After falling 6% last week, Bitcoin extended that decline at the start of the new week, dropping a further 3.5% over the weekend before recovering slightly. BTC fell from 95k last weekend to a low of 87k on Wednesday, then recovered to 91k on Friday. However, the bulls were unable to maintain this level, and BTC fell to 86k on Sunday before recovering to 87.5k on Monday in choppy trade.

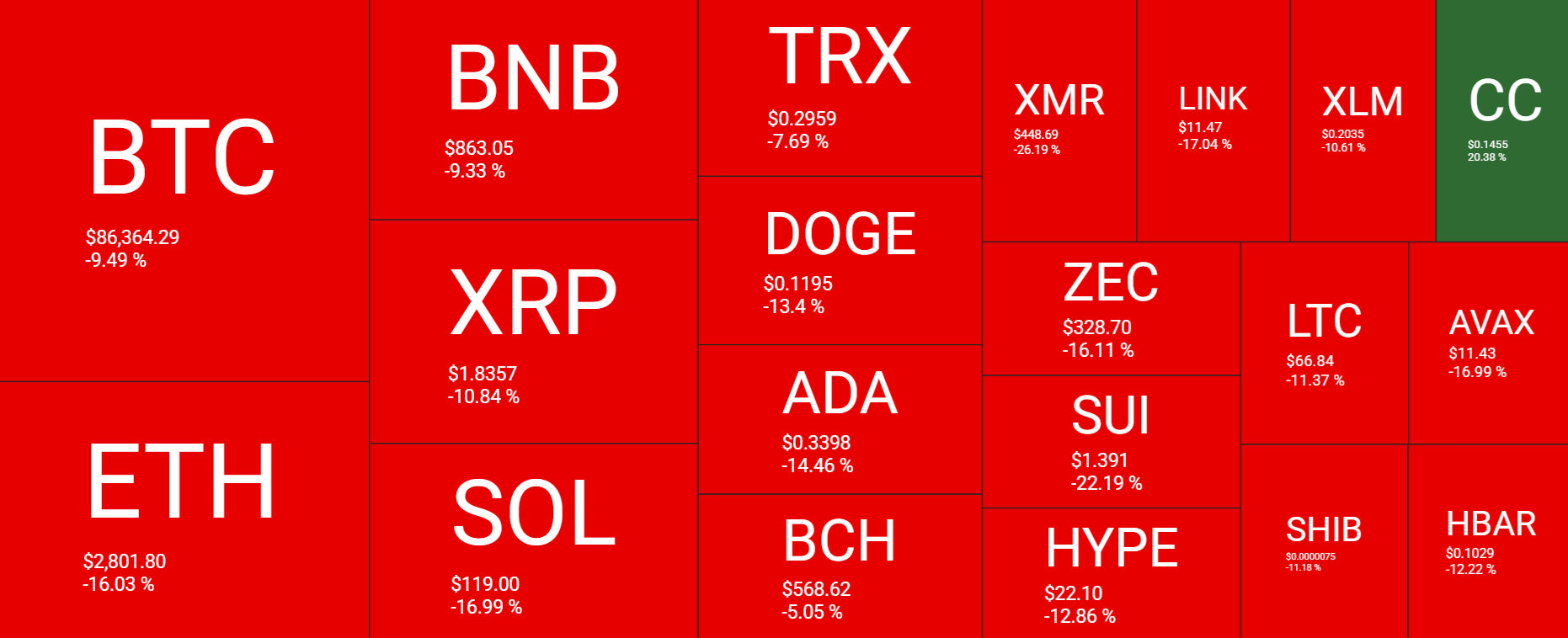

The selloff in crypto has been brutal, showing a sea of red. BTC trades over 9% lower across the past 7 days. BNB and XRP trade 9.3% and 10.8% lower, respectively. However, Ethereum and Solana have fallen 16% each.

The total crypto market capitalisation has fallen 3.5% to $2.91 trillion, the lowest level since 19 December. This is down from a peak of $3.28 trillion on 15 January.

