The last full week of January was ugly for crypto. Bitcoin declined 11% last week, falling from 89.2k at the start of the week to a low of 75k over the weekend, a level last seen in April. The price continues to trade at multi-month lows at 77k as the new week begins. BTC trades down 40% from its 2025 peak and is testing levels seen around the Liberation Day market fallout.

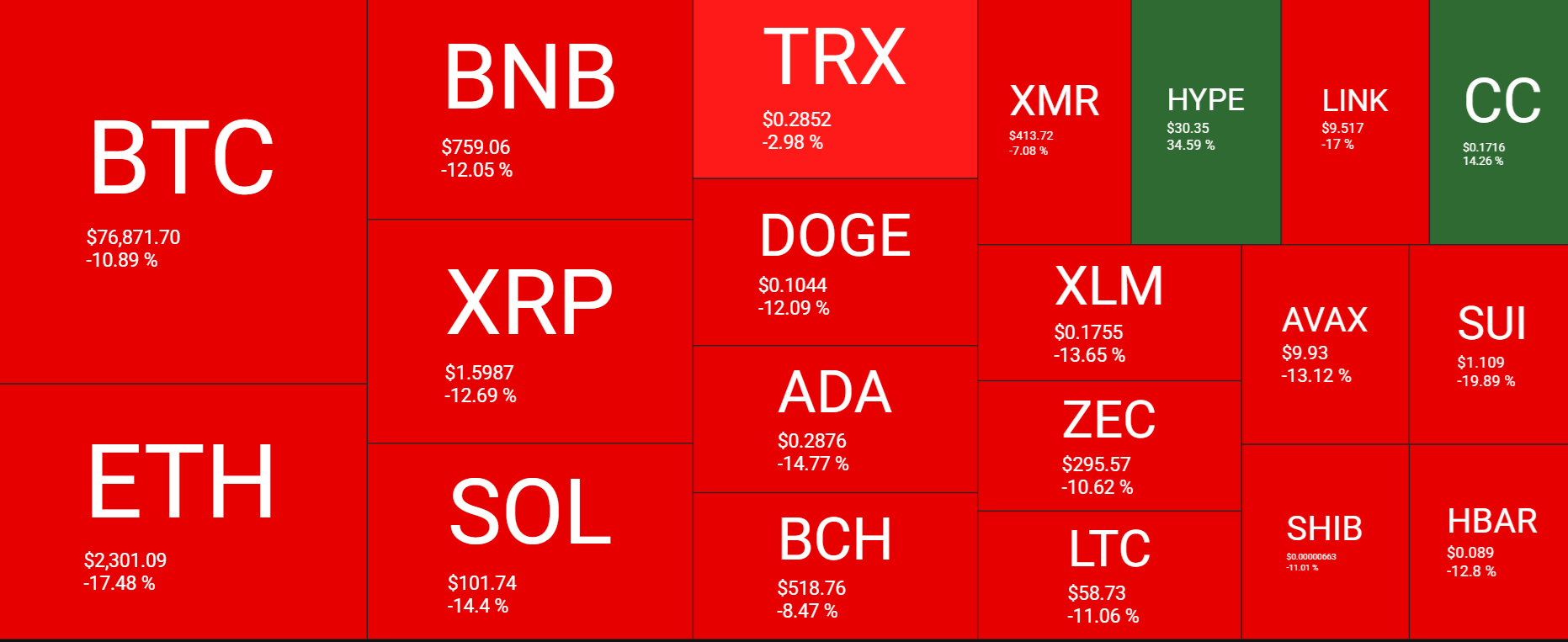

The selloff was brutal and seen across the broader crypto market. Major altcoins performed worse, with Ethereum trading 17% lower over the past 7 days; SOL tumbled 14%, while BNB and XRP fell 12% each. HYPE was a rare point of positivity.

The total crypto market cap has fallen below $2.5 trillion, down from $3.28 trillion just two weeks ago and to a level last seen in April.

