Last week was yet another quiet down week for crypto as a hack on the popular Curve protocol caused some negative ripples to form in the market. Curve Finance saw exploits of over $70 million at the end of July, which sent the price of CRV dipping drastically, from roughly $0.73 to below $0.60. This drop in the price of CRV could have implications on other DeFi platforms like AAVE as the Founder of Curve has a loan of roughly $70 million in USDT using CRV as collateral on Aave v2. Should a liquidation event occur, it could set off a negative chain effect on other crypto assets like AAVE. However, such an event is unlikely to happen as the Curve Founder has been actively repaying his loan by selling his CRV tokens via OTC transactions to various institutions to avoid liquidation. While the situation appears to be under control and the price of CRV has stabilized, traders may still worry that a sudden deterioration could occur due to bad memories from the LUNA-led market crash in 2022.

Moreover, rumours that the US DOJ could be suing world largest exchange Binance for fraud also made its rounds, and on top of this, news that the SEC has also begun an investigation into Digital Currency Group (DCG) and its relationship with Genesis Digital, which may worsen the already troubling situation at DCG which is currently embroiled in a lawsuit with Gemini and is also in the midst of selling its assets to pay off creditors. With no good news to support prices and plagued with worrying news, sentiment in the market dipped further into the weekend.

In spite of the negativity, BTC has been well-absorbed whenever it fell below $29,000, showing some kind of support below that price. Altcoins however, did not share the same fate, with most tokens drifting lower as the week went by, resulting in losses of between 5% to 10% for the week.

However, as the new week beckons, the excessive pessimism is seeing some light as altcoins which have been pounded lower all of last week begin to show signs of a technical rebound. Some theme plays seem to be picking up as well, as GameFi tokens like GALA and AXS are making a small comeback after Binance added the trading of YGG on its futures market.

