Despite high levels of volatility, Bitcoin rallied 4% last week and is extending those gains at the start of the new week. BTC started last week down at 107.4k, briefly spiked to 114k on Tuesday, and then fell to a low of 106k on Wednesday. From here, the price mounted a recovery, extending gains for a fifth straight session, reaching 115.5k, a two-week high.

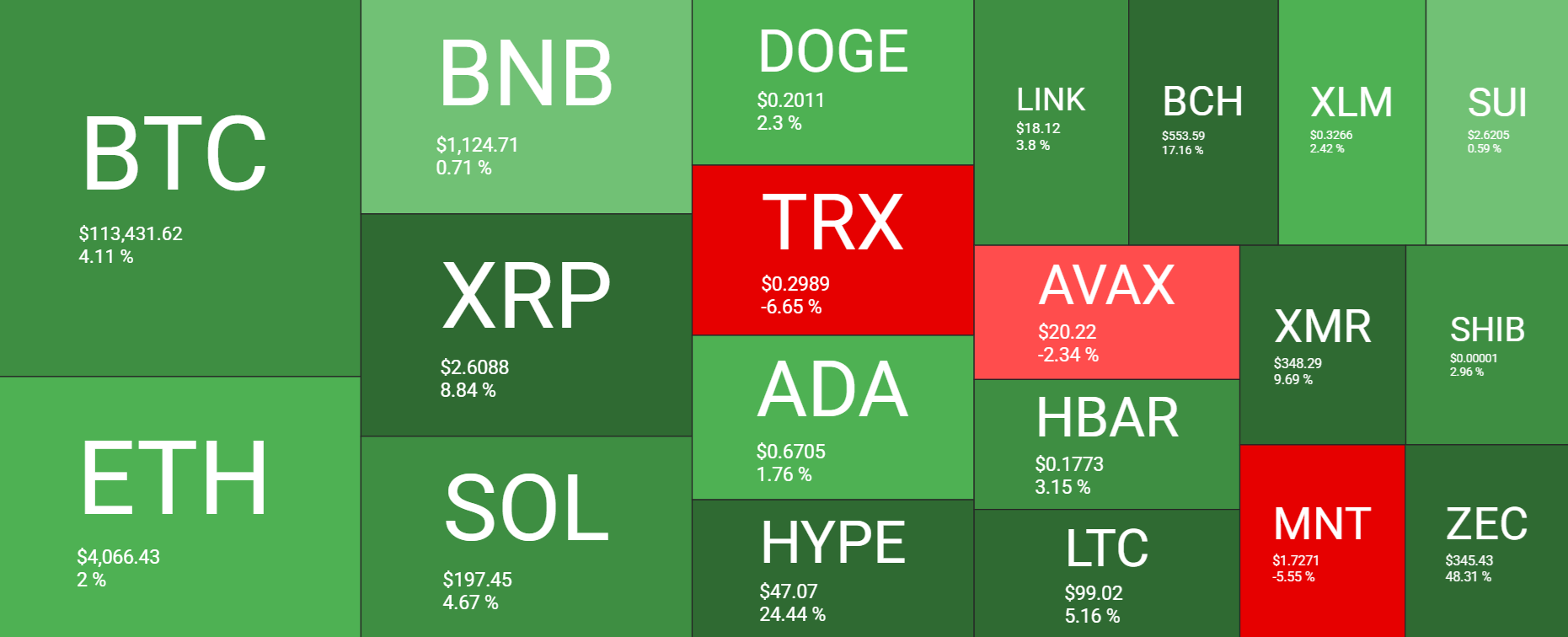

Altcoins were also broadly stronger. Ethereum rose 2% across the past 7 days, pushing above $4000, while SOL gained 4.6% and XRP jumped 8%. However, there were also pockets of weakness with TRX and AVAX among the few altcoins that fell across the past week. That said, altcoins across the board are rising on Monday.

The total crypto market capitalisation briefly rose to $3.82 trillion last weekend before falling to a low of $3.60 trillion on Thursday. The total crypto market cap has been steadily rising since and is at $3.9 trillion at the time of writing, an 11-day high.

