If you are new to investing on the Stock market, you might not be familiar with the concept of short selling or puts.

Did you know that you can sell Stock during a downtrend without owning it? And that this is actually a strategy used on an almost daily basis by institutional and professional investors?

You also might not be familiar with the fact that both types of investing allow you to trade an asset’s dropping market price.

Most new investors assume that the only way to trade is to purchase an asset at a lower price, wait for the Stock’s price to increase, and sell it at a profit. This is often called taking a long position.

A short sell on the other hand has been used by some of the world’s most prolific and successful traders to make their fortunes. George Soros made one billion dollars by short selling the British pound, and the legendary Michael Burry made a stunning one hundred million dollars by shorting the mortgage bond market, making an additional seven hundred million for his investors.

Using short selling and put options can be part of a powerful investment strategy. This article will give you an overview so you too can use the same tools successful institutional investors use.

What is Short Selling?

Short selling is how professional investors take advantage of the price drop in a specific market.

It is often combined other with financial products to either create a profit or limit risk on already opened positions.

A short sell or put options can open up completely new opportunities and possibilities when used appropriately as markets are dropping. As mentioned in the introduction, legendary traders have used these tools to create immense wealth.

How Does Short Selling Work?

Short selling usually requires a margin account, where traders “borrow” the asset they are interested in from their broker and sell the lent securities on the open market.

When the assets’ price falls, the investor or trader repurchases these at a lower price and pays the required fees to the broker for the credit extended and profits.

Beyond being a very effective way to trade, many institutional investors use it to limit risk of a long position if markets become volatile in the future.

This is what market experts call hedging.

Risks and Rewards: Short Selling vs Puts

The biggest risk involved when short selling is the lack of a specific price, which functions as a cap. This means that if an asset’s price reverses, this could hypothetically result in limitless losses.

This is why it is extremely important to have your stop and limit orders in place to protect you from this type of scenario.

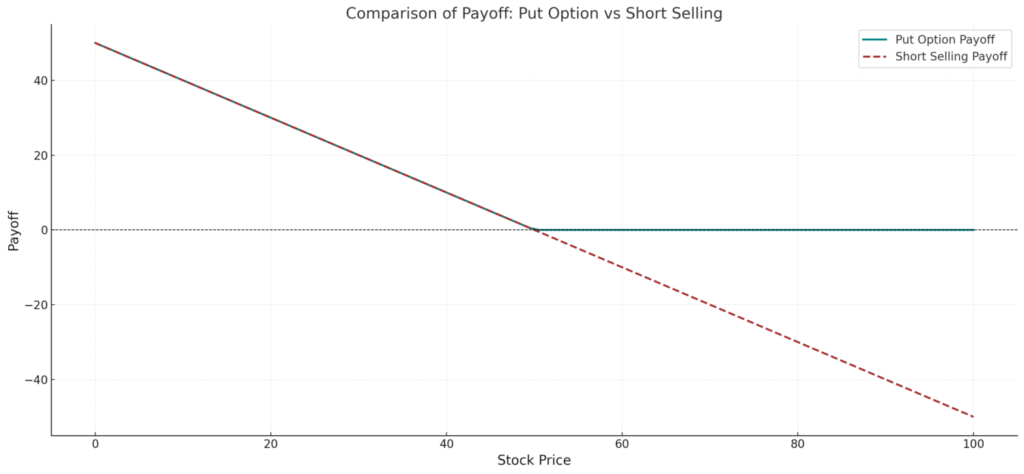

- Put Option Payoff (Teal Line):

- The payoff is capped at the strike price, and no further gains are possible once the stock price drops below a certain point.

- If the stock price remains above the strike price, the option expires worthless.

- Short Selling Payoff (Brown Dashed Line):

- The payoff decreases linearly as the stock price rises, indicating unlimited potential loss.

- As the stock price falls, the payoff increases linearly, with the maximum profit occurring if the stock price drops to zero.

Summary:

- Risk: Short selling has unlimited risk, while a put option’s risk is limited to the premium paid.

- Profit Potential: Both strategies benefit from falling stock prices. However, short selling doesn’t have a time limit, unlike a put option, which expires

Examples of Short Selling in Action

First, we’ll assume that the asset’s price you are looking at is already moving downwards and you have a margin account.

Let’s say your analysis has shown that the bear market sentiment will continue after market consolidation. Once the technical indicators you use have fully confirmed your speculation, you can plot your potential entry and exit points, and your stop loss and take profit limits. Then you can open a short position.

In general, whenever you trade, you should always perform extensive research and analysis, and be aware of the current market conditions.

What Are Puts?

Puts or put options are a financial product that allow investors and traders to take advantage of a bear market.

They are a type of contract that allows you to essentially short sell, but without the obligation to own the underlying assets.

Depending on the scenario, the benefits put options offer might be a better choice when looking to open a bearish position.

