Bitcoin rallied over 10% last week, marking its best weekly performance since mid-July. The cryptocurrency started the week at 54,300 before dipping to a low of 53,750. The price then rebounded higher to 60.5k, a two-week high. At the start of the week, a more cautious mood saw the world’s largest cryptocurrency head lower on Monday and trades at 58.5k.

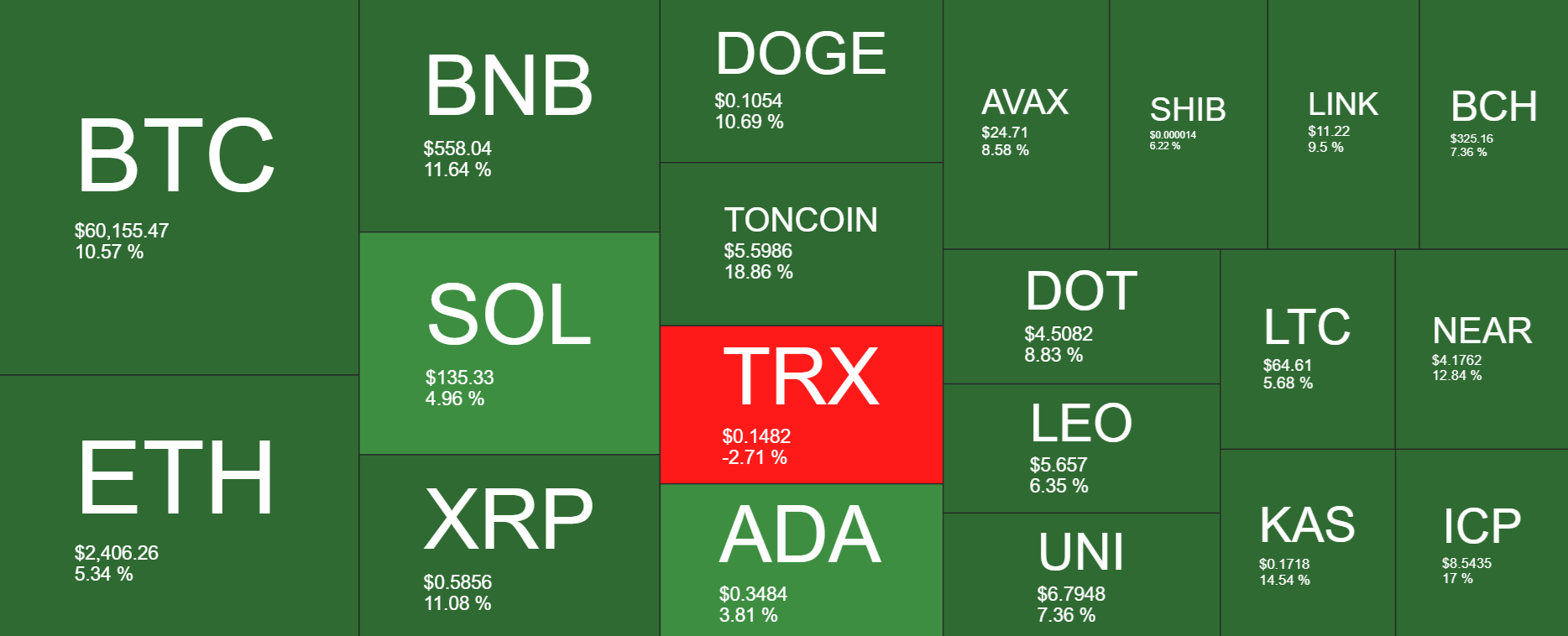

Last week’s upbeat mood was evident across the board, with Ether gaining 5%, BNB rallying 11%, and Solana gaining 5%. TON was another standout performer, gaining 18%, while XRP rallied 11%. There were few signs of weakness in the altcoin market, with TRX underperforming.

Bitcoin’s price action followed trends in the broader risk markets. Bitcoin’s correlation to the S&P 500 is at the highest level since June, which suggests that there are few crypto-specific catalysts for traders to focus on.

