Bitcoin remained unchanged across last week as the price consolidated in a tight range between $115,000 and $120,000, following its all-time high of $123,000 the week before. The price remains within this familiar range as the new week begins.

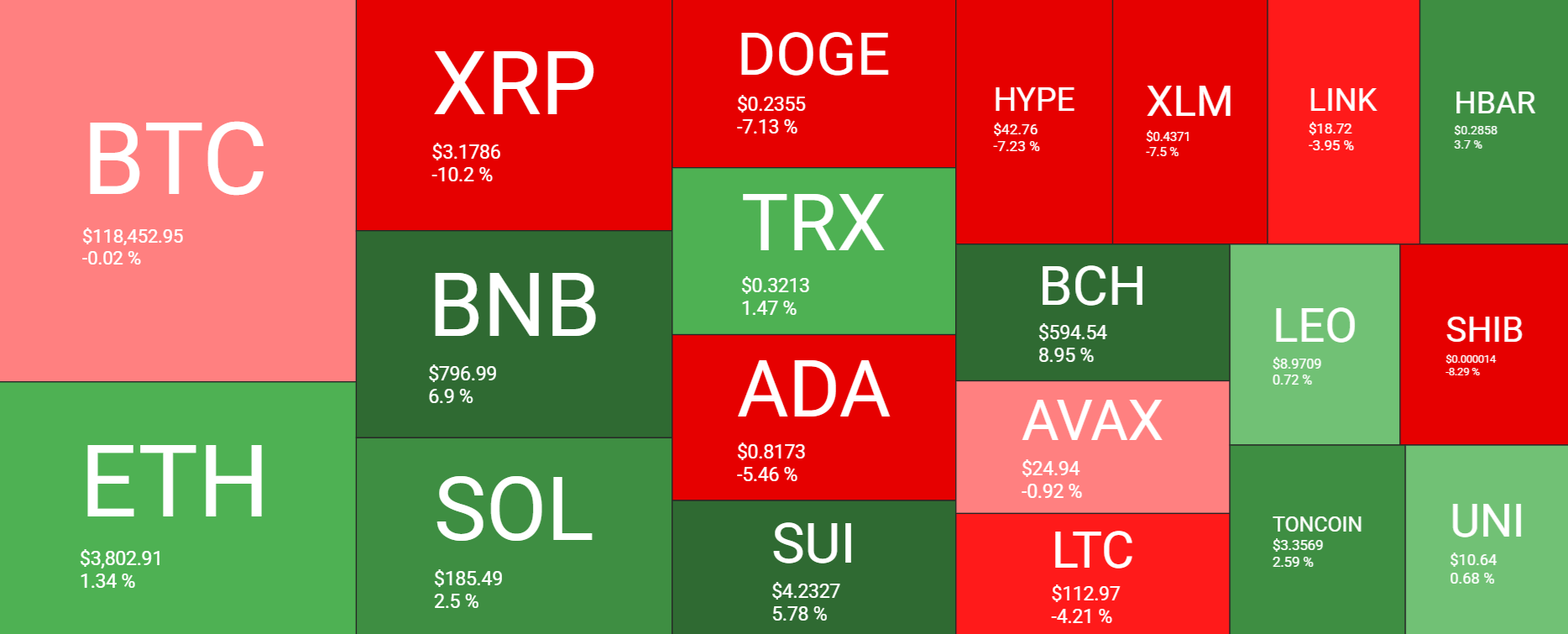

While Bitcoin remained broadly unchanged throughout the week, altcoins experienced heightened volatility, with strong gains at the start of the week followed by a steep selloff in the second half of the week. BNB has reached a record high of $855, while Ethereum and Solana maintained modest gains. However, Ripple fell sharply, dropping 10% after reaching a record high on July 11. Among smaller tokens, the picture was more mixed, with the likes of DOGE, ADA, and HYPE falling, while SUI, LEO, and TON posted gains.

The cryptocurrency market capitalisation is at $3.95 trillion as it looks towards $4 trillion and is up substantially from $3.09 trillion just a month ago. Meanwhile, the Fear and Greed Index is at 67, down modestly from 68, Greed, last week, but up from 49, Neutral a month ago. The current position of Greed indicates solid demand, which could support a higher price without the FOMO and froth typically associated with Extreme Greed.

