Last week’s economic numbers out of the USA came in largely stronger than expected, with inflation gauges revealing that the rate of inflation has climbed again. First, January’s CPI on a year-over-year basis reported a 6.4% increase versus expectations of 6.2%. Next came the PPI figures which rose 0.7% on the month versus expectations of only a 0.4% increase. The rebound in the inflation rate prompted some investors to fear that the Fed would be maintaining their hawkish stance for longer than was initially expected, which caused stock prices to fall, even as retail sales number showed that the consumer market was still stronger than anticipated, reporting a 3% growth in January versus expectation of 1.9%.

As a result of the conflicting economic signals, equity performance for the week was mixed, with the Dow ending down 0.13% for its third negative week in a row and a first since September 2022. The S&P 500 lost 0.28%, its second negative week in a row, while the Nasdaq rose 0.59% on the week.

Yields on the 10-year and 2-year US Treasury bonds rose to levels not seen since November after a series of Fed speakers talked hawkishly and as traders started pricing in higher rates on the back of the hotter inflation numbers. The dollar rose correspondingly, with the DXY gaining around 0.26% for the week after a huge retreat on Friday as traders took profit ahead of the long weekend as the markets take a break on Monday for the President’s Day holiday.

Precious metals lost around 1% for the week, while oil was the biggest loser, with both Brent and the WTI lower by almost 3.5% after the EIA reported that US crude oil stockpiles rose to their highest level since June 2021 after a larger-than-expected build.

Dollar strength continues to prevail in early Asian markets trading at the start of the new week, with USD/JPY pushing higher towards 135 even as the Americas are on holiday.

Cryptocurrencies, on the other hand, had a far better week as crypto prices surged higher even in the midst of crackdowns by the SEC.

BTC Smashes $24,000 Midweek, Led by American Buyers

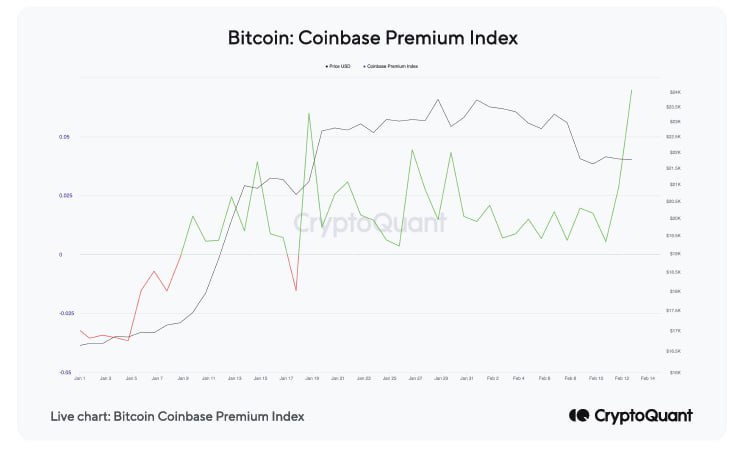

Just as crypto experts opined that BTC would climb a wall of worry, BTC price burst the $24,000 level in spite of the troubles that the US SEC had been imposing on the sector, proving once again its resilience. In fact, one interesting observation we made was that the very buyers that caused BTC’s price to climb from under $22,000 to above $24,000 last Wednesday were investors out of the USA.

This can be seen from the Coinbase premium index, which clearly depicts that the Coinbase premium had surged significantly when the price of BTC hit a local low below $22,000. This surge happens when large buying interests enter the market to buy from Coinbase, thereby pushing the premium higher. As Coinbase predominantly services only users based in the USA, this surge meant that USA based buyers were aggressively buying BTC when its price dipped to around $22,000 during the SEC FUD.

In fact, after buying from Coinbase in the spot market, these buyers may have taken to the derivatives markets to continue their rampage, as a huge surge in coin transfer to derivatives exchanges was observed prior to BTC’s price sweeping up from $22,000 to $22,800.

