Bitcoin edged 1% higher last week, snapping a two-week losing run. However, the price has remained within a tight range over the past 10 days, capped on the upside by 100k and 94k on the downside. The pair trades at 96k at the start of the new week, approximately where it ended last week.

While Bitcoin booked modest gains, other altcoins performed better. Ethereum rose just shy of 1% as it steadied following a 20% selloff in the previous two weeks. Meanwhile, BNB rose 7.5%, and XRP jumped 13% on optimism surrounding the Securities and Exchange Commission’s formal acknowledgment of Grayscale’s and 21Shares XRP ETF filing.

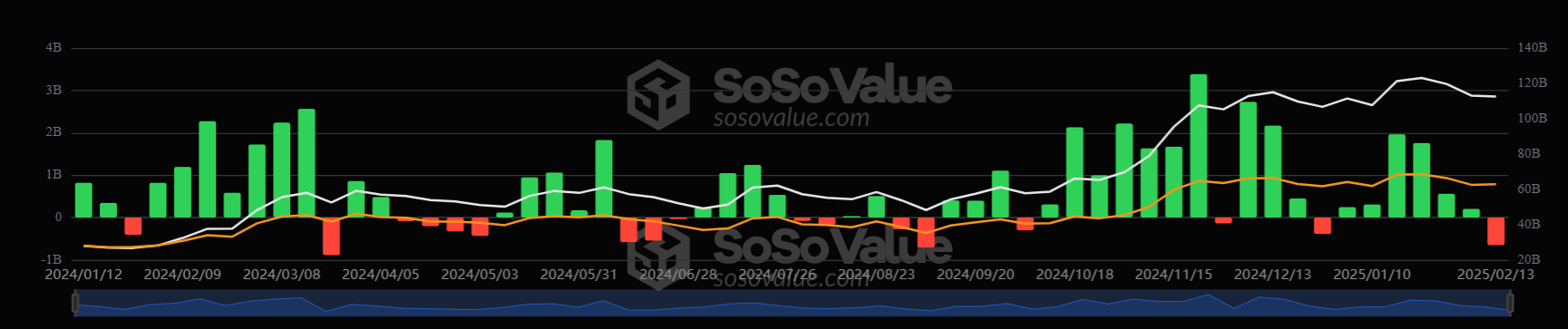

BTC ETFs saw outflows across the week after five weeks of inflows. According to FairSide data, spot BTC outflows totaled $580.2 million last week. Breaking this down to a daily basis, spot BTC ETFs posted outflows every day last week except Friday, which saw inflows of $70.6 million. BTC ETFs would need sustained inflows for the price to push out of range.

Macro View – trade tariffs & hotter inflation

Bitcoin traded in a sideways pattern across the week, continuing a trend from the previous week. The largest cryptocurrency has moved in a reasonably orderly manner despite more trade tariff developments from Trump and hotter-than-expected US inflation data.

Last week, US President Trump announced 25% tariffs on all steel and aluminium imports into the US, which will begin in early March. Trump also announced widespread reciprocal trade tariffs, although these will be delayed, giving time for negotiation. The reciprocal tariffs are set to take effect in Q2.

Despite the trade tariff uncertainty, risk assets, such as US stock indices, performed well, with the S&P 500 and Nasdaq 100 rising toward their record highs. The S&P 500 ended the week at 6114, which was just shy of its 6130 record high. The Nasdaq ended the week at 22,116, points away from its 22130 record high. Interestingly, despite Bitcoin trading more like a rare asset, as it remains closely correlated to US stocks, the crypto currency still trades some 10% from its record high.

However, the markets were briefly impacted by the hotter-than-expected CPI data, which showed CPI ticked higher to 3% YoY while underlying inflation also rose to 3.3%. Meanwhile, wholesale inflation, as measured by PPI, was hotter than expected. However, the transportation and healthcare services subcomponents saw prices decline, which could significantly impact the core PCE measure, the Fed’s preferred measure for inflation.

The market still sees a Fed rate cut this year, although it is not fully priced in and is not expected until the end of the year. The prospect of higher rates for longer could limit Bitcoin’s upside.

Could Bitcoin bears take control?

