Bitcoin rallied 3% last week, rising from 87k at the start of the week to a high of 91.5k its highest level since December 12. After losses in 2025, BTC is starting the new year in a positive manner, with the price extending gains to 93k at the time of writing on Monday. However, the price remains around 30% below its record high of 126k, reached in October. Buyers need to rise above 94k to open the door to 100k.

Bitcoin’s gains last week were not isolated to the largest cryptocurrency, with altcoins also pushing higher across the week. Ripple outperformed, rallying 12% over the past week, Solana rallied 8%, and Ethereum rallied 7%. Meanwhile, DOGE rose 20% and ADA 9.5%.

The total cryptocurrency market capitalisation has risen to $3.16 trillion, a three-week high, up from $2.95 trillion last week.

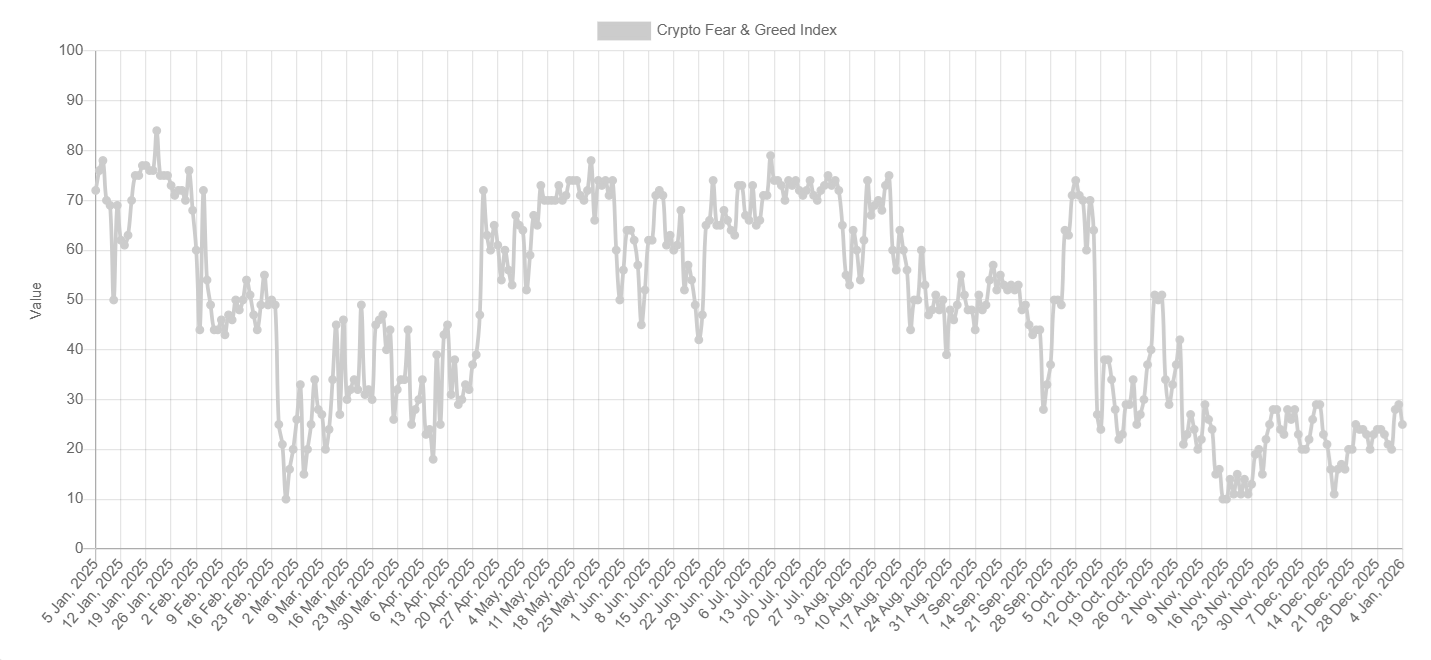

Meanwhile, sentiment analysis shows an improvement in morale. The Fear and Greed Index has recovered from 16 Extreme Fear on 16 December to a peak of 29 on 3 January, which is Fear territory. The index has slipped slightly to 26 at the time of writing, but remains in Fear territory rather than Extreme Fear.

