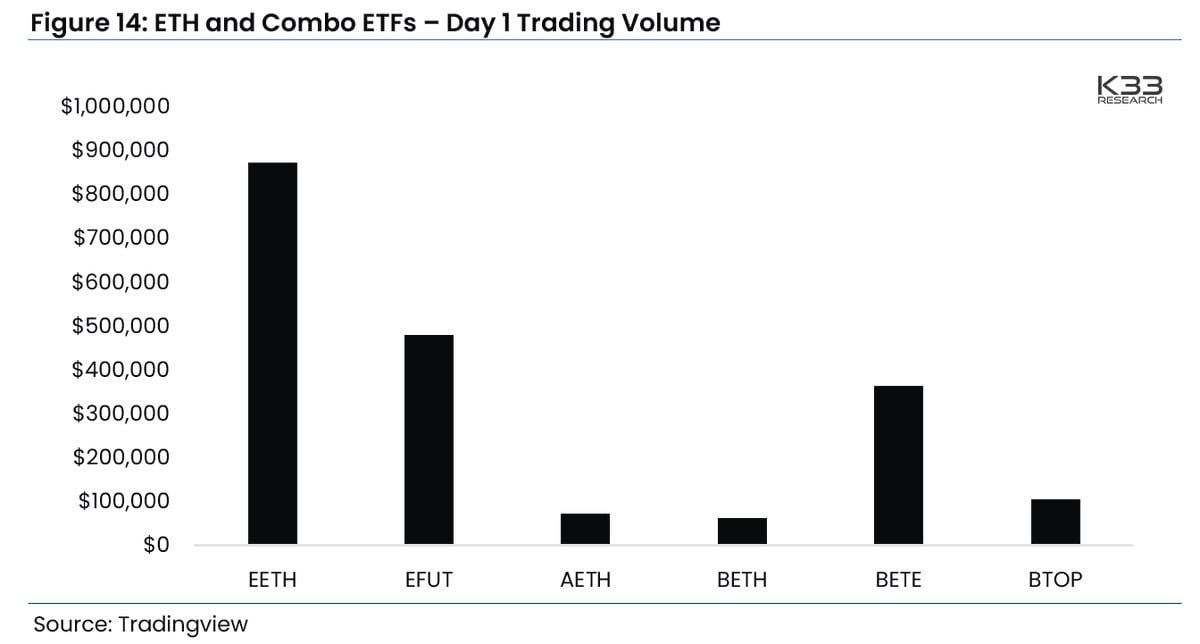

Last week started on a weak footing for crypto as the new ETH futures ETF trading started without much fanfare on Monday. Trading volume on the first day of listing was a very low $1.92 million total out of six funds that were made available for trading.

The disappointing launch gave investors an excuse to take profit on ETH, which sent the price of ETH and altcoins lower, as we had already pre-warned in last week’s report.

ETH was under further pressure after it was revealed that Justin Sun, a major ETH whale, had unstaked 20,000 ETH and sent them to crypto exchanges. Traders expecting a sale to take place might have tried to front-run the sale by selling ahead of Justin, sending the price of ETH slipping from its early week high of $1,760 to a low of $1,600, before recovering slightly.

Another reason for the price weakness of ETH was that the FTX hackers who stole around 130,000 ETH last year had started to sell their stolen ETH. In particular, the ETH/BTC pair suffered more significantly as the price of BTC had remained well supported in spite of the pullback in ETH and altcoins.

ETH price suffered against BTC due to FTX hacker

After remaining quiet for almost two months, the FTX hackers have started activating their wallets and have swapped at least 15,000 ETH into BTC on ThorChain. Since 30 September, these hackers have transferred a total of 60,000 ETH through 4 addresses. As they currently still hold a total of 125,735 ETH through 9 addresses, this phenomenon could continue to plague ETH as these hackers are likely to continue swapping these ETH into other cryptocurrencies, particularly to BTC, thereby putting pressure on the price of ETH.

