Bitcoin recovered some of its earlier-week losses following a 12% rally on Friday. However, the largest cryptocurrency still declined by 11% over the week. BTC started last week at 78.8k before tanking to a low of 60k, a level last seen in October 2024.

The price recovered on Friday as dip buyers stepped in, helping BTC end the week at 71k. BTC trades around this level at the start of the new week, marking an 15% rally from the 60k low. However, BTC is still trading 25% lower in just three short weeks.

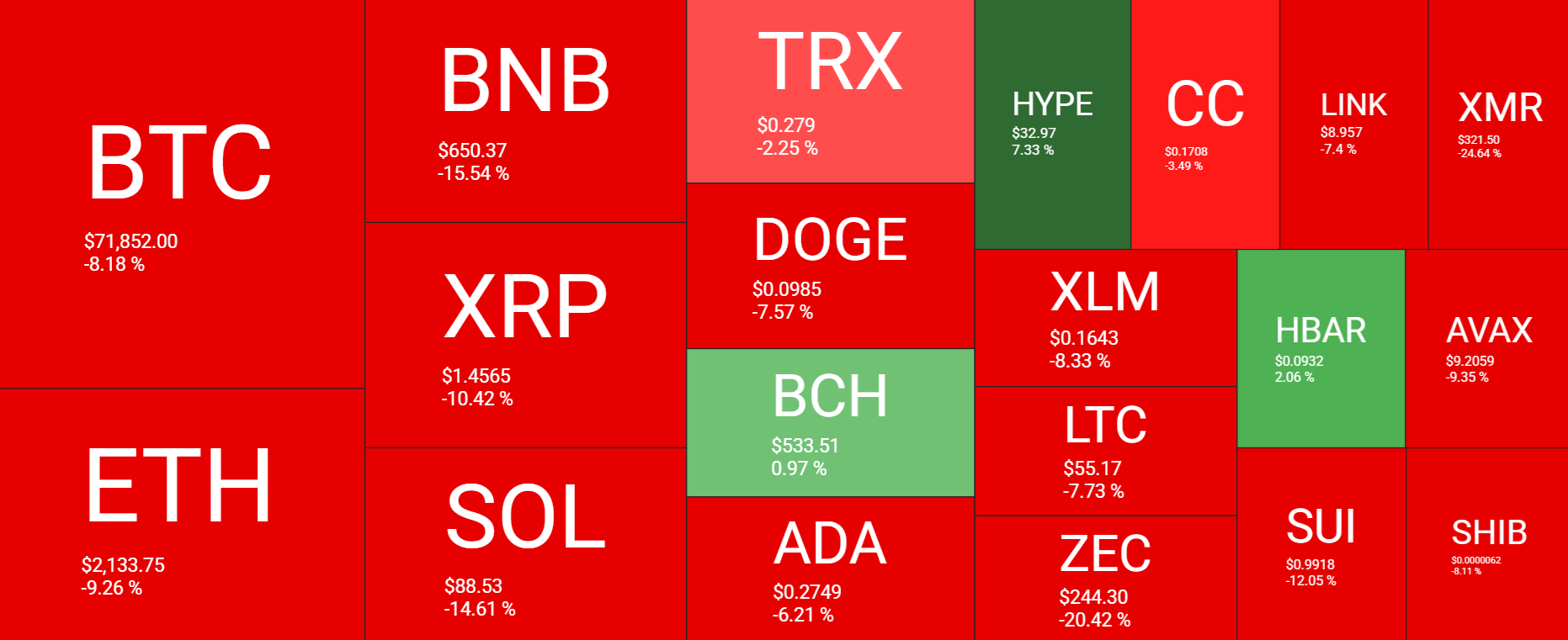

The selloff was broad-based, with Ethereum down 9% over the past 7 days, BNB down 15%, SOL down 14%, and XRP down 10%. HYPE and HBAR were among the few gainers.