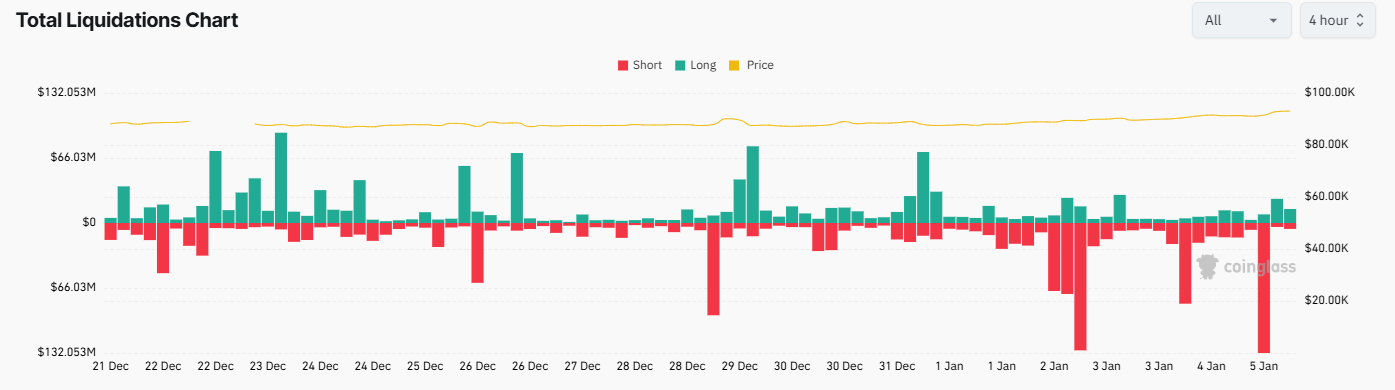

Liquidations over the past week have been minimal, with no day surpassing $500 million in total liquidations. Short liquidations have exceeded long liquidations as the Bitcoin price has risen. On 2 January, $326 million in shorts were liquidated, marking the largest short liquidation in a month.

Macro backdrop – 2026 outlook

2025 was a volatile year for Bitcoin. Positive catalysts included favourable regulatory changes in the US under President Trump, the rise of Digital Asset Treasuries (DATs), strong institutional demand, and easing monetary policy. Cryptocurrency majors such as Bitcoin, Ethereum, Ripple, and BNB all reached fresh record highs.

However, 2025 was definitely a year of two halves. Momentum fizzled in the second half of the year amid macroeconomic uncertainty, including tariffs, inflation, and the flash crash on 10 October that wiped out a considerable number of overleveraged traders. After rallying 34% and 43% at their peaks, both BTC and ETH have given up all of those gains and fallen 7% and 12% over the year.

The fact that BTC fell in a post-halving year has raised questions over the 4-year cycle.

Looking ahead to 2026, there are supportive fundamental factors, including a potentially dovish replacement for Federal Reserve Chair Jerome Powell. Meanwhile, the Federal Reserve is expected to further ease monetary policy, as inflation cooled more than expected, which could increase liquidity and revive demand for risk assets. US NFP data this week could provide more clues on the outlook for rates.

In 2026, spot BTC and ETH ETFs could fully absorb new issuance if demand picks up, while US policymakers continue to integrate stablecoin into mainstream finance.

However, there are reasons to be cautious, including the possibility of further BoJ rate hikes, which could trigger the unwinding of the carry trade.

Geopolitical tensions in 2026 may also create volatility.

