Bitcoin rose 5% last week, taking this year’s gains to 8.5% before falling lower. The price started last week at 90k, rising to a 3-month high of 97.9k before easing lower to 95k. The price is falling sharply at the start of the new week amid escalating geopolitical tensions over Greenland. BTC tested minor support at 92k before bouncing slightly to 93k at the time of writing.

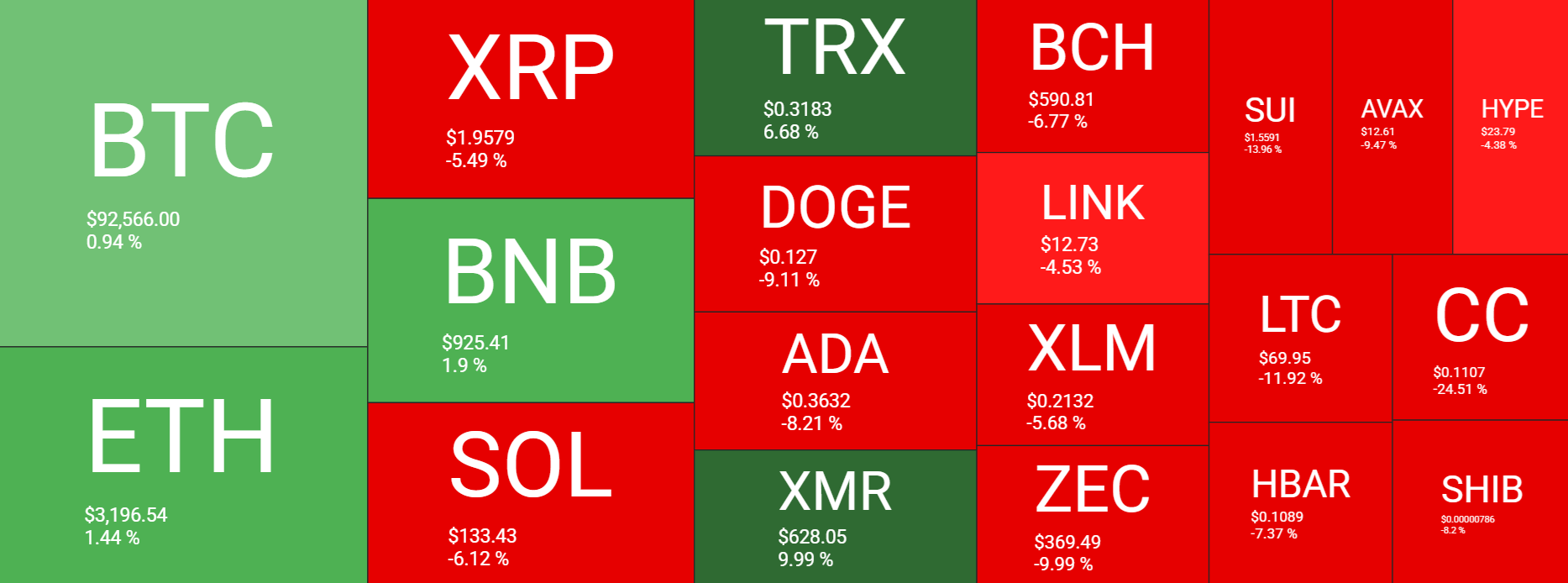

The strong performance seen in Bitcoin last week was mirrored in other major altcoins. Ethereum rallied 7%, BNB rose 4%, and SOL gained 4.7%. XMR was an outperformer, up 17%. However, the sharp selloff at the start of this week has left positions in a sea of red over the past 7 days, with just BTC, ETH, and BNB holding the flatline.

The total crypto market capitalisation rose to a 2-month high of $3.30 trillion during last week. However, this has fallen to $3.13 trillion, down 2.8% in the last 24 hours, only modestly above the $3.10 trillion it was at a week ago.

