Bitcoin rose 1.5% last week. The world’s largest cryptocurrency started the previous week on the front foot, rising out of the 7-month falling channel and above 70k to reach a high of over 73k, just off its record level. The price then rebounded sharply lower across the rest of the week. On Monday, Bitcoin steadied after 5 days of losses and remains below 70k.

The altcoin market fell across the previous week, with Solana dropping 7%, giving back strong gains from the prior week. Ether fell modestly, down 1.3%, and BNB dropped almost 5%. Dogecoin was an exception to the weakness, rising 6.7%.

Bitcoin ETFs

Bitcoin spot ETF inflows rose to $2.2 billion in the week ending November 1, marking the fourth straight weekly gain. It was also the highest level of weekly net inflows since mid-March, when spot BTC ETFs saw inflows of $2.57 billion, and the Bitcoin price reached an all-time high.

Breaking the data down, spot BTC ETFs saw inflows every day last week except Friday, which saw $54.94 in net outflows. The US Bitcoin ETF had two of the biggest inflow days on record, totaling $1.76 billion, contributing to a total of $5.3 billion in inflows in October.

In contrast, ETH ETFs have remained relatively stagnant, with just $30 million inflows this month, less than 0.6 of Bitcoin ETFs, despite the overall crypto market cap growing from $2.33 trillion to $2.54 trillion.

Bitcoin dominance

Data points to crypto capital being heavily concentrated on Bitcoin via ETFs during this bull cycle without much trickle-down into other crypto assets. Bitcoin has outperformed the crypto market, as its dominance reached nearly a 3-year high of over 60% this week. Some of this increase in dominance has come at the expense of Ether, whose price remained flat in October while Bitcoin soared 12%.

Macro backdrop & de-risking

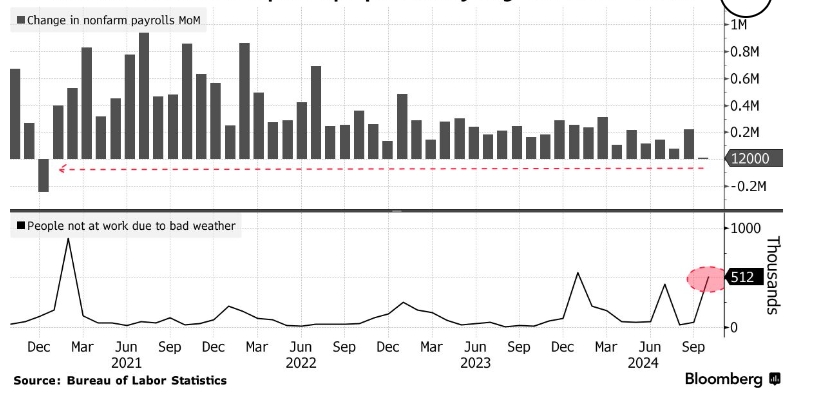

Last week, there was plenty of data for investors to digest, including US GDP figures, core PCE data, which is the Fed’s preferred gauge for inflation, and nonfarm payrolls on Friday.

While US Q3 GDP came in softer than expected at 2.8% annualized, down from 3% in Q3 and below the 3.1% forecast, this was still well above the historical average pace of around 2%. Meanwhile, core PCE was hotter than expected at 2.7% YoY, unchanged from the previous month and defying expectations of a decrease to 2.6%. Although personal spending rose 0.5%, well ahead of forecasts, highlighting a resilience among US consumers.

Finally, the US nonfarm payroll came in significantly weaker than expected: just 12k, well below the 113k forecast and down from 254k in September. The weaker jobs report comes amid ongoing strikes and due to the impact of the hurricanes. Given these one-offs, the Fed is likely to look through this report. Unemployment remained unchanged at 4.1%, while wage growth was 0.4% month on month.

All in all, data has not changed the outlook for the Federal Reserve and paves the way for the central bank to continue cutting interest rates, which bodes well for risk assets such as Bitcoin and stocks.

Despite the data, a combination of month-end portfolio rebalancing, disappointing earnings for key members of the Magnificent 7, and uncertainty ahead of the US elections led to some de-risking last week, but only after Bitcoin attempted to make fresh one-time highs.

The outlook for Bitcoin in the medium to long term is still bullish, but many have chosen to book profits and tightly manage risk ahead of the key events next week. The significance of next week, with the U.S. presidential election and the FOMC meeting, can’t be overstated. Heightened volatility should be expected.