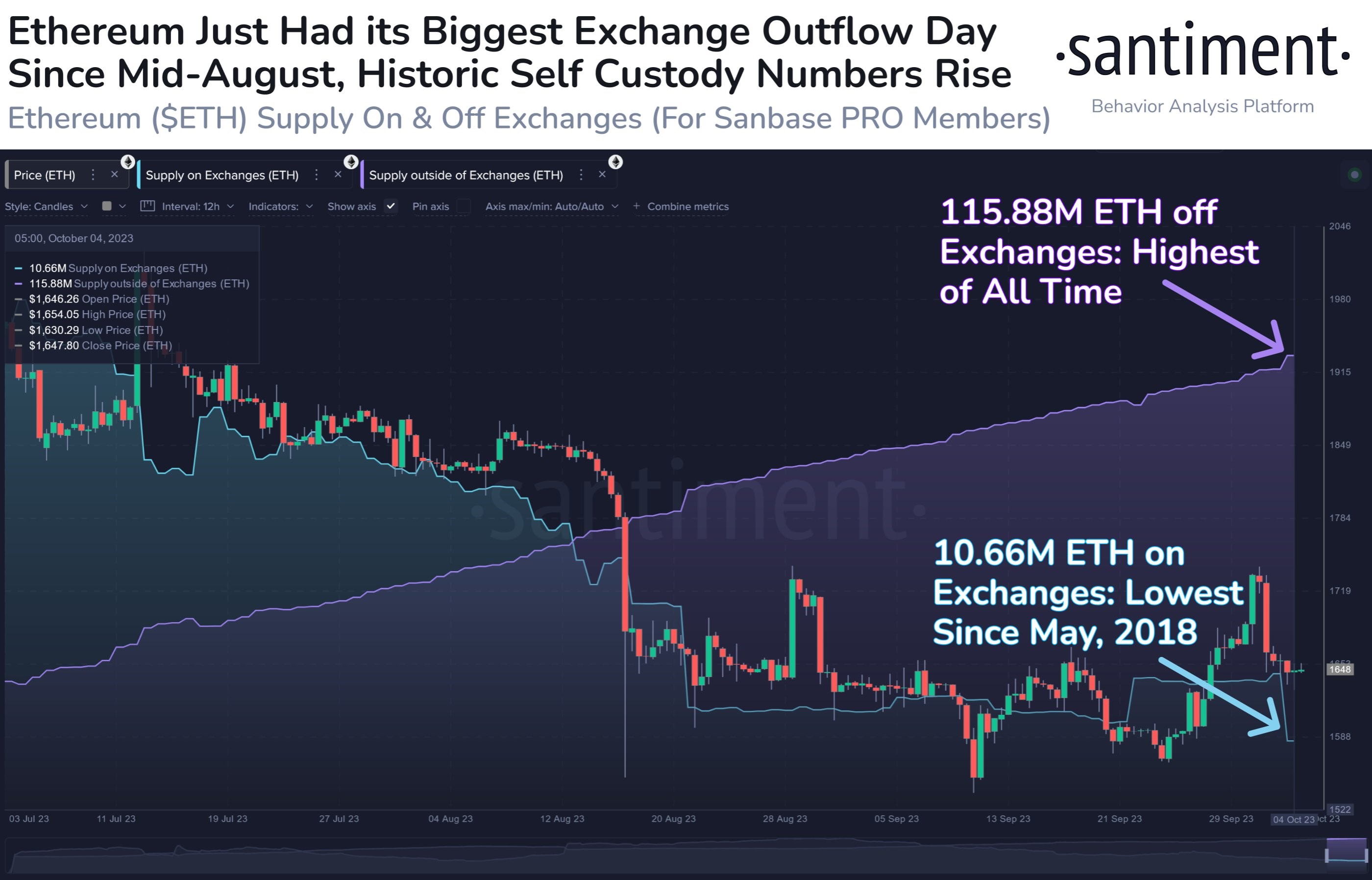

However, over a longer horizon, the fundamental picture of ETH has improved tremendously recently as the accumulation of ETH has increased. In spite of the FTX hackers sale, buyers have also increased to balance out the additional supply.

