Bitcoin fell over 5% in choppy trade last week. The price fell to 98K last Monday before recovering higher to a peak of 106.4K by midweek. It recorded its first monthly close above 100k in January. However, the elation was short-lived, and Bitcoin slumped sharply over the weekend and at the start of the new week, trading below 100K and tumbling to a low of 91.5k as Trump applied trade tariffs to Canada, Mexico, and China.

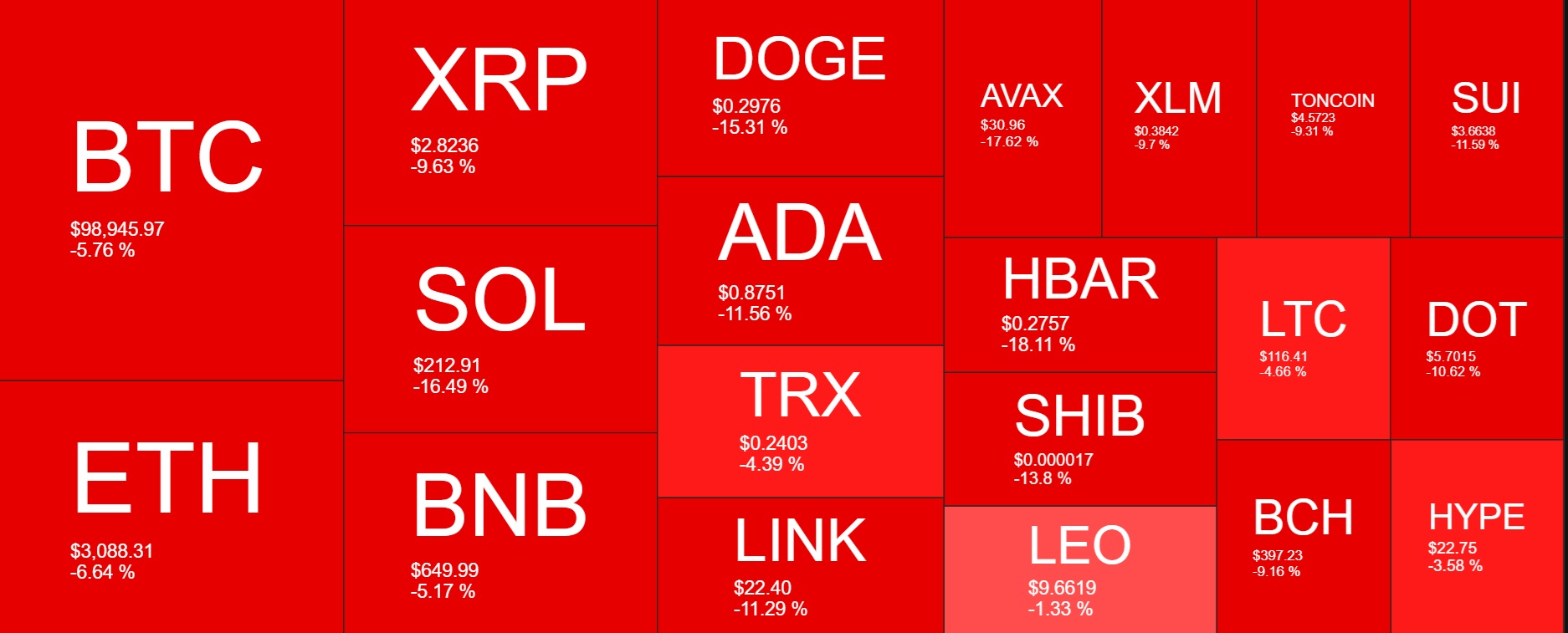

There was a bloodbath across the board, with Ethereum’s price dropping over 6%, Solana tumbling 16%, and XRP falling just shy of 10%. Dodge was down 15%, Link 11%, and Shibu fell 13% over the previous week as investors indiscriminately sold out of crypto. The altcoins have plunged further at the start of the week, with Ethereum dropping 20%!