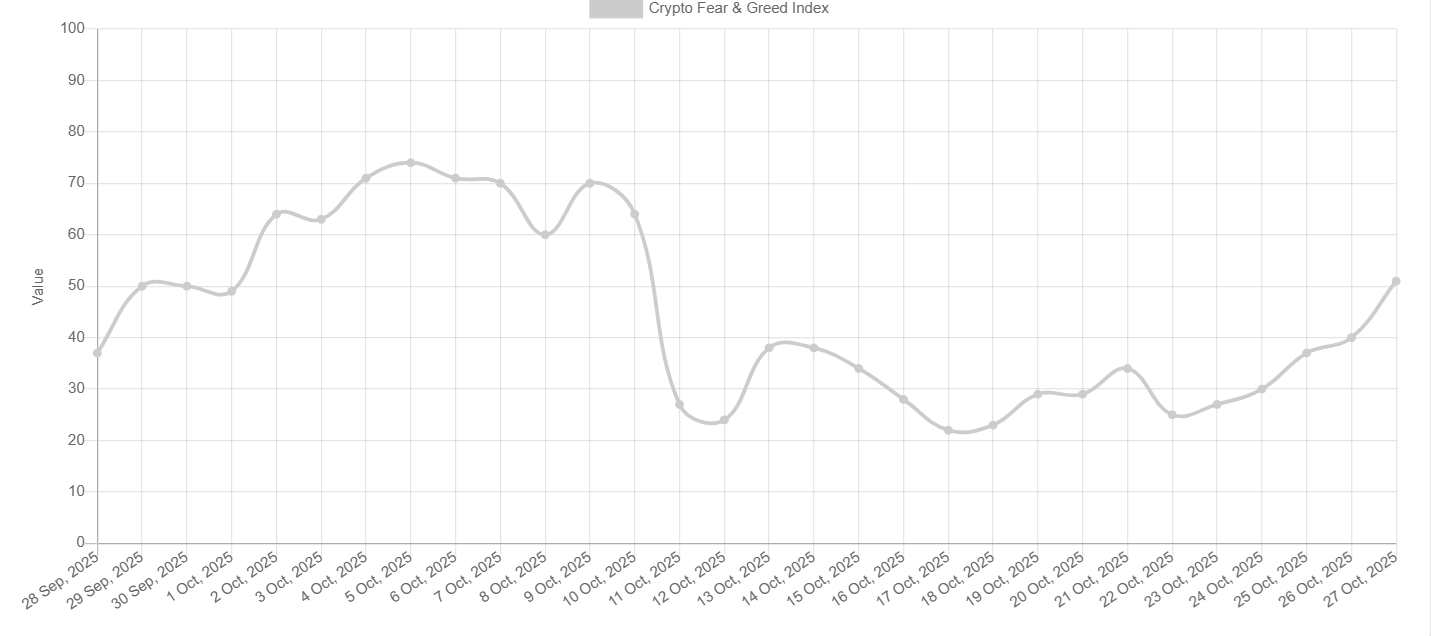

Sentiment returns to Neutral

Sentiment analysis shows an improvement in the market mood as the Fear and Greed Index finally clawed its way out of the Fear zone, moving to Neutral. The Bitcoin Fear and Greed index has risen to 51, up from 29 last week and up from 40 on Sunday. Sentiment has moved to Neutral for the first time in two weeks, marking the highest level since October 10. Market sentiment needs to continue improving for Bitcoin to extend gains further.