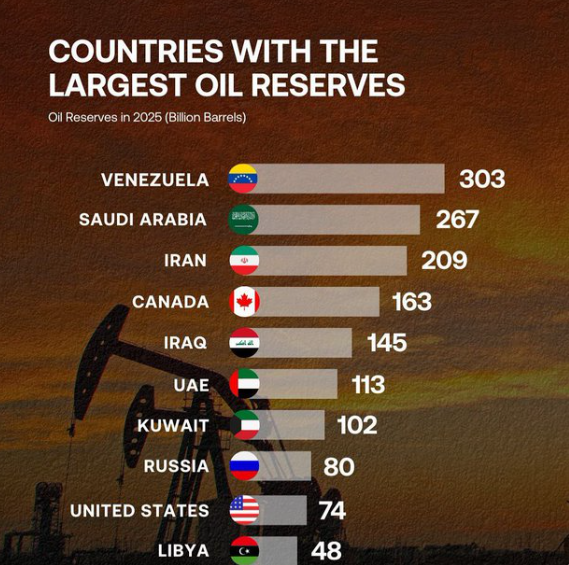

U.S.-Venezuelan geopolitical tensions: Why could this impact BTC?

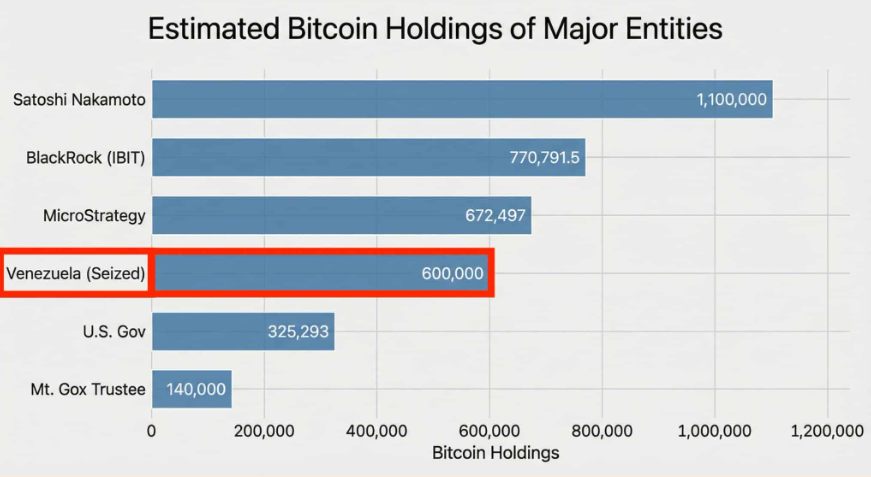

Venezuela’s shadow reserve of 600k to 660k BTC has come into focus after the US-led operation over the weekend to capture President Nicolas Maduro. This reserve, valued at approximately $60-$67 billion, makes Venezuela one of the largest holders of Bitcoin globally, rivaling institutions such as BlackRock and Strategy.

Venezuela has been accumulating BTC since 2018 through a combination of gold swaps, oil settlements in Tether, and domestic mining seizures. Hyperinflation in the country, US sanctions, and a collapsing bolivar have driven widespread use of Bitcoin and stablecoins.

By 2025, 10% of grocery payments and 40% of peer-to-peer transactions were conducted in crypto. Venezuela was ranked 17th in crypto adoption according to Chainalysis.

Should Venezuela’s 600 BTC be seized or frozen, it could trigger a supply shock, reducing available liquidity and supporting prices higher. Another option is to liquidate these reserves, although this is unlikely, given Trump’s support for BTC.