Understanding Put : How They Work and Their Benefits

A put option is a powerful tool that lets traders speculate on the price of an underlying asset. The idea is simple: the trader predicts that the asset’s price will drop to a specific level—known as the strike price—before a preset expiration date. If the price falls as expected, the option is considered “in the money,” a term commonly used in trading.

To trade put options effectively, there are three key terms to know:

- Strike Price: The predetermined price at which the asset can be sold.

- Premium: The cost of the option, which is influenced by the asset’s current market price, intrinsic value, and the option’s duration (longer durations often mean higher premiums).

- Expiration Date: The deadline for the option to be exercised.

The biggest advantage of a put option is its limited risk. No matter what happens, your maximum loss is capped at the premium you paid. If the asset’s price doesn’t reach the strike price by the expiration date, the option simply expires worthless, and you only lose the premium.

Put options also provide flexibility. Traders can sell a set number of the underlying asset within the agreed timeframe and price. Additionally, the holder can even sell the contract itself at an increased value before it expires, depending on market conditions.

For a put option to be profitable, the asset’s price must drop below the strike price before the expiration date. When this happens, the trader earns the difference between the strike price and the current market value, minus the premium.

Why Traders Love Put Options

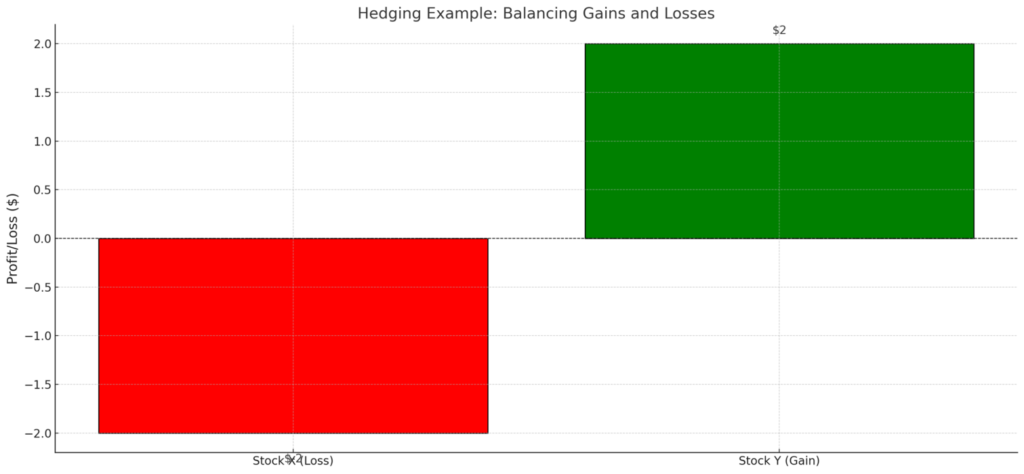

The main benefit of put options is the capped maximum loss, making them a preferred choice for institutional and professional investors. They are particularly useful for hedging, a strategy used to protect against future risks. Hedging involves opening a position that moves inversely to another, minimizing losses during market volatility.

For example, if you’re trading Stock X and it drops by $2, you could hedge your risk by pairing it with Stock Y, which might gain $2. Alternatively, you could open both long and short positions on Stock X, though this would result in a zero-sum trade.

In the real world, oil prices often provide a classic example of negative correlation. When oil prices rise, stocks in sectors like logistics, transportation, and aerospace tend to decline due to their dependence on fuel.

Key Consideration: Market Analysis

To succeed with put options, you need the ability to analyze the market and anticipate price movements with confidence. The asset’s price must fall below the strike price before the option expires for it to generate a profit. While this requires careful market evaluation, the downside risk is always limited, unlike in short selling.

Examples

If the holder of a put option is relatively confident, as inferred from analysis, that the prevailing drop in the underlying Stock or asset will continue beyond the strike price, but market conditions are more volatile than normal, then a put option can offer the profit potential of a short sell but with limited risk.

Key Differences Between Short Selling and Puts

The major difference between short selling and put options is the limited risk without the need to set stop loss orders. Without such limits on a short sell position, it may be subject to unlimited risk.

Furthermore, a put buyer does not need to borrow money or margin to exercise their put position.

On the other hand, due to the expiration date, a put option might not take full advantage of an ongoing downtrend, whereas a short position doesn’t have this limitation. With enough free margin and if the market continues to trend downwards, a short sale could stay open an indefinite amount of time.

The strike price is another potential downside of put options. If this price isn’t surpassed by the time the contract expires then the option is considered worthless.

Capital Requirements for Bearish Strategies

The capital requirements for short selling and put option is also very different. Although buying puts requires paying the premium upfront, margin trading can carry a much higher upfront cost.

Most brokers have a minimum deposit amount to open a margin trading account, and then a certain amount of your funds will be dedicated to the margin requirements to open your trades and keep them open.