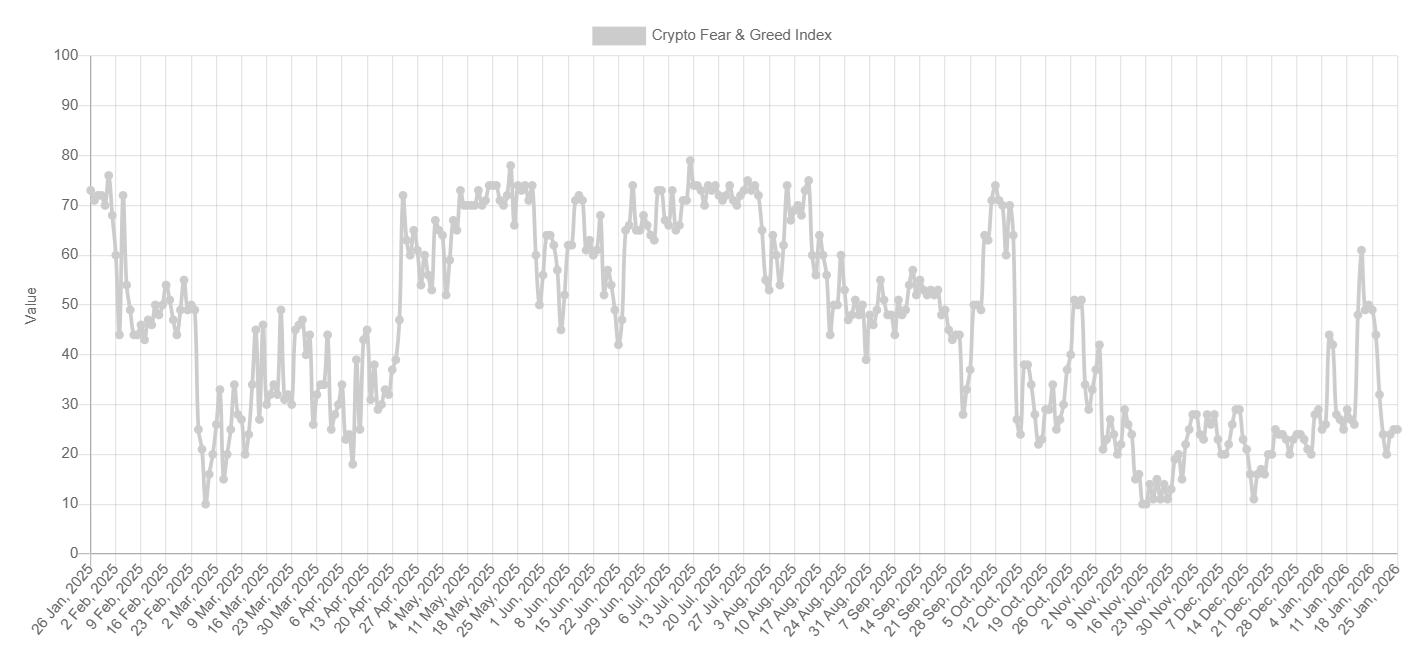

The Fear and Greed Index shows a deterioration in market sentiment. The index fell to 20, Extreme Fear, dropping from 49, Neutral, last week.