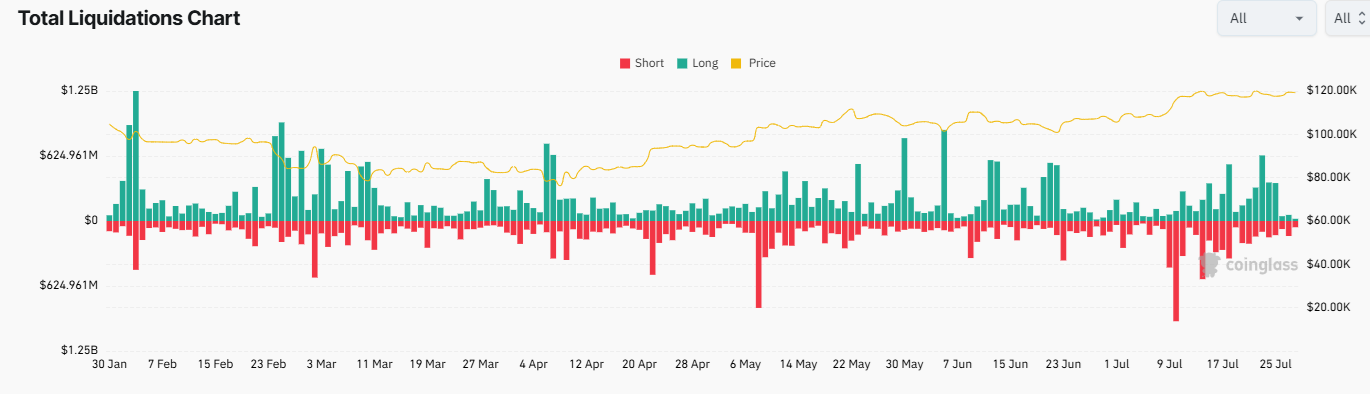

Liquidations calmed over the weekend. However, the sharp selloff in the second half of last week in the altcoin market resulted in high levels of liquidations flushing out overleveraged long positions. On Wednesday, Thursday, and Friday of last week, $1.75 billion in liquidations occurred, with the majority of these being long positions. On Wednesday alone, the drop in altcoin prices resulted in $630 million in liquidations of long positions.

