The weeks continue to get better and better for the cryptocurrency space. Bitcoin, the largest crypto by market cap, has hit an important milestone again as it cruised to $50,000 and is sitting quite comfortably above that mark. Bitcoin is now only around $10,000 shy of its all-time high of $62,000 hit in April of this year.

But it is not only the major cryptocurrency making big moves as Ethereum has also hit an important milestone. The programmable blockchain managed to break the $4,000 mark, for the second time this year. Ethereum has doubled in value since June 22.

All of this price action has seen volume returning to the cryptocurrency markets, which in turn has helped some of the smaller altcoins also climb. Solana has been seeing incredible gains over the past month. On August 15 it was valued at $44per coin but it recently hit an all-time high of $148.

This impressive crypto action is in contrast to the traditional markets. A big miss in August’s NFP jobs report led stocks lower on Friday to finish an otherwise positive week. The S&P gained 0.6% while the Dow shed 0.2% for the week despite both indices falling on Friday. Tech stocks were still strong, however, lifting the Nasdaq up 1.5% for the week.

Nonfarm payrolls increased by 235,000 in August vs consensus expectations of 720,000. The initial reaction from the market was confusion and shock since the number was a huge miss, but markets started calming down as traders began to lean towards the narrative of more accommodative policies.

FED Chair Jerome Powell has repeatedly emphasized the need for stronger jobs data before the central bank would start to unwind its bond-buying program, and thus, the disappointing report could change the taper schedule.

The USD fell through the 92 level but managed to salvage some losses in Asian trading today after two consecutive weeks of losses from the high of 93.7. With such a weak job report though, expectations are for the USD to fall further as taper expectations are now out of the water.

Gold and silver finally managed to gain some momentum, with Silver the outperformer with a 3% gain to $24.75 and Gold finally inching further northwards of $1,800 to $1,828.

Oil briefly went above $70 but is back below $69 as activities in traditional markets remain lackluster since it is a bank holiday in North America.

Two central banks are to meet this week to discuss interest rate policies. These are Sept 7 from the Reserve Bank of Australia, and Sept 8 from the Bank of Canada. Expectations are for both central banks to remain dovish with the COVID Delta Variant still continuing to plague economies.

Meanwhile, in Asia, the Nikkei 225 stock index of Japan continues from strength to strength, up 1.6% today after rising 3.6% last week as hope arises for more economic stimulus from Japan’s impending new leadership after current prime minister Yoshihide Suga said that he would step down in a shock announcement.

The cryptocurrency market didn’t suffer from US holiday blues as the King of Crypto’s BTC finally mustered enough firepower to blast through $50,000. Trading volumes are beginning to climb back into the crypto space as the asset class continues to outshine traditional trading.

Volumes Returning to Crypto Market

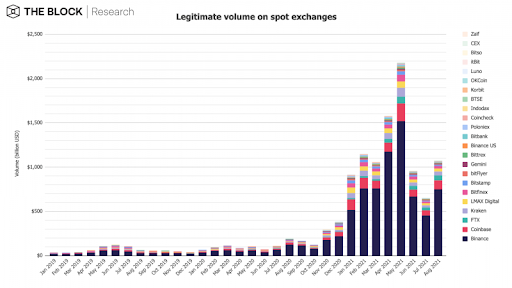

After cooling off for two months after hitting a peak in May, crypto spot exchange volume recovered to rise above $1 trillion again in August, with the month-over-month increase at a cool 64% from July to August. This large increase is a sign that short-term traders could be coming back into the market after the BTC price started rebounding.

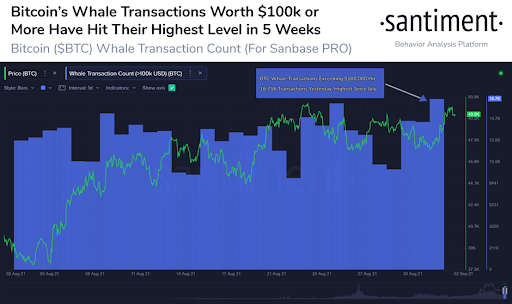

As trading volume started to increase, large BTC transactions of $100,000 or more have risen to a corresponding 5-week high as well, a sign that OTC trades and the use of BTC for large value transactions continues to increase, a good indicator of adoption.