The total cryptocurrency market capitalisation has recovered from Friday’s low of $2.17 trillion to $2.44 trillion as of writing. However, this remains below last week’s $2.66 trillion and $3.09 trillion a month ago.

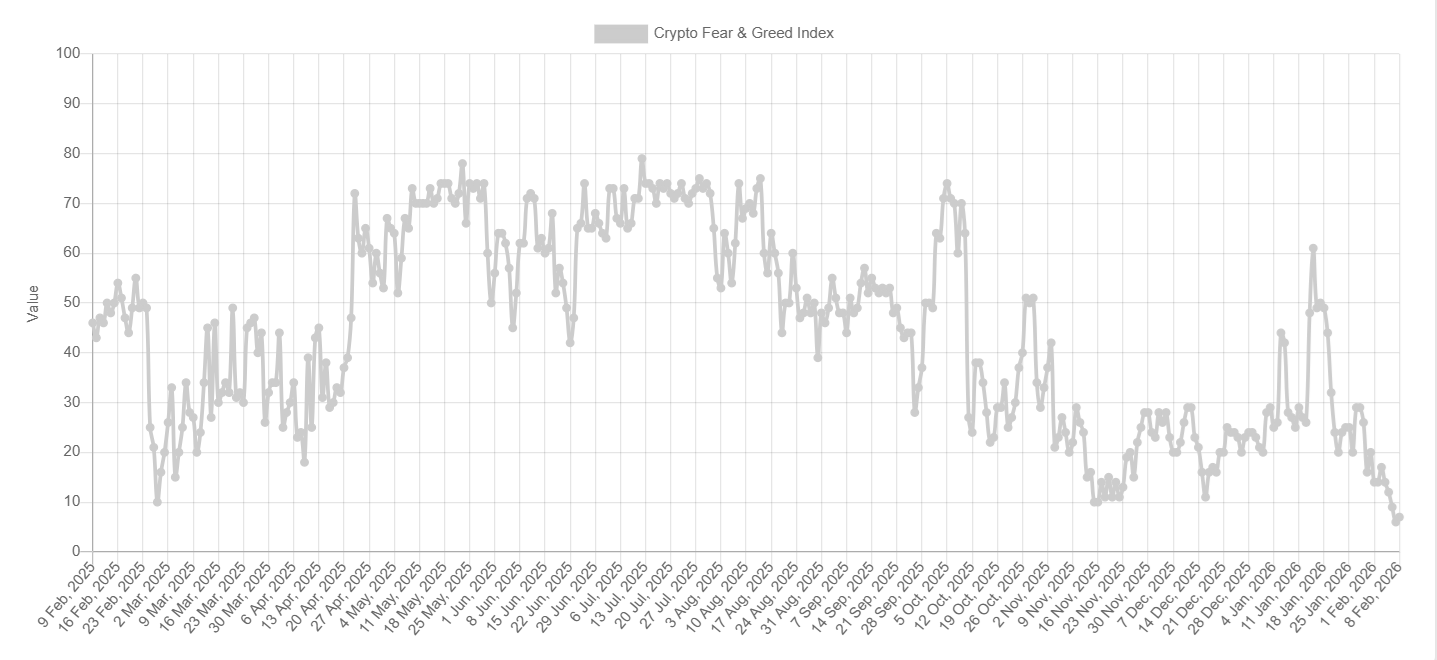

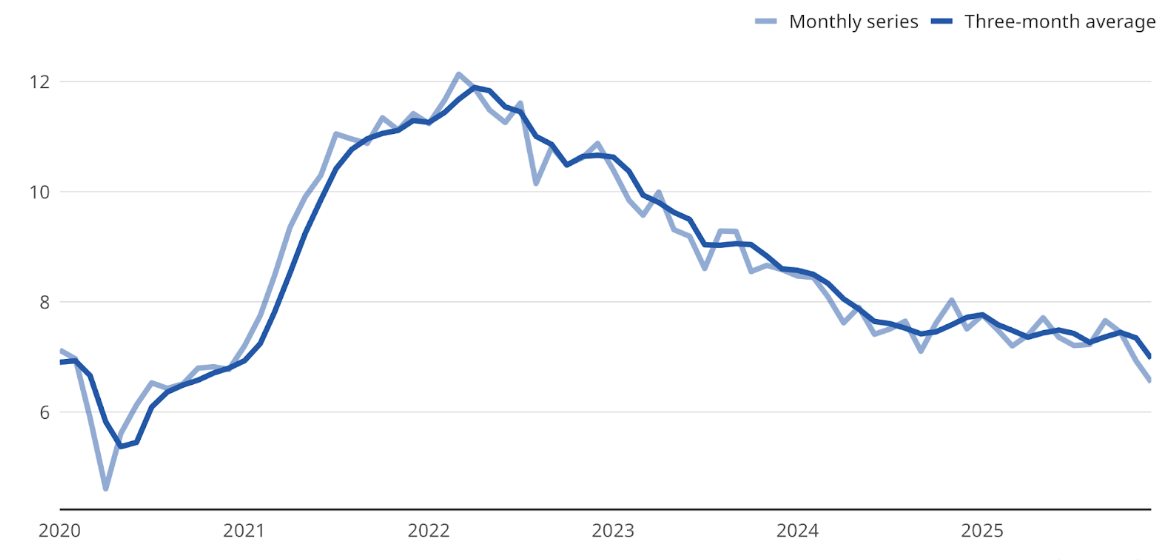

The sharp rise in volatility and a spike in defensive positioning drove a marked increase in fear. Crypto market sentiment plunged to 6 this week, “Extreme Fear”, marking the lowest level since the FTX collapse. This level of Fear has historically only appeared during major breakdowns in market confidence.