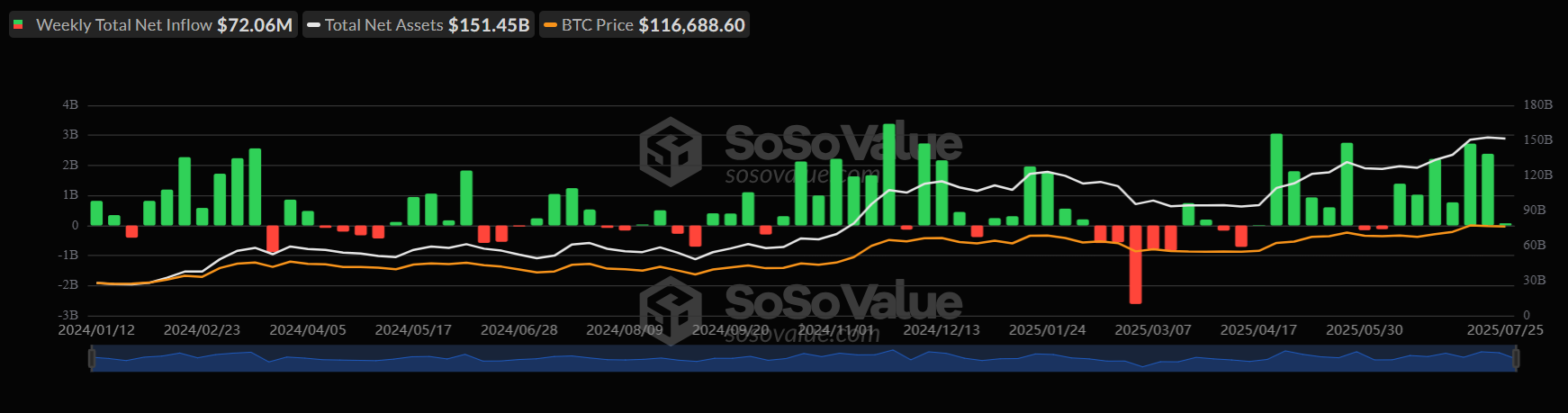

BTC ETF demand rises, but ETH ETFs outperform

Bitcoin recorded inflows of $72 million across last week, marking the seventh consecutive week of net inflows. However, these were significantly lower than the $2.39 billion and $2.72 billion seen in the prior two weeks. After twelve consecutive days of net inflows, the Bitcoin ETF experienced three days of net outflows during the first three days of last week, before reverting to net inflows. Institutional demand showed signs of wavering this week before recovering, as the Bitcoin price struggled to gain ground. Persistent institutional demand helps to support the BTC price.

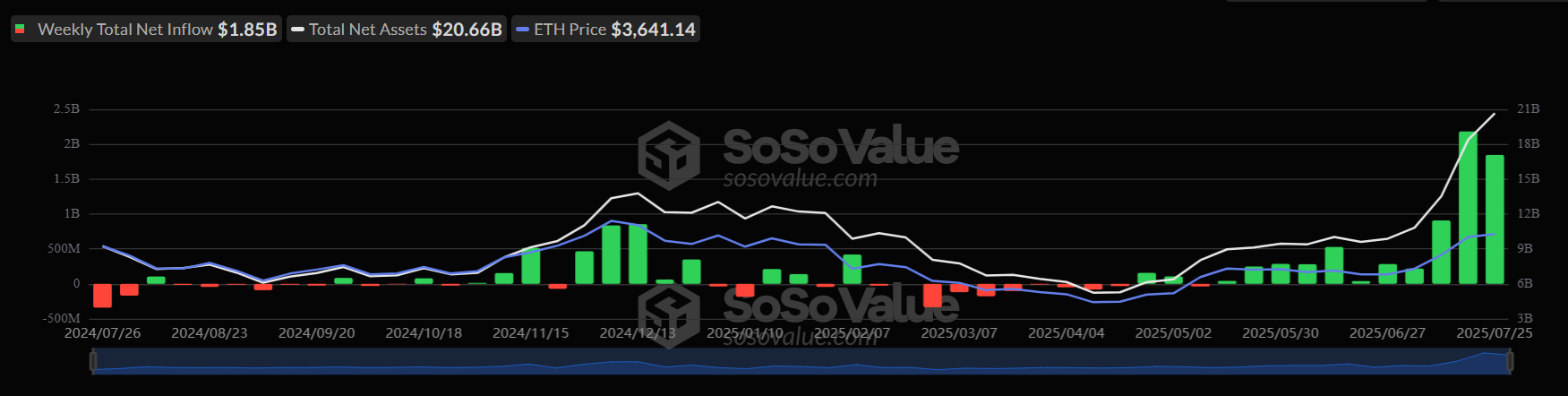

Meanwhile, ETH ETFs booked their 17th straight day of net inflows, with $452.72 million in net inflows on Friday alone. Across the week, the ETH ETF saw net inflows of $1.8 billion, the second-highest level on record after the previous week’s $2.18 billion, marking the 11th straight week of inflow, outpacing the BTC ETF.

This ETH ETF outperformance marks a significant shift and realignment in investor preferences, challenging Bitcoin’s long-held dominance as the institutional entry point in the cryptocurrency market. BlackRock’s ETHA fund reached $10 billion in assets under management in just 251 days, making it the third fastest-growing ETF in the industry’s 32-year history.

Bitcoin is likely to regain momentum in the second half of this year. However, recently, Ethereum has commanded the narrative and capital flows. This comes as the Ethereum price breaks out, after the Genius Act regulator clarity on stablecoins and rising demand for portfolio diversification.

Corporate demand broadens out

One of the strongest votes of confidence in Ethereum’s future has come from Joseph Chalom, the BlackRock executive who helped launch both Bitcoin and Ethereum ETFs. Joseph has left the asset manager to join SharpLink Gaming as CEO. SharpLink holds over 360k ETH ($1.3 billion) and plans to raise up to $6 billion to expand its ETH holdings. Chalom called Ethereum the “foundation of global finance”. The ETH price continues to break out.