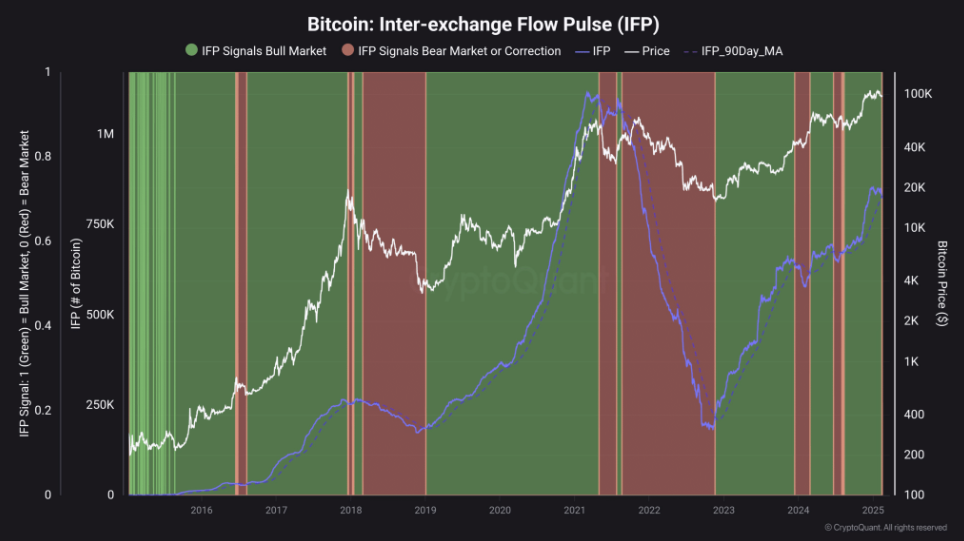

Bitcoin struggled to gain momentum last week, and market dynamics may be turning bearish, particularly when looking at the inter-exchange flow pulse (IFP). This key metric tracks Bitcoin movements between spot and derivative exchanges. The IFP flipped negative has historically signaled weakening risk appetite among traders and can often proceed with downward price action.

A negative shift in the IFP suggests that traders are closing positions, deleveraging, or preparing to sell, which has historically aligned with periods of increased selling pressures and possible price declines. For example, the price metric flipped negative in early 2018, which coincided with Bitcoin’s descent from its cycle peak. Similarly, in mid-2021, the IFP turned negative ahead of a sharp decline.

The IFP turning negative has raised concerns over the potential repeat of previous bearish cycles. Although the severity varies, some negative IFP periods are short-term corrections rather than the start of something more sinister.

Momentum in Bitcoin also points to further downsides. The RSI is below 50, and the MACD remains in negative territory, reinforcing bearish Bitcoin sentiment.

Sentiment turns negative

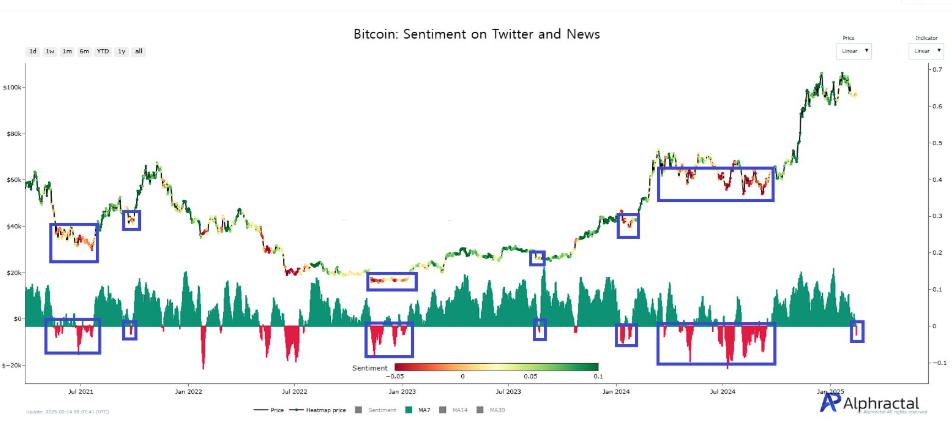

Market sentiment plays a key role in shaping Bitcoin’s price movements, and sentiment expressed on social media is a powerful forecasting tool. Analysis shows a shift in market sentiment, with Twitter and mainstream media turning negative for the first time since December 2024.

Historically, Bitcoin has seen significant price fluctuations following shifts in social media sentiment. When positive sentiment is high, it can drive buying activity; however, negative sentiment can trigger selling pressure.

Bitcoin sentiment has flipped negative for the first time, starkly contrasting the euphoria that fueled recent record highs. Historically, downtowns in sentiment have acted as Inflexion points.

The key takeaway here may not be that sentiment has turned negative but more that the market’s emotional cycle is entering a recent phase that sees weekends exiting and institutional and deep-pocketed investors quietly accumulating.

Active addresses and Bitcoin hash rate rise

However, it’s also worth noting that a surge in daily active addresses and transactions points to growing institutional participation. Such spikes often precede major price moves amid higher market interest.