The index stood at 7 today, down from 14 last week and 27 last month, underscoring how quickly sentiment can change. While Bitcoin’s price has recovered from its lows, the Fear and Greed Index suggests that the market remains highly stressed.

Bitcoin liquidations

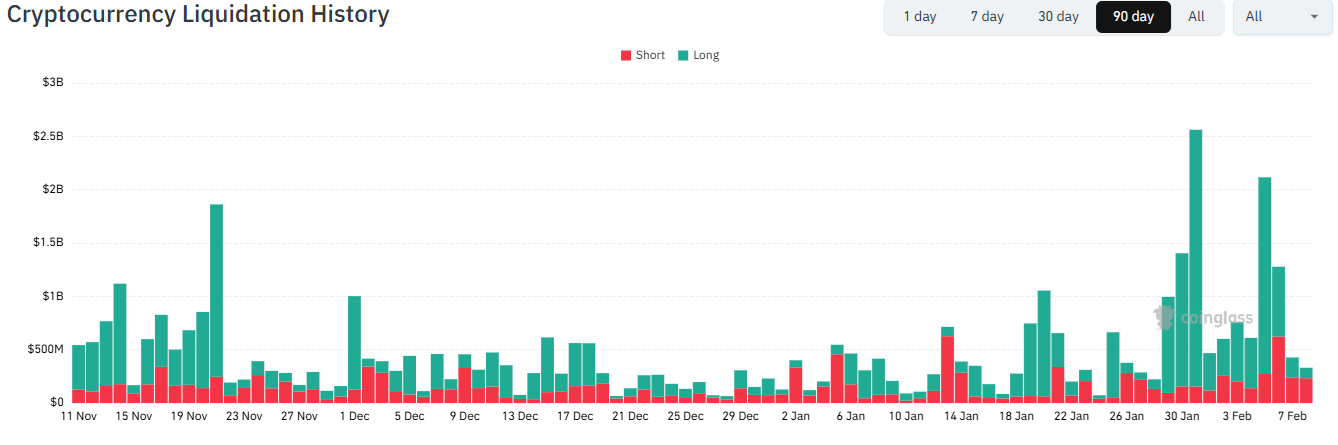

Bitcoin’s downward spiral to a low of $60k on Friday triggered a wave of liquidations across the crypto market, wiping out a total of $4.85 billion across the week, according to Coinglass data, the majority of which were long positions. The recovery to 71k hasn’t sparked much in the way of short liquidations.

