Touch trading involves entering the market precisely at the live price impact intersecting with a predefined price, often a horizontal support or resistance level. As highlighted later, there exist various advantages and disadvantages associated with employing this strategy.

Explaining touch trading

Definition and mechanics of touch trading

This strategy involves swiftly adjusting if moving against the market tide. This rationale stems from the ability to anticipate a market reaction at the point of interest, allowing investors to promptly exit to mitigate losses when their analysis fall short.

In terms of trade management, this often leads to employing floating stop-loss or tight fixed placements, relying on the market’s rapid reversal from significant support. A tighter stop may elevate the risk-to-reward ratio, and early entry at the source provides the added advantage of potential profit growth.

Conversely, traditional price action trading styles often necessitate broader stop-loss placements as entries farther from the origin must consider the potential of a benign pullback against the anticipated direction.

While the allure of additional trading opportunities and greater profit potential seems enticing, it’s essential to scrutinise the downsides. Below, we outline three drawbacks necessitating consideration before embracing this approach.

The role of support and resistance in touch trading

Support and resistance are very important for this strategy as they are the keystone of the method. As mentioned above, a position is entered if the opening price action hits or touches an interest point such as support or resistance.

Advantages of touch trading

Early market entry and potential for greater profits

As you may have gathered at this point, this method of trading requires a high level of experience and much tighter trade management compared to other methods.

It also leverages the higher trading frequency (i.e. volatility) seen during market openings.

Beyond the fundamental rule of the market, which is when supply increases prices drop and when supply drops and demand increases prices increase – there is another especially important rule for traders – the higher the potential risk, the higher the potential reward.

If you enter at a resistance or support breakout the moment it happens, without price action confirmation, then you’ll likely benefit from the full breadth of the trend. But you also run a much higher risk of a reversal that will cause losses.

Increased trading opportunities

Arguably the most distinctive advantage of adopting the aggressive nature of this strategy is the ability to enter the market at its origin, facilitating an earlier entry and, potentially, an increased opportunity for profit.

While waiting for price action confirmation can provide an additional layer of confidence in predicting market movements, it may not always yield an early entry opportunity.

