With the world looking to source more renewable energy, and leave things like oil and coal behind, Natural gas is one such source that is emerging as a good source of electricity for a number of reasons. It releases less carbon compared to other fossil fuels and the infrastructure around gas plants is much quicker and easier.

It is also for this reason that the US, especially, has taken it upon itself to drive a lot of investment and effort into producing natural gas. This has also seen the reliance on Natural gas in the US being ramped up. This resource has now made its way into the commodities market because of its importance in the future with regards to renewable energy, as well as the added reliance.

Natural Gas

| Current price for today (4 July 2025) | $3.179 |

| Price Change 24h | 0.3% |

| Price Change 7d | -6% |

Natural gas prices historical overview

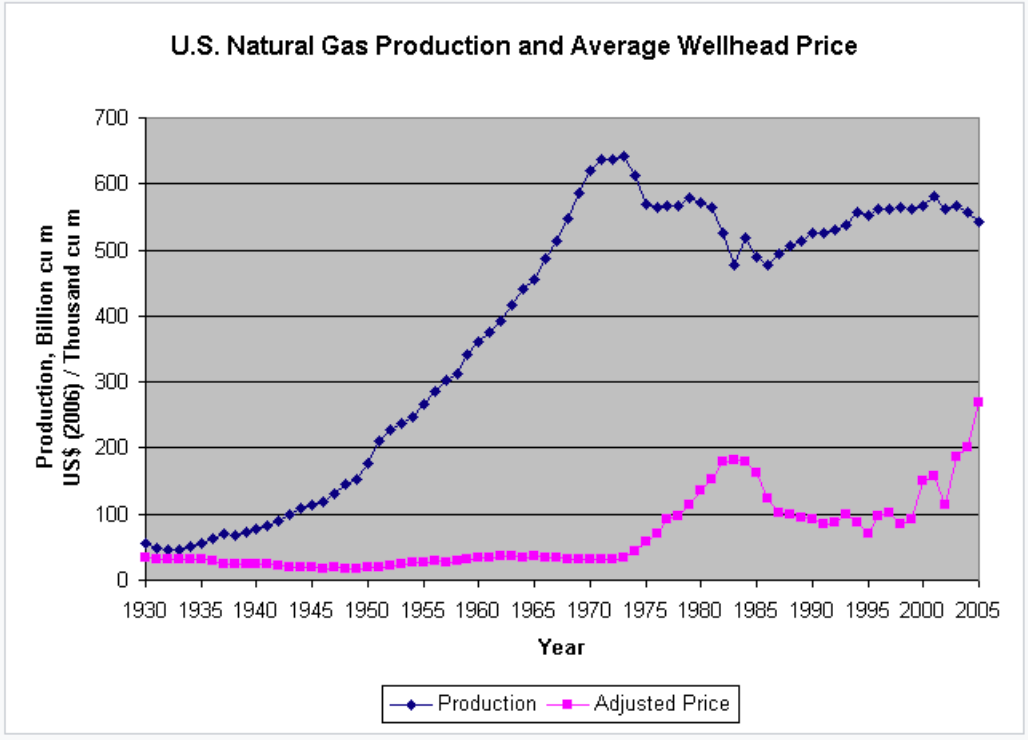

Since the 1930s, in the USA, there has been an up ramping of the dry gas production to meet the growing needs of an expanding population. The peak of production of Natural gas came in around 1975, but in terms of its market price, Natural gas prices only started to climb once production eased off from its all time high.

By 1975, nearly half the marketed gas in the US was sold to the intrastate market, resulting in shortages during 1976 and 1977 in the Midwest that caused factories and schools to close temporarily for lack of Natural gas.

It is these falls in supply that have set the trend for the Natural gas prices forecast most recently with supply interruptions causing spikes in price since 1990. Historically, this has helped boost the price, but in the modern era, the price of gas has been falling, partly because of new technology and added supply.