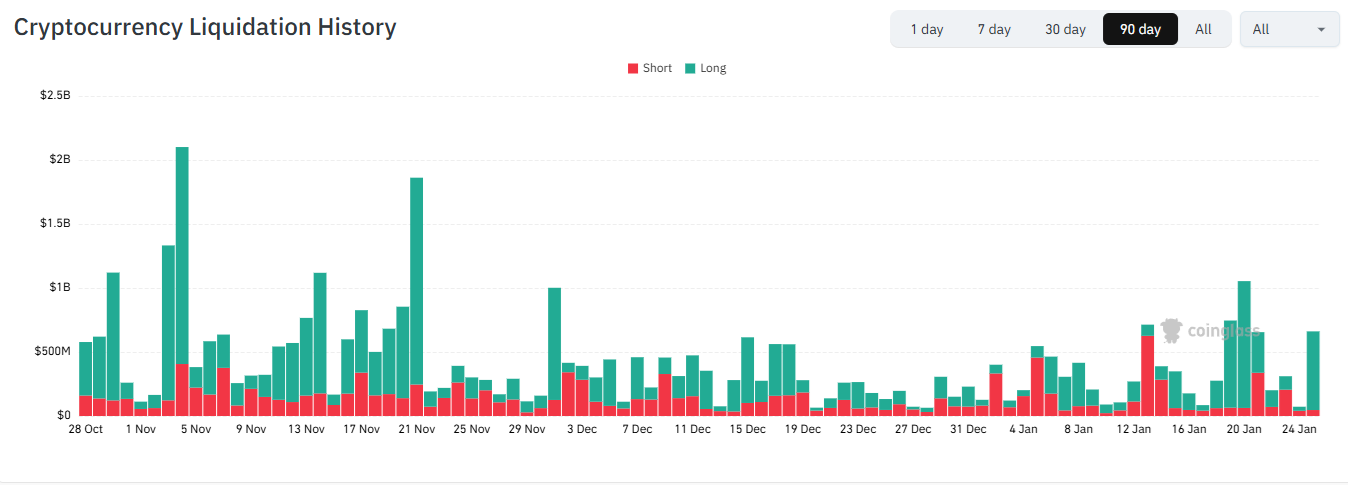

The sharp drop in the crypto market sparked a wave of liquidations. As BTC and ETH spiked below $87k and $2800, respectively, liquidations ramped up. Over the past 24 hours, total liquidations reached $664.4 million; of this, $615 million were long positions, compared to $448.75 million in short positions. Delving deeper into the figures, Ethereum recorded the highest level of long liquidations, with BTC in second place at 4188.25 million.

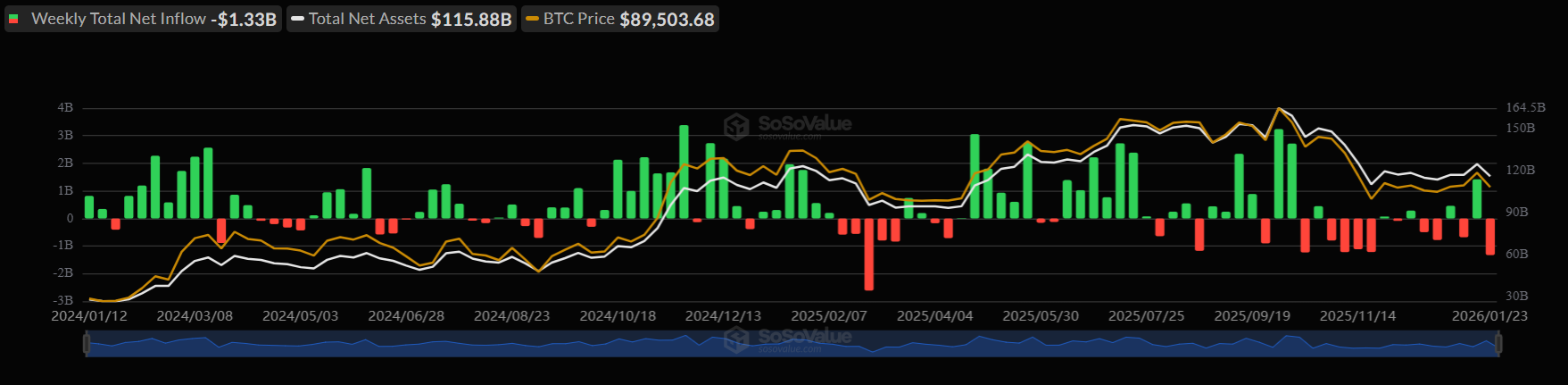

BTC institutional demand evaporates

US spot Bitcoin ETFs extended their outflow streak to five days as market sentiment continues to wane. According to SoSo Value data, BTC ETFs posted $103.5 million in net outflows on Friday, an outflow streak that began the previous Friday. Over the five days, including four trading days last week, owing to the short week and Martin Luther King Day on Monday, total outflows reached $1.72 billion. This was the largest weekly net outflow since August.