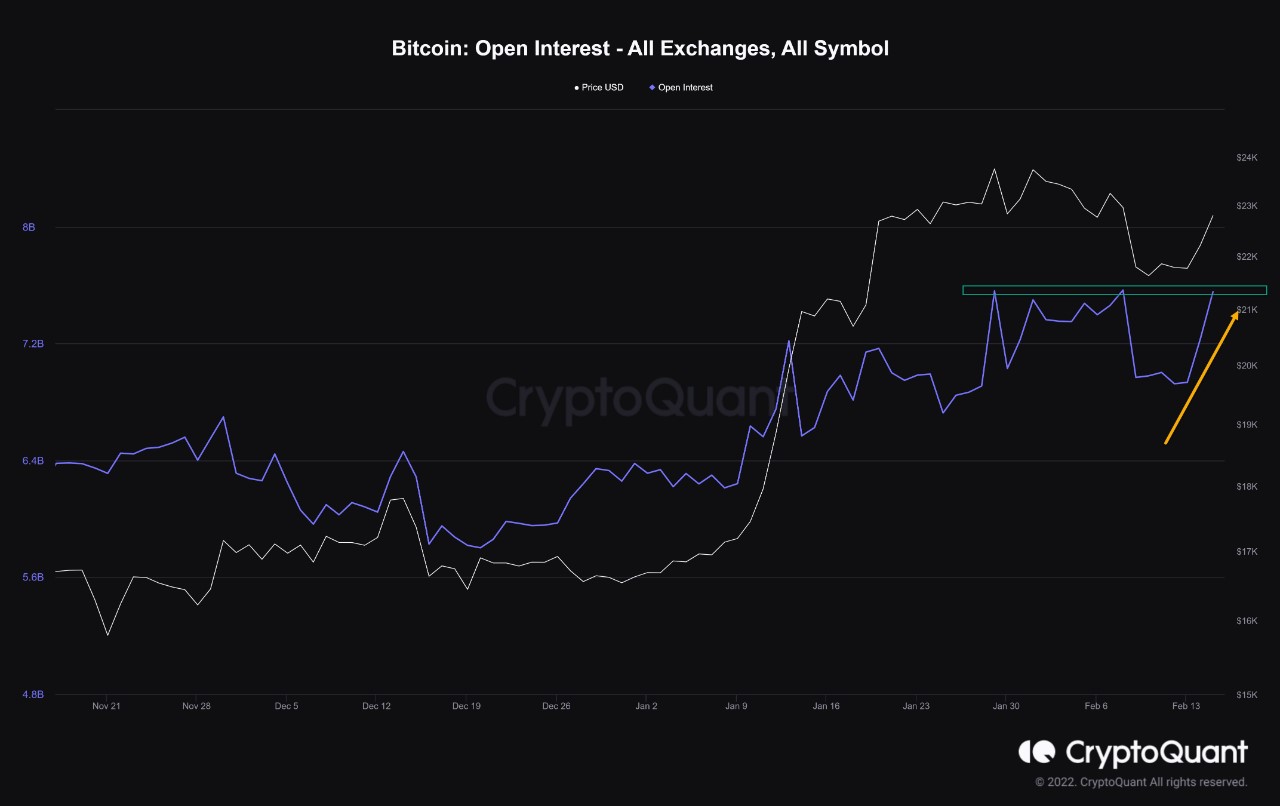

As another indication that those coins transferred were for taking long positions, the open interest surged in tandem with the increase with BTC’s price on Wednesday.

While the actions look premeditated, the only unhappy people were the bears as around $200 million of shorts got liquidated in the move, almost similar in magnitude to the amount of longs that were liquidated when the price of BTC fell during the SEC FUD earlier. Overall, last week was a tale of two sides with a happy ending for crypto bulls, as bids for BTC appear to be getting more aggressive.