ETFs

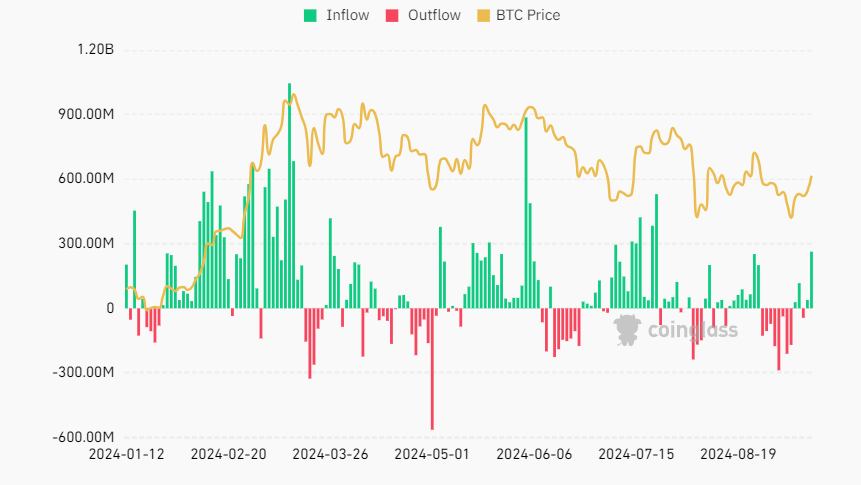

Bitcoin ETFs turned positive last week, with the Bitcoin ETF seeing over $400 million in inflows as bulls picked up the pace, pushing the Bitcoin price to end the previous streak of outflows. This took the total number of bitcoins bought to 6892 BTC while producing 2250 coins in the same period. This shows a sharp increase in demand from the crypto market as stakeholders focused on bullish macro events.

In a further breakdown of these figures on September 13th, Bitcoin ETF recorded $263.2 million inflows, marking the highest level since July 22.

The rebound in ETF inflows this week came after outflows in the previous week, which saw the price of the assets slump below 55,000. However, renewed institutional demand has seen the price regain 60,000.

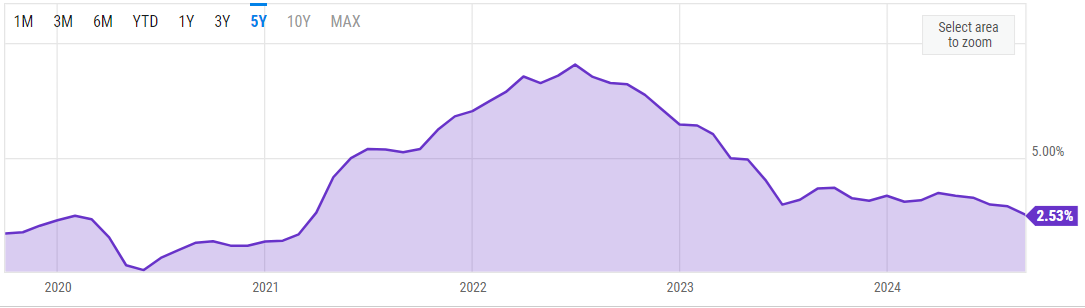

Macro backdrop – cooling inflation

Last week, the major factor boosting crypto markets and the broader risk environment was optimism surrounding cooling inflation in the US and projections of a cut in interest rates. Last week, US inflation cooled by more than expected to 2.5% year on year, down from 2.9% and a 3-year low. Meanwhile, core inflation, which discounts more volatile items such as food and fuel, was slightly hotter than expected on a monthly basis, at 0.3%, up from 0.2%.

The data comes after US non-farm payroll reports for August showed the jobs market cooled but didn’t collapse. While unemployment ticked lower, job creation was stronger than in July but slightly weaker than expected.