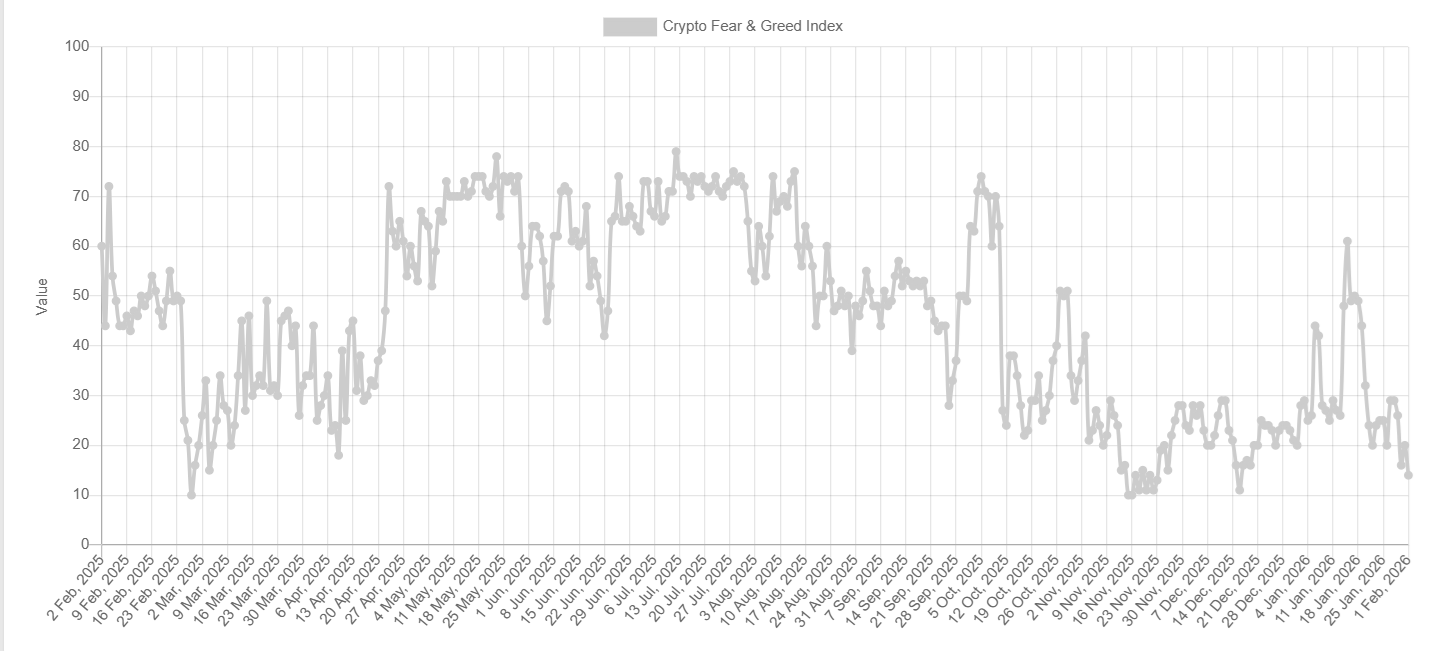

Sentiment analysis indicates a marked deterioration in sentiment toward cryptocurrency. The Fear and Greed index has fallen to 14, Extreme Fear, down from 25 Extreme Fear last week. This was the weakest Sentiment since mid-December, when sentiment had fallen to 11.

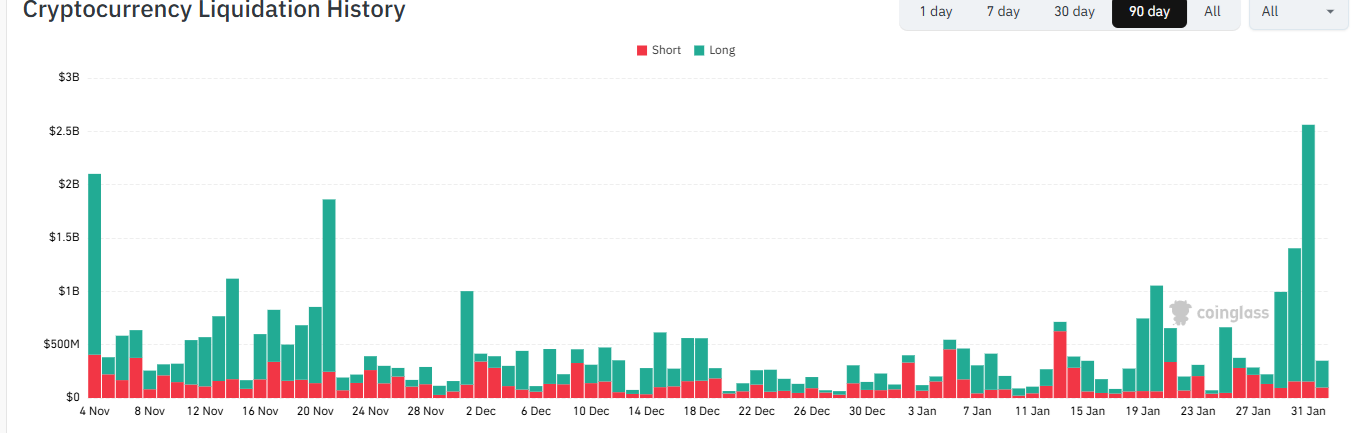

Crypto liquidations hit $2.5 billion

Bitcoin falling towards 75k and Ethereum plunging towards $2300 resulted in liquidations piling up as leverage was unwound. Over $2.5 billion in positions were flushed from the system over 24 hours, marking the 10th largest liquidation event in crypto’s history – larger than in Covid and the FTX collapse. Liquidations create a cascade of forced selling. Liquidations push prices lower, which in turn trigger further liquidations, forcing prices even lower.