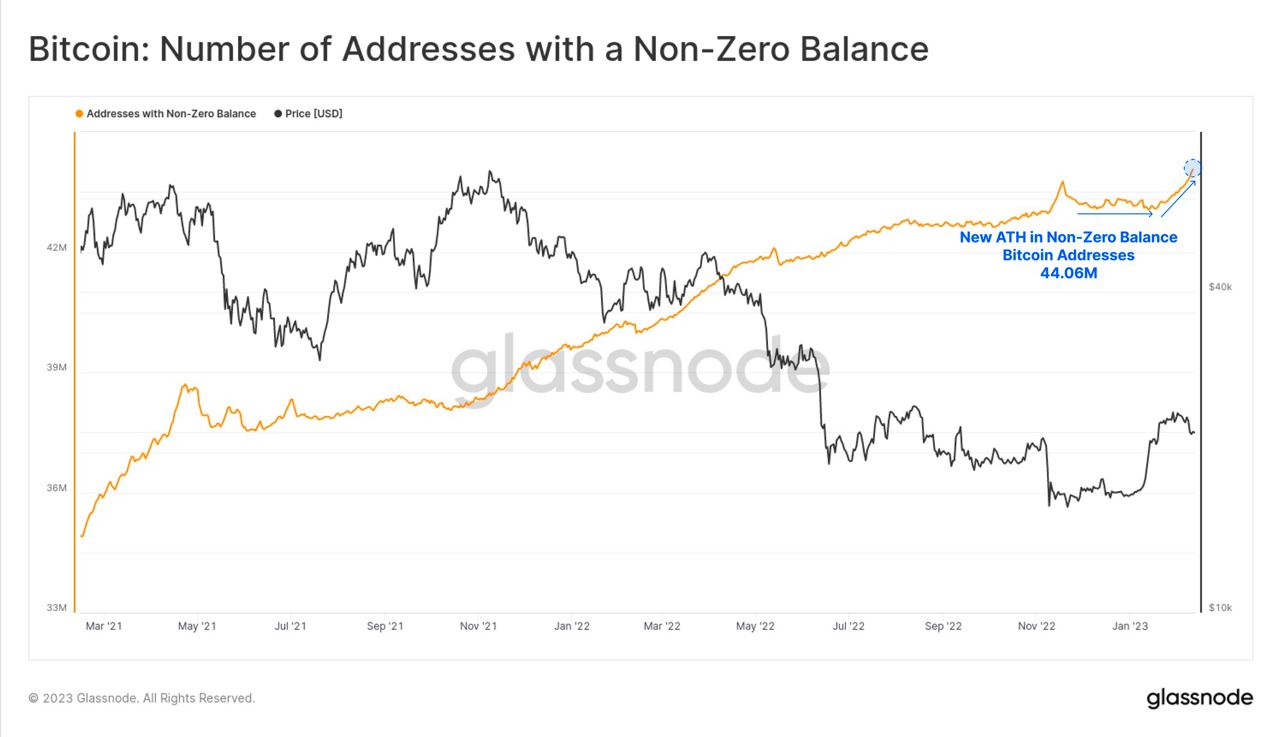

First-Time BTC Buyers Continue to Increase

Even as the price of BTC retreated after failing to breach the $24,000 resistance the first time earlier, the number of first-time BTC buyers have been increasing as the number of BTC addresses with a non-zero balance has been rising more aggressively even while price has been falling. This shows that adoption from BTC is growing steadily and that the demand for BTC on the ground is actually very strong. The number of non-zero addresses is even making a new ATH with each passing day, showing that the demand appears to be indifferent to short-term price fluctuations.

Funds Have Been Flowing into Crypto Since Mid December

To get a perspective of the amount of funds flowing into the crypto market since November, we can see that the supply of USDT, the most used stablecoin, has been increasing since December last year. Since then, more than $4 billion more USDT has been minted. While the latest $1 billion new mint in USDT was a move from BUSD after the latter have had some run-in with the SEC, there is still at least $3 billion which could have flowed into the crypto market in recent times over the last four weeks, which could provide ammunition to buy whenever shallow dips appear.