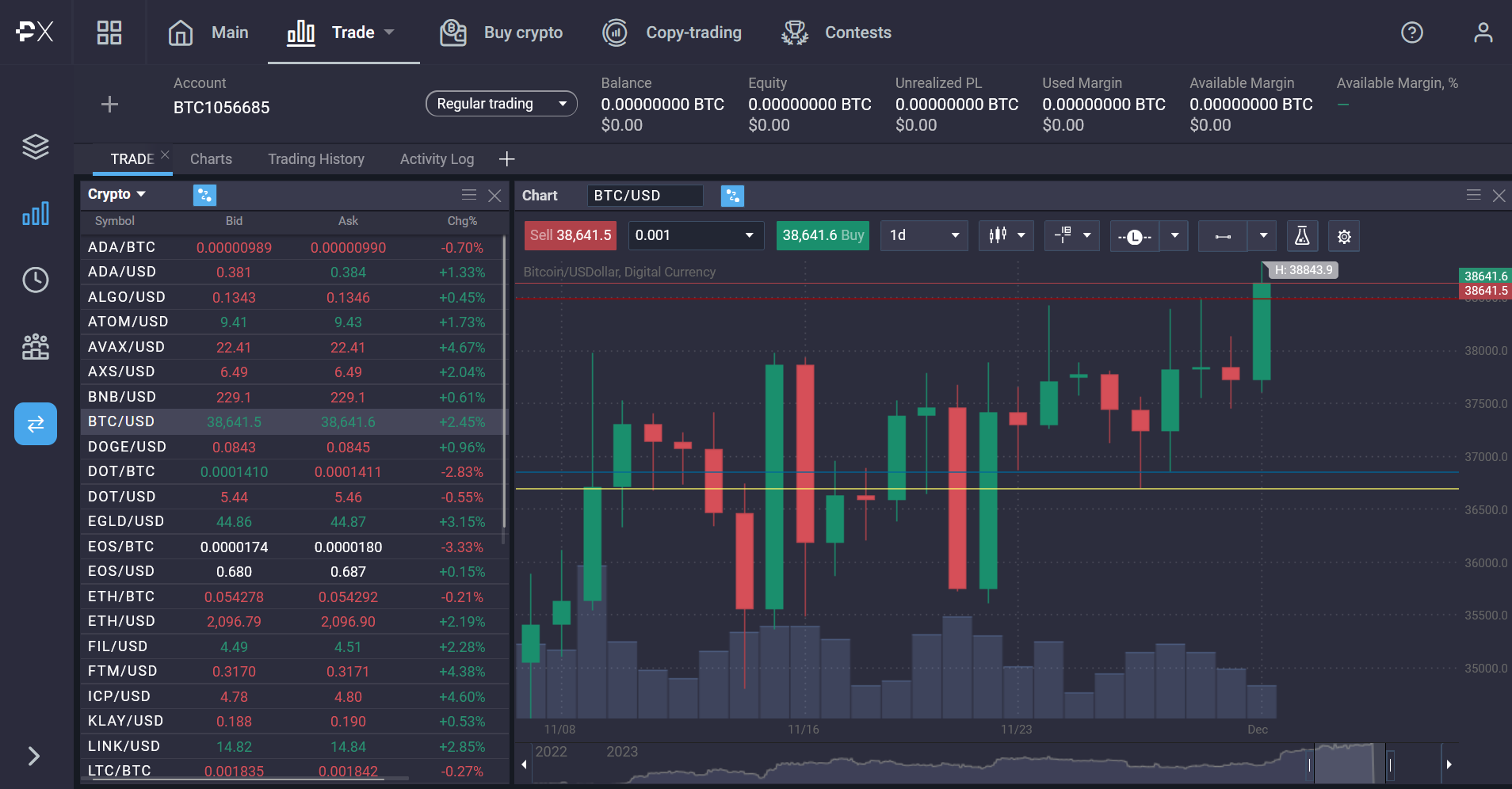

In the depicted chart, the blue line indicates a potential entry point for a bullish trade at the support area. Conversely, the red line showcases a potential long trade for a price action trader who patiently awaited the bullish engulfing candlestick for added assurance(which doesn’t completely engulf in the chart above). However, it becomes evident that relying solely on price action at crucial points can result in delayed entries into projected moves or, in a worst-case scenario, no entry at all if definitive price action confirmations are elusive. This brings us to the crucial advantage of opting for touch trades.

You’ll also notice that the resistance used as the exit point still remains unconfirmed. This may result in a breakout or a correction and retesting during the next timeframe interval.

Challenges and risks of touch trading

Lower hit rate and increased risk

This drawback stands out as a pivotal consideration when thinking about the adoption of the strategy. The surge in trading opportunities seldom accompanies a guarantee of a notably high success rate. While the approach presents a greater number of trading prospects, its inherently aggressive nature entails a heightened trade-to-trade risk, resulting in a probable lower hit rate for profitable trades compared to a cautious technical trader who opts for waiting for conspicuous price action confirmations.

In theory, one might assume that a higher hit rate, coupled with lower trading frequency, should roughly equate to a method utilising a lower hit rate but with higher trading frequency. However, reality often proves more intricate. The complexity lies in individual trading personalities, which can significantly differ among traders and subjective trade management.

Many traders find it challenging to seamlessly transition between a conservative and an aggressive trading style. In this context, it implies that touch trading might not suit every trader, even with successful mastery. Some traders prefer stacking the odds in favor of a trading opportunity, steering clear of hit-or-miss styles that hinge on substantial historical data to validate their efficacy.

Not suitable for beginners

It’s not uncommon for trading educators to steer novice traders away from highly subjective and aggressive trading styles, that are vulnerable to the market’s sharp reversal or price changes such as touch trading. At its essence, this strategy demands an in-depth understanding of market rhythm, overall price action, order flow dynamics, and a comprehensive comprehension of why prices typically behave as they do. This understanding extends beyond merely pinpointing key support and resistance areas and placing stop or limit orders; it involves actively deciphering market intricacies and searching for trading opportunities.

While this method is frequently labeled as ‘blind,’ success with it is far from a task one can accomplish with closed eyes. Executing potential trades demands intense concentration, closely monitoring live price action as it approaches the crucial interest point, and a significant amount of hands-on management during the initial phase when the price is still in the proximity of the key area. Remember that touch trading requires a high level of adaptability and responsiveness to real-time market conditions. Unfortunately, most novice traders often grapple with heightened emotions, making it challenging to think and act impartially. Success in this method hinges on swift and ad hoc decision-making, rendering it often inaccessible to beginners who are still acquainting themselves with the fundamental intricacies of the business.

Trade management in touch trading

The need for swift adjustments

Trading during volatile market conditions mean the need for dynamic and rapid adjustments.

Emotional and psychological challenges

It takes deep concentration, emotional stability, moving outside your comfort zones and a particular type of person to touch trade. New traders beware.

Who should consider touch trading?

Assessing suitability for touch trading

As mentioned above, this strategy not only requires extensive experience, it also requires robust control of your emotions. When it comes down to brass tacks, using this trading method requires you to be just as comfortable losing and be able to emotionally recover quickly enough to act again.

If you are using leverage, then your account needs to have enough margin to protect your remaining trades from margin stop out.

If you (and your account) have those characteristics, then this can be a very exciting and potentially profitable strategy.

Alternatives to touch trading

Break out trading can be a decent replacement for the touch trading approach. Essentially, you use indicators to predict the range of prices where the asset’s value may break through support or resistance.

With the right combination of indicators you may be able to speculate the approximate length of the breakout trend. This strategy carries less risk and gives you a more generous margin of error.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.