Fading institutional demand

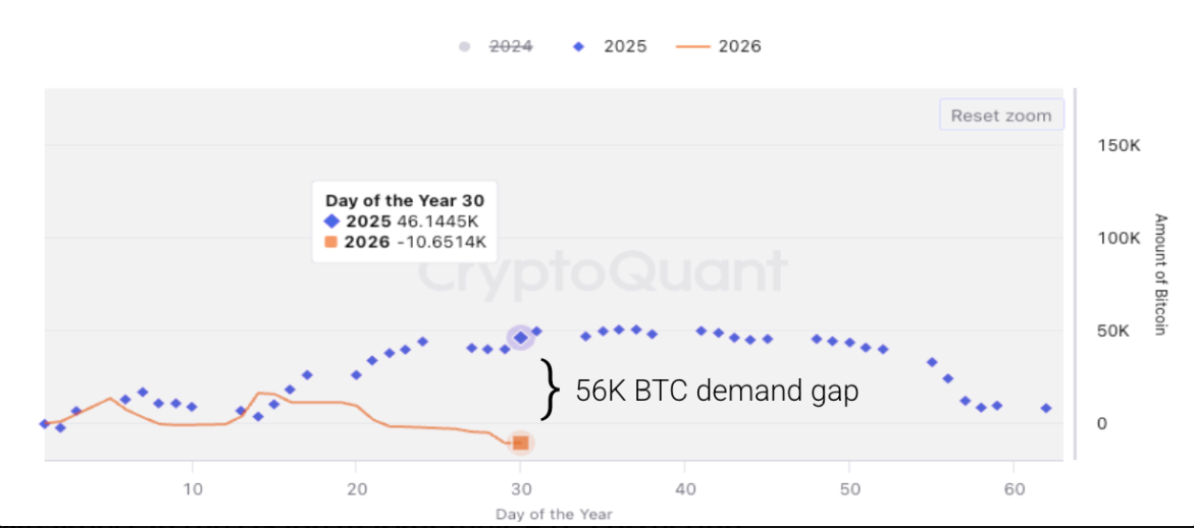

Institutional demand for Bitcoin remained weak with outflows totalling $318.07 million according to SoSo Value data. This marked the third consecutive weekly outflow since January 23, failing to support BTC prices. Persistent outflows could lead to further corrections in BTC prices in the coming weeks.

A deeper look at institutional demand indicates it has reversed significantly. According to Crypto Quant, ETF purchased 46,000 BTC on a net basis in 2025, contributing to Bitcoin demand growth. However, ETFs have become net sellers of Bitcoin so far this year, reducing holdings by 10,600 BTC and leaving a 56,000 BTC gap versus last year, which has led to lower demand and greater selling pressure.

Macro backdrop

Risk sentiment weakened last week before recovering on Friday. On the macroeconomic front, risk sentiment remained weak even as expectations for Federal Reserve rate cuts rose, boosted by signs of weakness in the U.S. labour market.

ADP payrolls shared 22,000 new jobs right in January, missing forecasts of 48,000. Meanwhile, job openings fell to 6.54 million in December, the lowest level since September 2020. Initial jobless claims rose to 231K, up from last week’s 209K.

The data broadly support further rate cuts by the Federal Reserve, although attention this week will be on the non-farm payrolls and CPI reports for further clues on the timing of the next rate cut.

Treasury Secretary Scott Besson also attempted to calm market fears surrounding the nomination of Kevin Wash as the new Federal Reserve president and any plans for balance-sheet moves. Worries that Warsh had previously criticised the Fed for its bond purchases had led the market to fret over a smaller balance sheet and reduced liquidity. Bessent’s comments soothed those worries, supporting risk assets higher.