Adding to the crypto Treasury trend, WindTree Therapeutics, a Nasdaq-listed biotech firm, announced a plan to purchase up to $700 million in BNB, Binance’s native token. This development came after BNB reached an all-time high, reinforcing the narrative that corporations increasingly consider crypto not just as a hedge but as a strategic reserve.

These latest developments also suggest that the crypto market is no longer just about Bitcoin and could be in the early stages of the altcoin phase.

Is Altcoin season coming?

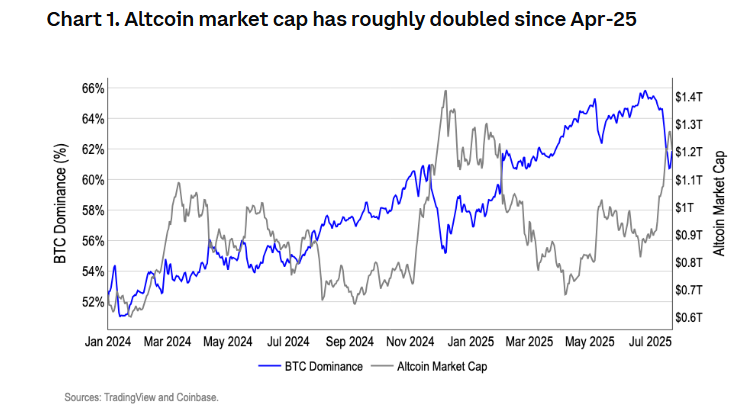

The total altcoin market cap, removing stablecoins, has almost doubled since April 2025. However, crypto markets experienced extreme volatility this week as the bull run in altcoins was suddenly challenged by sharp corrections, raising questions about whether the altcoin season has arrived.

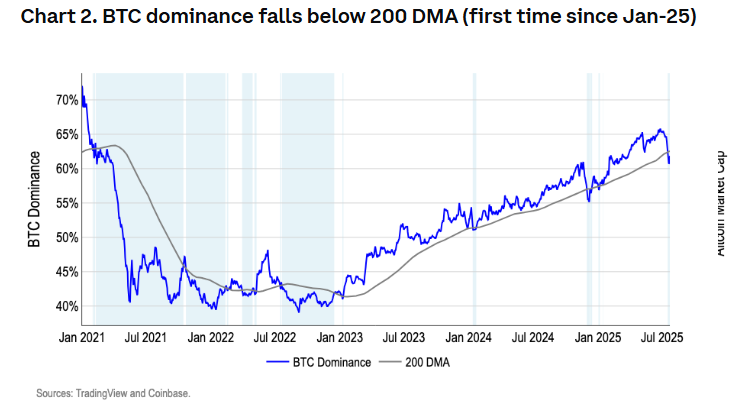

Bitcoin dominance has fallen below its 200-day moving average for the first time since January 2025, a significant technical break that could signal a shift towards altcoins. Whilst bitcoin dominance still hovered north of 60%, the move under the 200 DMA could validate the altcoin season narrative and has historically preceded multi-week stretches of altcoin outperformance.

This adds to evidence that we are moving towards altcoin season. The cycle often begins with Bitcoin Dominance, followed by an Ethereum Season when liquidity shifts into Ethereum. This is followed by large-cap altcoins, before the full risk-on Altcoin Season, when low-cap alts experience a wild phase. It’s also worth noting that Altcoin Season Index is still at 43, after briefly spiking to 54 this week, still some way from the 75, which signals full-on Altcoin season.