Macro backdrop

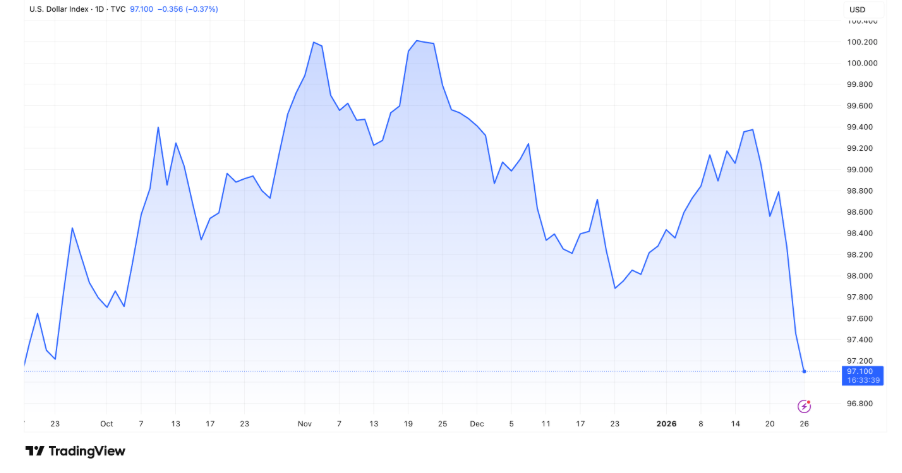

Bitcoin, along with broader risk assets, fell sharply at the start of last week after President Trump escalated trade war tensions between the European Union and the US in his bid to acquire Greenland. Despite an improvement in risk sentiment following Trump’s speech in Davos, Bitcoin struggled to push much beyond 90k. Trump withdrew his threat of tariffs and announced a framework for a future deal on Greenland. While this briefly revived risk sentiment, gains lost momentum by Friday. US equities ended the week 0.3% lower, and the USD tumbled 1.8% and is extending those losses at the start of the week.

The USD has fallen to a 4-month low amid increasing pressure in global markets. The US dollar index posted its worst annual performance since 2017 last year and has started this year on a weak footing too, down 1.3% year to date. At the same time, traditional safe havens such as gold and silver have rallied to fresh record highs.

High volatility is being seen in the FX market, with talk of possible intervention to support the yen after the New York Fed checked rates with other major banks. This is widely regarded as a warning sign. For the first time in decades, US policymakers appeared openly concerned about the yen.

Expectations of coordinated US-Japanese action boosted the yen to a two-month high whilst dragging the dollar down. Meanwhile, the markets are also positioning cautiously ahead of the Fed’s upcoming rate decision and a potential announcement by Trump regarding Jerome Powell’s successor. Market expectations for an imminent policy move remain low. According to CME FedWatch data, the probability of a 25-basis-point rate cut is less than 3%.