Separately, tech stocks were hit hard over the previous week, but recovered on Friday. Concerns about AI’s impact on software and the significant AI capital expenditure hit tech stocks, and high-beta Bitcoin acted as an extension of that decline.

A Friday rebound in tech stocks coincided with Bitcoin’s recovery. The Nasdaq rallied 3% on Friday but still posted a 1.9% weekly loss, its worst weekly performance since November.

Bitcoin bear market

Bitcoin has recovered from the 60,000 lows, boosted by dip buying, which has helped BTC stabilise near current levels around 70k. This rebound does not confirm a trend reversal. Instead, the move could be a temporary pause in a broader corrective phase, leaving the question of whether further downside lies ahead.

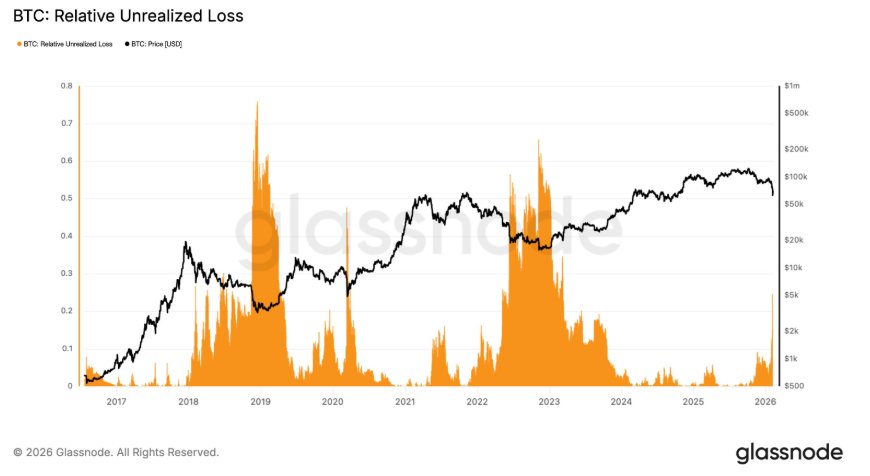

Elevated relative unrealised loss is a defining characteristic of bear markets. This measures the dollar value of underwater coins relative to the total market capitalisation. When Bitcoin declined toward 60,000, this ratio surged to roughly 24%, a level well above the typical bull-bear transition zone, placing the market firmly in bearish territory.

The metric indicates an intense bear market, but it remains below extreme capitulation levels historically seen above 50%. This suggests Bitcoin is in an active capitulation rather than at its final bottom. Selling pressure is widespread but may not be fully exhausted, which could lead to further volatility as the market approaches equilibrium.

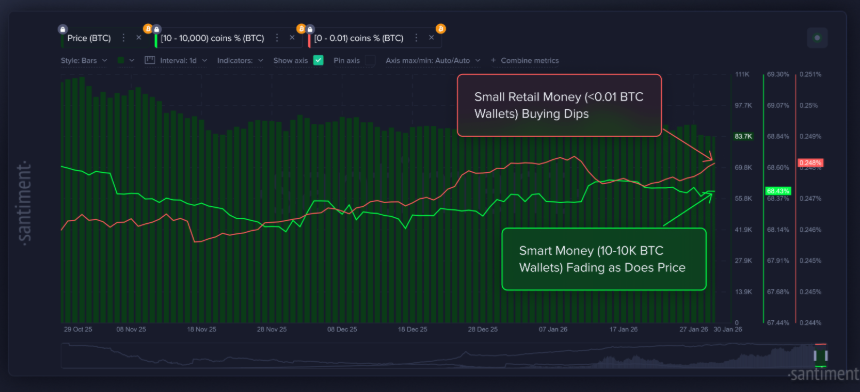

The distribution of Bitcoin supply across wallet sizes is another key area to examine. Data show that those holding less than 0.01 BTC have steadily increased holdings. This group comprises retail participants who often respond emotionally to price fluctuations. They are currently accumulating.