Bitcoin retail rises, whales remain steady

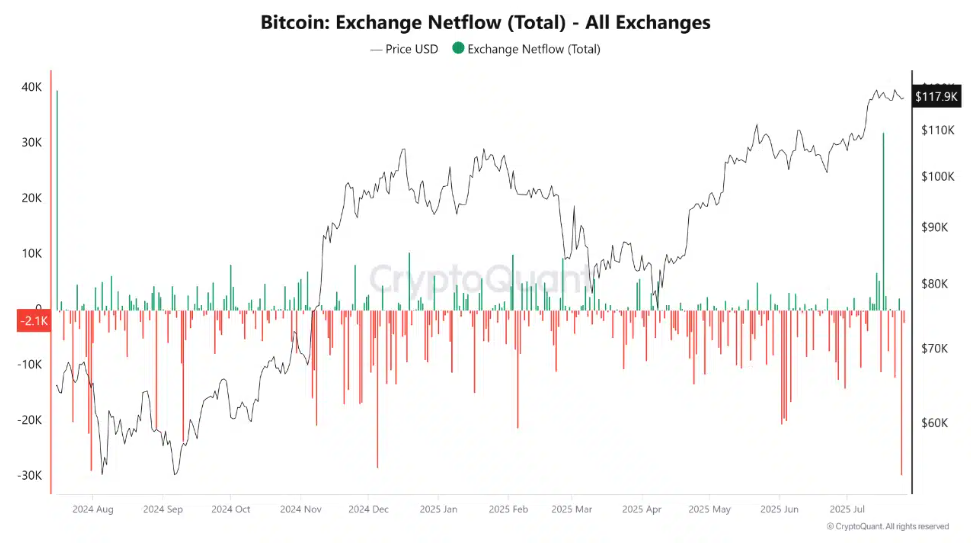

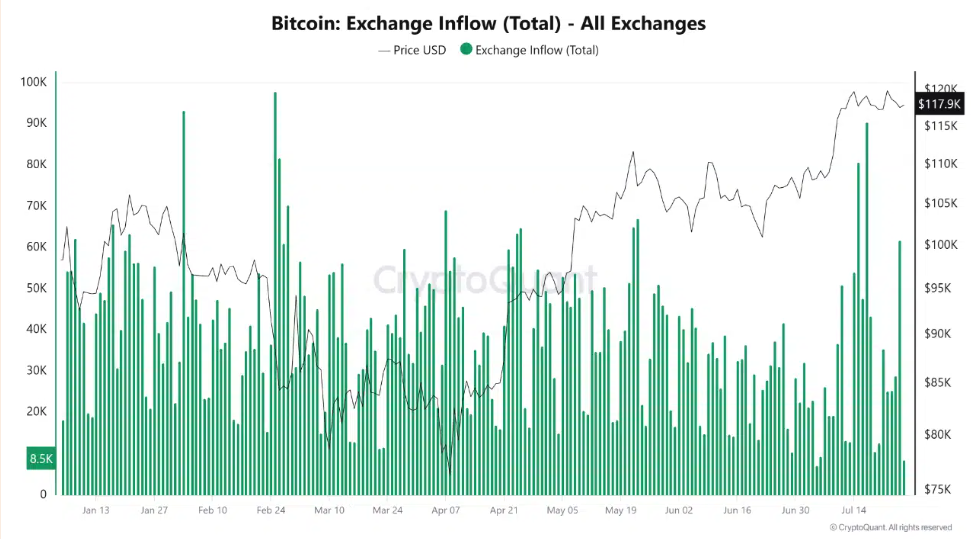

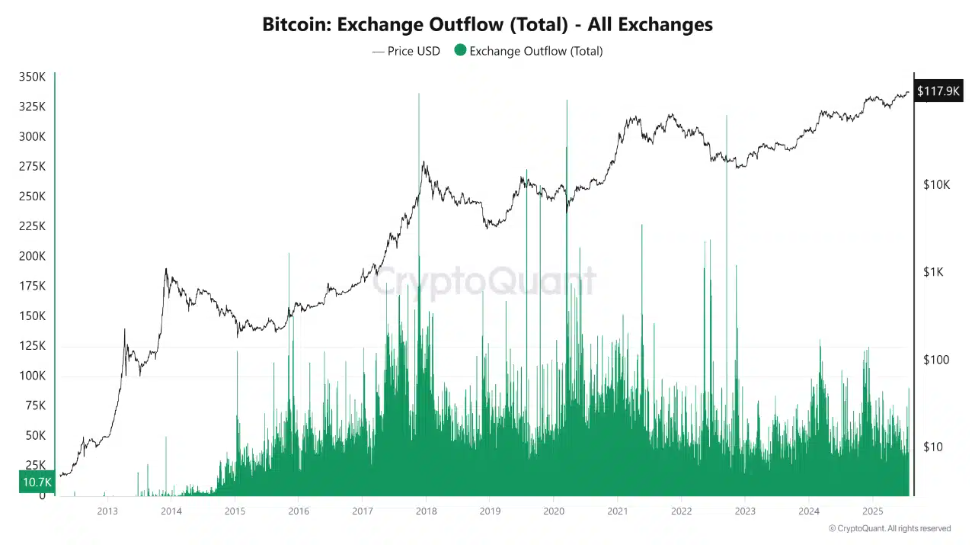

While Bitcoin remained range-bound, on-chain data still shows solid demand as outflows hit a yearly high, even as 60k BTC flowed onto exchanges.

The Bitcoin market is showing strong levels of absorption. While over 60k BTC were deposited into exchanges in a single day, which is typically a bearish signal, this was swiftly countered by over 90k BTC in outflows.

This resulted in a net outflow of 29k, the largest seen over the past 12 months.

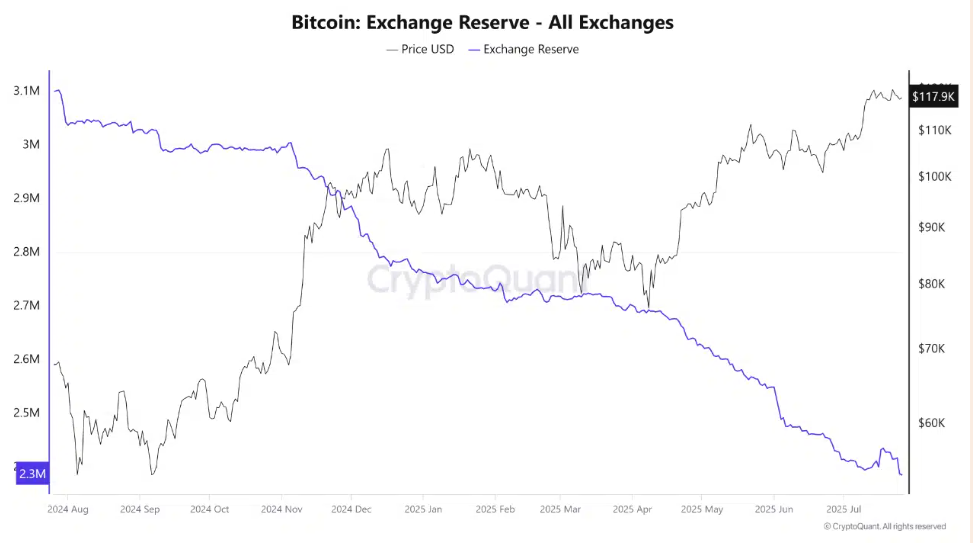

This suggests robust demand with buyers stepping in aggressively despite the price action. Exchange reserves fell to a fresh low, signaling that long-term holders are continuing to withdraw coins from trading venues, marking a bullish move.

Meanwhile, retail traders returning to Futures markets are seeing a sharp increase in smaller-sized orders, particularly within the 116 to 120k range. This activity suggests an increased risk appetite among less experienced traders.

At the same time, it’s important to note that big players remain in consolidation, a behavior that typically precedes major upside moves.

The market’s successful absorption of a large influx of supply without breaching key price levels is a sign of strength, as is the consolidation of larger players, which could indicate a potential continuation of new highs.

Looking ahead

This week is a significant week for macro, with the Federal Reserve’s interest rate decision scheduled for July 30th. Fed funds are currently pricing in a 0% chance of a rate cut this month and a 60% probability of a 25-basis-point rate cut in September. However, policymakers appear divided, with Fed Governor Christopher Waller leading the dissenters. A slightly more dovish stance from the Fed could help Bitcoin and the broader crypto market rise.

The pause on US reciprocal tariffs will also be lifted on August 1st (August 12th for China). However, with trade deals agreed for Japan and the European Union, the worst-case scenario has been avoided, and the market is cheering US trade deal optimism.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.