Bitcoin traded in a relatively familiar range last week, dropping to a low of $64,500 on April 2 before spending the week grinding higher to a peak of over $70,000 on the weekend. Despite Bitcoin’s uncharacteristic strong weekend performance, the price of the cryptocurrency declined 1.3% across the week.

Bitcoin was not alone in experiencing losses last week. Other cryptocurrencies, including Ethereum, which dropped over 6%, Solana, which fell almost 10%, and Doge, which declined by 7%, also faced similar challenges.

The crypto market’s modest downward trend was influenced by recent comments from Fed policymakers, including Federal Reserve Chairman Jerome Powell. Powell suggested that the central bank will maintain a cautious approach toward rate cuts. This, coupled with a strong U.S. jobs report on Friday and the resurgence of the US manufacturing sector, indicates a robust economy. These factors contribute to reflation worries, supporting the view that the Fed could maintain high interest rates for an extended period. The potential impact of these macroeconomic factors on the crypto market is significant, as they can influence investor sentiment and market trends.

On Monday, April 1st, data showed that the US manufacturing sector returned to growth for the first time in 16 months. The surprise jump served as another example of the solid fundamentals of the US economy. Bitcoin plunged 2.4% on April 1, followed by a 6.4% drop on April 2.

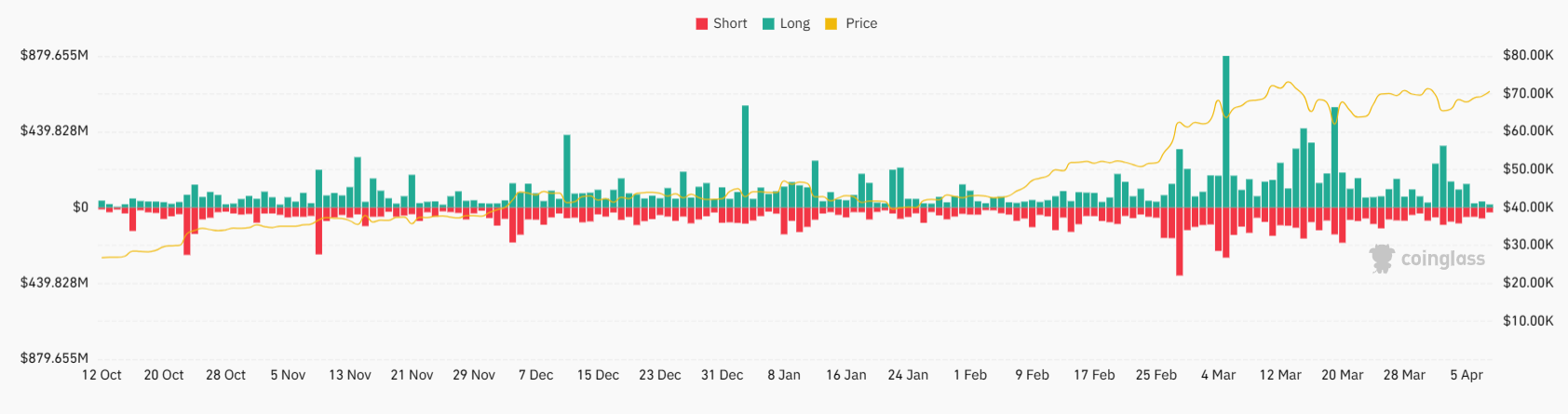

The sudden price drop to $64,500 led to a major liquidation event of over $350 million long Bitcoin positions, according to Coinglass data. Liquidations have stabilized as the BTC price grinds higher.

Digital Gold & dip buying

Last week’s risk-off mood in the crypto markets was not unique to that space, as equities also moved lower across the week. The market no longer believes the Fed will cut interest rates three times this year and sees a year-end rate of 4.631 basis points, above the Fed’s dot plot target of 4.625.

Gold has been the standout performer, hitting an all-time high this week of $2350 amid increased central bank buying, reflation worries, and heightened geopolitical concerns. What’s been particularly notable about gold’s latest rally is that it has come despite recent hawkish views on rate cuts, suggesting that fears of inflation re-materializing are overshadowing worries of the Fed keeping rates high.

Bitcoin has been increasingly seen as a form of digital gold, and as such, it could start driving demand from a new type of investor. As a result, there could be more aggressive dip buying of Bitcoin than in previous cycles.