Profit Potential and Risk Exposure: Short Selling vs Puts

Both short selling and put options have the same profit potential when used in a bearish strategy. The only limitation would be that the put option has a specific timeframe in which it expires, whereas short positions without any risk management measures and enough margin could, in theory, stay open indefinitely.

The downside risks when buying puts is only the premium. With a short position on the other hand, again theoretically, losses may be unlimited without the appropriate risk management measures like stop loss to close the trade if the market moves against you.

Cost Comparison: Short Selling vs Puts

When trying to compare costs there are many variables that contribute. One of the biggest contributing factors is your choice of broker. Especially with a short sell position, brokers offer higher but fixed spreads, while others offer variable spreads that may increase in response to market volatility.

In a purely hypothetical scenario where all things are the same though and no extra fees are applied:

When buying put options, the costs are upfront and locked in. A short sell on the other hand, especially when dealing with variable spreads that increase or decrease according to market volatility, may be more challenging to foresee or calculate.

Commissions, fees, and margin costs

Commissions and fees differ greatly from broker to broker. Most credible brokers are very transparent about their pricing and fees. At PrimeXBT, for example, we publish our fees but also offer some of the most competitive rates in the industry.

Margin only needs to be considered when short selling. This also depends on numerous factors including the amount of leverage used to open the position, the underlying asset, and the type of margin.

Effect of Market Conditions on Short Selling and Puts

If you are trading using bearish strategies, then it is also a good idea to use a momentum or volume indicator to confirm whether the trend is strong and persistent or if there is potential for a reversal.

Although technical analysis is a powerful tool, it only uses past data to make price predictions – and can overlook current conditions, upcoming events or even news being published at the time of your trading.

Although the average investor may not have the investment expertise or investment knowledge held by other financial institutions, having as much information as possible is the best way to be successful.

Volatility and Liquidity: How They Impact Short Selling and Puts

Volatility can be detrimental to both short sell positions and a put option. Of course a short sale, especially one that has a stop stop-loss order, is more susceptible to closing due to a momentary price reversal.

A put option will only close if requested by the buyer or if it reaches its expiration date.

High liquidity contributes to market stability and minimises the risk of slippage (i.e. the time needed to execute an order once it is placed). If you are using bearish strategies, either short sell or a put option, these conditions are more desirable as they make markets move more predictably.

Regulatory Considerations for Short Selling and Puts

As with any type of trading that creates income, it is best to consult your local authorities regarding reporting of income created from capital gains or investment activities.

Which Strategy is Right for You? Short Selling or Puts?

A reasonable strategy balances numerous variables – including profit, timing, current market conditions and risk appetite.

What works now, may not work in a different context, so it is important to be flexible – and these two ways to trade falling prices, are a great way to do so. As mentioned previously, each method of trading, put options or short selling, depends on your own investment goals and the amount of risk you are willing to take to achieve them.

During a bear market, you may want to hedge downside risk of your portfolio holding for a specific amount a time, then a put option is probably the best – since the cost is known and will not change throughout the duration of the contract.

In fact, institutions frequently use a put option to directly hedge risk on their other holdings when Stock prices drop.

If you have a bit more risk appetite and would want to take full advantage of dropping prices, then short selling might be more appropriate.

Conclusion

No matter your strategy, even a market downturn can present numerous opportunities. Using a put option or short selling can help you succeed, much like institutional and professional investors.

If you are confident that the market will surpass a certain level, at which you can set your strike price, and you would like more control over potential risk, then put options might be the best choice.

Conversely, if you want to maximise your profit potential as a Stock falls, short sales might be better as they do not have an expiry date, and hypothetically could be kept open with enough margin for as long as a Stock declines.

With the appropriate measures, you can even protect your investments and Stock trades, by hedging your open positions with short positions or with put options.

Ready to explore advanced trading strategies?

Is buying puts better than shorting?

They both have their own benefits and disadvantages, depending on your risk appetite, conditions and the reasons you'd like to trade a downtrend.

Is buying a put the same as selling a put?

No, buying a put allows you to sell the underlying security at a predetermined price, whereas selling a put allows you to buy the underlying assets at a predetermined price.

Is selling a put option long or short?

It is a long position - or a position in which you expect the asset or Stock price to rise.

What is the main difference between short selling and puts?

Short selling involves borrowing and selling an asset you don’t own, while puts are contracts that let you sell at a specific price within a timeframe.

Which is riskier: short selling or buying puts?

Short selling carries unlimited risk if the market moves against you. Puts have limited risk, capped at the premium paid.

Do I need a margin account for short selling or puts?

Short selling requires a margin account, while buying puts does not

Can I use short selling or puts to hedge my portfolio?

Yes, both strategies can be used for hedging. Puts are often preferred for limited risk exposure

What are the costs associated with short selling and puts?

Short selling involves margin requirements and borrowing fees, while puts require an upfront premium payment

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.