US Presidential election debate

The first debate between the Republican nominee, Donald Trump, and the Democratic candidate, Kamala Harris, was a fiery show. Neither candidate mentioned cryptocurrencies nor the crypto industry, which was disappointing given Trump’s pro-crypto stance throughout his election campaign. Meanwhile, Kamala Harris has given few clues regarding her stance towards cryptocurrency. While Harris made no mention of crypto in the debate, her camp has started to show a slight shift that will most likely be a continuation of the Biden administration.

The crypto market’s reaction to the US Presidential debate was short-lived. The weakness in the aftermath of the debate was quickly bought back when the price didn’t break lower. With just fifty days to go until the US election, the political and regulatory landscape will remain in focus for the crypto market.

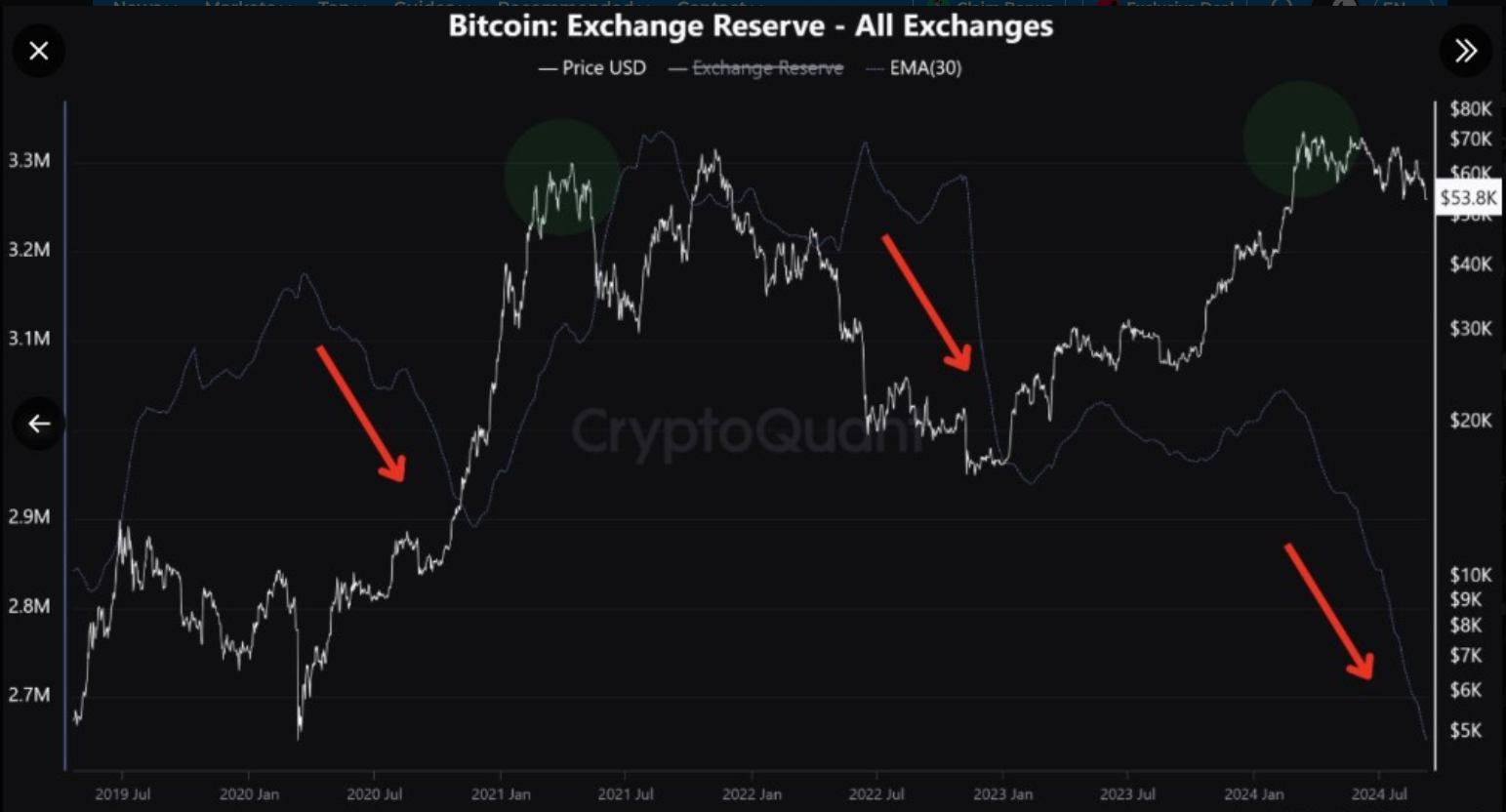

On-chain data

According to data from Quant Crypto, Bitcoin reserves on crypto exchanges have been steadily declining. As more investors move their Bitcoin holdings from exchanges to cold storage, the available supply on the open market decreases. Historically, this has been linked to subsequent price rallies, raising expectations of a move higher in Bitcoin in the near future as the reduction of Bitcoin reserves on exchange points to a decrease in selling pressures.

Meanwhile, Stablecoin coin reserves on exchange are rising. Stablecoin balances represent balances available for investors to make purchases at the right time. The rising amount of crypto-backed currency on exchange suggests investors are preparing to use this capital once the conditions are more favorable.