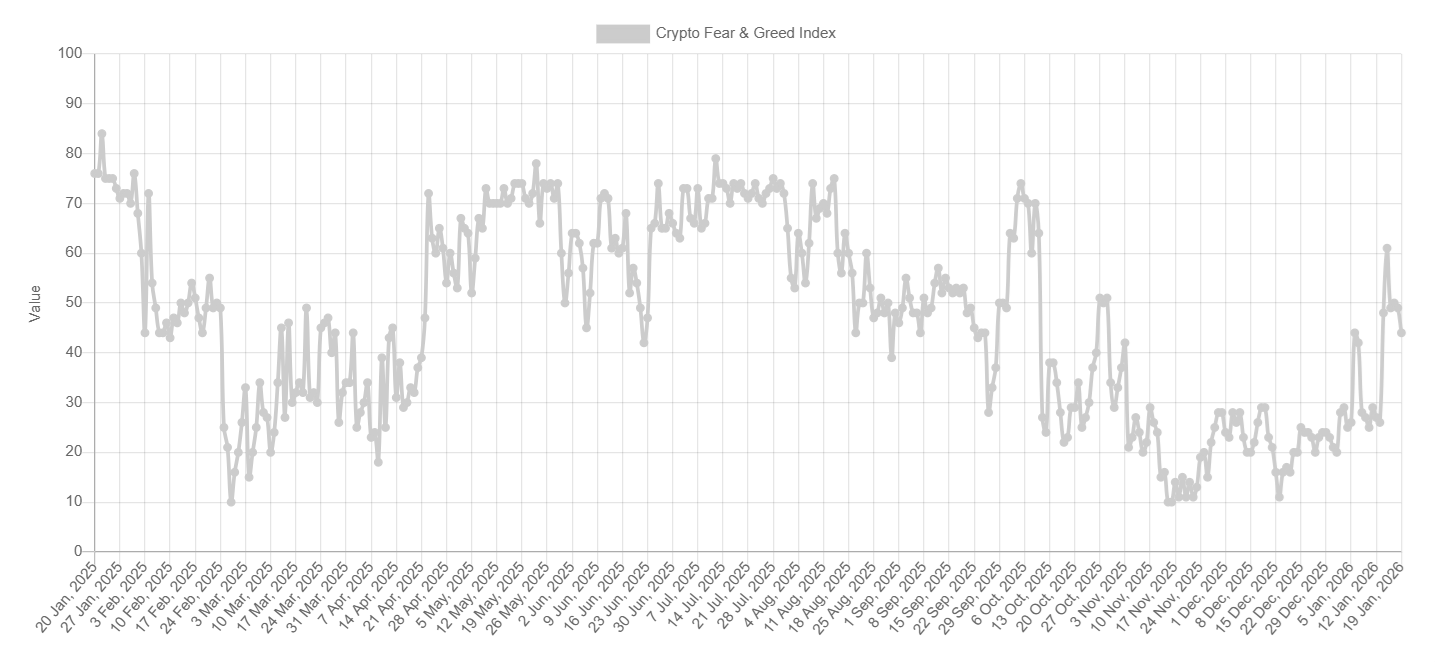

Sentiment analysis shows that sentiment towards crypto has improved. The Fear and Greed Index has risen to 44 back in Fear territory, down from Neutral (50) yesterday but up from last week (29) and Extreme Fear (16) last month. The 50 level marked the brightest sentiment since sentiment collapsed on October 11, when $19 billion was liquidated from crypto markets in a single day, triggering a prolonged risk-off period.