For instance, 110,000 ETH were observed to have moved off of exchanges on Wednesday, the largest outflow in a single day since 21 August. The amount of non-exchange ETH currently sits at an all-time-high of 115.88 million units, while its exchange supply is at its lowest in around 5.5 years. Such aggressive buying behavior can easily offset the pressure caused by the FTX hackers, who should only have 125,735 more ETH to sell.

BTC remains strong despite macro headwinds

For the second week in a row, the price of BTC remained strong against the backdrop of falling gold and stock prices, perhaps due to the expectation that the SEC would approve spot BTC ETFs soon. Comments from two former Blackrock directors which asserted last week that the SEC will approve at least one spot BTC ETF within the coming three to six months gave the crypto market reason to stay bullish.

Another positive spin for crypto that took place last week was that Patrick McHenry, the new interim US House Speaker following Kevin McCarthy’s historic removal, is pro-crypto. While his position is a temporary one, this news at least brings about a short respite from stern regulators as crypto market participants hope for more crypto-friendly policy makers to make their way into the White House.

With assets in the traditional finance space unwinding in the last couple of weeks, BTC has come up tops in terms of resilience as it has started to trade on its own fundamentals instead of being dragged around by the broad macroeconomic outlook.

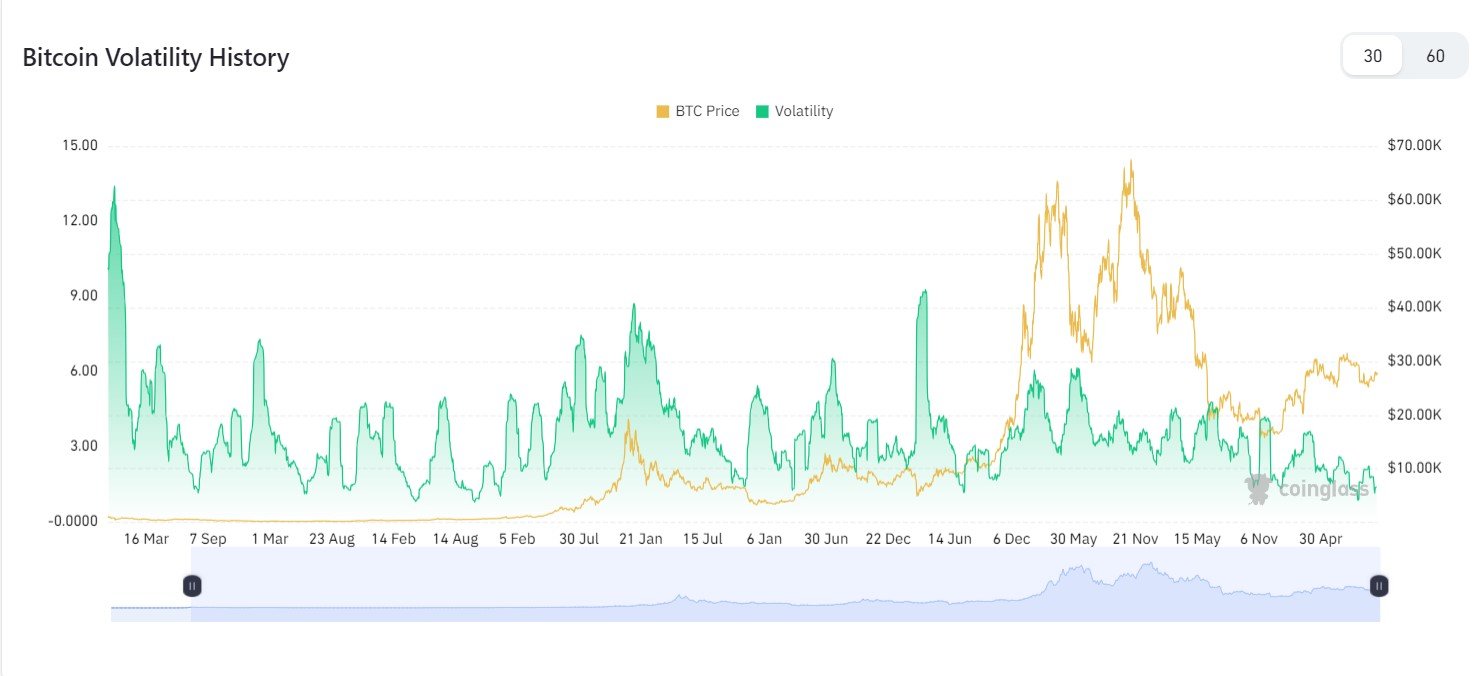

With BTC’s historical volatility having fallen to one of its lowest levels that were previously followed by a sudden surge, a larger move in the price of BTC in the days ahead could be possible. At the moment, the possibility that this volatility surge is for price to lean to the upside is there although nothing can be certain in trading.