US elections

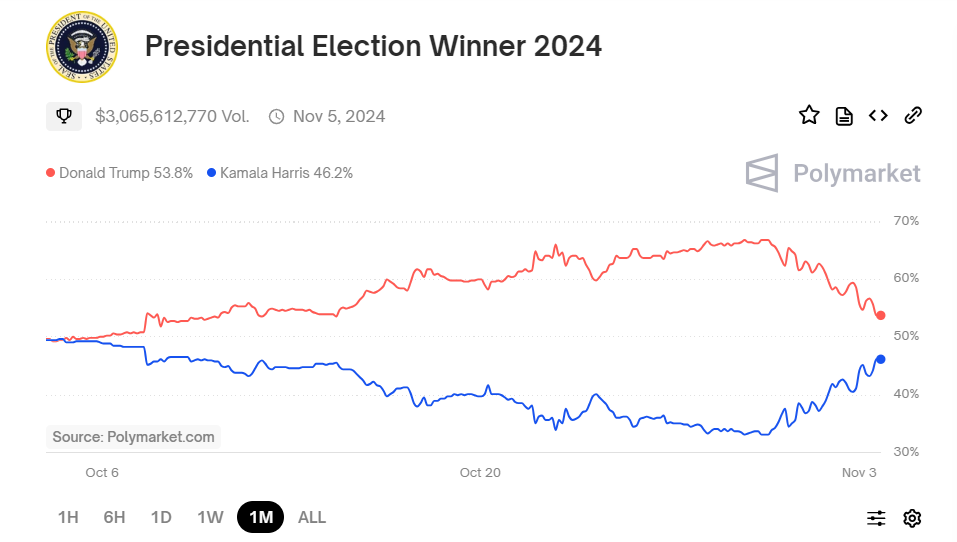

Markets hate uncertainty. With just days to go, Trump’s chances of winning have narrowed dramatically on the Polymarket. While polls are still too close to call, the markets appear to have been following the prediction trackers, such as the Poly market, which saw Trump’s victory chances rising to a 67% high at one point.

Since then, though, Trump’s odds have been falling as the price of Bitcoin and cryptocurrencies in general has also declined. At one point at the weekend, the Poly market saw the former president’s chances of victory decline to less than 53%. At the same time, Bitcoin fell as low as 67.6k. Since then, Trump’s chances have risen slightly to 56%, while Bitcoin has also pushed higher to 68.8K.

What is particularly interesting is just how correlated Bitcoin’s price action is to the Trump election odds.

Trump vs Harris

Trump has portrayed himself as a pro-crypto candidate throughout the election campaign. Trump made it clear, particularly in Bitcoin 2024, that he would take action to improve the regulatory backdrop for the crypto sector, protecting the ability to own Bitcoin and other digital assets while also ensuring responsible, reasonable regulation around stablecoins. Among other points, he even talked about Bitcoin being held in reserves.

Kamala Harris has also been clear that she is open to a change of regime and approach between herself and Biden. She has identified digital assets as an area of innovation that she thinks could be explored, ensuring they align with consumer protection. While she is not as pro-crypto as Trump, Kamala could also support the sector.

However, with both candidates looking to spend big and add significantly to the National Debt (Trump by $7.5 trillion and Harris by $3.5 trillion, according to the nonpartisan think tank), Bitcoin could be a winner under either President over the medium term.

Bitcoin volatility

The volatility premium for options expiring November 8th points to a market positioning for high volatility over the next week, fueled by the US election results and the FOMC meeting. Options markets are currently pricing in an 8% move in Bitcoin next week.

Meanwhile, when considering patterns prior to previous US elections -before the 2016 and 2020 elections, Bitcoin flirted with record highs after building a multi-year base. Now, just days before the 2024 election, Bitcoin was flirting with record highs last week after building a multi-year base. While it’s notable that the sample size is small, the similarities are uncanny.

Short term reactions

Should Trump win the presidency with full control of Congress, also known as a red sweep, this could result in the biggest reaction across the financial market and boost Bitcoin higher.

Meanwhile, with or without a split Congress, the Harris win would likely see the Trump trade quickly reversed, potentially pulling Bitcoin lower.

Given that the Bitcoin market is open 24 hours a day, the market could react to the exit polls as soon as they are released.

Bitcoin, the USD & the Fed

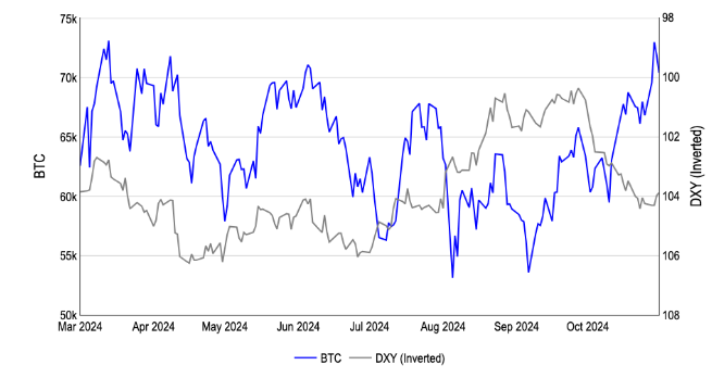

This week also sees the Federal Reserve interest rate decision, where the central bank is expected to cut interest rates by 25 basis points. However, given the recent resilience of US economic data, the Fed is expected to cut rates more gradually than initially expected. This, combined with expectations of a Trump win in the elections, helped boost the USD, which saw its strongest monthly performance since 2022 in October.

Bitcoin value is denominated in U.S. dollars, and therefore, Bitcoin can be sensitive to U.S. dollar gains and losses. However, the stronger U.S. dollar in October didn’t prevent Bitcoin from gaining 12% across the month, which suggests that the relationship between Bitcoin and the US dollar index is less clear in the short term.

Other US data points, such as the ISM services and manufacturing PMIs, will also be in focus, as well as China’s meeting of the Standing Committee of the NPC. However, these are expected to play second fiddle to the US election and Fed announcement.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.