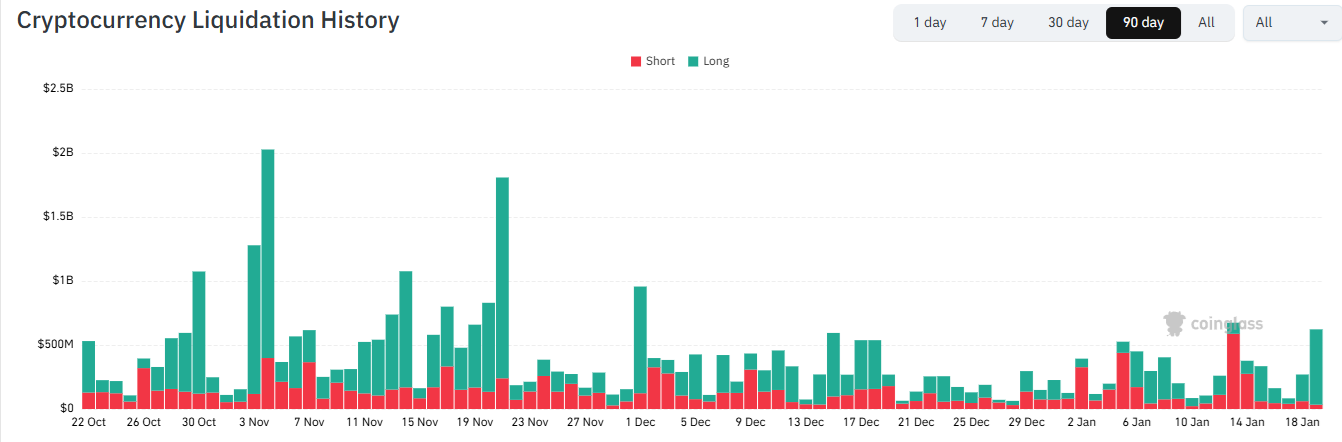

Liquidations

Bitcoin’s break above 95k coincided with a wave of short liquidations in the crypto market. On Tuesday, total crypto liquidations reached $673 million, of which 87% were short positions. This market is the largest short position liquidation since October’s major liquidation event.

Bitcoin’s fall back to 92k today has sparked a wave of long liquidations totalling $787 million over the past 24 hours. This marks the largest long liquidation since 1 December.