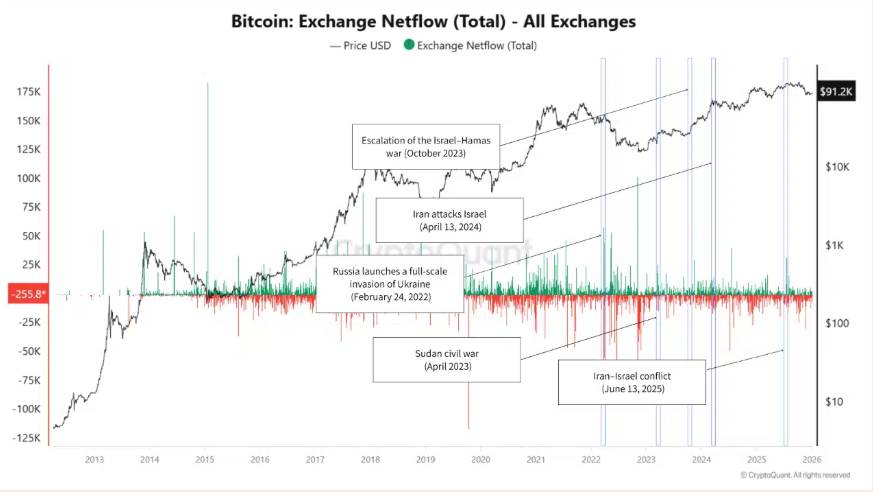

Until the private keys are surrendered or legal claims resolved, the 600k BTC remains effectively locked, creating short-term volatility and a longer-term supply shock that favours price appreciation. At the same time, uncertainty can cause big moves in the short term. For now, this is not the case; there is no sign of panic selling as exchange netflow figures remain subdued.

This calm reaction reflects how investors distinguish among different types of geopolitical risk. Historically, Bitcoin has responded more strongly to events that directly affect global capital flows, such as regulatory crackdowns, function enforcement, or major US-China economic tensions.

Why falling oil prices could support BTC

Oil and gas prices are falling following Trump’s military operation to remove Venezuelan President Maduro over the weekend. The markets are reacting today with oil prices moving lower. Oil fell over 1% on the open to $57 per barrel. Typically, geopolitical tensions involving oil-producing countries lead to higher oil prices. However, this hasn’t been the case since Trump announced plans to develop Venezuela’s vast oil and gas reserves. The prospect of additional oil and gas entering the market drove prices lower.

Greater oil supply and lower prices mean lower inflation and more Federal Reserve rate cuts, thereby increasing liquidity and boosting demand for risk assets such as Bitcoin. This remains theoretical; any changes to the oil supply could require significant investment in Venezuelan production, making it slow and uncertain.

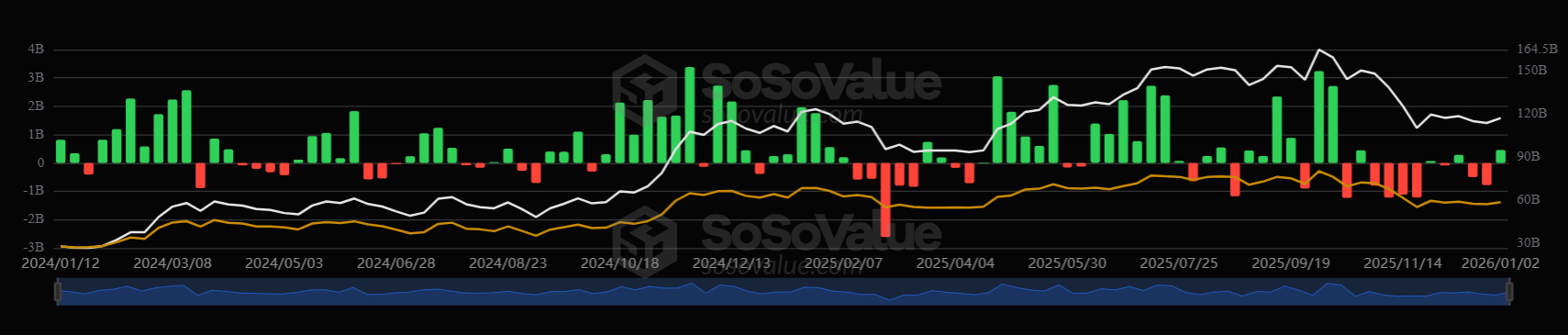

Is institutional demand returning?

Institutional demand started the year on a strong note, recording a net inflow of $471.1 million on the first day of trading. This marked the largest inflows since December 17, when U.S. spot BTC ETFs recorded net inflows of $457.3 million. On a weekly basis, BTC ETFs recorded $458.7 million in net inflows, the strongest since early October.

Spot ETFs have started the year on a firm footing after weakness in November and December. Spot ETFs recorded $4.57 billion in outflows across November and December as the BTC price dropped 20%, marking the most significant two-month selloff since BTC ETFs debuted in January 2024. The outflows came as many institutional investors sold BTC in Q4, potentially to harvest tax losses. These institutions could be re-entering the market at the start of the year, although it is still early days.

Crypto ETF inflows are often used as a gauge of sentiment toward the asset class and as a signal of short-term price direction, depending on whether they are experiencing inflows or persistent outflows. Strong BTC ETF inflows could help lift BTC price higher.