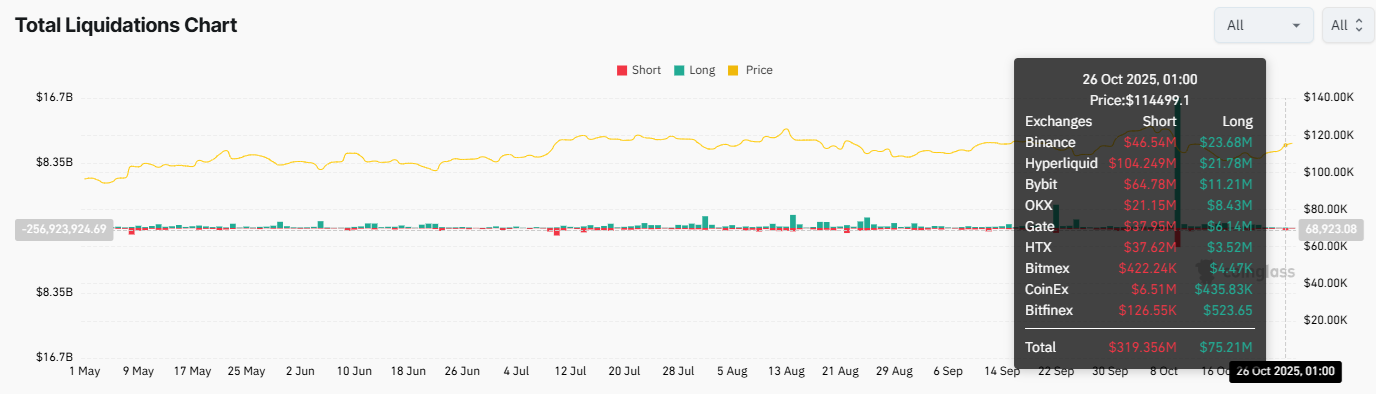

Bitcoin liquidations

As prices have recovered in recent days, the market has seen a significant amount of short positions liquidated. According to Coinglass data, $347.5 million in short positions were liquidated yesterday, with $195 million liquidated in the past 24 hours. Most liquidations occurred within the BTC and ETH perpetual contracts, triggered by the price increase. This reflects a classic short squeeze dynamic that could signal the start of a more sustained bullish phase.

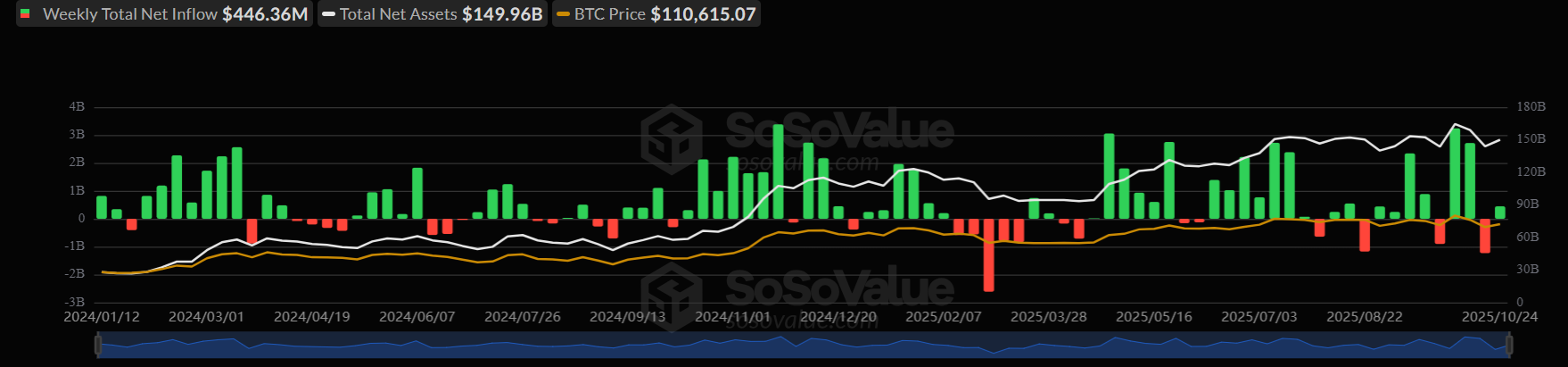

BTC institutional demand returns

US spot Bitcoin ETF demand recovered last week. Spot BTC ETFs recorded net inflows of $446.36 million last week, marking a recovery after $1.2 billion in outflows the previous week. The data suggests that institutional demand returned after a wobble in mid-October. Across the month of October, BTC net inflows are currently at $4.22 billion, up from $3.55 billion in September, highlighting ongoing demand. Persistent institutional demand supports the BTC price.