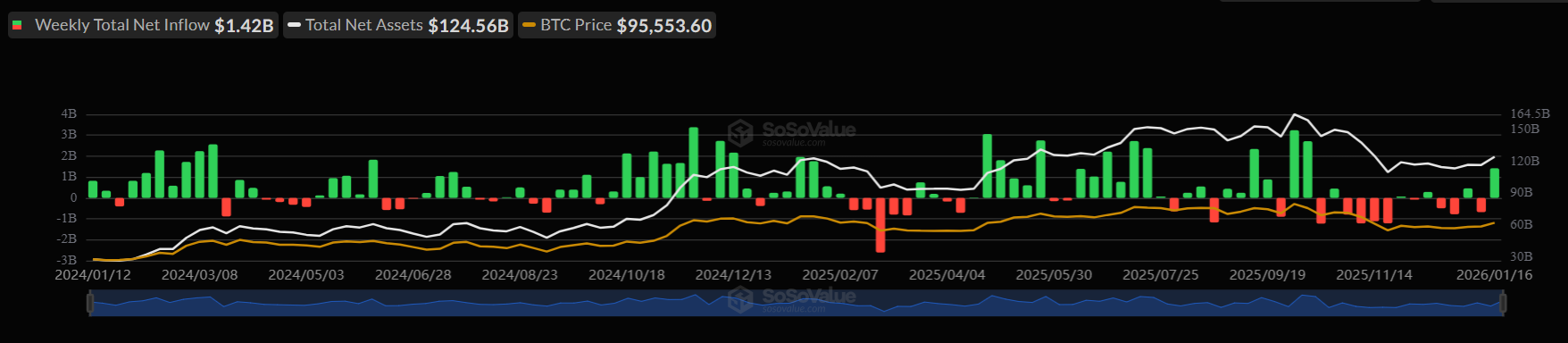

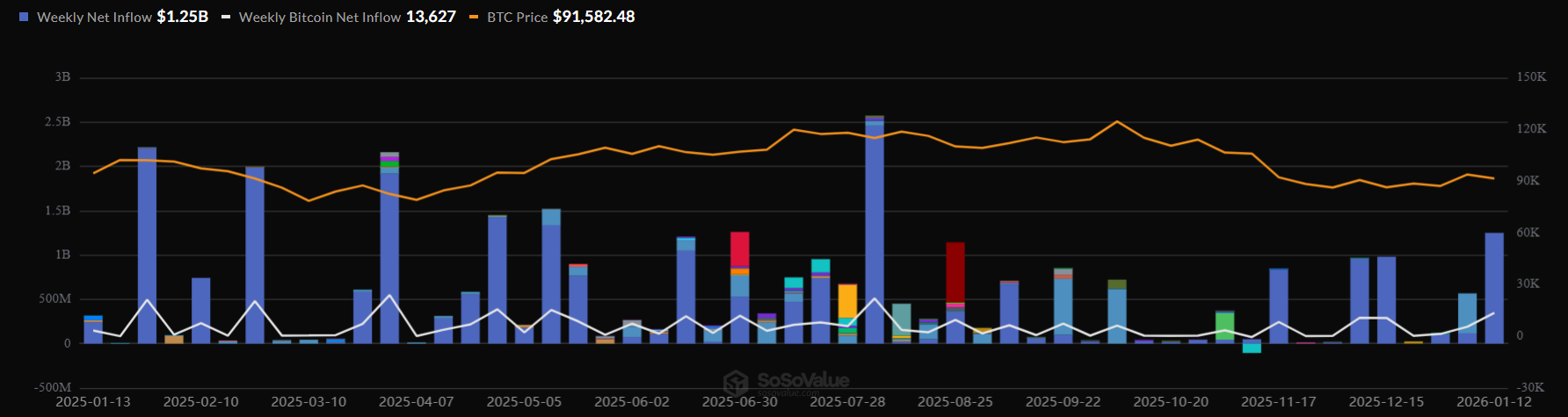

BTC ETFs rebound

Bitcoin’s rally last week was supported by growing institutional demand. The SoSo Value chart shows that spot BTC ETFs recorded net inflows of $1.42 billion last week, the highest weekly inflows since early October, when BTC reached a record high of $126.2k. Such inflows often signal growing investor confidence. Capital entering ETS typically reflects longer-term positioning rather than short-term speculation.

These current trends suggest that market participants expect clean price appreciation, reinforcing bullish sentiment despite near-term volatility and mixed macro signals. Should this level of inflows persist or intensify, BTC could rally towards the 100k psychological level.

Corporate demand for BTC was also strong last week. Strategy acquired 13,627 BTC last Monday, following 1287 BTC purchase the prior week, bringing total Bitcoin reserves to 687,410.