The new technologies of hydraulic fracturing and horizontal drilling have increased these estimates of recoverable reserves to many hundreds of trillion cubic feet, meaning that there is less fear of running out. And, it is this hydraulic fracking that has reduced the spot price of Natural gas considerably since 2008.

As a form of fossil fuel, and the fact that it is not finite, the movements of supply and demand have a big influence in the price of Natural gas. The historical overview shows that from 2000 to 2009, there were a number of disruptions in supply and fears of running out, but Shale gas has emerged, through new mining technologies, to allay fears of running out for the next 100 years.

Top factors that affect Natural gas prices

Some of the more external factors that influence the Natural gas price predictions include Weather, demographics, economic growth, price increases and poverty, fuel consumption, storage, and exports. However, it is also important to look at factors that impact the supply side of the price forecast, as well as the demand side of the forecast.

Three major supply-side factors affect prices:

- Amount of Natural gas production

- Level of Natural gas in storage inventories

- Volumes of Natural gas imports and exports

Three major demand-side factors affect prices:

- Variations in winter and summer weather

- Level of economic growth

- Availability and prices of other fuels

The dry Natural gas production, and thus the supply of it, has a huge part to play in determining the price of Natural gas in the markets. By increasing supply beyond the needs or the factors like cold weather, there will be a surplus which will push the prices lower. This has been noted by the increased supply thanks to new drilling and mining techniques and the Shale energy movement.

More so, when the Natural gas stores are low, and there is difficulty in procuring new gas deposits, then there is often fear that comes into the market about reduced supply and therefore an increase in price is forecasted. Again, when the Shale gas movement came about in the USA, there was a prediction that these deposits would not run out for another 100 years, meaning constant supply and a lowering of price.

On the demand side of things, Natural gas is used primarily as a resource for heating houses. Thus, the demand for such gas is quite seasonal, and can rise and fall dependent on the severity of a winter.

More so, because gas is linked to prosperity of people, its demand can increase when there is better economic performance in the markets. Economic growth allows for more people to have access to gas, and to be more demanding of it, which also pushes the price up.

On top of this, gas is one resource people can use for heating and other means, but because there are alternatives, if the price of gas moves to be too expensive due to high demand, people can move to other fuels and thus lower the demand, and the price.

Natural gas prices forecast for 2024-2025

It will be difficult to make a Natural gas price forecast for the next couple of years, as there are a lot of different moving pieces. For the past year of 2023, we have seen Natural gas markets act in a very lacklustre manner, as the market recovered from the initial shock of the Ukraine war.

During 2022 Natural gas markets rose to roughly $10, but spent several months collapsing as wintertime in Europe was nowhere near as cold as people had feared. Furthermore, the Germans and other European powers had stored enough Natural gas to get through the injection season.

The concerns that taking Russian gas out of the marketplace would cause a major shortage seemed to have been averted, at least for the time. Because of this, the fears of massive shortages have disappeared.

Furthermore, expect Natural gas production to be steady in North America, with the facility in Freeport, Texas being rebuilt and allowing for the export of Natural gas from America, it flooded the market with plenty of supply, therefore pricing lost a lot of its initial momentum. Natural gas future momentum may be all over the place, but it is obvious that there is a lot of demand.

After the massive selloff last year, one would assume that we will eventually see a recovery in 2024. However, it’s worth noting that liquid fuels production in America could continue to expand, and therefore could make this a relatively cheap market over the longer-term, albeit not as cheap as we saw after the crash after the Ukraine war.

The global liquid fuels consumption will continue to expand as smaller economies grow, and of course some countries are trying to fight carbon emissions. Natural gas is a cleaner version of fuel in comparison to coal or oil, and thus more green economies may be interested in using Natural gas along with other types of energy such as solar and wind. However the electric power sector will have its affect.

The Natural gas price forecast today, and the Natural gas price forecast for the next six months are expected to be very different as market issues play themselves out. Then, the gas price predictions for the next 5 years will also be interesting to watch because of the way in which the resource is being produced and handled.