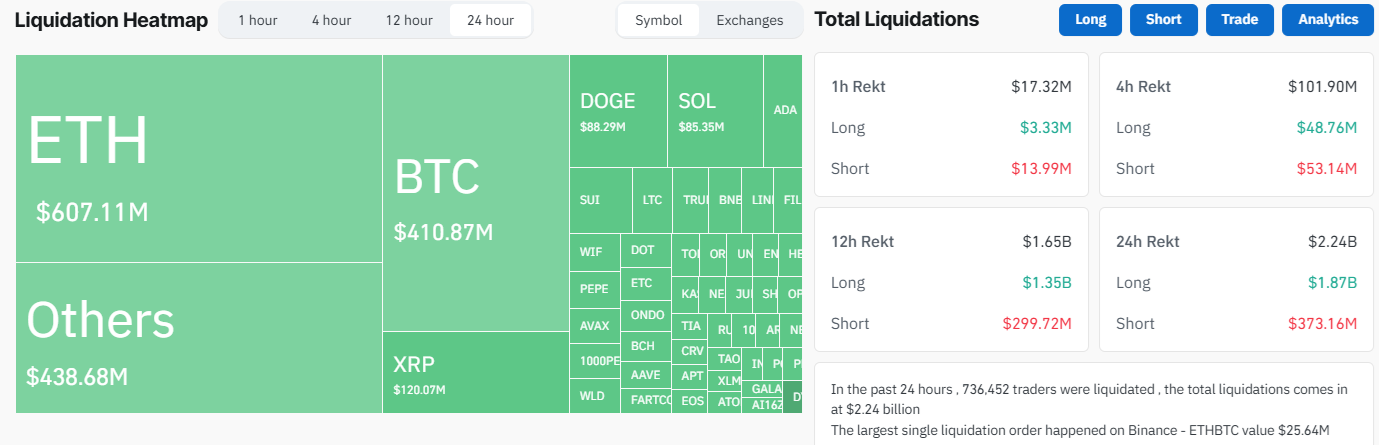

Liquidations

The last 24 hours have been tough for crypto, with Trump’s trade tariff announcement triggering over $2.24 billion in crypto liquidations, the majority of which ($1.87 billion) were long positions. This suggests that many traders were betting on crypto’s continued rise, and Trump’s tariffs quickly changed market sentiment, resulting in a long squeeze. Bitcoin wasn’t the hardest hit; instead, Ethereum suffered the most.

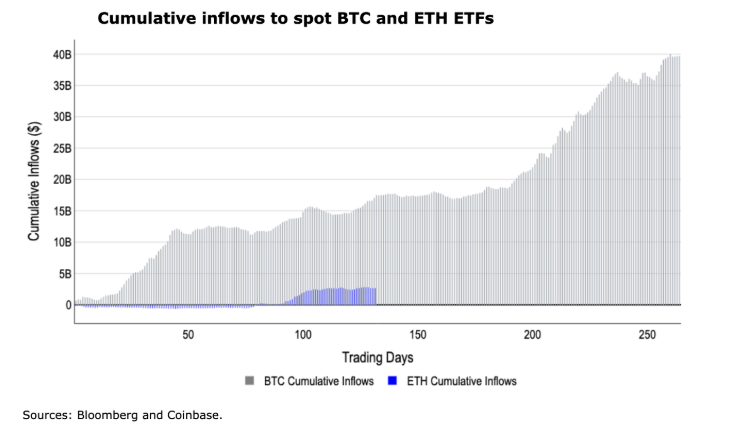

Bitcoin ETFs

Spot Bitcoin ETF booked the fifth straight week of net inflows last week, although flows could come under pressure this week as the mood changes.

According to SoSoValue data, net inflows reached $559 million, down from $1.79 billion the previous week. Last week, ETFs reached a significant milestone of $125 billion holdings, now accounting for over 6.05% of the current BTC supply. This milestone comes just a year after they started trading in January 2024.

Meanwhile, Black Rock, the world’s largest asset manager, controls the largest Bitcoin ETF by assets under management at $58 billion. The fund accounts for over 46.4% of the market share among all US Bitcoin ETFs and has grown to become the 31st largest ETF in the world.

Despite these milestones, stronger Bitcoin ETF growth is required to support higher prices.

Last week, the SEC, acting under chair Mark Uyeda, continued its efforts to advance the crypto ecosystem. The Canary Litecoin ETF officially became the first non-Bitcoin or Ethereum ETF acknowledged by the SEC and is open for public commentary regarding the decision. The SEC will have around 240 days to give a final decision, setting the deadline of September or October this year. This decision could set a precedent for the future of other crypto ETFs as LTC, unlike BTC and ETH, does not have a CME futures instrument, which had formed the core basis of the BTC and ETH approval.