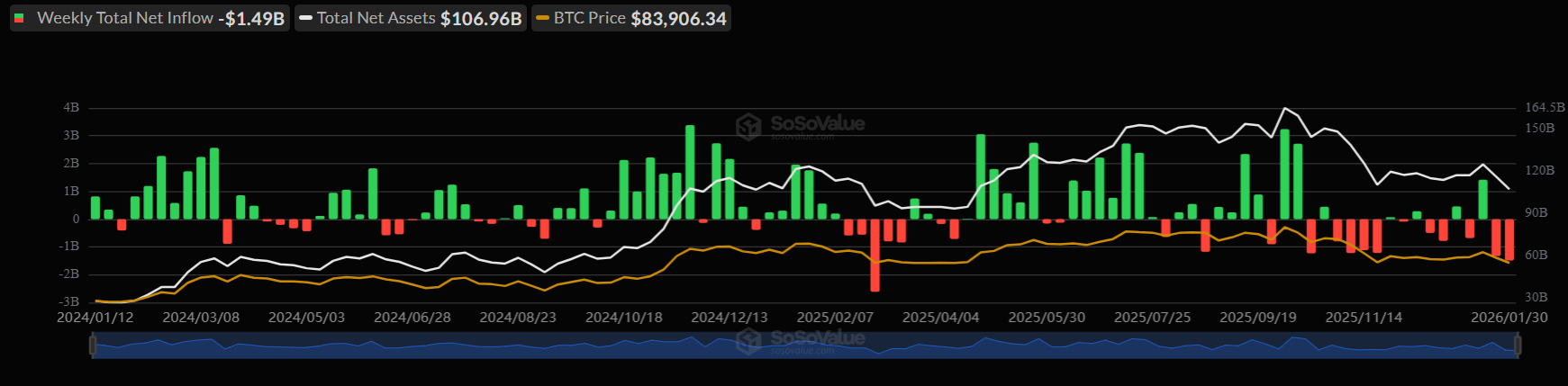

BTC ETFs outflows as BTC falls below ETF cost basis

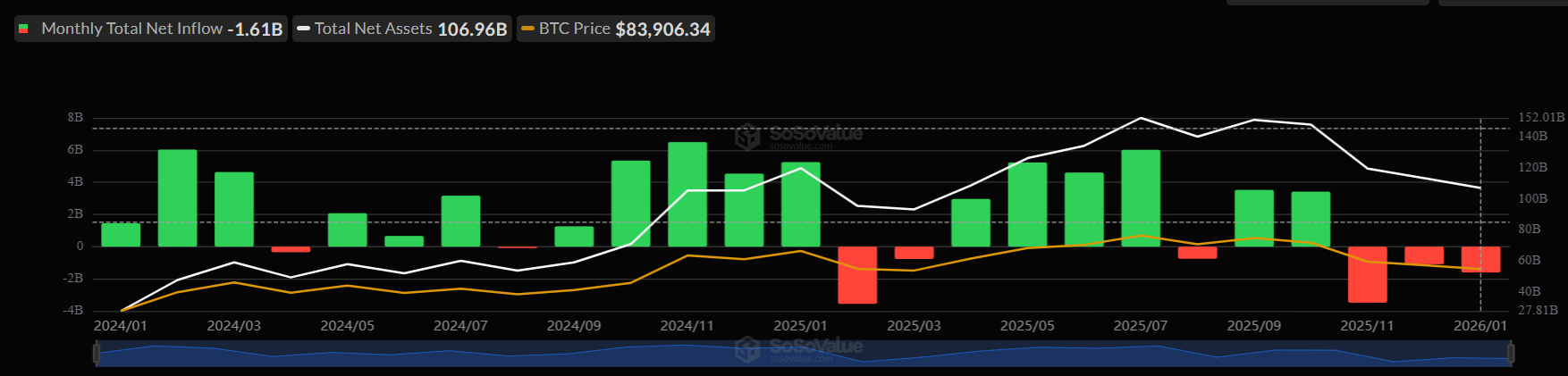

US spot BTC ETFs continued to bleed last week. Spot BTC ETFs recorded $1.49 billion in net outflows across the week, bringing total outflows across the past two weeks to $2.82 billion.