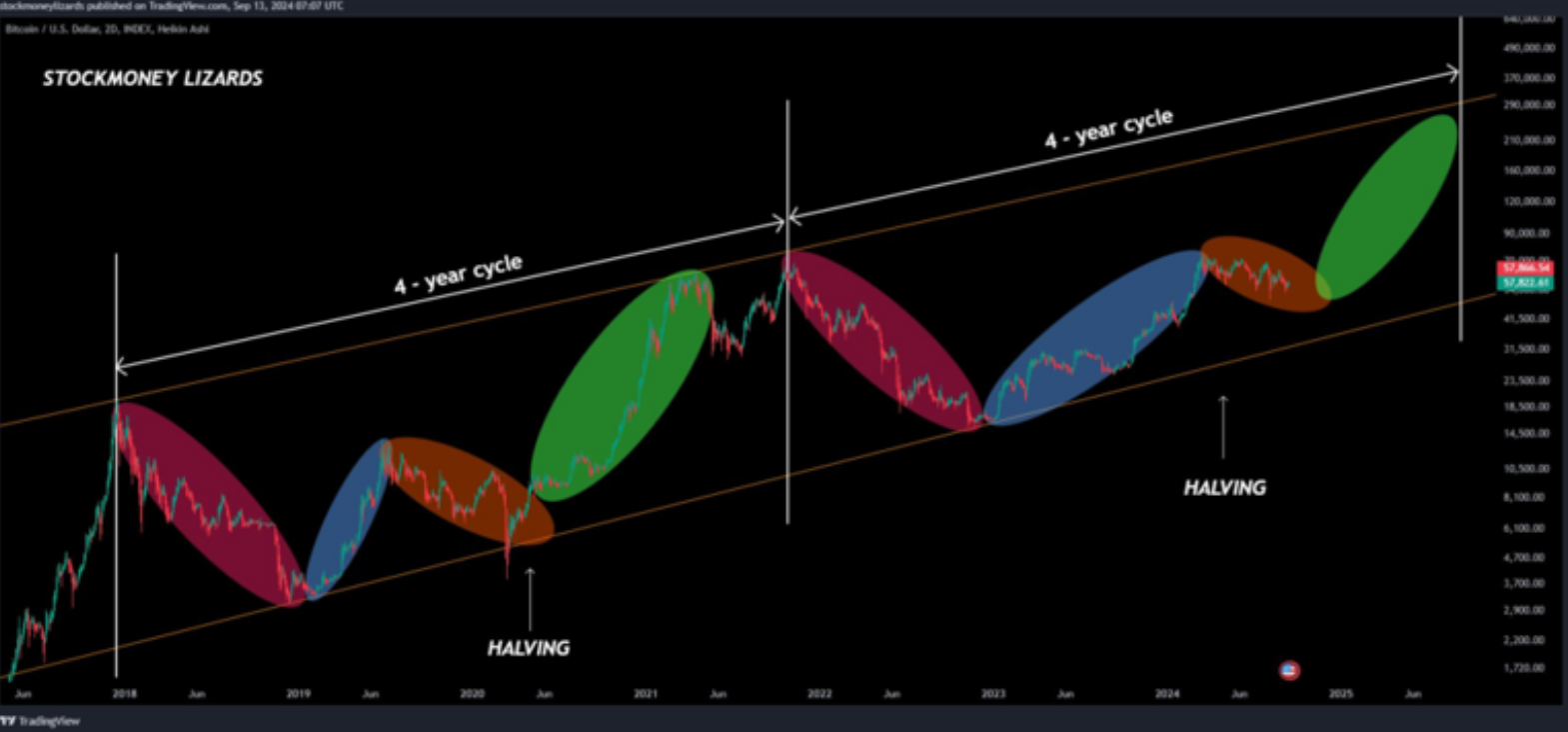

Where are we in the 4-year cycle?

After a frustrating six months of consolidation with a bearish bias, signs appear that Bitcoin could be nearing the end of its re-accumulation and consolidation phase (orange) of the Bitcoin 4-year cycle before the final leg higher, which is often the strongest move higher (green).

While September is traditionally a bearish month for Bitcoin, there are signs that the outlook is improving. Central banks across the globe are starting rate-cutting cycles. The US Federal Reserve is expected to begin cutting rates next week. A lower interest rate environment increases liquidity, which benefits riskier assets such as Bitcoin.

