The shortened holiday week over Thanksgiving did not do much for the markets, especially when considering so-called safe haven assets like gold, and even cryptocurrency which was rampaging upwards the week before. However, there was some good news when it came to Forex.

Looking at the stocks, they also seemed to be in holiday mode as not too much happened there other than some general consolidating in a holding pattern. Yet, the Dow is feeling a bit of selling pressure, but that is not too much to be worried about.

The US Dollar is facing a time of weakness as it stands, but this is good news for other foreign currencies as the EURUSD has broken some key milestones on its climb. But interestingly, Gold also fell back at a time where the dollar was showing weakness — something that does not often happen.

It is not only Gold, the primary safe haven asset, that fell over the holiday week, there has also been a rather big drop for cryptocurrencies that were flying. Bitcoin was heading towards its previous all time high only to be stopped in its tracks last week.

Unsurprisingly, with Bitcoin grabbing the headlines in the previous weeks, greed, and rumours, were at the heart of this most recent collapse. It was also not only Bitcoin that felt the pinch as the major coin helped many altcoins take off, but these coins also felt a rather large collapse as well based on other factors.

This was short lived though as the beginning of the new week saw Bitcoin rally and even tip a new all time high on some exchanges as the coin settled around the $19,800 mark.

More pleasing for the cryptocurrency space, Ethereum, the second-largest cryptocurrency by market cap, has seen a major milestone in its development reached which will no doubt pump a lot of potential and promise into its market.

With theCryptocurrency market bouncing back after falling, will it continue to rally. And, will the rest of the traditional markets go back to normal after taking a break? Read the rest of our weekly market research report to find out.

Short Week Stumps Stocks

In a holiday shortened week, stocks did nothing much but continue consolidating in a holding pattern waiting for something to drop, be it positive or negative news related to the stimulus package.

However, the Dow is finding selling pressure with every move above 30,000 and this level may curb the upward trajectory of the Dow because a small double top pattern is seen. However, any downward move should be quite well supported at around 28,500.

EURUSD Breaks Key Resistance And Gold Breaks Key Support

USD weakness continued against most FX majors, with the EURUSD breaking 1.1900 convincingly this time to close at the week’s high. The pair will be testing the 1.1965 resistance that has been keeping it down since August and is expected to post higher gains in the week ahead.

Despite a USD weakness, gold broke its support at $1,800 as it traded lower to end the week at $1,786. More weakness is expected as traders unwind their position in gold as the end of the year draws near with no US stimulus in sight. Gold may take till 10 December when ECB announces its stimulus package to gather the bulls back in.

Rumour and Greed Sink Crypto Prices After a Week of Excitement and Speculation

The week in cryptocurrency market could be divided into two distinct parts, with the early part of the week filled with much euphoria as the price of XRP skyrocketed to $0.79 on Tuesday, shocking even the most bullish XRP advocate at the magnitude and pace of the advance, as XRP rallied more than 150% over 5 days.

EOS also had a good run, moving from $2.80 to a high of $3.80 within the week. Overall, the sentiment in the crypto market was at a high, with most altcoins clocking between 20% to 150% growth.

The moves in the altcoin market seemed a bit too fast too soon for it to be sustainable. BTC in the meantime, tried twice to break its ATH of $19,600 but could not. This mark has now finally been breached, even if it was short-lived. It seems Bitcoin is well placed to push further and higher now.

This is despite when, on Wednesday night, a rumour about the US Treasury Department’s plan to control self-custody of cryptocurrencies made its round.

The rumour was started by Brain Armstrong, the CEO of another crypto exchange. In a series of Tweets, Brian exposed that the US Treasury was going to enact a law to stop the self-custody of cryptocurrencies, and that he and a group of prominent crypto advocates were trying to prevent it.

The tweets caused instant panic in an already overleveraged market and cryptocurrencies instantly dived at a much faster pace than when they were rising. BTC fell $3,300 to a low of $16,100. The rest of the crypto market saw blood bath as overleveraged traders either quickly unwound or got their margin positions liquidated.

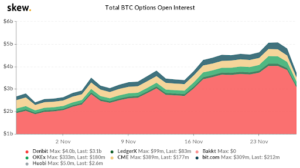

The perpetual futures market saw $1.9 billion worth liquidations of long positions in the 24 hours after the tweet, with half of the positions in BTC. Open Interest in the Options market also fell from $5 billion to $3 billion.

As it was a Thanksgiving weekend, activity naturally slowed down since it was a major holiday both in the US as well as Europe, where most fund managers would have taken time off.

Grayscale Bitcoin Trust added around 7,000 BTC in the week but has yet to make any purchase since the price of BTC dropped, perhaps due to the public holidays. As such, there wasn’t much institutional support for BTC as it fell.

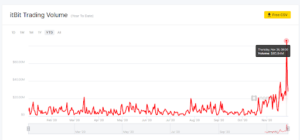

However, BTC found a set of new buyers as Paypal’s users took the opportunity to acquire perhaps their first cryptocurrencies. Paypal uses ItBit exchange exclusively for its customers’ crypto purchases.

As can be seen below, the trading volume of ItBit spiked significantly during the drop last week. It increased from its norm of about $15 million per day to $85 million on Thursday.

Most experts view the drop as a positive sign for the overall crypto market as the market was getting way overheated and overleveraged. However, opinions are mixed if the low of $16,100 was the intermediate low, or that more retracement would be forthcoming.

ETH Hits Milestone For Staking To Launch on December 1

The 2nd largest cryptocurrency ETH, saw a reversal of the poor interest in ETH 2.0 last week. It very quickly managed to gather the minimum amount required for ETH 2.0 to launch. Within 1 day, the staking percentage grew from 25% to more than 100%, with much more than the minimum required amount of ETH deposited.

As the price of various cryptocurrencies started gaining, ETH followed suit with a quick move from $500 to $620, possibly caused by late buyers purchasing ETH to deposit into the staking contract. Price cooled back down to $500 during the selloff, which is an area of good support.

We expect interest in ETH to be back this week as ETH 2.0 will be launching on Tuesday, December 1st. ETH has since rebounded to a high of $590. We expect more upside for ETH since there is no resistance until $800 and that its RSI at 65 is no longer overbought after cooling off.

The coming week will determine if BTC and the broad crypto market will venture higher or if it reverses back to lower levels. Meanwhile, institutional interests in BTC continue to increase with 2 filings by large traditional funds with the SEC to purchase BTC.

Fidelity will be offering a Bitcoin Index Fund and Guggenheim Fund sought approval to be able to invest up to $500m in BTC through Grayscale Bitcoin Trust. More purchases of BTC will be made once these 2 filings gain approval and we expect a lot more of such institutional and corporate purchases to come through to support the price of BTC or raise it higher.

Information provided in PrimeXBT’s market report includes information provided by Kim Chua, Lead Market Analyst for PrimeXBT, in addition to charts from various data sources.

*Disclaimer: Price information is averaged to accommodate the high volatility of the assets and is as close to accurate at time of print as possible.

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.