Despite elevated levels of volatility, Bitcoin started and ended last week at around 60k. However, the largest Cryptocurrency by market cap experienced heightened volatility, falling to a low of 49.5k on Monday, August 5. This marked the first time that BTC had traded below 50k since mid-February. While bulls showed a willingness to buy the dip, bringing the price back above 60k by the end of the week, investors have failed to maintain this price, highlighting the fragility of sentiment in the Crypto market. Bitcoin trades -4% at 58k at the start of the week.

The broad altcoin space was more of a mixed bag. While Solana and XRP booked solid gains across the week of 6.7% and 4.9%, respectively, the bullish recovery wasn’t reflected in other coins, such as Ethereum, which fell 8% last week and is extending the decline at the start of this week.

Risk assets & heightened volatility

Elevated volatility wasn’t confined to Cryptocurrencies. The broader financial markets also experienced extreme swings, with global risk assets selling off across the board. The Nikkei dropped 12% on Manic Monday, Eurostoxx dropped 1.45%, and the S&P500 fell 3%.

Markets have somewhat rebounded following the dumping of risk assets last Monday, although uncertainty continues to cloud the market mood and investor sentiment. Macro continues to be a key driver for Crypto price action.

The extreme market activity seen last week came as the market reacted to the following:

- On July 31, the BoJ hiked rates by 15 basis points to 0.25%; the minutes of the meeting were released on August 4. This move was a catalyst for the reversal of the Japanese yen carry trade against higher-yielding currencies and US stocks.

- This was swiftly followed by a weaker-than-expected US non-farm payroll print on August 2, which raised fears of a recession. However, Hurricane Beryly could have caused the significantly weaker-than-forecast data blip, which, combined with stronger jobless claims, calmed recession fears.

- Earnings from the Magnificent 7 stocks have disappointed, raising questions about their lofty valuations. These are the stocks that had driven much of the gains in the S&P500 and the Nasdaq 100 in recent quarters. The results have increased concerns over the health of the global consumer.

- Middle East turmoil also weighed on market sentiment as tensions between Israel and Iran escalated, raising fears of a broader conflict in the Middle East.

Manic Monday’s selloff appears to have been overdone. Still, macros dominance is likely to continue in the absence of Crypto sector-specific catalysts over the coming weeks.

Bitcoin whales accumulate

Despite a steep decline and pursuant volatility, Bitcoin whales have been actively accumulating.

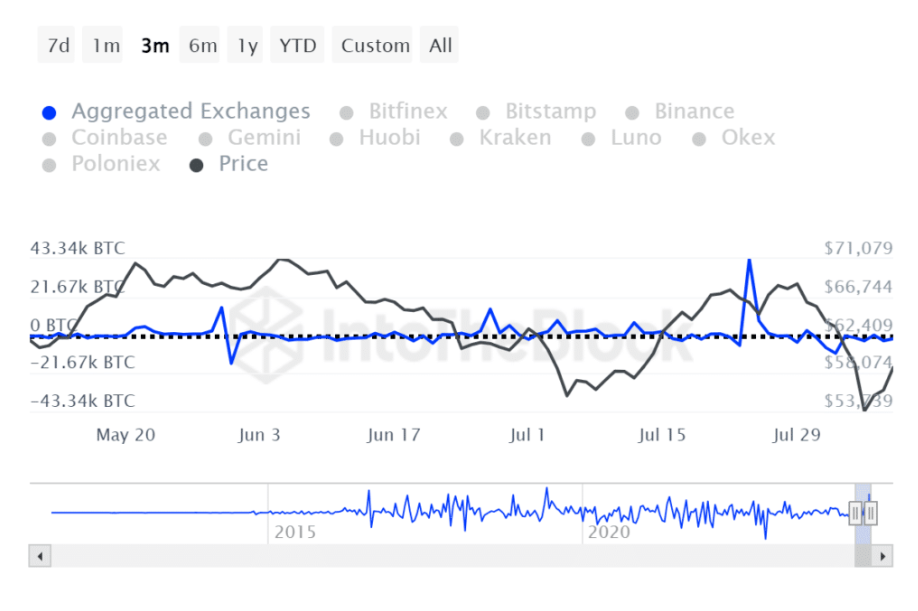

According to Netflow data, Bitcoin saw net outflows from exchanges totalling $1.7 billion over the past week. This marked the largest volume of outflows in over a year, indicating significant movement of Bitcoin away from exchanges. These outflows are typically interpreted as a sign of accumulation as investors move their holdings to private wallets. This movement points to long-term holding rather than leaving the tokens on exchange for a potential sale.