ETF flows could remain strong until halving

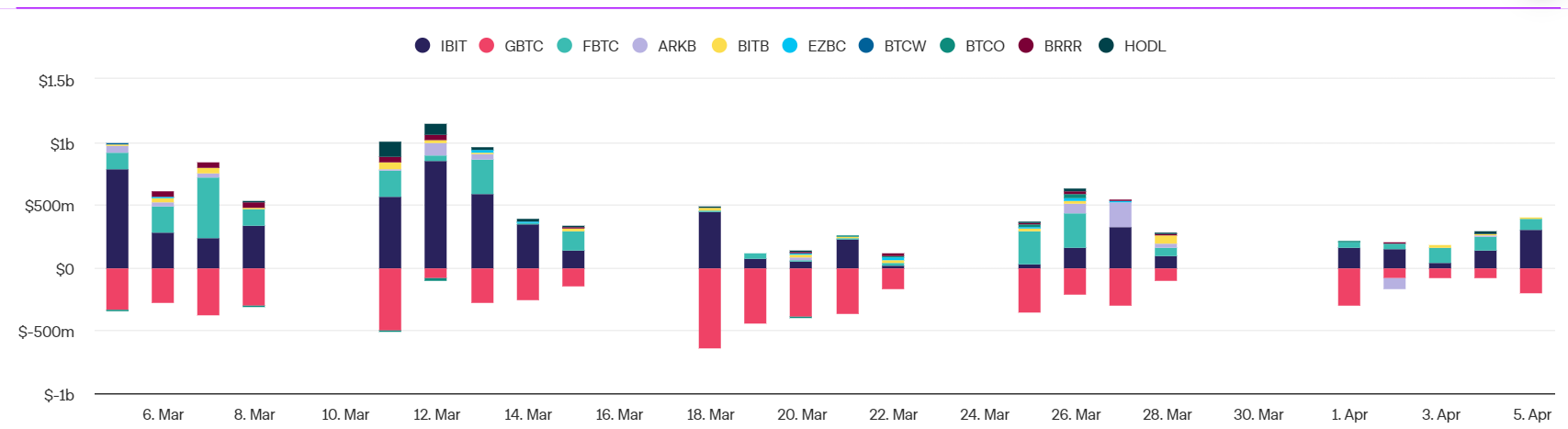

US spot bitcoin ETS inflows rebounded further last week, helping Bitcoin claw back some earlier losses. Bankrupt crypto lending firm Geniss has also finished selling billions of dollars worth of shares in Grayscale Bitcoin Trust. The inflows of institutional demand represent the most fundamental shift in the market structure, which, coupled with the upcoming halving, keeps the outlook for cryptocurrency encouraging.

Expectations are that ETF inflows will remain high until Bitcoin halves later this month. However, it will be interesting to see whether a drop in ETF and on-chain volumes occurs afterward.

Bitcoin ETF volumes soared to $111 billion in March, almost triple the volume for the previous month, highlighting the interest in the product. Bitcoin ETF inflows picked up at the end of last week, with two days of over $200 million in net inflows on April 4 and 5. This followed a few low days earlier in the week with $85,7 million in outflows on April 1.

BCH’s halving event

Bitcoin cash was a clear outperformer last week, posting gains of 13% after the forked blockchain underwent its second ever, having even just weeks before Bitcoin’s equivalent.

BCH’s halving event on Thursday reduced block rewards from 6.25 BCH to 3.125 BCH. Following the event, prices spiked to levels not seen since 2021, reaching almost $700 in early Friday before settling around $660, marking a 13% increase. With Bitcoin’s halving event under two weeks away, BCH’s pre- and post-halving moves could provide clues about what to expect from Bitcoin.

Funding rates normalize

Bitcoin’s funding rates dropped sharply over the weekend, easing back to deemed neutral levels.

Typically, a fall in the funding rate, which measures the payments to traders based on the difference between perpetual contracts and spot prices, indicates a shakeout of over-leveraged bullish traders.

Funding rates soared when Bitcoin rose to its ATH mid-March, signaling an overheated market. However, with funding rates normalizing as the price booked a weekly loss, there is now scope for fresh longs entering the market, which could pave the way for a more sustained rally.

An 11% fall in Open Interest in Bitcoin futures over the weekend, according to Coinglass data, also points to the exit of over-leveraged long positions, supporting the view that there could be more room to run higher.

Stocks dropped, and gold at an ATH ahead of US inflation data

U.S. stocks fell across the previous week, with the Dow Jones dropping over 2% in its worst weekly performance since October. Nerves returned to the market after several Federal Reserve officials, including Fed chair Jerome Powell, confirmed that patience was needed before cutting interest rates, given the strength of the US economy and the increase in inflation.

The US non-farm payroll report was much stronger than expected, with 303k jobs added against the 200k forecast in March. The blowout jobs report raised the prospect that the Federal Reserve could delay interest rate cuts for longer.

By the end of the week, the market was pricing in just a 50% probability that the Federal Reserve would start cutting interest rates in June, down from 75% just a month ago. Meanwhile the market is pricing in a 70% probability that rates will be cut in July.

Looking ahead, attention will be very much on the US economic calendar, with inflation data being released this week. Inflation is expected to rise to 3.4% in March, up from 3.2% in February.

A combination of strong employment and slow progress on inflation over the last few months could raise doubts about the pace and scale of rate cuts this year.

In addition to the US inflation data, the March Fed meeting minutes will also be released. At this meeting, officials continued to point to three rate cuts this year.

Along with the macro data and FOMC minutes, the US earning season will kick off in earnest on Friday, with banks such as JP Morgan, Citigroup, and Wells Fargo releasing the numbers. With the S&P 500 up 9% year to date following a strong Q1 performance, the bar is high for stocks to keep rising, and the market will want to see confirmation of these lovely valuations.

Meanwhile, gold reached a record high last week above $2300, boosted by weaker prices paid component to the ISM services PMI, which highlighted a softening in service sector inflation. This pulled the US dollar lower and boosted golf to another record high before hawkish comments from Fed officials pulled the precious metal lower.

Oil prices also rose firmly last week, boosted by geopolitical tensions in the Middle East, concerns over tightening supply, and an improving demand outlook. Crude oil rose to its highest level since October, with WTI hitting $86.91.

However, with signs of tensions in the Middle East easing at the start of the week, oil prices have fallen 2%.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.