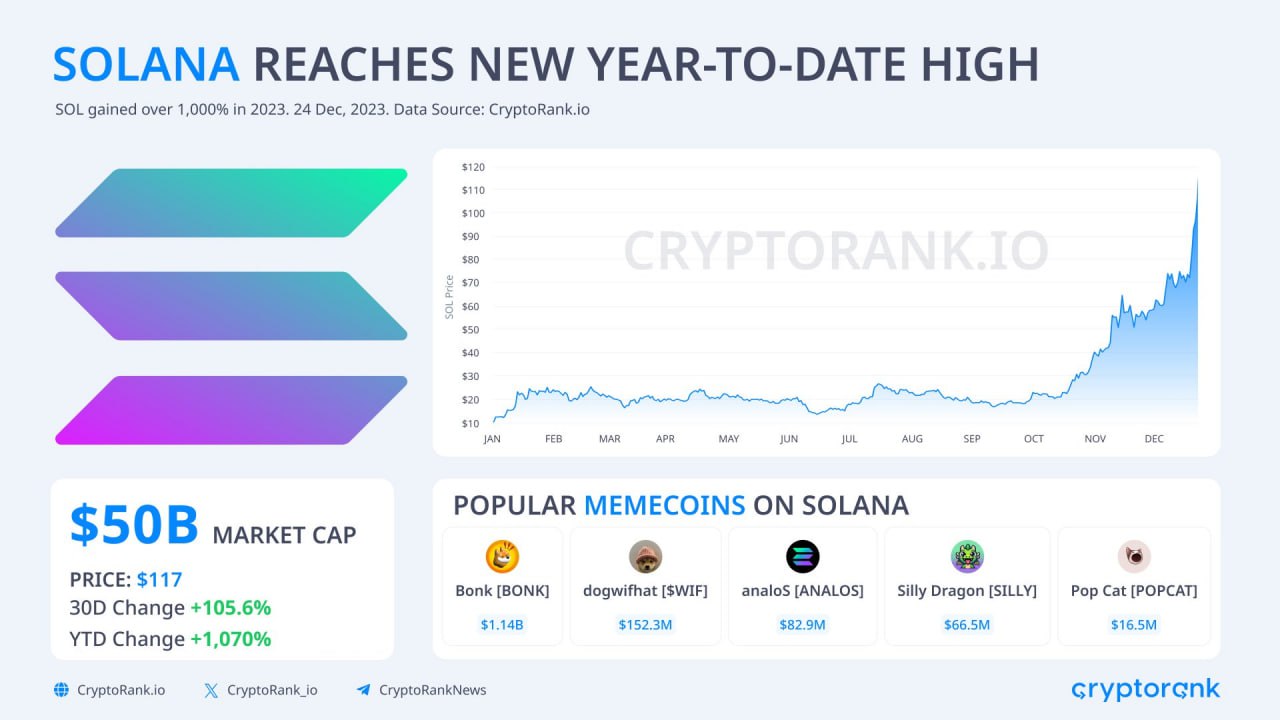

Of particular note was SOL, which managed to stage a strong rally of 80% since Wednesday to hit a high of $119, becoming the best performing top ten crypto asset of the year, clocking in at a head-spinning 1,000% gain.

Regardless, as market participants waited for news regarding the spot BTC ETF, the price of BTC consolidated between $43,000 and $44,000 in a tight range, which gave altcoins a chance to finally shine. Old coins too had a resurgence as funds from BTC rotated into altcoins, with old favorites in the last cycle like FTM and NEAR netting solid gains. NEAR doubled over the week, while FTM has been grinding higher and rose by around 30%. AVAX rose close to $50, DOT also put in remarkable double digit percentage gains. Other notable coins that performed very well included INJ and SEI, which were newer tokens.