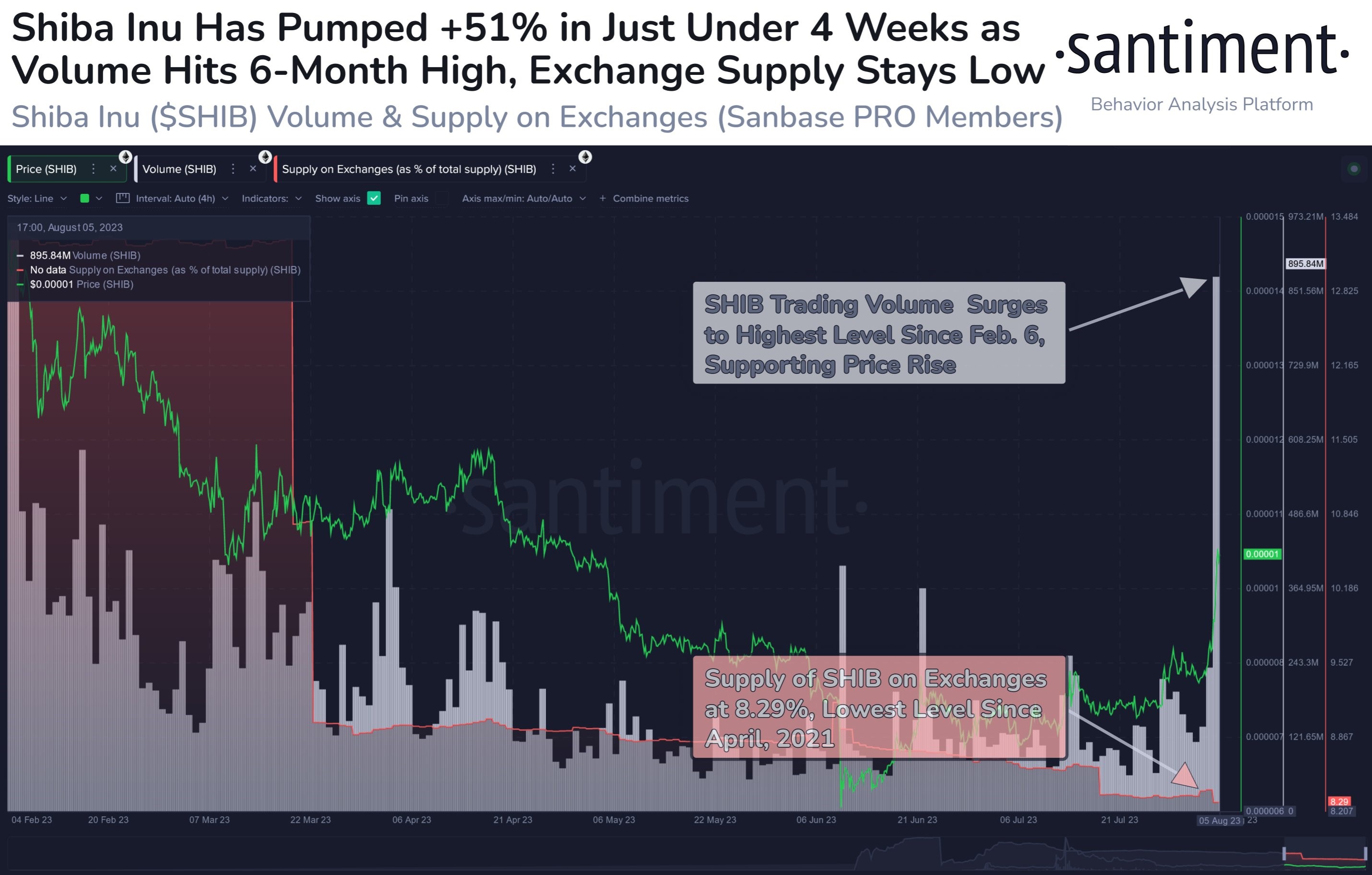

The dog-themed coins which we had highlighted last week continue to show resilience as well, and as we had indicated to keep on your radar, SHIB has been one of the top performing coins last week.

SHIB rises against the tide as upgrade draws near

SHIB has been leading the dog coins movement with a 15% surge over Saturday on good volume. The impending launch of the Shibarium Layer-2 ecosystem which aims to solve network congestion and scalability issues on the SHIB main network has the community very excited and many are buying the token ahead of the launch which will be sometime in August. The listing of one of its ecosystem coins LEASH on some smaller exchanges in recent times has also added optimism that the SHIB ecosystem could be taken more seriously by the broad crypto community.

While trading volume on SHIB has surged exponentially, the supply of SHIB on exchanges has remained at a one-year low, which means that holders are not selling their SHIB tokens. Having an explosive buy interest and low sell interest could mean that the SHIB token could continue to see positive momentum in the near-term.