Weather, demographics, economic growth, poverty, consumption an much more – all affect the future gas prices predictions and how the price will move. Some factors are obvious — colder weather meaning more Natural gas usage for heating. Or temperature which also comes into play, affecting demographics, as there is a tendency for US residents to move to warmer areas meaning less demand.

The gas price forecast is also moved by market conditions, such as economic growth and slow down that can make the price rise and fall. The compounding effect of this is that the rising price of gas can also make people move away from the fuel source which leads to added supply and less demand.

Natural gas price forecast for 2030 and beyond

The short-term energy outlook is a bit of a mixed picture, but it’s worth noting that there has been quite a bit of historical precedent to believe that energy will make a turnaround, be it Natural gas or Crude oil.

Falling Crude oil prices have made Natural gas less attractive for net exports at times, but the reality is that technology is working on solutions to transporting liquefied Natural gas exports in a much more effective manner, making Natural gas a very likely winner in the future.

Gas demand will more likely than not pick up, as the global economy recovers from the pandemic, and the potential major recession that we are facing over the next year or two. Keep in mind that Natural gas tends to have a huge influence from electricity generation, which of course is greatly influenced by whether or not the economy is humming along.

Furthermore, demand will more likely than not pick up as people worry more about sustainable energy, as Natural gas burns much cleaner. Because of this, it’s very likely that many governments will push for more Natural gas instead of Crude oil as well. That being said, gas increased demand is also cyclical, so you need to pay attention to weather patterns, as it is used to heat homes in the northern hemisphere.

Future gas prices predictions

Gas price prediction can be rather difficult, but in the long run, the factors that push its price are quite clear and obvious. It is a sustainable resource, and thus has an important role to play in the long term, and thus its demand will only get bigger.

However, it is also a resource that is becoming easier to acquire thanks to new technologies and mining methods — so supply is also on the rise. It becomes about balancing the supply and the demand, but the good thing is demand is rapidly rising.

This is especially true given the fact that wholesale electric prices can skyrocket from time to time, so using a cheap fuel to produce electricity is going to be crucial, especially with smaller economies that are considered to be “emerging markets.”

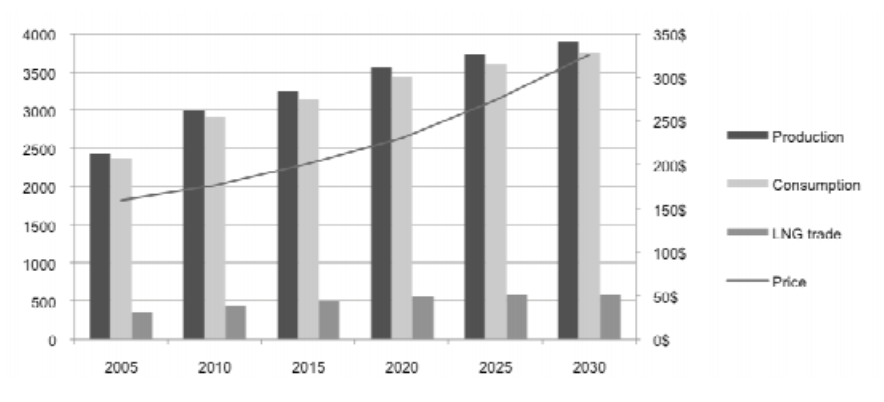

Experts are also predicting big growth in use by Asian countries such as India, Pakistan and Bangladesh, where the industrial sector serves as the main growth driver. The use of Natural gas is expected to grow at an annual rate of 3%, accounting for half of global consumption.

Experts are mixed when it comes to future projections, with most expecting a bearish turn. For example, The World Bank, in its Commodity Markets Outlook, forecasts US Natural gas prices to remain close to $2.80/MMBtu. The EIA Forecast 2021 (Energy Information Administration*) expect Natural gas prices to average $3.07/MMBtu. Currently, Natural gas is trading higher at $4.80/MMBtu.