Macro backdrop

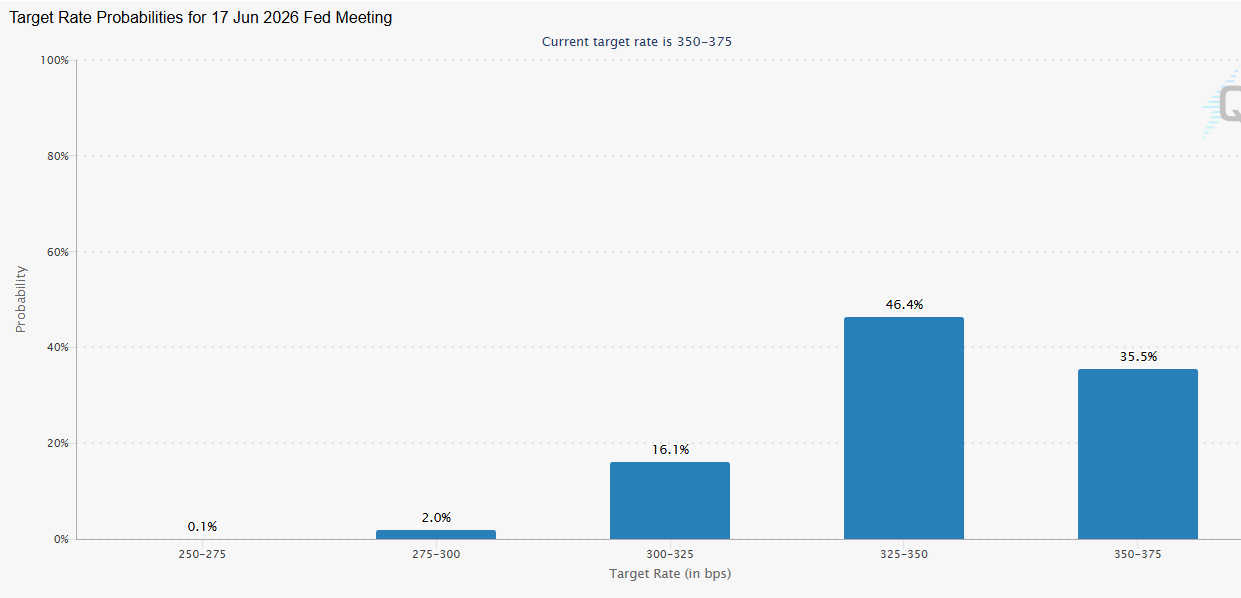

US CPI data showed that headline inflation rose 2.7% year on year in December, in line with November and matching expectations. However, cool CPI, which excludes more volatile items such as food and energy, rose 2.6% in December, softer than the 2.7% expected. This cooler-than-expected core inflation reading strengthened risk-on sentiment, pushing US equities to record highs and lifting BTC to a nearly two-month high at 97.9 K.

However, the price pulled back on Thursday following US jobless claims, which fell to 198K in the week ending January 10th, below expectations of 215 K and down from the previous week’s 207 K.

According to the CME FedWatch tool, markets are currently pricing in a 95% chance that the Fed will leave rates unchanged at the January 27-28 meeting. The market expects the Fed to cut rates for the first time this year in June.

Geopolitical risks

Geopolitical tensions have created volatility across the cryptocurrency and traditional markets so far in 2026. In early January, attention was on Venezuela; last week, on Iran; and heading into this week, Greenland is the primary focus.

President Trump announced 10% tariffs on goods from the UK, Norway, and six EU countries, as he seeks Denmark’s permission to take control of Greenland. These tariffs could rise to 25%. The EU is preparing to retaliate with €93 billion in tariffs as the NATO allies sit on the brink of a trade war.

Risk sentiment is falling with US stock futures 1% lower, while Gold has rallied to fresh record highs.

Despite the volatility, on-chain data is looking more encouraging, at least for now. However, should EU-US geopolitical tensions and trade-war fears rise, this could change.

Bitcoin OG selloff falls sharply

Bitcoin OGs have reduced selling pressure, supporting the odds of crypto asset recovery. OGs are the early investors in BTC, including miners, developers, and first adopters.

The impressive run by Bitcoin this cycle attracted profit-taking from this cohort, many of whom purchased BTC when the price was below $100, over 5 years ago.

According to data from CryptoQuant, selling pressure from Bitcoin OG’s has dropped from a 90-day average of 3000 BTC in 2004 to 1000 BTC in 2006, a 73% decline in two years.

Institution demand passes mined BTC

The massive selling pressure in late 2025 from long-term holders, ETF outflows, and excessive leverage appears to have been largely reset, providing a structural foundation for a solid recovery. Institutional demand for BTC is nearly five times its new supply, or the BTC miners mint.

At the time of writing, institutions had absorbed 30K BTC, significantly more than the 5.7k BTC that had been freshly minted. A similar trend was seen in 2025 and 2024 when ETFs debuted. In fact, JP Morgan has predicted that crypto inflows will surge in 2026 following a record $130 billion in inflows last year.

JP Morgan noted that they expect institutional flows to be facilitated by the passage of additional crypto regulations, such as the clarity act, which could trigger further institutional adoption of digital assets.