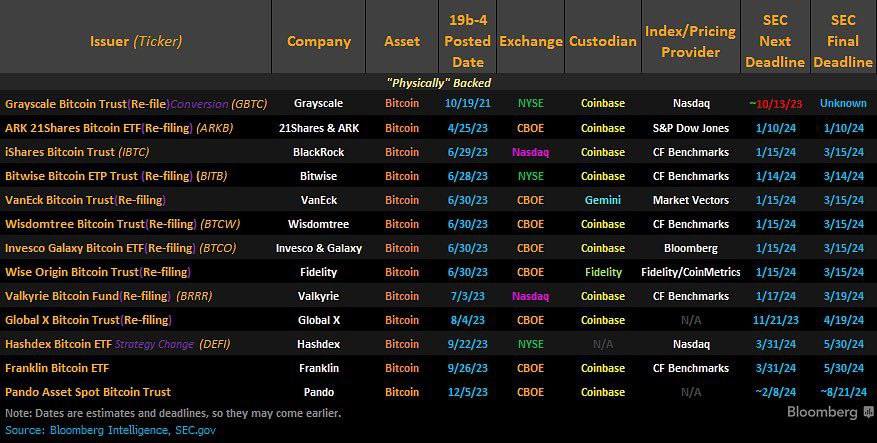

Some profit-taking ahead of the Christmas holidays was seen as prices eased off their highs, but were still very well supported as market participants refused to be left out in case the BTC ETF came anytime. With more frequent meetings between the SEC and ETF applicants, who have now all acceded to a cash settlement and several TV commercials already being rolled out from multiple ETF applicants, expectations are high that an approval could come almost immediately upon the new year.

Meanwhile, Hong Kong has also upped its crypto game by announcing that the city-state is open to spot BTC ETFs too, and Argentina has approved that contracts can be settled in BTC along with other cryptocurrencies and commodities such as beef or milk. Argentina’s new president is a libertarian and recognizes the value of BTC.