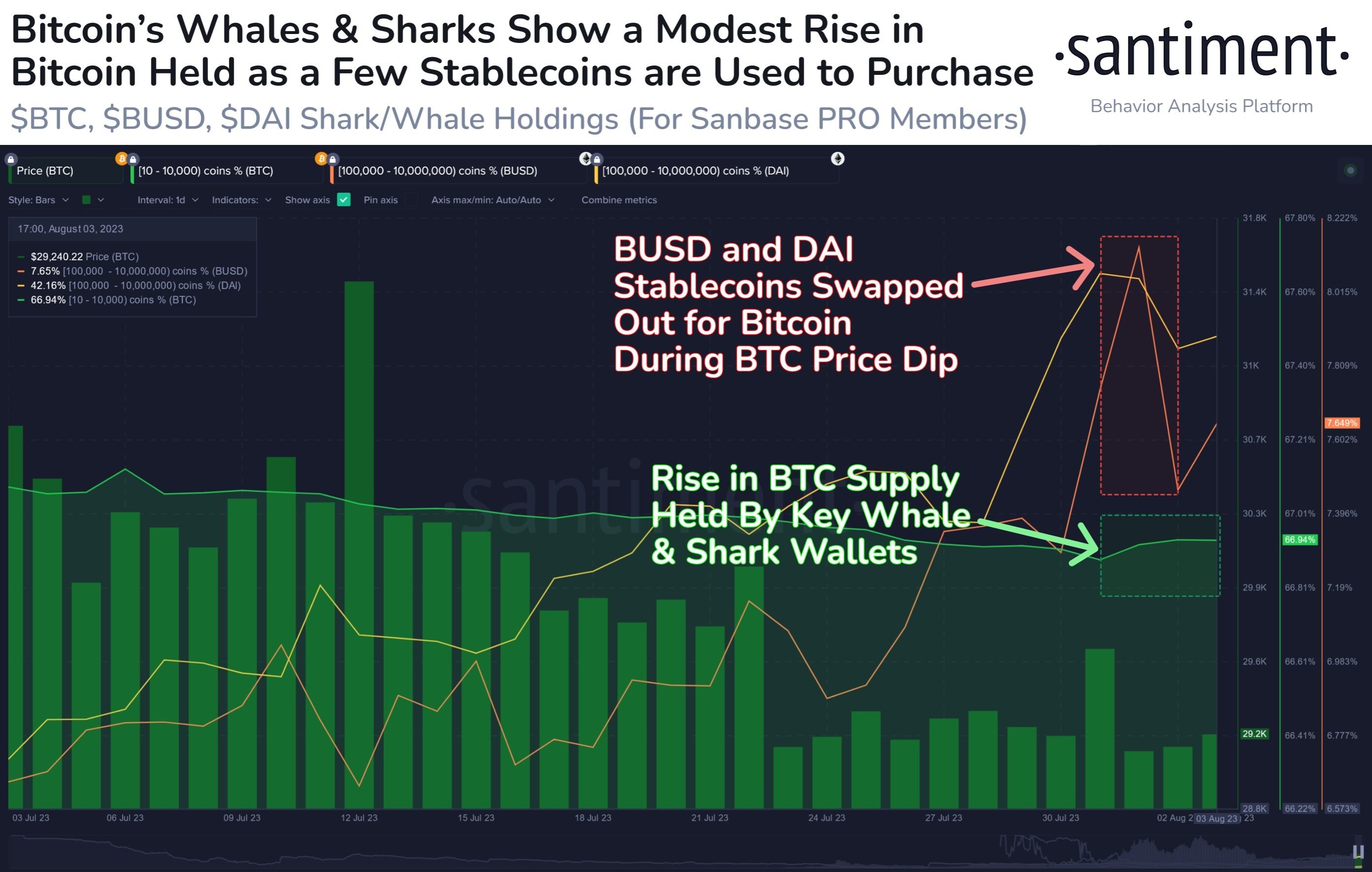

Whales add BTC after a month of selling

As we had also pointed out in last week’s report, whales had been offloading their BTC over the past weeks, resulting in a weakening in its price as demand failed to offset the selling. However, a slight improvement in the supply-demand dynamics seems to be occurring as whales have begun to purchase BTC again in the spot market. There has been a decrease in the supply of stablecoins and a corresponding increase in BTC supply held by whale wallets heading into August after the price of BTC dipped below $29,000. This could mean that a small bounce in price should not be ruled out, especially now that market sentiment is at a low point. Year-to-date, crypto prices have demonstrated an ability to bounce higher whenever sentiment hits a low point and thus, a contrarian up move should not be ruled out.

One of the whale wallets that bought BTC may have been MicroStrategy, which announced on Wednesday that it has acquired an additional 467 BTC for $14.4 million and is holding a total of 152,800 BTC as at the end of July. In addition, the firm also revealed that it is planning to issue and sell up to $750 million in stock to fund BTC purchases and other uses. However, as per most other MicroStrategy BTC announcements, the move failed to have any positive impact on the price of BTC as investors see the firm as a BTC permabull.