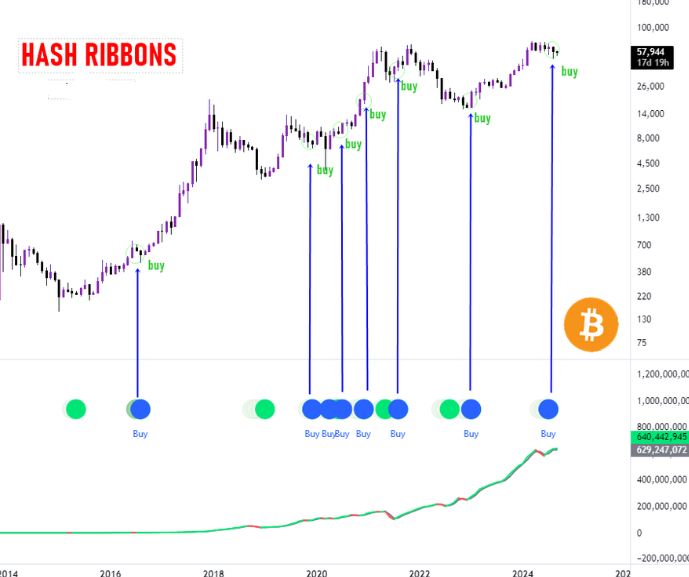

Meanwhile, technical indicators also flash encouraging signals. The Bitcoin hash ribbon has flashed a buy signal. This has been a reliable indicator for Bitcoin and often comes ahead of a pump in the token. The Hash Ribbon identifies periods when Bitcoin miners are distressed and may capitulate. The creator of this indicator, Charles Edwards, believed that “when miners give up, it is possibly the most powerful Bitcoin buy signal ever.”

Looking ahead

Federal Reserve interest rate decision

The Federal Reserve will announce its interest rate decision at the end of a two-day meeting on September 17th and 19th.