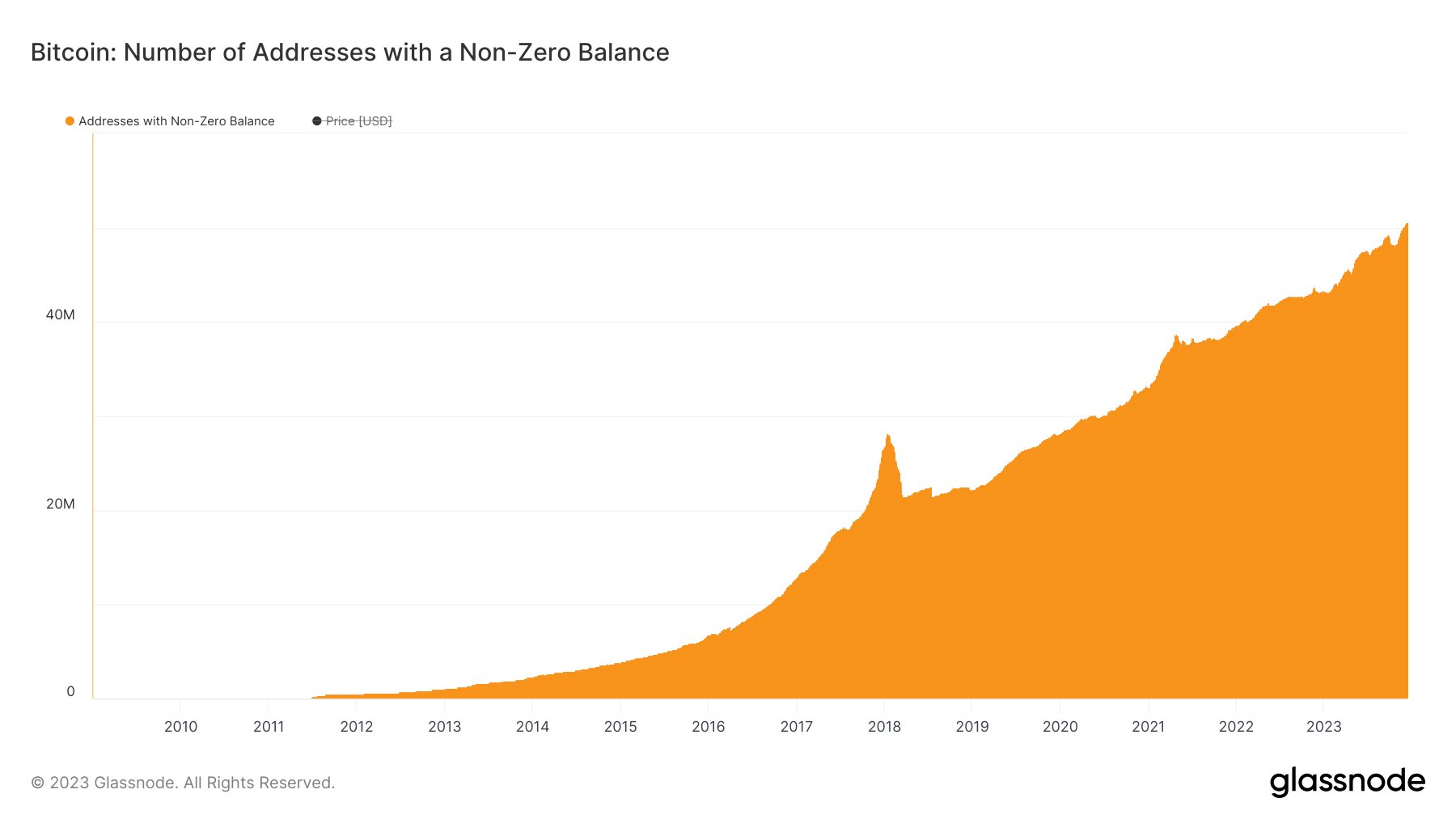

Such moves show that the pace of BTC adoption is blazing forward, with 2024 possibly being a watershed year as the spot BTC ETFs providers fight to advertise for BTC after Google relaxed its advertising rule a week ago to allow for crypto product advertisements. Traditional financial giants promoting BTC will finally give BTC (and crypto) a legitimate status that could bring in a barrage of money into the crypto space.

Already, the number of non-zero BTC addresses has climbed to an ATH, surpassing 50 million addresses.