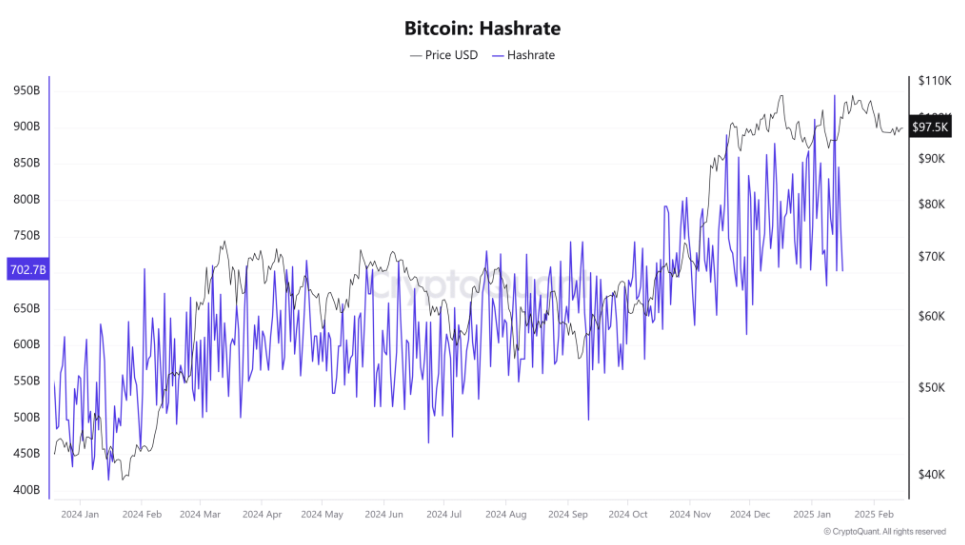

Furthermore, bitcoin’s hash rate has risen sharply, indicating minor confidence and long-term network security. There is evidence that these levels could mean reduced selling pressure.

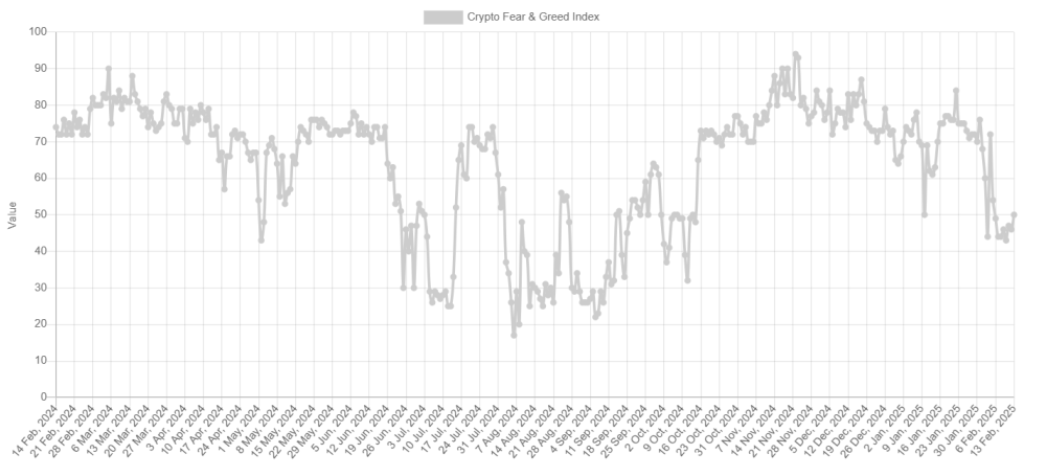

The fear & greed index turns neutral

The fair and greed index shows that Bitcoin trader sentiment has hit neutral as the price consolidation continues. The index, which keeps track of the average sentiment among Bitcoin traders and the wider cryptocurrency market, is at 54, showing that sentiment is neutral. This is down sharply from the end of January, when Bitcoin was in the extreme greed zone. February kicked off with a rapid deterioration in sentiment, and the index plunged into fear. However, now investors are neither bullish nor bearish as they wait for fresh catalysts.

The mixed pictures being offered and that -chain data says, as fundamentals, support the ongoing price consolidation.

Week Ahead

Trump’s announcements could continue to influence the markets. Investors appear to be increasingly numb to announcements with market volatility significantly lower than the first tariff announcement at the start of the month.

The January Federal Reserve interest rate meeting minutes could also provide further insight into the Fed’s reasoning for keeping interest rates on hold. How I fell after Federal Reserve chair Jerome Powell spoke last week and plenty of Fed officials are due to speak this week, the minutes may be considered out of date. Should Fed speakers sound more for cash owing to the stick inflation and still solid U.S. economic growth, Bitcoin and other risk assets could come under pressure.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.