The price of BTC broke into $30,000 finally last week after a three-week consolidation after traders returned from the Easter holidays. The move was triggered by a series of positive news for the crypto industry, when the much-anticipated ETH Shanghai fork was successfully implemented on Wednesday and traders cheered by pushing the price of ETH up by 10% overnight. At the same time, news that Twitter would let users trade stocks and cryptocurrencies from within the Twitter app further led crypto prices higher, with BTC once hitting $31,000 before Friday’s profit-taking caused price to pull back. However, the price of BTC is still hovering around the psychological level of $30,000 as at the time of writing.

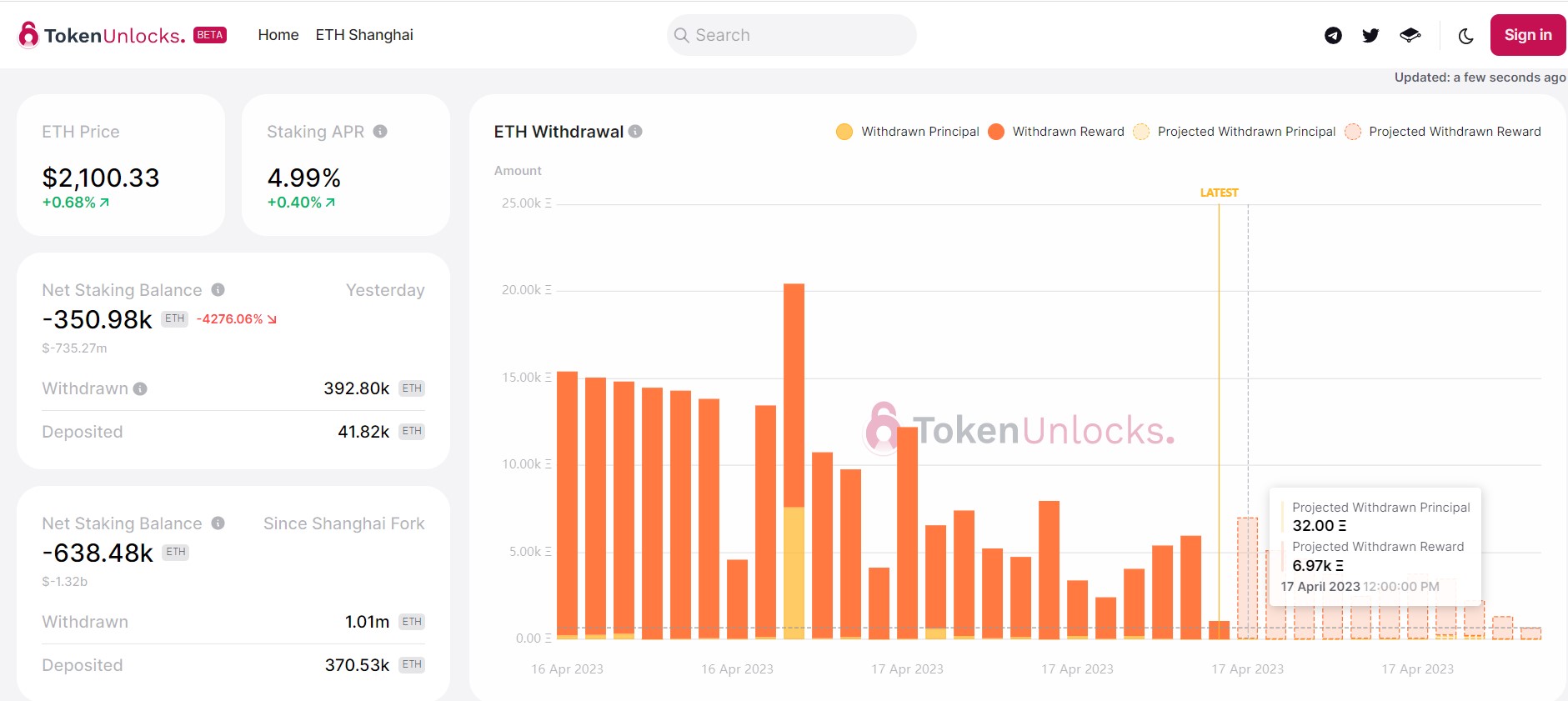

Even though BTC performed well, most of the attention last week was on ETH, which successfully transitioned into Shapella, where stakers could start to withdraw their staked ETH and rewards for sale. While some over anxious traders were afraid that this could pressure the price of ETH, as we had mentioned before in one of our earlier market research reports, this withdrawal is done in a controlled manner where only a small portion of ETH can be withdrawn each time and will not cause a sudden surge in the supply of ETH to the market and cause a steep fall in the price.