According to data, volumes across BTC derivative markets also rose. BTC Futures volume climbed 17% from July to hit $1.73 trillion in August, while BTC Options volume showed an even more substantial increase, rising 66% from $10.72 billion to $17.79 billion from July to August. While these numbers are still lower than May’s peak, they certainly show that interest is returning to the crypto market, and this interest is likely to continue as more positive adoption news is being announced by the media.

One such event is the legal tender law in El Salvador that goes into effect tomorrow, Sept 7.

September Has Some Good PR Events For BTC

With BTC becoming legal tender effective Tuesday, Sept 7, the Legislative Assembly of El Salvador passed legislation creating a $150 million Bitcoin Trust to support the development of crypto infrastructure and services across the country. The government has also set aside $23.3 million toward rolling out crypto ATMs and $30 million to incentivize the use of the state-backed “Chivo” wallet.

Another event that could bring a lot more new attention to BTC and the crypto market will be the upcoming SALT Conference to be held between Sept 13 to 15 where well-known BTC bulls Anthony Scaramucci and Cathie Wood are expected to take to the stage to talk about BTC and crypto. SALT is a global thought leadership and networking forum encompassing finance, technology, and geopolitics and is attended by leading asset managers and entrepreneurs with top asset owners, investment advisors, and policy experts. Former US presidential candidates Jeb Bush and John Kerry are rumored to be attending the conference. Other influential pro-crypto speakers will be there as well to explain the importance of cryptocurrencies to investment managers.

Meanwhile, out of Asia, Japan’s SBI Holdings announced that it will launch a BTC and crypto fund before the end of November. The fund could reach several hundred million dollars and will include BTC, ETH, XRP, LTC, and other cryptocurrencies. SBI also added that should the first fund receive a good response, they will “move quickly” to offer a second fund.

August Saw Increasingly Impatient BTC Buyers

All the good news and return of trading volume proved to be good support for BTC, with dip-buyers increasingly willing to bid higher to get their hands on the coveted inflation hedge.

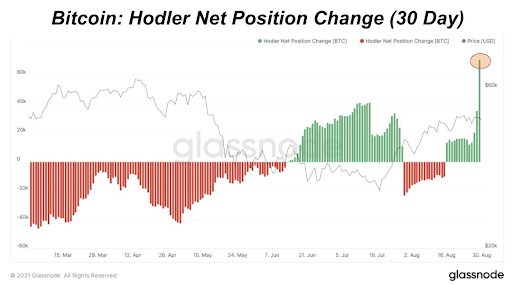

Early last week saw a large spike in BTC holdings by BTC hodlers, a sign that hodlers were not giving up supporting the price of BTC despite price action appearing to be rather weak.

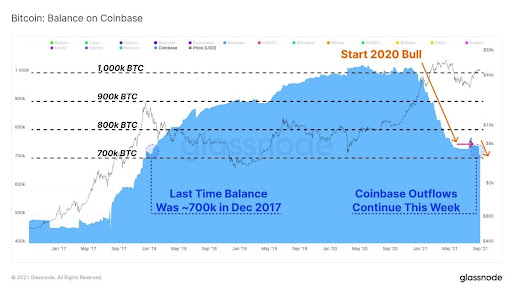

After a period of moderate BTC inflows following the May Sell-off, Coinbase has seen a large outflow of coins. This brings the total balance to just over 700k $BTC. The last time the Coinbase BTC balance was at this level was in December 2017.