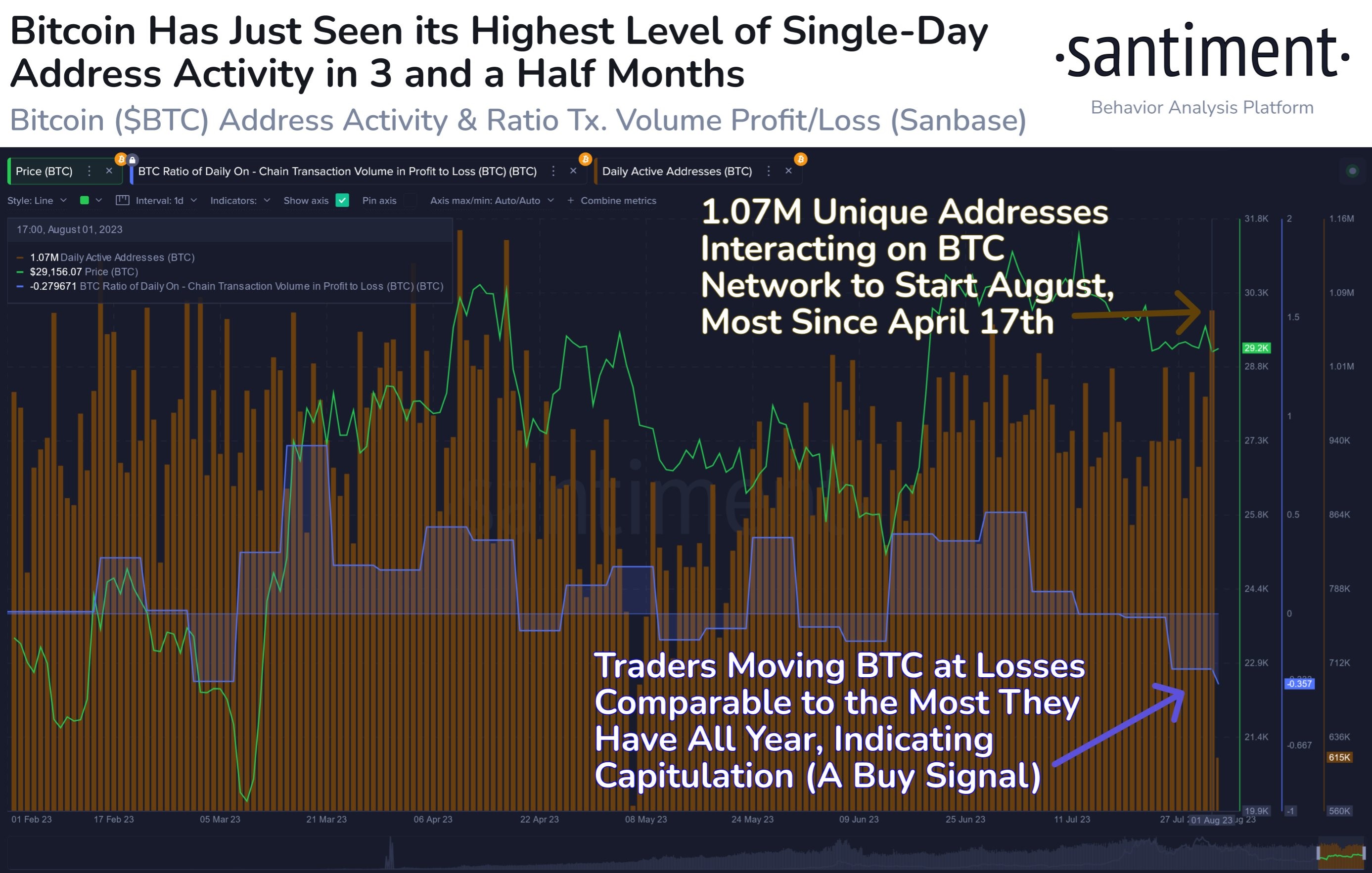

Contrarian buy signals showing up

Another interesting BTC metric that is displaying contrarian buy signals is the number of traders selling at a loss, which has hit the highest volume of the year. Moreover, the number of single-day BTC address activity is also rising to its highest level in 3.5 months, showing that trading activity is returning to the market. Viewing this metric together with the fact that whales are restarting to buy BTC may suggest that a short-term bounce is probable.