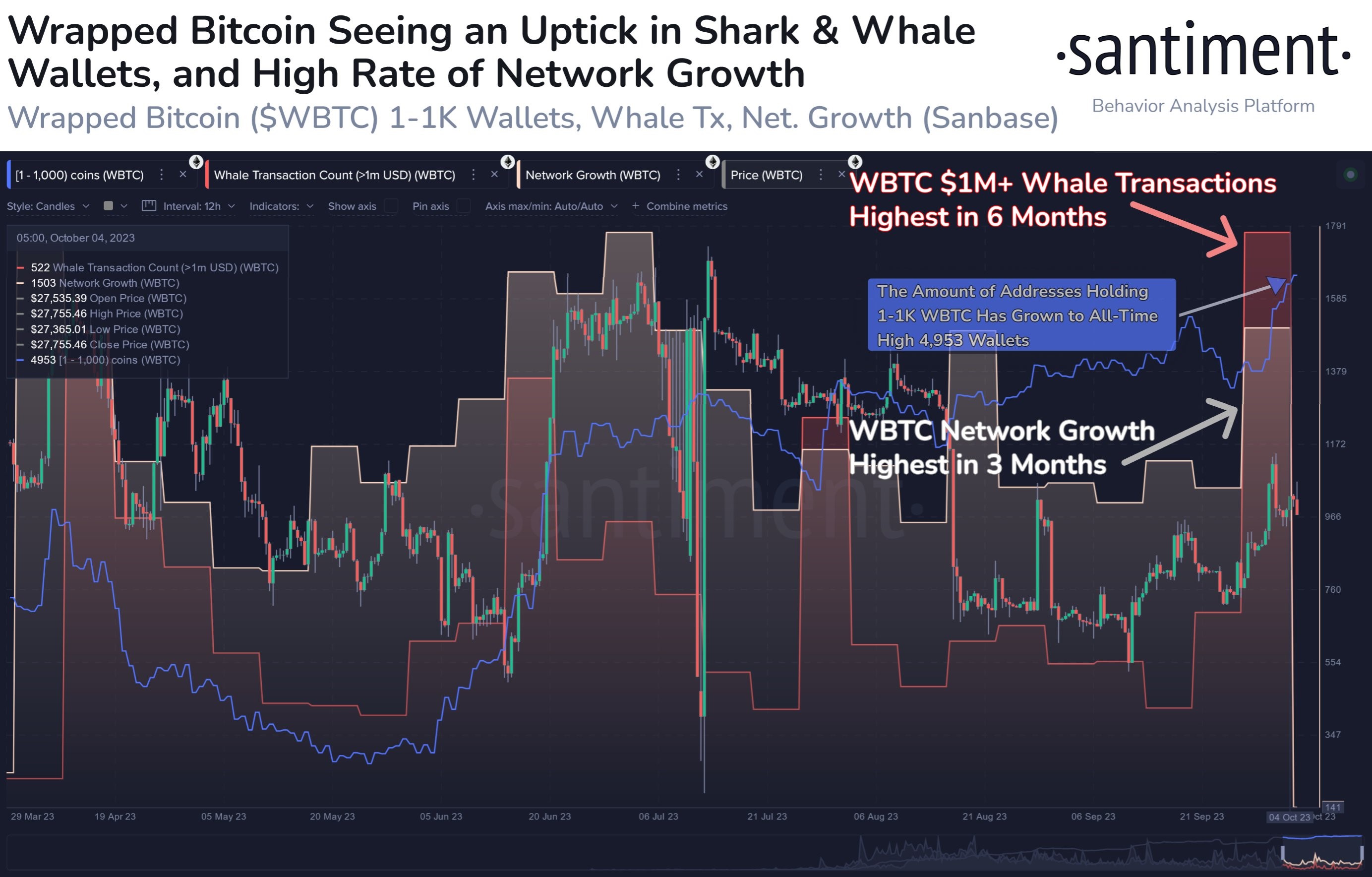

Wrapped BTC comeback underscores improving BTC fundamentals

In another sign that supports a stronger BTC price, wrapped BTC, which had been one of the important catalysts that ignited the 2021 bull run, has made a comeback in terms of transactions. Last week, wBTC witnessed its highest rate of whale transactions involving more than $1 million since March. Its network growth has also recorded its highest since July, with a notable spike in new wallets containing 1 to 1,000 wBTC. Similar increases were also seen prior to both the March and June crypto rallies this year. Hence, this development, on top of the spare USDT reserve in the market which we had highlighted in last week’s report, could support the price of BTC even if the selloff in traditional financial assets continues.

Altcoins lag as good news did little to excite

Last week saw some renewed interest in forgotten coin AVAX which was one of the stars of the 2021 bull market. After gradually declining for more than a year due to a lack of attention, the price of AVAX finally awoke after a new dApp was launched on the network last week, which caused activities on the blockchain to come alive again.

On 4 October, the number of transactions on the Avalanche chain reached 577,000, the highest in the past quarter. This was mainly due to the launch of Star Arena, a friend tech-like social software. The renewed activities on the blockchain has prompted a more than 10% jump in the price of AVAX, which has been on the decline for more than a year.

However, good things did not last long for the new dApp as the platform subsequently got hacked and users lost their funds. This could put an end to the bounce in the price of AVAX.