At the same time, wallets holding between 10 and 10,000 BTC have shown mild net distribution during the dip. The divergence is notable as public sentiment on social platforms remains overwhelmingly bearish.

This imbalance suggests the optimism is not fully reset, and a deeper bear phase could see retail capitulation align with bearish social metrics. Until then, the rebound may struggle to gain traction.

Some signs of optimism

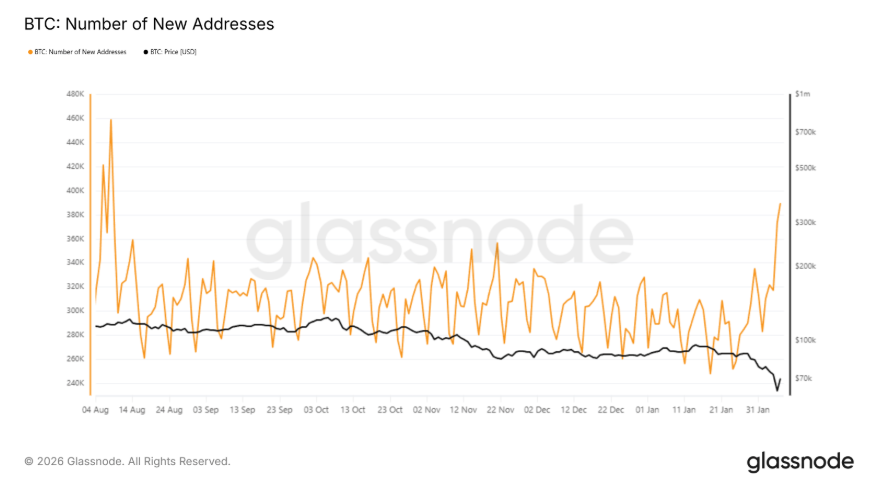

Despite price weakness, network activity presents a contrasting signal. Bitcoin has seen a sharp rise in new addresses over the past week. The number of investors making their first on-chain transaction increased by nearly 37%, indicating new participation in the network.

This growth reflects continued interest in Bitcoin, even as prices correct. While there is no guarantee of immediate upside, rising addresses suggest confidence in Bitcoin’s longer-term value proposition.

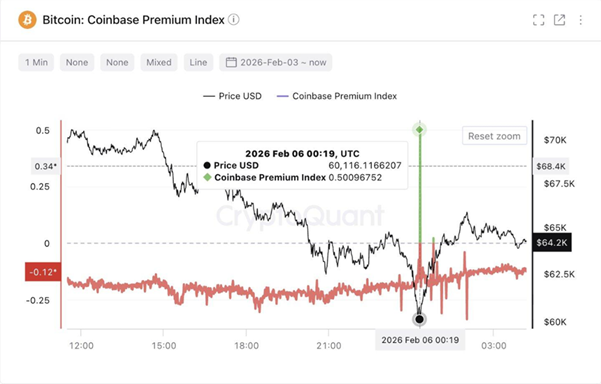

Ki Young, the founder of Crypto Quant, noted another sign of optimism. The Coinbase premium index spiked to 0.5 early Friday as Bitcoin fell toward 60,000, then slipped back into negative territory.

The spike indicates renewed buying interest from U.S. institutional investors, but it does not confirm a bottom. Still, it suggests that aggressive selling has weakened and that US buyers are gradually re-entering the market.

Conclusion

Bitcoin’s rebound from the 60k lows reflects opportunistic dip buying rather than a confirmed trend reversal. While price action has stabilised near 70k and on-chain data point to renewed network participation, broader signals remain fragile. Elevated unrealised losses, weak institutional demand, and cautious macro sentiment suggest the market is still navigating a corrective, bear-market phase.

Until selling pressure eases more decisively and institutional flows turn supportive, Bitcoin is likely to face continued volatility, with the recent recovery best viewed as a pause rather than the start of a sustained recovery.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.