The SEC’s changing rhetoric has encouraged exchanges to refile other altcoin ETFs, which, if approved, could open new pools of liquidity. For example, the BTC and ETH ETFs resulted in $39.7 billion and $2.7 billion in inflows into BTC and ETH, respectively.

The DeepSeek Effect

Last week, there were few White House crypto-specific catalysts. Bitcoin and liquid tokens aligned with risk assets such as US equities. The choppiness in price action early last week was driven by Chinese start-up DeepSeek unveiling its R1 model, which it claimed to be cheaper and more efficient than Open Eyes ChatGPT.

This unveiling triggered panic and a shift in market valuations, hitting the Nasdaq, Nvidia, and crypto markets. However, the market’s recovery last week also suggests some recognition of the productivity gains from cheaper AI models that could significantly fuel massive global growth over the long run, lowering AI costs. This could itself feed into a more accommodative monetary policy, improving the macro outlook over the longer term.

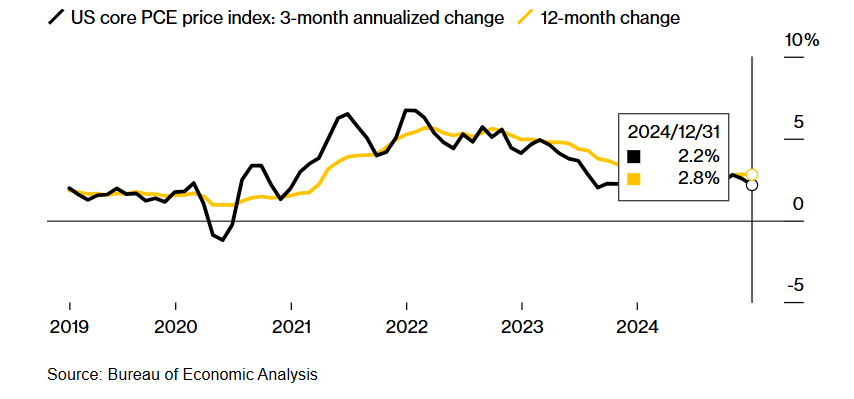

Macroeconomic backdrop

The Fed left rates unchanged at 4.25% to 4.5%, which is in line with expectations. Policymakers highlighted solid growth, a resilient labour market, and still elevated inflation as reasons to leave rates unchanged. Federal Reserve chair Powell indicated the central bank was in no rush to move on interest rates until the data showed it necessary.

Core PCE figures released on Friday showed that the Fed’s preferred gauge for inflation was 0.2% MoM and 2.8% annually, still above the Fed’s 2% target but in line with forecasts. The three-month core PCE figure eased to 2.2%, its lowest level since July.

US GDP data for the final quarter of last year was also softer than expected: 2.3%, down from 3.1% in the previous quarter and below the 2.6% forecast.

The Federal Reserve’s wait-and-see mood, combined with data hinting towards easing inflation and cooling growth, helped to support risk sentiment across the board, lifting Bitcoin above 105k and the S&P500 rise towards a record high.

Trump applies trade tariffs

However, the mood has soured significantly over the weekend as Donald Trump announced trade tariffs of about 25% on Canada and Mexico and 10% on China, with tariffs on the EU to follow.

The market is reacting to the risk of a trade war, as all three countries have vowed retaliatory measures. When global trade tensions arise, the crypto market can become more volatile.

Not only is there a threat of retaliation and a trade war, but the move to implement trade tariffs is expected to be inflationary as it increases business costs. These costs will be passed on to the consumer and could prevent the Fed from proceeding with rate cuts. Keeping rates high for longer is less beneficial for risk assets.