Gas price forecasts for next 5 years

The biggest driver that will influence the gas price, especially in an upward direction, is the drive to make this resource the largest primary energy source on the planet. It is a fuel that is greener than its other fossil fuel compatriots, and the production infrastructure is robust enough for it to become a key global fuel.

Many expect gas to become the largest primary energy source by 2034. It will also be the last of the fossil resources to experience peak demand, which is being predicted for 2035. But, because it can operate alongside the growing uses of sustainable energy, the next five years is sure to see steady growth in its demand.

Another factor that needs to be considered, that suits this gas prediction, is a factor that many market analysts look at: gas in storage compared to five-year average.

Dwayne Purvis, an engineering and management consultant based in Texas, explains that the gas price may be ready for a massive spike in the next five years.

“The standard frame of reference —five year range of storage—has been deformed by the extreme demands of 2014’s “polar vortex” and the chronic gas shortage, obscuring reality.”

“For the better part of the last three years storage trended down as demand chronically exceeded supply. In a longer time frame, normalized storage volumes have trended downward for nearly 10 years as storage did not expand with production. These overlapping trends caused last winter heating season to end with only 12 days of supply in storage.”

Natural gas price forecasts for next 10 years

Much like the five year prediction of the Natural gas price, the next 10 years are set to see prices steadily ride due to demand for energy, as well as demand for cleaner fossil fuels. In fact, going as long as 10 years, the prediction of a 3% price rise on average still stands as many market analysts agree on this figure.

For long term predictions on an asset like this, it is very much about how the world can meet rising demand with rising supply, and how the market can move and adjust to these rising models. Demand for gas will rise, and there is little doubt about that, but the production and supply of gas needs to match it, and not over run it, for the price of gas to keep rising with demand.

The only other factors that can have a role on the gas price in the long term is the incoming supply from US Shale gas deposits which have recently come to the fore and added a lot of supply to the market, dulling the prices somewhat.

McKinsey, in their North American Gas Outlook to 2030, have noted how Shale may dip the price a little:

“Based on these anticipated supply and demand drivers, we expect to see North American gas prices remain stable in the medium term. However, as supply from Shale resources, particularly from associated gas, continues to grow, prices should decline slightly, to roughly $2.50 per million British thermal units, and remain at that point for the long term. At these prices, we anticipate that North America will be able to meet 25-plus years of demand.”

Summary: what is the future of the Natural gas

The future of Natural gas as a resource and a commodity is good. The usage of this resource is only getting bigger as it suits a better expectation for what is required from the world of fossil fuels as it is greener, and even more sustainable.

The production of Natural gas is also being ramped up in response to a predicted demand for the fuel, but this production comes in waves as the growth of Shale fuel, for example, has bolstered supply and dulled demand which has lowered the price — but this has also helped make Natural gas more available and usable for new industries.

The price of Natural gas is mostly agreed to grow by 3% each year, and this could increase rapidly as traditional fossil fuels are left behind. Currently, the price of Natural gas is quite low, which means a sudden rally could be expected this year, and it would be a good time to invest in the long run.

Are natural gas prices expected to go up or down?

In general, Natural gas prices are expected to move upwards by about 3% per annum based on growing demand, but offset by growing supply and the injection of Shale gas energy.

What time is the natural gas inventory report?

The report is generally updated and available every Thursday at 10:30 am EST

Should I lock in my natural gas rate?

Because Natural gas is considered a longer term investment based on its steady gaining in price, in general, it is better to lock into a fixed price contract.

What is a good price per therm for natural gas?

The average cost of Natural gas per therm can very significantly by season, location, and other factors. However, a good average is around $1, but closer to $0.90.

Do natural gas prices go up in winter?

Yes, because Natural gas is used for heating and cooking, it is at its highest demand in January and the winter months so the price of gas is usually at its highest at the beginning of the year.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.