XRP also had some time in the limelight after having drifted into quiet oblivion over the past couple of months. While there was no major takeaway from the Ripple party event that took place last weekend, Ripple Labs nonetheless had one good news to share – that it had obtained the full Major Payment Institution license for digital payment token services in Singapore, which means that Ripple is now a fully-regulated digital payment service provider in Singapore. The price of XRP moved around 5% on the news.

Other than this piece of news, in the latest installment of the lawsuit between Ripple and the SEC on Wednesday, US district judge Judge Torres denied the SEC’s appeal, which effectively means that the previous ruling in the lawsuit will be final. However, the SEC is still able to take this decision to court in April next year unless it withdraws the lawsuit. As a result, the price of XRP did not react.

The two examples above, including the price weakness of ETH relative to BTC, sums up the sentiment in the crypto market at the moment, where only BTC is the preferred investment.

Commodity complex slipped but Israel war could support prices

Stocks gyrated between gains and losses last week after a mixed series of job reports. Initially, the JOLTS report released on Tuesday strongly beat expectations, sending US yields surging to 16 year highs and stocks tumbling.

However, the private sector new job creation data, also known as the ADP jobs report released on Wednesday came in much lower than expected, creating just 89,000 for September, way below the 160,000 analysts expected. This miss managed to calm US yields a bit and gave stocks a little room to rest from its relentless fall until Friday where the major jobs data, the non-farm payrolls, would be released.