This trend suggests that confidence among whales remains high despite the market’s downturn early last week. These large holders likely viewed the lower price as a strategic buying opportunity as they expected the market to rebound. Should this trend continue, bullish sentiment amid the market’s most influential players could help offset or even overshadow other bearish factors.

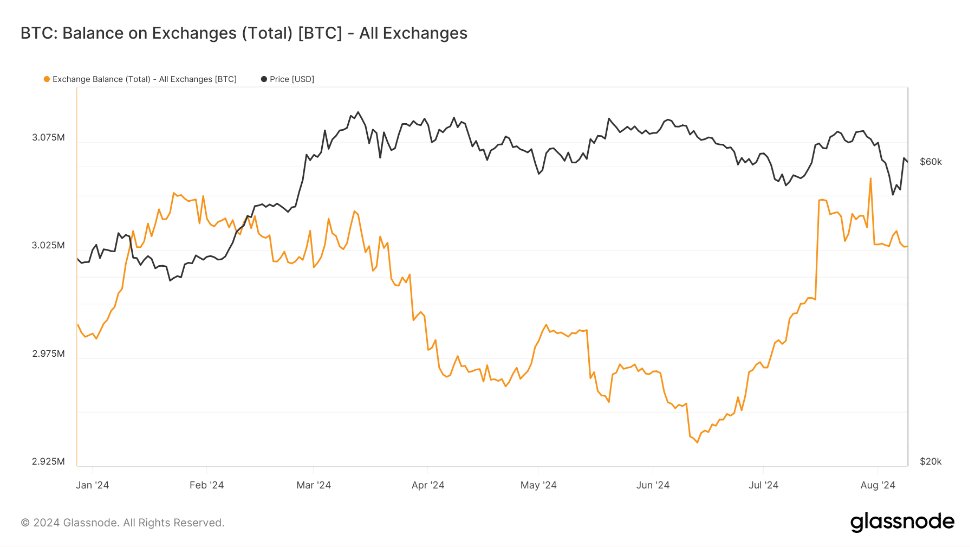

According to Glassnode data, Bitcoin’s balance on exchange has significantly decreased in recent weeks. The balance was 3.057 million on July 30. However, in line with the Netflow analysis, it fell to around 3.026 million on Sunday.

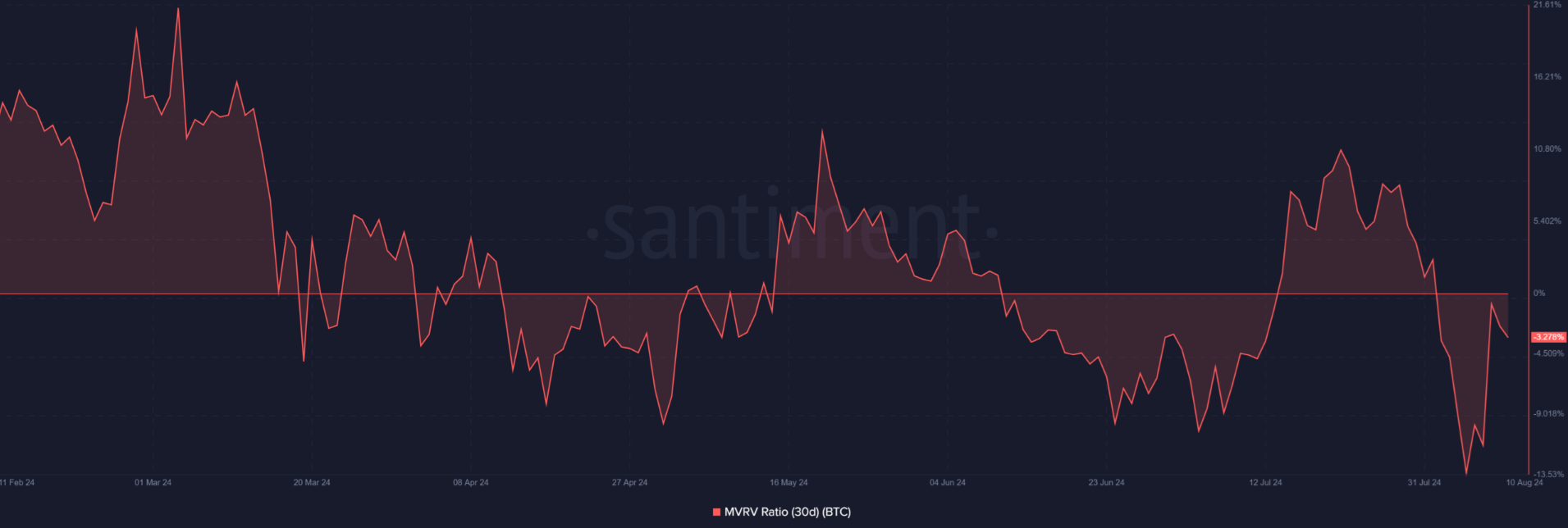

MVRV could suggest Bitcoin is undervalued

The MVRV ratio chart showed that Bitcoin’s 30-day MVRV was -3.278%. This indicates that the average holder has been at a loss over the past 30 days. The negative value could suggest that Bitcoin may be undervalued. Low MVRV levels are often seen as possible buying opportunities. This also aligns with the trend of whales accumulating during the market downturn. This could point to a future price recovery.