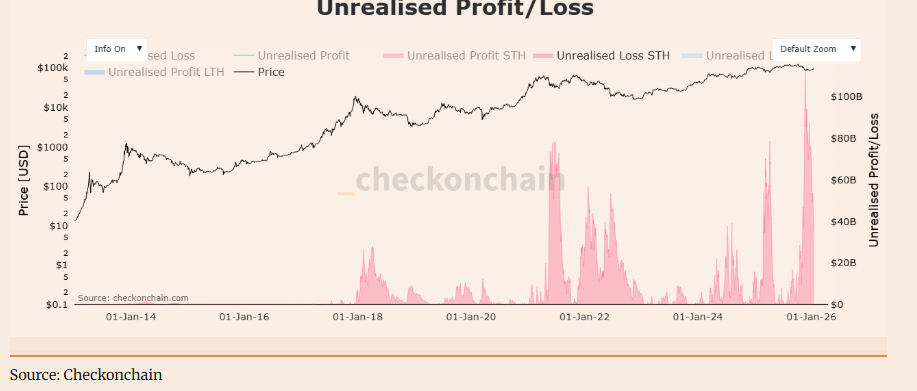

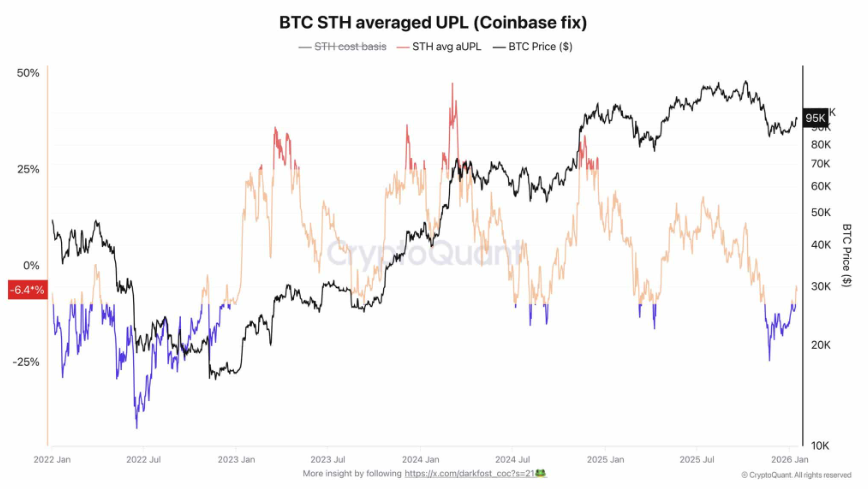

Short-term holders see conditions improve

After reaching a record high of 126k in October, Bitcoin faced sustained selling pressure, falling to a cycle low of 80K, with the drawdown weighing heavily on short-term holders as unrealised losses jumped. In November, according to a checkonchain data, short-term holders’ unrealised losses surged to a record $110 billion.

However, the strong start to 2026, which saw BTC recover above 95k, led to STHs’ unrealised losses falling to $65 billion, helping the cohort out of extreme stress.

The chart below shows how STH entered the capitulation phase with STHs holding average losses of over 10%. However, as the BTC price has recovered, the STH losses are now closer to 6.4% as pressure has eased. This reduces the likelihood of panic-driven selling.

Will BTC continue its recovery?

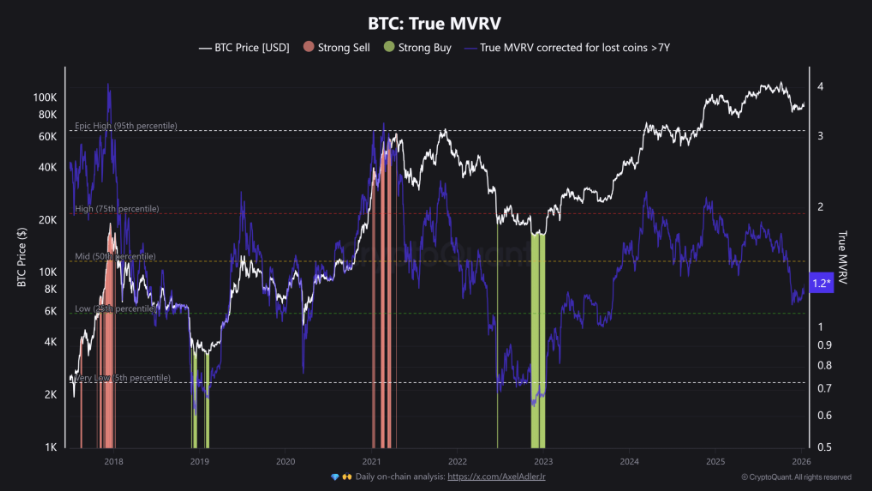

The true MVRV, which identified key market cycles and investor sentiment shifts, bottomed out near 1.0 and recovered to 1.1. Previous recovery patterns at similar levels have shown that shifts or local tops occur when the oscillators surge towards 1.5 or 2.0. In other words, if the current recovery continues, it could cool off if the MVRV climbs towards 1.5 or 2.0. At the time of writing, BTC is trading at 92.5 K, up a solid 16% from the Q4 2025 low of 80.6k.