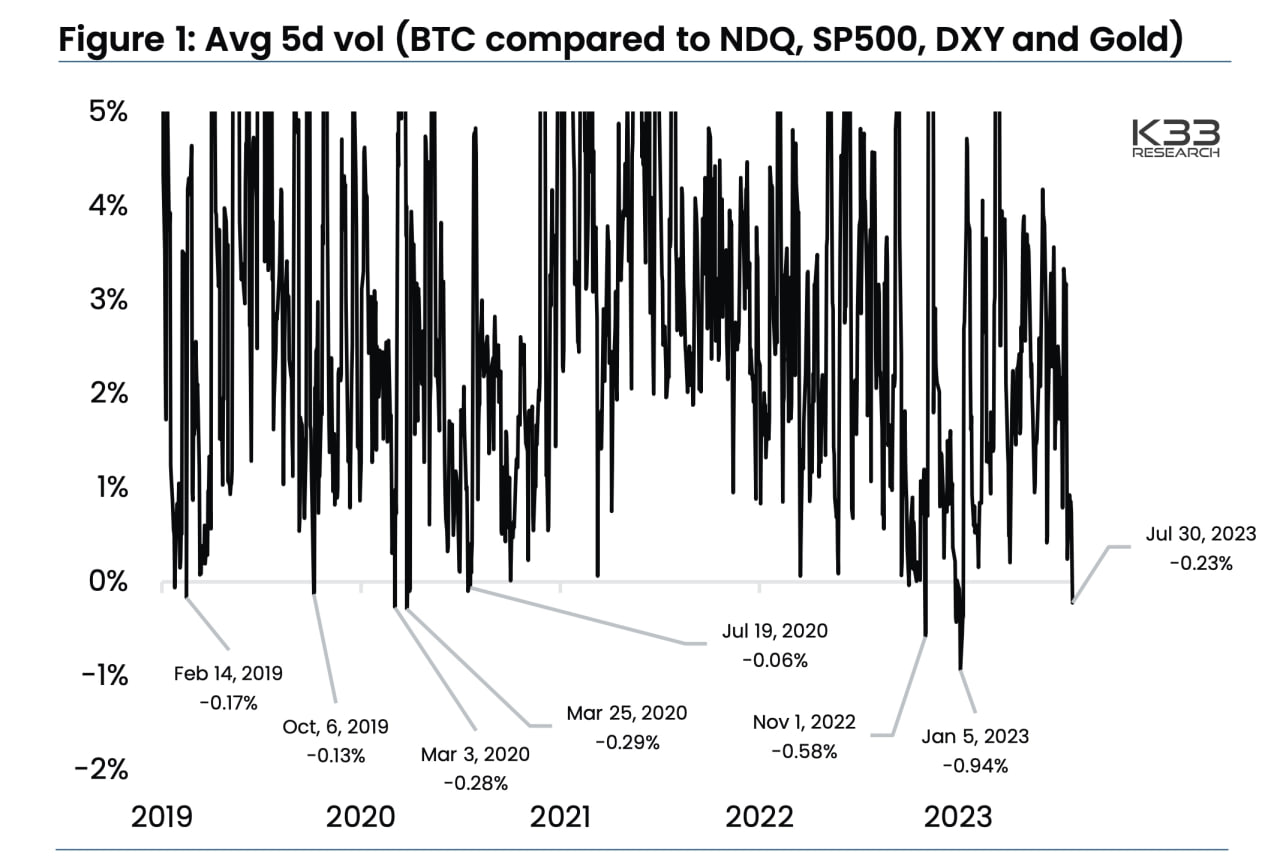

Furthermore, BTC’s historical average 5-day volatility is also at a pivotal point that previously had been followed by sudden price bounces. BTC’s current 5-day volatility is below that of major traditional assets like Nasdaq, the S&P 500 and Gold, falling to a negative region. Historically, whenever this volatility measure fell to such a level, it often snapped back with a quick and sharp price movement that sent the volatility of BTC rising well against its peers. That said, we are not expecting BTC to break into a bullish trend as the current risk-off sentiment in stocks could still weigh on crypto, what we are suggesting is that a small bounce is not improbable.

Stocks drop on US ratings downgrade but dollar immune

US stocks fell after Fitch Ratings downgraded the long-term foreign currency issuer default rating for the USA to AA+ from AAA on Tuesday night. The ratings agency cited expected fiscal deterioration over the next three years in the USA as their reason for the downgrade. The last time the USA got a downgrade from a major ratings agency was in 2011 when Standard & Poor’s cut the rating to AA+ from AAA.

The US equity markets started tumbling on Tuesday after the news was made known. Despite a beat in the ADP employment data on Wednesday, the stock market did not show any sign of recovery even until the week was over. Eventually, all three major US stock indices closed lower for the week, with the Nasdaq and S&P dropping about 2.9% and 2.3% respectively as the tech sector was the hardest hit, while the Dow lost 1.1%.

Sentiment was made worse after the non-farm payrolls report came in worse than expected, with the labour market gaining just 187,000 jobs against market expectation of 200,000 jobs.

The dollar managed to escape unscathed in spite of Fitch’s rating’s downgrade, with the DXY even eking out a gain of 0.4% for the week while Gold and Silver continue to underperform. Gold lost 0.8% and Silver dropped 2.9% as the dollar strength continued to put pressure on precious metals prices.

Oil, however, continues to trade on its own fundamentals instead of being pressured by the strong dollar, with Brent gaining 2.14% and the WTI rising 2.76%. Oil prices have been given a further boost after reports confirm that Saudi Arabia will extend and deepen its voluntary production cuts until September and possibly beyond to control supply even as demand from China is increasing.

With regards to central bank action last week, Australia unexpectedly held rates steady while the UK raised rates by 25-bps but gave more dovish guidance as its inflation rate had fallen quicker than initially anticipated. A trend of dovish pivot appears to be developing amongst central bankers as inflation rates across the globe starts to cool.

According to the FedWAtch tool, after the non-farm payroll release, around 88% of traders now expect the FED to hold rates steady at its next meeting in September. However, the dollar is still stronger as we begin the new week, with commodity prices trading in the backfoot, weakening by a tad.

As traders wonder when this spate of dollar strength will dissipate, the CPI figure due to be released this Thursday and the PPI number due on Friday could become even more keenly watched than before. Should both figures come in weaker than anticipated, the dollar may finally see some profit-taking as the chances of a dovish FED increase.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.