XRP lawsuit ends

XRP outperformed last week after a landmark ruling that could reshape the Cryptocurrency industry.

A Federal Judge in the US sided with Ripple in its long-standing legal battle with the SEC, ruling that XRP is not a security. This marks a pivotal moment for the digital asset with potentially far-reaching consequences. Despite the victory, Ripple received a $125 million civil penalty. While this is significantly less than the SEC’s initial demand of $2 billion, it is still a considerable fine. The court also imposed an injunction preventing Ripple from violating securities laws in the future.

The rulings bring more clarity to Crypto regulation and could provide a clearer path forward for the industry. That said, the SEC is expected to appeal the July 2023 ruling, meaning that Ripple’s legal battles may not be over just yet. While the verdict boosted market confidence, helping XRP’s price higher last week, XRP is falling in line with the broader Crypto market at the start of this week.

Week Ahead

The market remains on edge amid concerns over a US recession and the unwinding of a global yen-funded carry trade. This week, the focus will be on whether the pricing of the start of the Fed rate-cutting cycle is justified by upcoming economic data and how much more of the carry trade is yet to be unwound. These concerns, combined with worries of a broadening out of the conflict in the Middle East and the upcoming US election, mean that volatility is likely to remain for now.

Looking at the economic calendar this week, US CPI and retail sales data stand out as potentially influencing sentiment and the markets.

1. US retail sales & inflation data

US retail sales (Tuesday, August 13) are expected to rise by 0.4% MoM, with the retail sales control group, which has less volatile inputs and feeds more directly into the GDP calculation, expected to increase by 0.1% MoM. A negative print could feed the economic slowdown or recession narrative, increasing anxiety in the market. Meanwhile, a stronger-than-forecast retail sales print will help calm recession fears, boosting demand for risk assets such as Bitcoin and stocks.

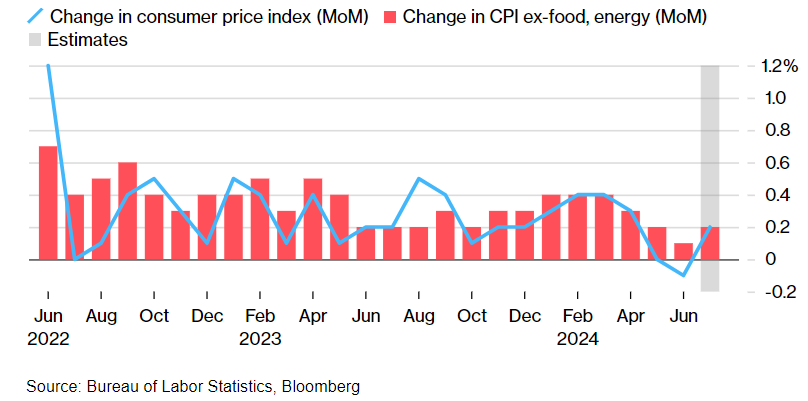

US CPI inflation data is due on Wednesday at 12:30 GMT and is considered the main risk event for the week. The data is expected to show that inflation is edging closer to the Federal Reserve’s 2% annual target. On a monthly basis, CPI is expected to tick up to 0.2% from 0.1%. Although this will not likely derail the September Fed rate, cut bets.

A cooler-than-forecast inflation print could bolster recession worries, potentially sparking market volatility.

Investors will also listen closely to comments from several Fed speakers, including Atlanta Fed President Raphael Bostic. Philadelphia Fed President Patrick Harker and Chicago Fed President Austan Goolsbee. Fed commentary last week suggested that policymakers were increasingly confident that inflation was cooling sufficiently to cut rates.

2. Retailers report earnings

Meanwhile, earnings season in the US is entering its final stages. While the majority of firms have reported quarterly financial results, there are still some big names to watch, including retailers Walmart and Home Depot. Investors will be watching to see what retailers say about consumer spending, which is a major driver of economic growth, particularly in light of recent economic data.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.