ETH Price Rises After Successful Shanghai Fork

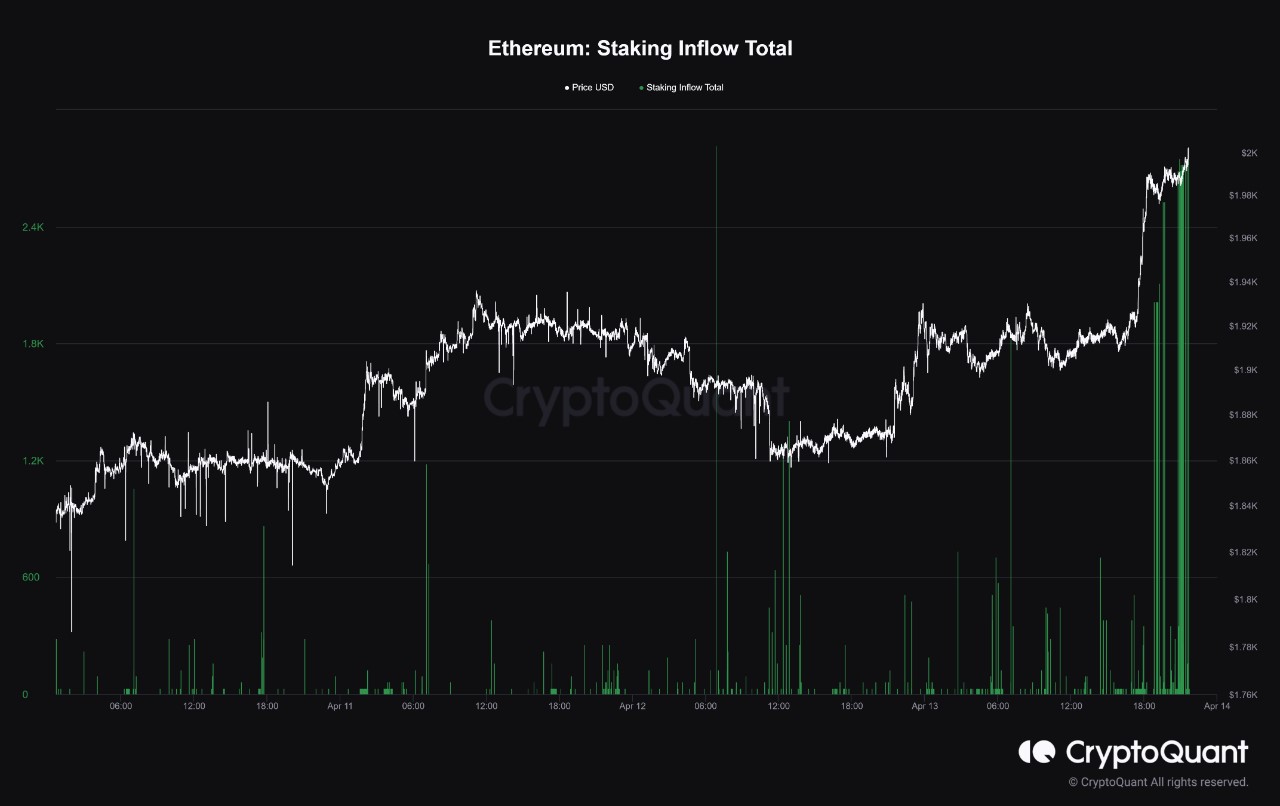

Indeed, the price of ETH surged slightly more than 10% after the upgrade to an 11-month high of $2,130 after market participants noted that the withdrawal amount was only around 1.3% of the total number of ETH staked, while the amount of ETH that was newly entering into the staking program increased sharply in the 24-hours following the unlock. This shows growing investor confidence in the staking program and raises the possibility that more ETH could be added into the staking program than removed as time goes by, which would amplify its scarcity value.

As of the end of Sunday, around 1 million units of ETH were withdrawn, while around 370,000 ETH were newly staked as confidence in the staking program increased. In other words, since the opening of the withdrawal function on Wednesday, only 638,480 ETH had been added to its active circulating supply of 120.21 million units, which is only a low 0.53% which is not likely to have a material impact on its price. Furthermore, with the initial few days of ETH unlocking which has the highest number of withdrawal now behind us, the number of ETH that would be withdrawn for sale in the following days is expected to be on a declining trend, which means the selling pressure would be gradually reduced.

ETH Rally Leads Altcoins Higher

As the price of the leader of altcoins ETH continued to show strength, the market mood of altcoins improved dramatically. A day after the successful ETH upgrade, altcoins began to start rising from Thursday as traders started to take more more risk by shifting out of BTC into riskier altcoins. Among the top market cap assets, DOGE, ADA, SOL, FTM, ARB, INJ, all showed notable advances.

Not to be left out in the dust by altcoins, the metrics of BTC is also at optimistic levels.