In January, BTC ETFs recorded $1.61 billion in net outflows, marking the third consecutive month of outflows and the longest such streak since BTC ETFs were launched in January 2024. This shows a weakening of conviction among large institutional players.

BTC’s break below 80k is significant. This technical level has been retested twice following the correction phase that began in October 2025. Each successful rebound reinforced 80k as a critical support.

However, 80k was also the cost basis for Bitcoin ETFs. Therefore, the fall below 80k puts a large cohort of institutional investors at risk of entering unrealised losses. $1.6 billion in net outflows were recorded in January. These outflows could accelerate if the price remains below the ETF cost basis, triggering widespread panic-driven redemption.

Why has Bitcoin plunged?

The crypto market is under heavy selling pressure, with prices falling sharply over the weekend following the US government entering a partial shutdown and Trump announcing Kevin Warsh as the new Federal Reserve Chair to replace Jerome Powell in May.

On Friday, Trump announced the appointment of Kevin Walsh as the new Federal Reserve chair. While Warsh supports lower interest rates, he has also been critical of the Federal Reserve’s balance-sheet expansion and may seek to reduce it, thereby withdrawing liquidity from the market. These concerns helped push yields on longer-term Treasuries higher, lifting the dollar and sending gold, silver stocks, and Bitcoin sharply lower. Tighter liquidity is generally unfavourable for assets like Bitcoin, which perform best in periods of cheap money.

The announcement sparked a recovery in the U.S. dollar and a significant selloff in Gold and Silver. Gold trades down $1000 per ounce in just a few days.

The US government also entered a partial shutdown on Friday after lawmakers missed the midnight funding deadline, adding another layer of uncertainty for the market, which was already struggling to find buyers.

The shutdown has triggered a sharp market reaction with Bitcoin dropping 7% on Saturday. As part of the shutdown, the Securities and Exchange Commission will significantly reduce its operations, impacting the cryptocurrency sector. With Congress failing to finalise a funding bill, the SEC is operating with the mission staff halting reviews of crypto exemptions and storing innovations.

Bitcoin sinks below its Fair Value

The price action has pushed Bitcoin below its True Market Mean. Glassnode data indicate that Bitcoin fell below its True Market Mean for the first time in 30 months, which is 80,500. The last time this happened was in late 2023 when BTC traded at just 29,000. Historically, a breach below this level signals a transition from a bull market to a midterm bear market.

BTC holders are facing a grim reality as the short-term holder cost basis has climbed to 95.4 K, whilst the active investor mean stands at 87.3 K. The spot price is significantly below all of these averages, meaning the market now faces a substantial overhang of unrealised losses.

So how low can BTC go?

Bitcoin appears to have found support at 75,000 for now; however, warning signs indicate further losses may be ahead. One such warning sign is the lack of strong accumulation at this level.

Exchange outflows, which track how much Bitcoin is being moved off trading platforms into long-term storage, have declined sharply. Around January 31st, outflows stood at approximately 42,400 BTC, and on February 2, they fell to 14,100 BTC, representing a decline of nearly 67%. This suggests that investors are not rushing to buy the dip, which is a warning sign in itself.

Whale behaviour is also flashing warning signals. Whales holding between 10,000 and 100,000 BTC have been steadily reducing their exposure over the past two days, with combined holdings falling from 2.21 million BTC to 2.20 million BTC, representing 10,000 BTC sold at the current price of $750 million.

And then there’s the short-term holder net unrealised profit and loss (NUPL), which measures whether recent buyers are in profit or loss, and this also signals caution. The NUPL sits at -0.23, putting traders in a capitulation zone. However, it’s worth noting that in November, the NUPL fell to approximately -27 before a strong rebound, suggesting there could be further downside.

Combining falling outflows, whale selling, and incomplete capitulation suggests that conviction could remain weak.

With Bitcoin at risk of a deeper downside, there may be parallels in price action that mirror past bear markets. The 20-week SMA is crossing below the 50-week SMA. Historically, this has seen additional downside continuation. This was last triggered in 2022.

Strategy is still accumulating ahead of the earnings announcement

Against the challenging backdrop and ahead of Q4 earnings, Michael Saylor’s Strategy signals that it is continuing its accumulation. Even with Bitcoin below its recent average purchase price and well under previous entry levels, Michael hinted at deploying fresh capital into the market, supporting the view that Bitcoin’s long-term fundamentals outweigh short-term macro pressure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.