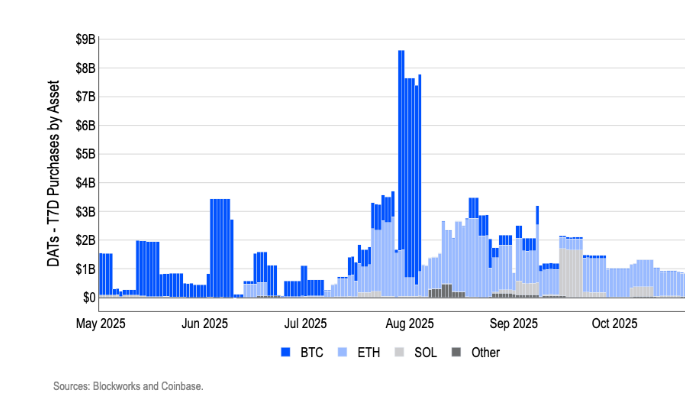

Where are the DATs?

Bitcoin Digital asset treasury companies have largely shrugged off the post-October 10 drawdown and have yet to re-engage. Over the last two weeks, BTC buying by DATs fell to near-year-to-date lows and has not meaningfully recovered, even on days when prices have rebounded. This matters because BTC DATs are usually the largest and most flexible entities, with the capacity to scale when conviction is high—the absence of this cohort for nearly two weeks points to fragile confidence at current levels.

However, the chart shows that the only consistent buyers since the record drawdown have been on the ETH side, though a single entity appears to be driving most of the net buying.

Macro backdrop

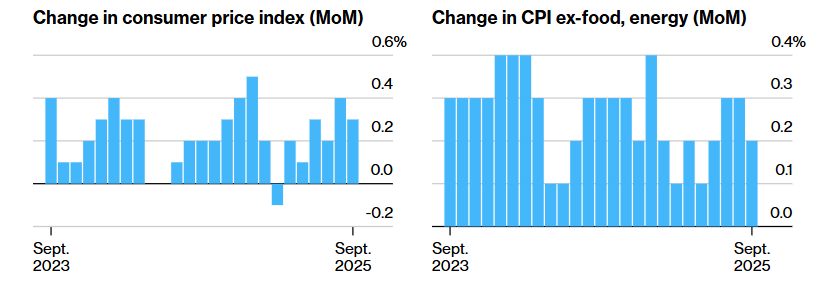

The ongoing US government shutdown has led to a shortage of US data. The shutdown is on its 25th day and is the second-longest federal funding lapse in history, leaving markets and the Fed flying almost blind on policy decisions.

However, on Friday, US CPI inflation data was released as an exception. The data showed that September CPI was cooler than expected at 3% YoY, up from 2.9% in August, but below the 3.1% forecast by economists. Meanwhile, core CPI unexpectedly fell to 3% YoY from 2.9%. On a monthly basis both CPI and core CPI cooled.

The data supported the view that the Federal Reserve will cut rates by 25 basis points in October and again in the December meeting. The prospect of a lower interest rate environment boosted Bitcoin and other risk assets, as US stocks rose to fresh record highs. The FOMC rate decision is on Wednesday.

In addition to Federal Reserve rate cut optimism, easing trade tensions between the US and China are helping support risk assets. The mood music between the US and China was already improving towards the end of last week. And news after the weekend that top trade negotiators for the US and China have agreed to terms on a range of contentious issues, paving the way for Donald Trump and Xi Jinping to finalise a deal when they meet this week. U.S. Treasury Secretary said the trump threat of 100% tariffs on Chinese goods is effectively off the table, thanks to progress that has been made.

The prospect of improved trade relations between the world’s two largest economies is boosting Bitcoin’s support. The market will wait for confirmation of a wide-ranging trade deal on October 30 when the two leaders meet.