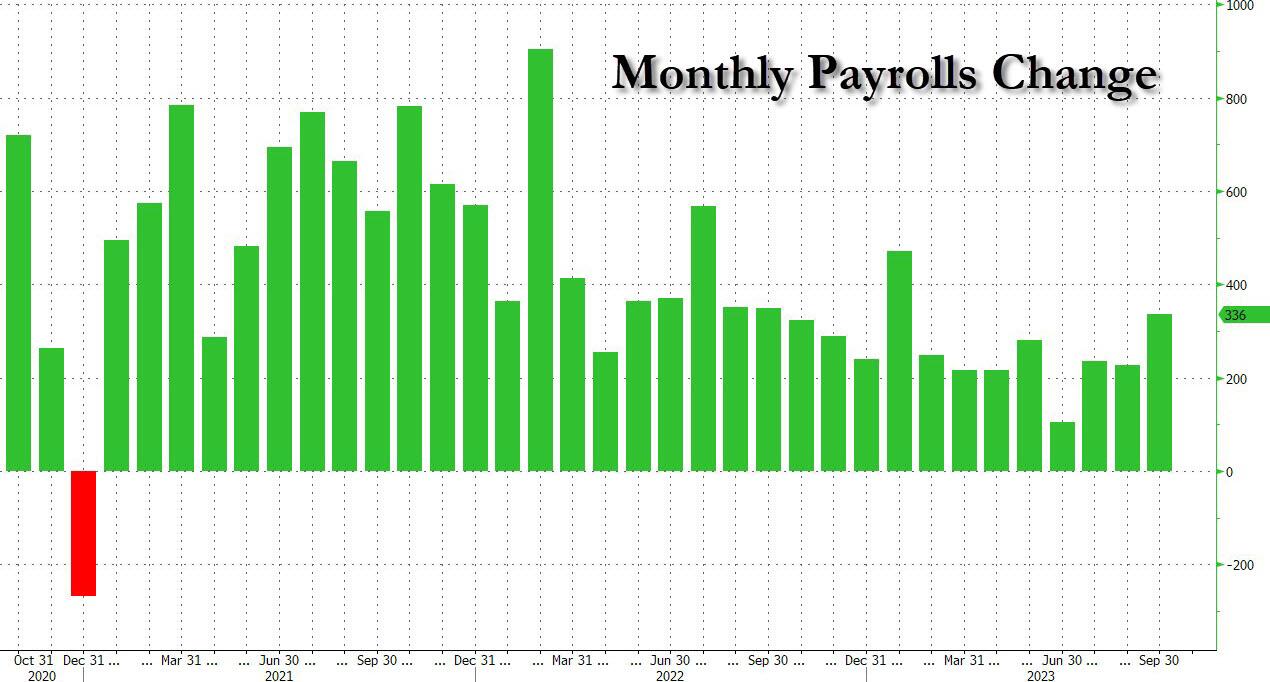

The big data did not disappoint to shock the market as the non-farm payrolls unexpectedly soared by 336,000 in September, coming in double that of expectations of only 170,000.

While stocks initially dropped as investors feared the strong jobs report would give the FED excuses to become more hawkish, the major indices recovered towards the close of Friday’s trading to end the day higher after US yields slipped off their highs.

The end result was that for the week, stocks managed to close slightly in the green, with only the Dow losing 0.3%. The S&P gained 0.48% and the Nasdaq rose by 1.6%. As traders with varying views position themselves differently in the days ahead, the equity market could continue to fluctuate between gains and losses as the market seeks out a direction until the 01 November FED meeting.

Even though yields remained persistently high, the dollar appeared to be facing some resistance ahead of 107 and this had given its peers some leeway to breathe as the Euro and pound started to see some respite. The commodity complex however, continued to fall, with Gold losing 0.84%, while Silver was even weaker, down by 2.55% for the week.

Oil was the biggest loser, as the WTI lost a whopping 8.9% after US gasoline inventories showed a surprise big spike. Brent Crude too succumbed to a wave of profit-taking after weeks of gains to close the week lower by 8.4%.

However, the start of trading this week came with a bang for the commodity complex as the war that broke out in Israel over the weekend is intensifying, with more middle eastern countries joining the fight against Israel. As a result, precious metals prices gained around 1%, oil prices jumped almost 5% in early Asian trading, while US stock futures traded in negative territory.

As America is likely to intervene in one way or another regarding the situation in the middle east, what transpires next in the war may have a direct impact on the US markets and would remain as the main event risk in the immediate future should the situation deteriorate.

With regards to the usual economic data that would impact the markets, this week will see the minutes of the last FED meeting released on Wednesday, while numerous FED speakers will also be speaking throughout the week. Inflation numbers like the PPI and CPI will also be released, on Wednesday and Thursday respectively.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.