Institutional demand growing for altcoins

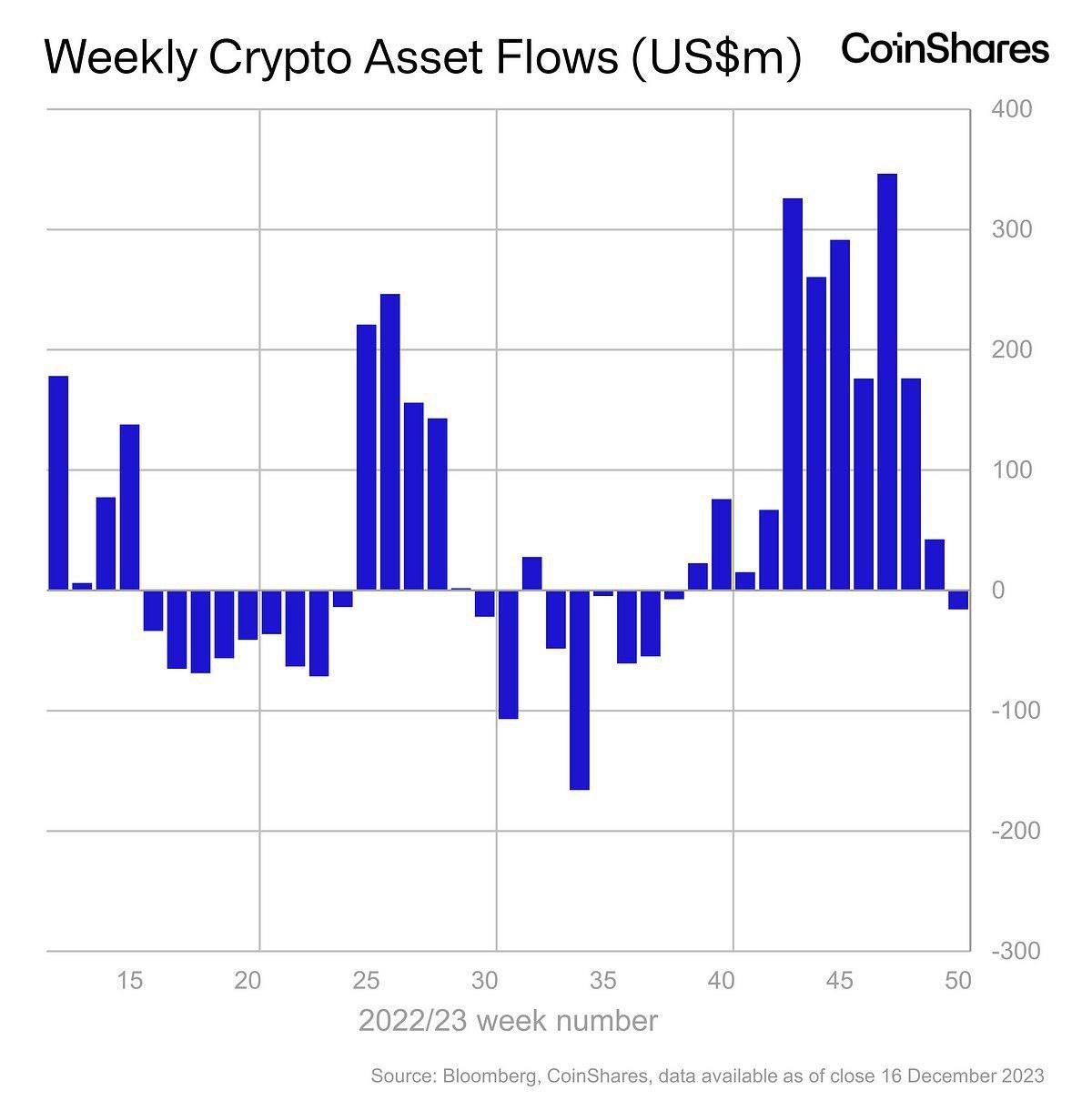

As traditional funds get hungrier for crypto exposure, inflows from this investor class have started to move into altcoins, as can be seen by the latest digital asset investment product update by Coinshares.

Even though there was a minor outflow totalling $16 million the week before, ending an 11-week run of inflows, this could be explained by some investors derisking or taking profits ahead of the year-end. The bulk of the outflow was in BTC, with some from ETH.

However, trading activity remained well above the year average, totalling $3.6 billion for the week, compared to the year-to-date average of $1.6 billion. The inflow into altcoins was more noteworthy, showing that professional investors are getting comfortable with allocating their funds towards higher risk altcoins. This bodes well for the altcoin space in general as the market sets up for the bull run next year.

Of the altcoins that saw inflows, SOL saw the highest inflow, with around $10.6 million of inflow, while XRP saw inflow of $2.7 million. ADA saw inflow of $3 million. The way it looks now, SOL is still the most favoured coin amongst institutional grade investors.

SOL almost doubled in a week

After consolidating around the $70s area, SOL did a blistering run to register a 80% gain over the week, displacing XRP and BNB respectively to become the number 4 top coin by market cap. The buying on SOL has been relentless, with almost no pullback seen throughout the week, with the buying style indicative of institutional buying. Interest in SOL has been increasing from the institutional arena ever since October this year, as its on-chain metrics have been improving strongly in recent times.

Last week, DEX volume and daily active addresses on SOL even usurped ETH to become the most active chain for the first time ever, causing pundits to announce the “death of ETH”. However, the lackluster performance of ETH could be due to other factors that are not related to the chain at all, one of which we shall be exploring in the next segment.

That said, despite SOL’s magnificent rise from the ashes, the route ahead for its price may be fraught with difficulties due to the large stash of SOL that bankrupt FTX and Alameda still holds. The bankrupt dual of FTX and Alameda will still have a large stash of SOL to sell, albeit with the bulk coming in 2025.

Apparently, the dual allegedly transferred 13.22 million units of SOL to exchanges between 24 October 24 to 14 December for sale, and still have on hand another 2 million units they can sell anytime. In the short-term, the current demand for SOL has outweighed the selling pressure imposed by the dual. However, over the longer-term, the two firms will still have another 40.5 million units of SOL that will be unlocked linearly every month from now until 2025. However, looking at the demand for SOL, especially from institutional investors, the firms should have no issue selling SOL via OTC to large investors, which will then not affect its market price.