Whales pull back

Whale behaviour is always worth watching. Whale activity often signals market direction. Data on Glassnode shows the number of whales holding 1000 BTC or more has dropped to a three-month low of 1350 since October 14.

The first dip from the October 14 local high was when Bitcoin’s price corrected from 115k to 106.4k, a 7.4% decline. This suggests that large holders have been taking profits, leaving much of the current buying to be done by smaller participants.

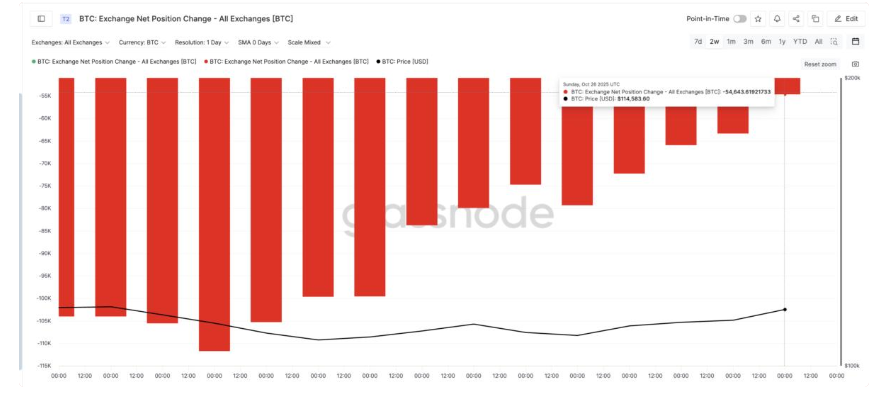

A related metric, exchange net position change, supports this view. This measures how much Bitcoin moves in or out of exchanges each day. While negative values mean outflows (buying), positive values mean inflows (selling).

On October 15, outflows reached 111,720 BTC, signaling strong buying pressure; however, by October 26, they had dropped to 54,643 BTC, a 51% decline. Here, the outflow still suggests accumulation, but the slowdown indicates that buying intensity faded.

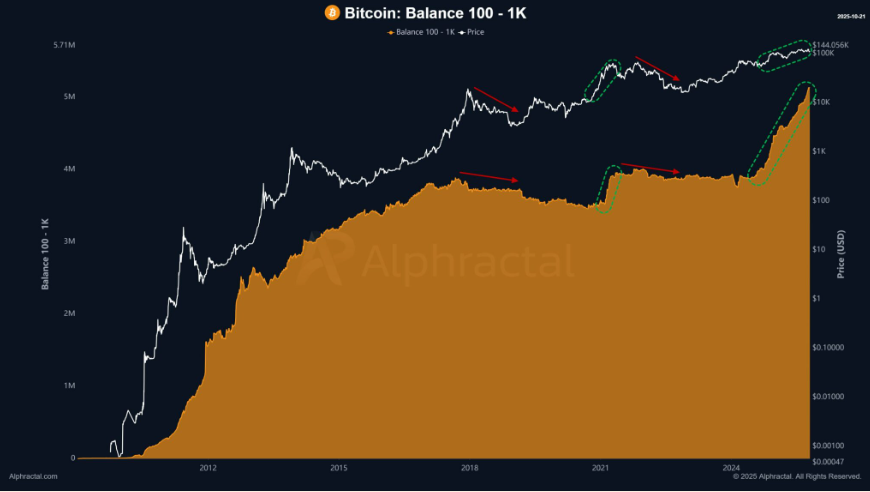

100-1K BTC holders accumulate

However, in a more encouraging development, addresses holding between 100 and 1000 BTC are accumulating again, similar to the major rallies of 2017 and 2021.

Accumulation by this cohort has so far been a key signal before major bull runs. In both 2017 and 2021, heavy buying by these holders was followed by strong price rallies; however, when they slowed or halted purchases, major corrections soon followed.