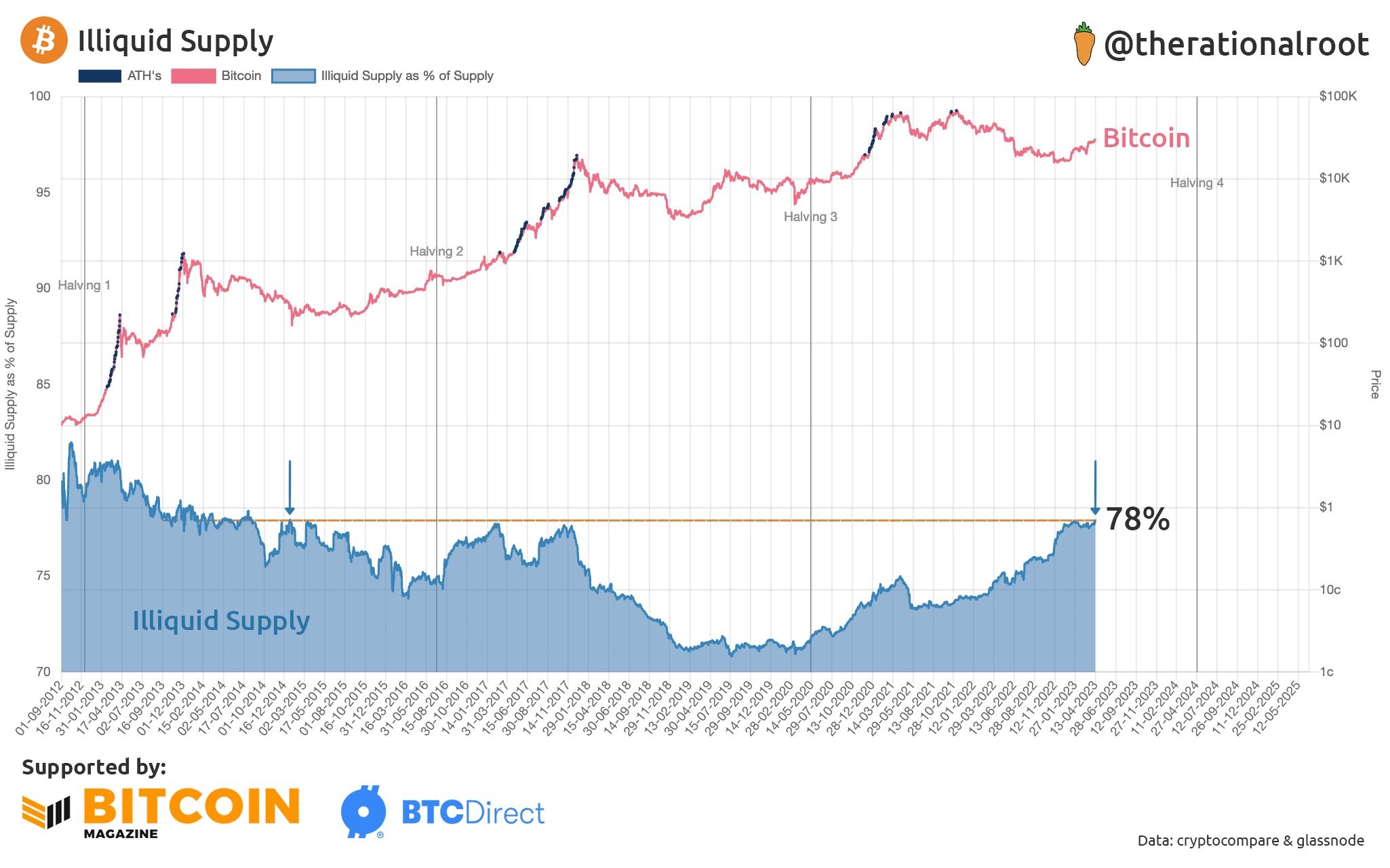

BTC Illiquid Supply Rises to Pivotal Level

The illiquid supply of BTC has been increasing sharply since the end of 2022 after plateauing in 2021 and is now at the highest level since end-2014. This signals that the scarcity narrative of BTC has gotten even stronger since the end of 2022 and an increasing number of BTC have been held for the long-term and not been sold. This could imply that more investors are treating BTC as a store of value.

Latest CPI and PPI Numbers Shows Cooling Inflation

On the traditional finance side, Investors cheered the latest inflation data releases, with both the CPI and PPI readings coming in cooler than expectations last week, which they saw as a strong indication that inflation is indeed easing off. Furthermore, a dovish revelation from the March Fed meeting minutes also gave investors some relief, as Fed officials were mindful of the negative impact the recent banking sector stress would have on the economy and would be careful about over tightening. A good start to the earnings reporting season on Friday led by strong showing from bank stocks also gave investors reason to cheer, as major banks like JP Morgan reported better-than-expected earnings.

Overall, for the week, the Dow notched its fourth-straight positive week by rising 1.2%. The S&P added 0.79% while the Nasdaq ticked higher by 0.29%.

The dollar recovered slightly as this new week began, while the price of Gold and Silver has remained largely flat. Oil continues to add on to their gains made the week before, with the WTI gaining around 2.3% and Brent Crude adding 1.43%.

On the economic front, this week is less hectic and the main market moving release could come on Thursday with the release of the US unemployment claims to reveal the state of the US labour market.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.