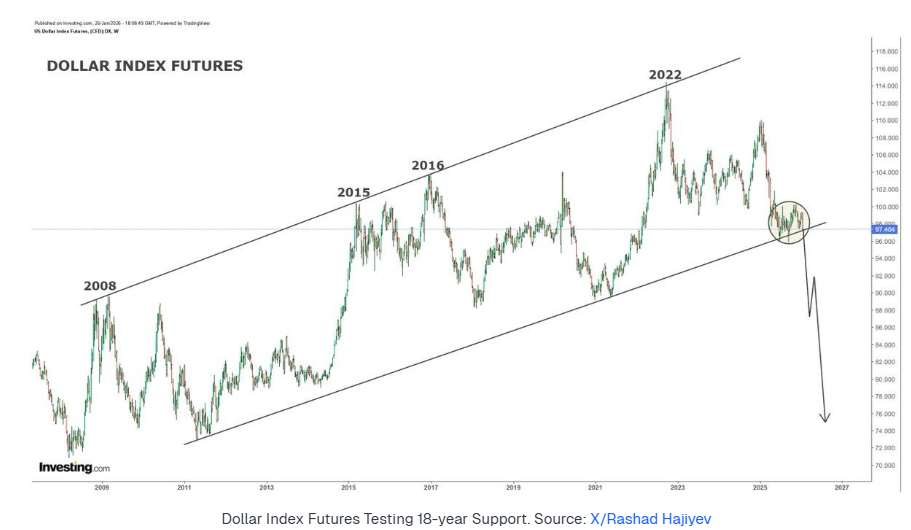

Attention is on the DXY’s 18-year support level, which, if it breaks, could see the DXY heading towards $85 and then $75. This could act as a catalyst for further upside in Gold and Silver.

Safe-haven Gold and Silver extended gains to fresh record highs and have risen further at the start of the week. Gold surged past $5000 to $5100 while Silver broke above $100 per ounce for the first time. Gold and Silver trade 18% and 53% higher so far this year, compared to a 1.5% gain in the S&P 500 and a 1.1% decline in BTC.

Bitcoin is trading like a high-beta risk asset rather than behaving as a hedge, and is highly sensitive to rates, geopolitical risk, and cross-market volatility.

Could USD weakness lift BTC?

Historically, Bitcoin, the largest cryptocurrency, has had an inverse correlation with the US dollar index. When the US dollar index falls, it often leads to upside momentum for BTC. Furthermore, a weaker dollar typically lowers borrowing costs, improves liquidity, and creates conditions that also favour risk-taking, which also favours cryptocurrencies.

What’s also interesting is Bitcoin’s correlation with the Japanese yen, which is currently near record highs. This could suggest that the yen intervention that is strengthening the yen is also supporting BTC. Looking at what happened during the last yen intervention, BTC saw a 29% weekly decline followed by 100% rally. This is not to say that we would necessarily see a repeat performance. However, the next few weeks may be crucial for defining the direction of the dollar, the yen, and the crypto markets.

However, it is worth noting that Gold and Silver are clearly the preferred havens at this time. As precious metals soar and Bitcoin struggles below a key resistance level. The Bitcoin Gold ratio continues to trade in a falling channel, last seen in 2023.

BTC market mood remains defensive

BTC’s bounce from 87.2K last week was not sustainable. There are questions over whether today’s bounce can be sustained as well amid an ongoing threat of a transition to bear market conditions.

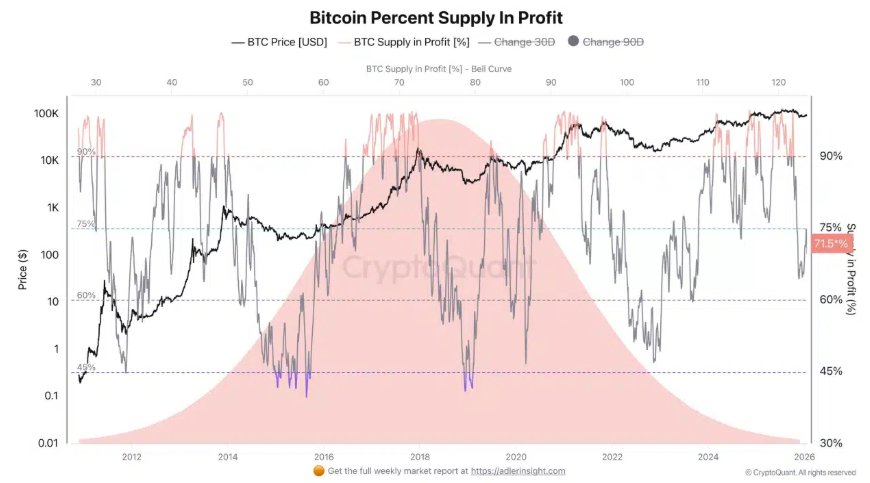

The number of holders in profit has been too small to sustain bullish demand at 71% this is typically a level seen in a bear market shift. The supply in profit needs to climb above 75% and stay above it to reflect growing market conviction. While supply in profit jumped to 75% in the early January BTC price bounce, holders chose to take profits and limit losses.