The sustained increase in holdings from this group points to longer-term conviction and is often one of bitcoin’s strongest long-term bullish indicators.

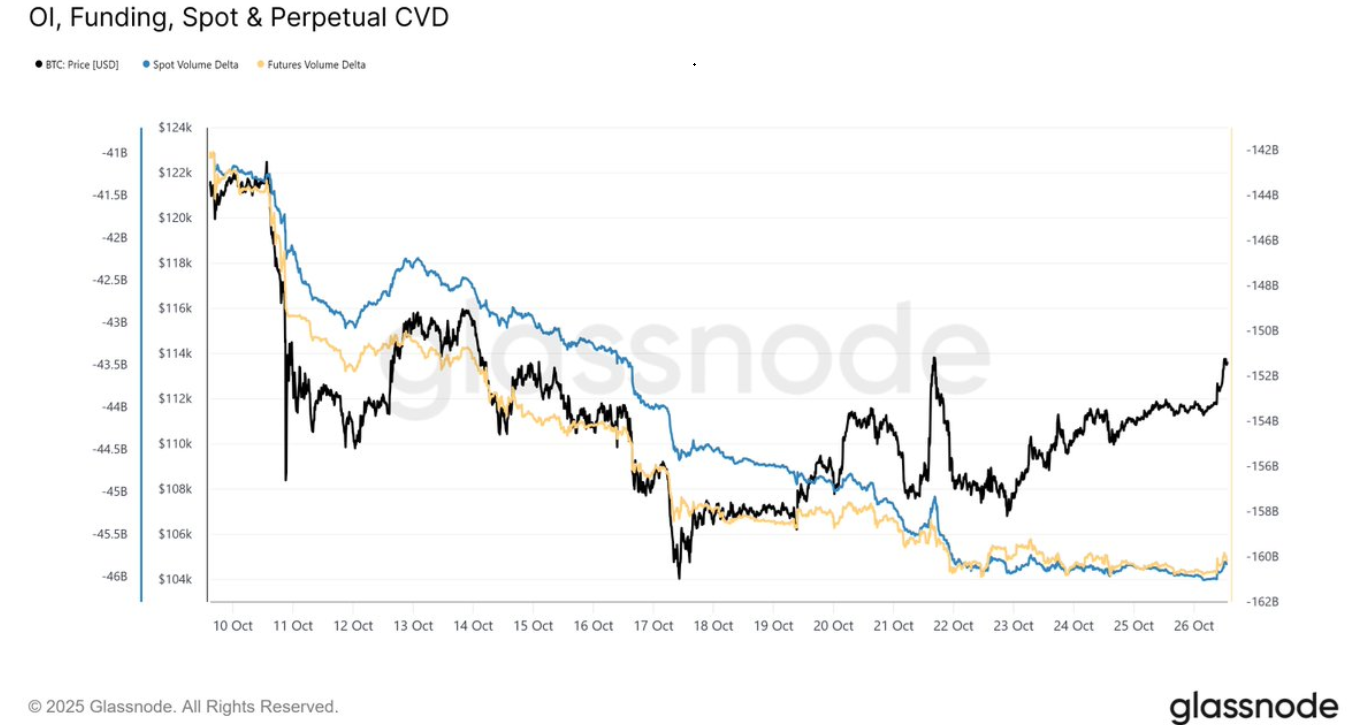

Adding to bullish signals, Glassnode noted that, for the first time since October 10th, the flush spot and futures Cumulative Volume Delta have flattened, suggesting that aggressive selling pressure has subsided over the last several days.