However, there are still reasons to be cautious. On the weekly chart, the price remains below the 50 SMA, which is considered the limit for the bear market. The price also remains below the 365-day MA, another key limit for the bear market, which sits around $101k. This acted as a barrier in the 2022 bear market, halting a recovery.

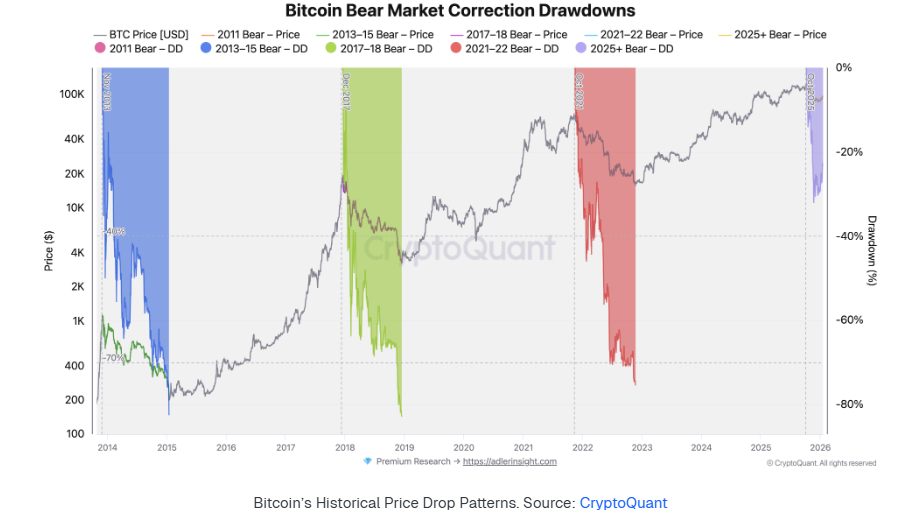

Historical drawdowns point to further declines

Bitcoin’s price history shows a recurring pattern of deep declines. After topping in 2013, BYTC fell 75%. This was followed by an 81% drawdown in 2017 and a 74% decline after the 2021 high. In the current cycle, the pullback has been a more modest 30%, small by historical standards. This could mean it’s still early in the cycle, with further drops ahead.

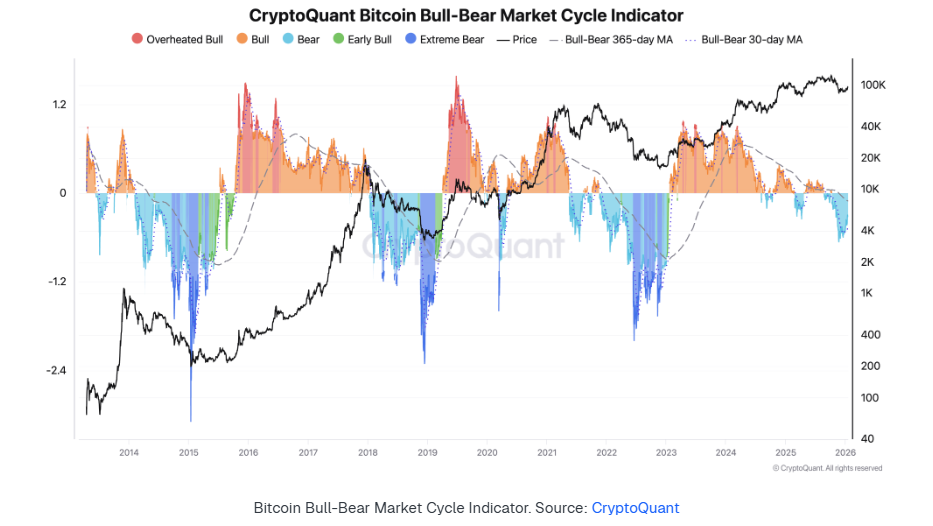

The Bull – Bear Market Cycle Indicator, which tracks broader market phases, shows bearish conditions that began on October 25 have not yet moved into the extreme bear phase, the dark blue zone. This does mean that lower levels are likely. That said, there is also an argument that the increasing institutional involvement and Bitcoin’s growing mainstream adoption mean these cycles could be less extreme.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.