A deeper decline in supply and profit would point to intensifying bearish pressure.

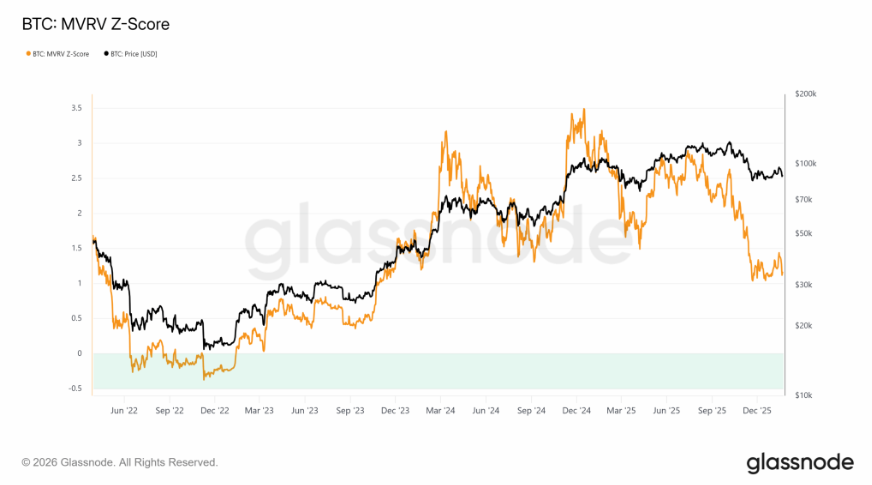

The MVRV evaluates Bitcoin’s fair value to see whether it is overvalued or undervalued. The MVRV-Z score is at 1.12, a sign that holders are witnessing unrealised profits, but not sufficient to trigger a mass selloff.

Values below 0 capture a bear market capitulation phase, while the previous market tops occurred when the score was between 3 and 5.

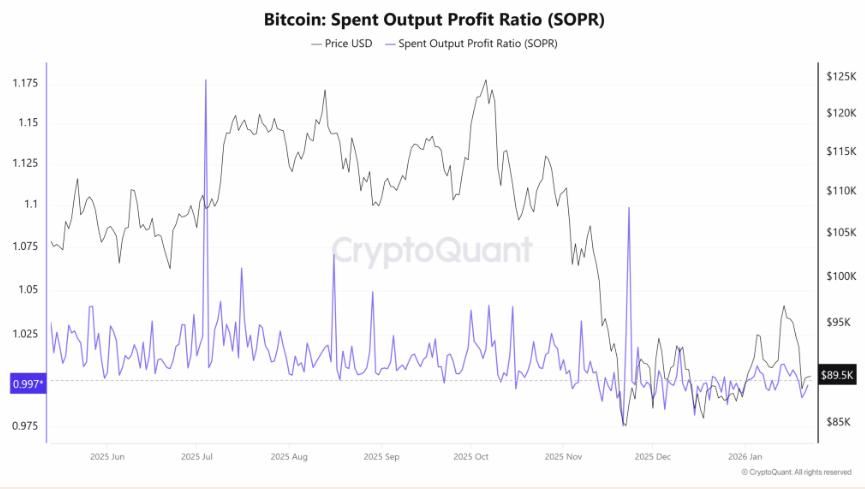

Finally, the Spent Output Profit Ratio measures whether coins are being sold at a profit or not. Since late November, the SOPR has remained below 1 for the most part, suggesting that holders have been selling at a loss. This investor fatigue is the soft capitulation, where weaker hands exit the market.

In conclusion, the MVRV Z-score of 1.12 is moderately bullish, and the SOPR, which has been below 1 in recent weeks, suggests a local price bottom could be forming. However, this could change depending on macroeconomic developments in the coming weeks and months.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.