MATIC Surges on Announcement of zkEVM Launch

MATIC has outperformed the market again as its price continued to rise even when the broad crypto market had retreated off its highs last week. The announcement of Polygon being the first L2 to launch the beta version of its zero-knowledge Ethereum Virtual Machine zkEVM on March 27 sent the price of MATIC token moving against the broad market’s tide over the week, rising 33%.

The soft launch date of March 27 may put Polygon ahead of its competitors before zkSync and Scroll. Zk-based roll-up technology is accepted as the gold standard for scaling, which is deemed as superior to optimistic-based rollups like Arbitrum and Optimism because they are less secure. Malicious transactions on an Optimistic Rollup can stay valid for up to seven days or more before being reversed.

This launch date could be just in time for ETH’s Shanghai upgrade, which would reduce the cost of L2 roll ups by 10–100-fold. Hence, the timing of this launch could drive a lot more users from other chains to move to try out Polygon.

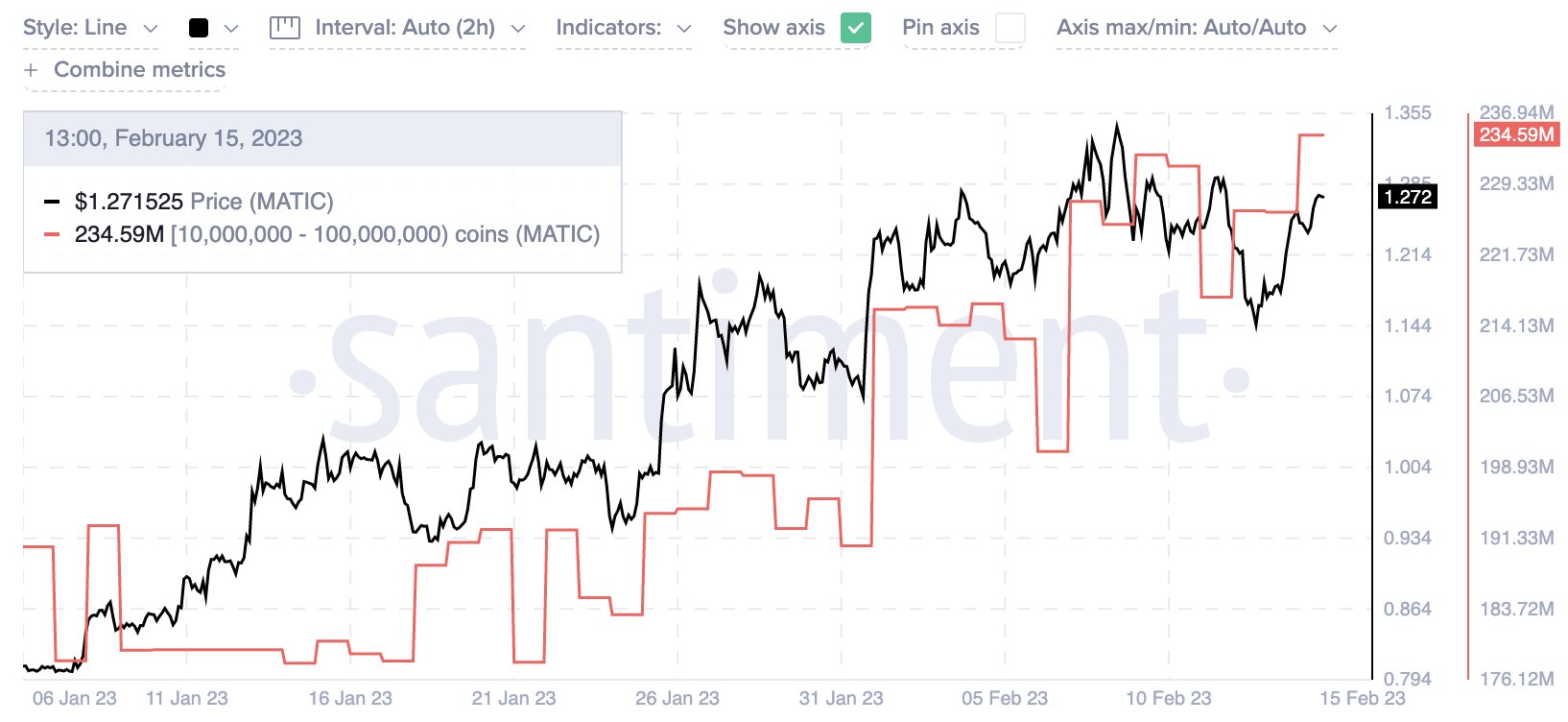

News of the zkEVM launch has caused holders of MATIC to load up on the token, as whale addresses with between 10,000 to 100,000 MATIC have bought another 20 million tokens post the announcement, just ahead of its pump from under $1.18 to $1.56 before a slight pull back towards the end of Sunday.

Galaxy Digital Expects ETH Withdrawals at Shanghai to Be Minimal