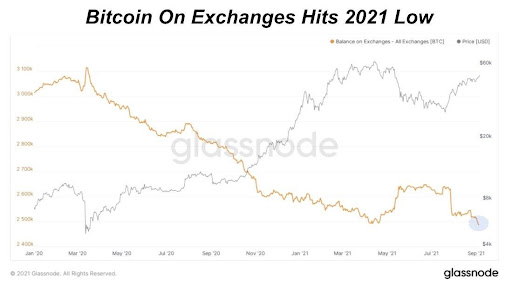

In affirmation with the Coinbase outflow, BTC balance on all exchanges has also shown a similar movement, with the balance beginning to fall sharply again after increasing towards the end of April, showing that BTC is flowing out of all other exchanges in the same period. The BTC balance on exchanges has hit a new two-year low of 2,486,418.983 units, even lower than the low realized in April, resuming its downtrend.

In a similar trend as BTC, the balance of ETH at exchanges is also continuing to decline. In fact, the exchange balance of ETH did not even increase by a notable amount during the market correction between May and July, a sign that investors in ETH could be a lot more committed to holding their ETH for the long term.

ETH Breaks Out of 3-Month Consolidation As Metrics Continue to Impress

ETH led the market higher last week after it exploded up from the $3,377 resistance that had its price capped for the past month. This breakout was imminent as ETH’s metrics had been improving in leaps and bounds ever since the London Fork. Other than what we had mentioned in our last week’s report, other metrics like miner balances have also shown a complete turnaround since mid-August, with the hoarding of ETH by miners tripling from the end of July’s all-time-low of 81,512 units to 243,000 units currently, a three-year high. This goes to show how bullish miners are on the price of ETH after the success of the London Upgrade, and that bullishness has inevitably translated into a quick price appreciation.

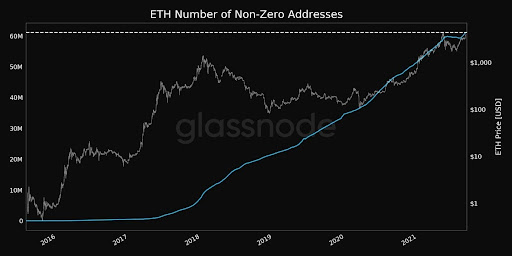

Other than miners, the non-zero addresses metric for ETH is also showing positive signs as the number has started to rise again after a pause in the last two months, a sign that ETH is seeing new entrants entering the market to buy, implying that mass-market adoption has resumed its uptrend. This bodes very well for the continued price appreciation for ETH.

SOL Roars Another 50% To Yet Another ATH

The altcoin market is witnessing some breakout attempts after BTC rose above $51,000 in early Asian trade today after a quiet last week as traders’ attention was all on one particular token called Solana (SOL).

It appeared as though SOL had sucked the liquidity out of all other altcoins after its tremendous run since early August, continuing to see rising interest translate into a continuous rise in price. SOL has become a legend for the past 2 weeks with its meteoric rise of more than 150% since smashing its ATH. This has firmly put SOL into the crypto top ten with it now placed at number 8 as the most notable alternative smart contracts blockchain next to ETH.

On a month-over-month basis, SOL has risen more than 700% on the back of explosive interests from developers and projects building on it as well as partnerships and integrations. The week before saw SOL integrating with LINK, while last week saw blockchain-based music streaming platform Audius, which had recently partnered with TikTok, launching SOL-based NFTs onto its platform for its users. Further to these, a meet-up between the team members of SOL and top play-to-earn NFT game Axie Infinity also had traders in wild speculation about a possible move to SOL, further extending SOL’s gains as traders FOMOed into the new hot token.

Meanwhile, other altcoins may get a chance to play catch up this week as momentum for SOL starts to slow down. One such candidate could be XRP, which observers on the lawsuit notice the judge looking increasingly annoyed with the SEC – a situation that could be favorable for Ripple. Japan’s Rakuten has announced that it will resume XRP margin trading from Sept 8, which could bring in some fresh margin traders from Japan. Japan is well-known for its retail traders who are apt at using margin to make consistent earnings and Rakuten is Japan’s biggest cryptocurrency retail exchange.

BTC finally edging above $50,000 could put the wind beneath the wings for altcoins and drive further momentum in the market this week.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.