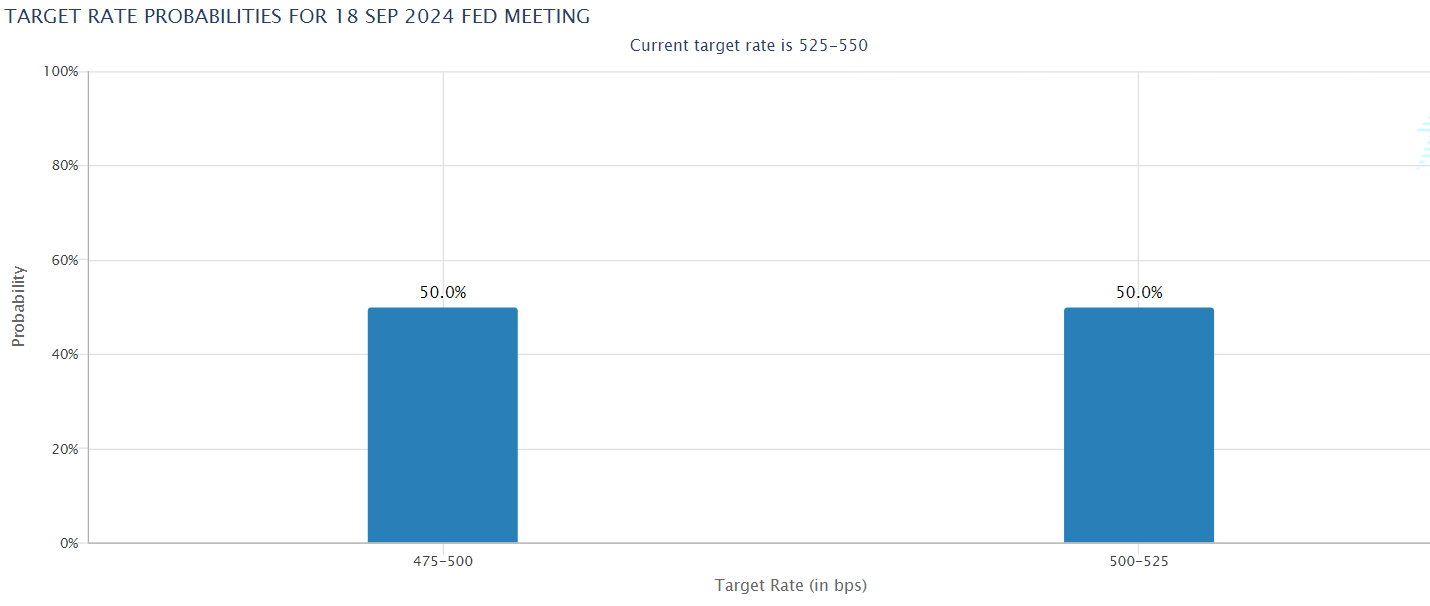

There is almost no doubt that the Fed will start a rate-cutting cycle; however, there are still doubts over the size of that first rate cut. While the market had reined in 50 basis point rate cut expectations following the hotter-than-expected core inflation data, expectations for an outsized cut were boosted higher after comments from former New York Fed President Dudley, an article in the Wall Street Journal by the so-called Fed whisperer.

At the start of the week, the market is pricing in a 5050 probability of a 50 basis point rate cut. Whatever the rate decision, be it a 25 basis point or a 50 basis point cut, there is likely to be a volatile reaction.

Recent data has shown that the US inflation is cooling, but the hotter core inflation reading suggests that inflation remains a little sticky, which would support a 25 basis point cut. However, concerns over the slowing jobs market could prompt the Fed to cut by 50 basis points.

A 50 basis point cut could spook the market, raising concerns that the Fed is behind the curve and may struggle to orchestrate a soft landing for the US economy. This could prompt a sell-off in riskier assets, such as Bitcoin, as the market worries about a recession.

US Retail sales

Ahead of the Fed rate decision, US retail sales data will be released on Tuesday and are expected to show a slight decline of -0.2%. Given the focus is on the Fed, the data is not likely to move the markets.

BoJ rate decision

On Friday, the BoJ will announce its rate decision. While the central bank is expected to adopt a more hawkish stance, it is not expected to hike rates again until later in the year. The BoJ often catches the market by surprise, so investors should be cautious. Another rate hike could see the further unwinding of the carry trade, which could impact risk sentiment and therefore impact Bitcoin.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.