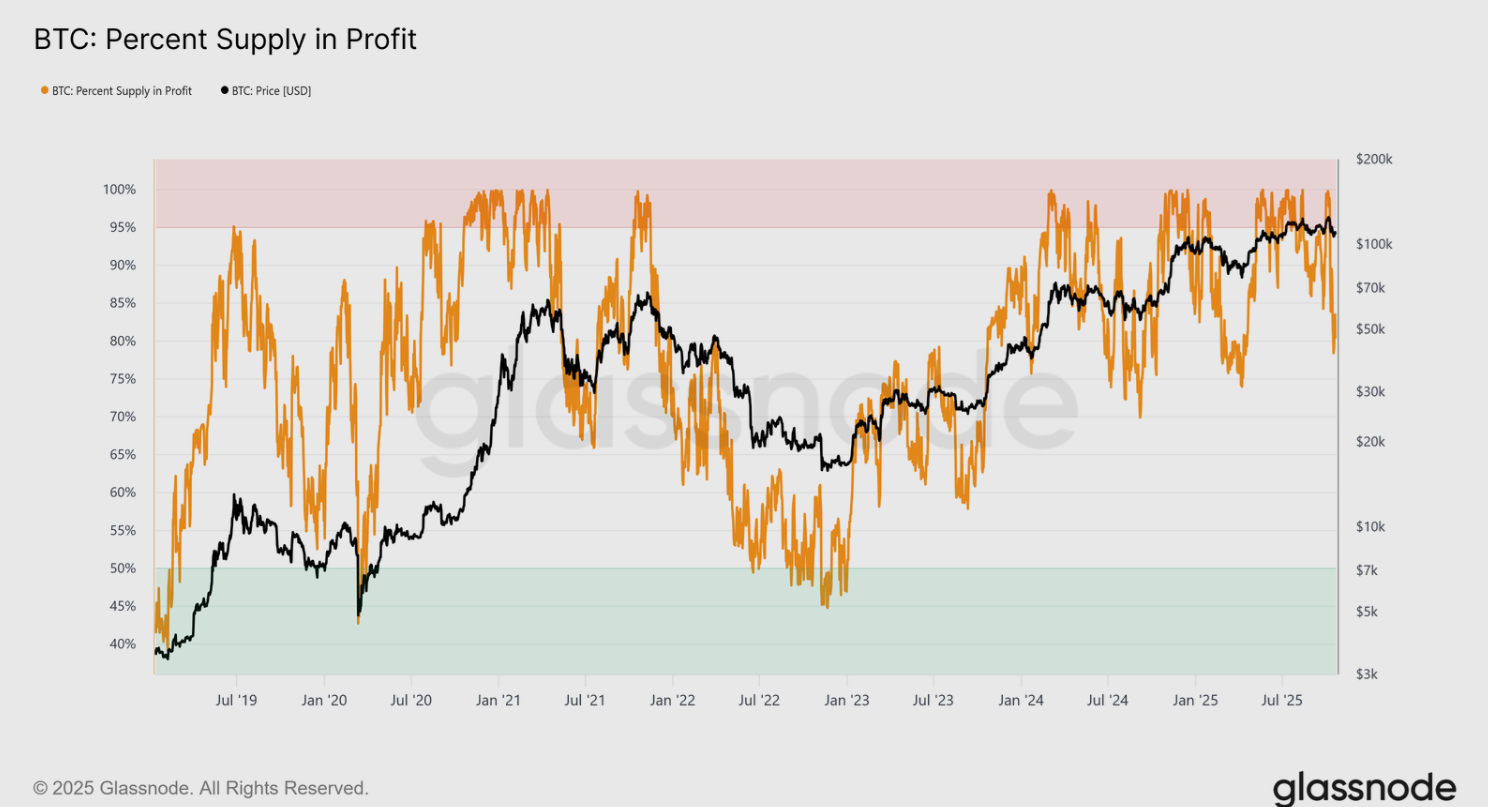

BTC price rises above the STH cost basis

Finally, the price has also moved above the short-term holders’ cost bases of around 113.1 K. This is a pivotal level that has tested investor conviction among those who bought near recent highs. While failure to recover above 113.1K could have sparked a deeper contraction, Bitcoin’s recovery to 115.5K is a bullish signal.

BTC/USDT technical picture

The technical picture is also bullish, as BTC rises above the 50 SMA and the 23.6% Fib retracement of the 74.4k low to 126.4k high. Buyers will now look towards 120k —the round number —and on to 126.4k —the record high.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.