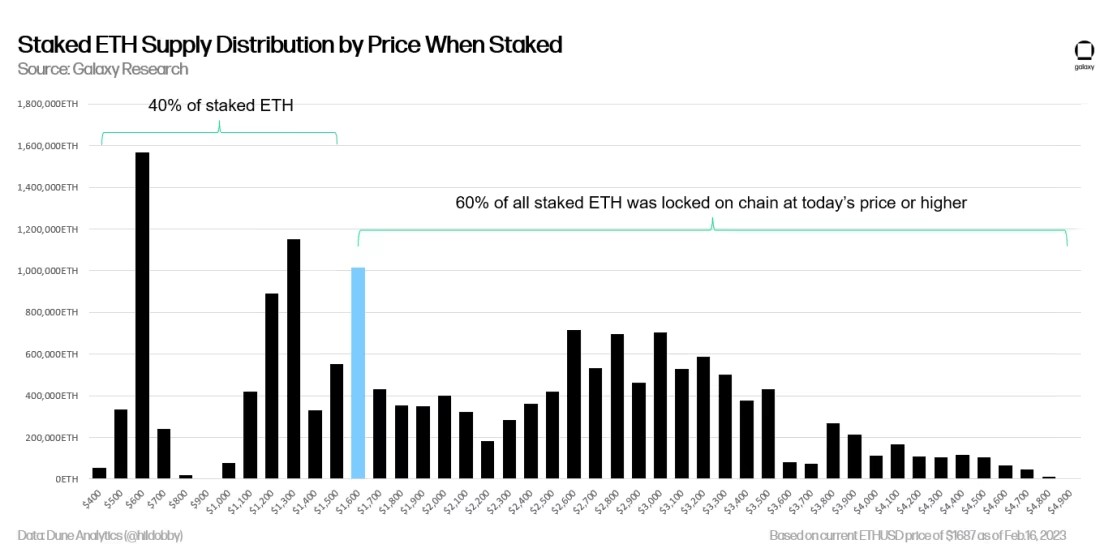

Speaking of Shanghai, in a recent report released on February 16, Galaxy Digital opined that the upcoming Shanghai upgrade would not cause a significant portion of staked ETH to be withdrawn. This is because 60% of all currently staked ETH are still underwater as at today’s prices, with the bulk of them having been purchased between $2,500 and $3,500.

According to their data, only 1,138 validators out of a total 36,416 validators have committed to exiting the validator set of principally staked ETH waiting to unlock in Shanghai, representing only 0.2% of ETH validators. While the firm expects the number to rise as Shanghai approaches, the fact that only 0.2% have taken the exit queue with only a month to go shows that most validators are not planning to exit at this point.

The early part of this week is expected to be quiet as the USA breaks for President’s Day on Monday. More volatility could come mid-week after investors get to pore over the Fed meeting minutes set for release on Wednesday, while Thursday will see the release of the preliminary GDP for 1Q2023. On Friday, the Fed’s favorite inflation gauge – the PCE index, will be released. The stock market may get another hiccup again should this number also show a hotter than anticipated reading, while the effect on cryptocurrencies could be immaterial as last week has demonstrated.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.