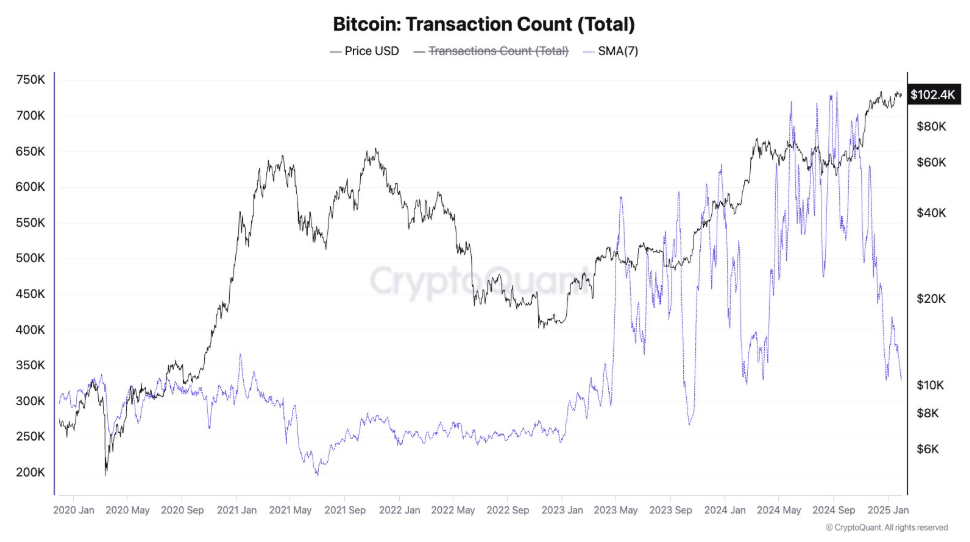

On-Chain analysis – Bitcoin transaction count

Bitcoin’s transaction activity has dropped to its lowest level since March of last year, marking a significant decrease in network movements. However, the transaction volume remains higher than the peak seen in 2022.

This suggests that despite lower immediate activity, the longer-term demand for Bitcoin transactions could still be robust, indicating underlying strength. Low transaction activity is not ideal for positive price action and could suggest reduced interest and investor enthusiasm.

Dormant wallets (lost coins) return

Bitcoin is seeing old addresses come back to life, which often occurs during strong trends and signals that Bitcoin could be gearing up for its next big move.

Old Bitcoin accounts (aka lost coins) that have been dormant for years, often held by early investors or whales, are starting to see movement again. This suggests that long-term holders could be preparing to take profits or adjust their positions. Historically, the reactivation has aligned with bullish phases and could indicate the final leg of this run.

Should these previously inactive Bitcoin holders start selling in large volumes, this could apply strong downward pressure to the price in the near term.

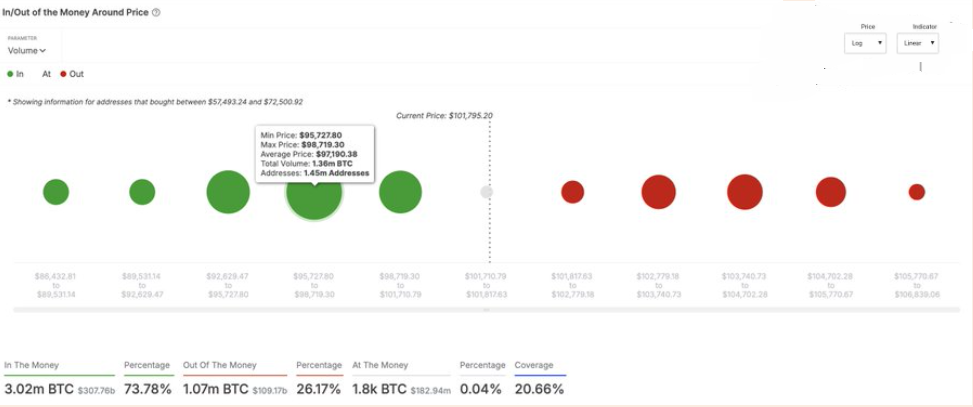

97,190 was critical support, with on-chain data showing a significant cluster of BTC holdings at this level. Data shows that there were around 1.45 million addresses for BTC between 95,772 and 98,719, with a total volume of 138K BTC. Bitcoin broke below this level, potentially leading to a steeper correction. The key is whether support at 90k can be maintained.

Week Ahead

A volatile start to the week is being seen across the markets as investors react to Trump’s decision to apply trade tariffs. Concerns of rising inflationary pressures in the US have driven a sell-off in crypto and stocks while strengthening the USD.

While Trump headlines are likely to be a key driving force this week, attention will also be on the US ISM manufacturing and services PMI and the US non-farm payroll report.

The US non-farm payroll is 170 K jobs added to the economy. This comes after 256 K were added in December. The unemployment rate fell from 4.2% in December. Strong jobs data could add to inflation fears and a more hawkish Fed. However, any sense of weakness in the US labour market could inject some optimism surrounding rate cuts.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.