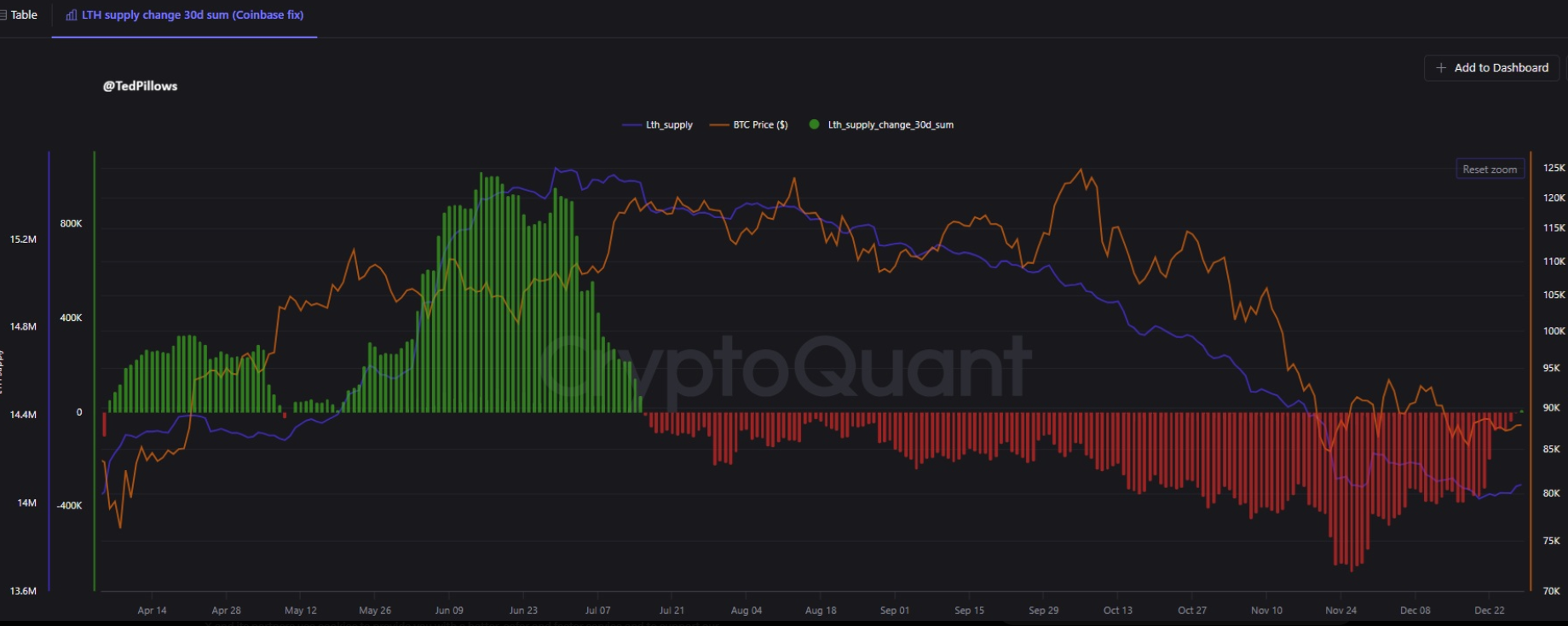

Bitcoin long-term holders halt selling

Bitcoin long-term holders have paused the selloff in BTC. The shift in behaviour could signal a potential Bitcoin price rebound and bring a positive signal for the months ahead.

According to CryptoQuant analysis, long-term holders, investors who have held coins for over six months, have been selling since mid-July. A change in behaviour from this cohort is raising expectations for a potential relief rally as distribution pressures fade.

On-chain data indicate that the group has not only paused the selloff but is resuming accumulation, suggesting that confidence is returning. According to CryptoQuant, such shifts have historically preceded consolidation phases or bullish recoveries. Although this signal does not imply an immediate rebound, it rarely aligns exactly with a market bottom.

If this trend persists and institutional demand rebounds, then BTC could be looking at a more positive start to January.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.