ETH rally stalled by Celsius asset sale

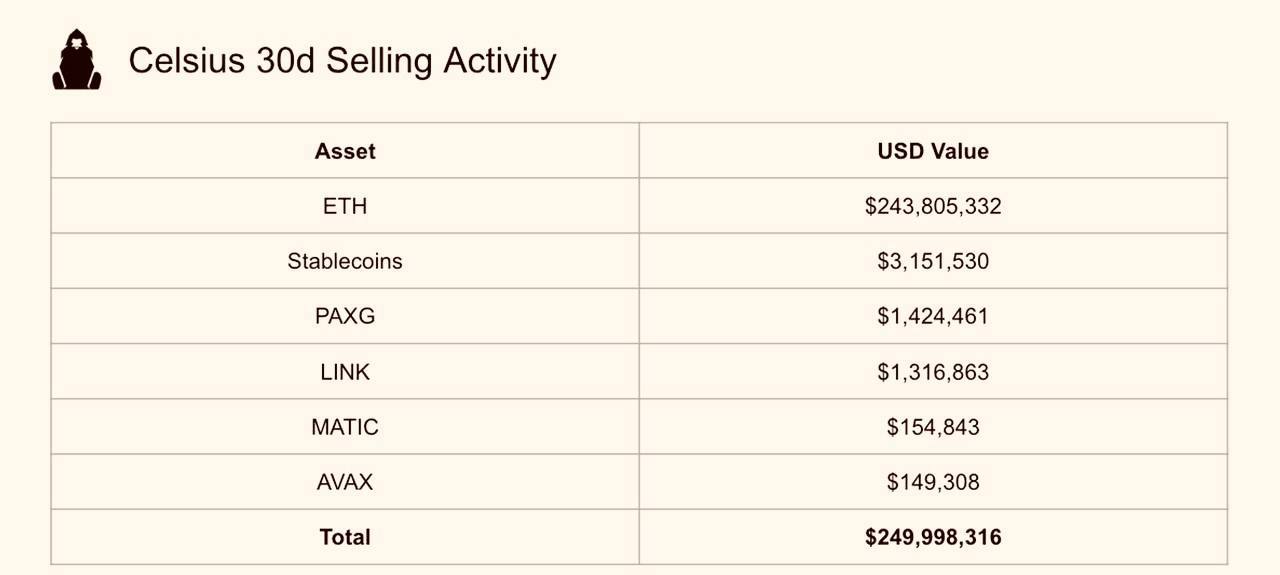

The most disappointing crypto during this rally has been ETH, which had been under tremendous selling pressure all throughout the past two months in spite of notable price increases in the market. Despite having broken a key resistance, the price of ETH had failed to make headways as the price of other altcoins sped forward. This relative underperformance could be attributed to liquidation selling by bankrupt crypto firm Celsius, which had stealthily sold around $243 million worth of ETH over the past month.

Initially, Celsius was to return the crypto assets in-kind to its creditors, however, that plan had been changed to a cash return, which would entail the bankrupt firm having to sell off these assets into cash before returning them to creditors.

The list of tokens that Celsius have been and are still selling include ETH, MATIC and LINK, all of which have underperformed the broad altcoin market in the past month.

Despite the recent sell-off, Celsius still retains a substantial $3.94 billion in crypto assets, out of which 84% are BTC and Ethereum.

However, interest could return to ETH as the Dencun upgrade in January draws near. Late last week saw a resurgence in price for ETH Layer2s, with OP and ARB clocking impressive 100% gains after being left out in the cold throughout the recent rally. As such, the price of ETH could recover strongly next year after the upgrade and when the spot ETH ETF theme comes into play after the BTC one is confirmed.

Selling on BTC could come after ETF approval

On the subject of BTC, it is interesting to note that Celsius has not yet started selling its BTC, one possible reason could be that it is waiting for the spot BTC ETFs to be approved so that they can sell at a higher price point. With this possibility in mind, investors ought to exercise caution in January near the ETF approval dates in case there is any unforeseen outcome.

Also, traders should keep in mind that the Mt Gox batch of BTCs could also be coming into the market beginning January 2024. Hence, the ETF approval window becomes of even greater significance.

The updated deadlines for spot BTC ETFs are as follows:

Stocks gain as PCE index confirms easing inflation

US stocks continued to rip higher, with the three main indices notching their eighth positive week in a row — a first for the S&P 500 since 2017 and for the Dow, dating back to 2019. The S&P advanced by 0.8% for the week, the Dow added 0.2%, while the Nasdaq jumped 1.2%.

The FED’s favorite inflation gauge, the PCE index, came in less than expected. The November core personal consumption expenditures price index rose just 0.1% last month, and gained 3.2% from a year ago, in line with expectations. Economists anticipated a monthly increase of 0.1% and 3.3% from a year earlier.

US yields have continued to fall on the news, dragging the dollar lower again as the DXY ended the week lower by 0.8%. The weaker dollar has led the commodities complex higher, with Gold and Silver gaining around 0.3% and Oil prices rebounding for the second week, gaining by around 1%.

This week is expected to be a quiet week for the traditional financial markets as traders are mostly away on the year-end holidays. Monday was Christmas and many markets will be closed until Wednesday where trading is expected to be light heading into the New Year.

The crypto market however, could continue to see rotational plays on altcoins as king BTC pauses to wait for the ETF news. Once the New Year arrives, the spot BTC ETF play will most likely return with a bang and volatility is expected as rumors about the approvals should start to make their rounds until mid January when the interim deadline for most of the applicants is. This year-end is proving to be action-packed for crypto traders who are finally seeing solid price growths after a dismal 2022.

Risk warning: Our products are complex financial instruments which come with a high risk of losing money rapidly due to leverage. These products are not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the inherently high risk of losing your money. If you do not understand the risks involved, or if you have any questions regarding our products, you should seek independent financial and/or legal advice if necessary. Past performance of a financial product does not prejudge in any way their future performance.