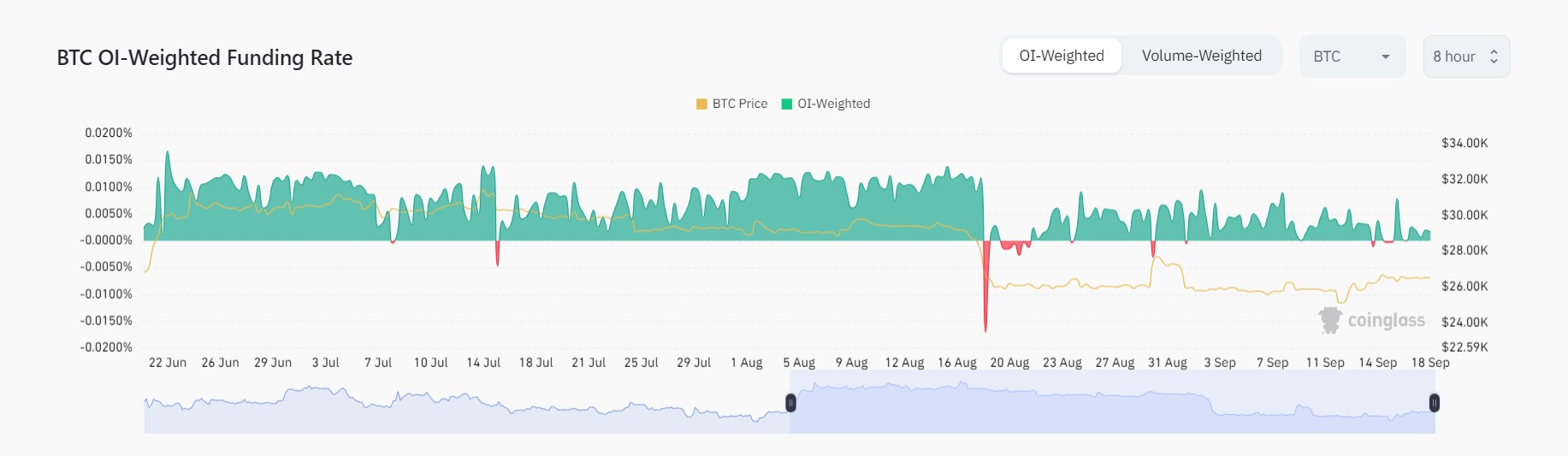

Following news that investment behemoth Franklin Templeton Investments have also filed a spot BTC ETF application last week, sentiment in crypto markets improved dramatically, as market watchers grew more confident that the approval would eventually be obtained by at least one, if not several, of the Wall Street giants. With the next decision dates being around mid-October, some investors may possibly have entered the market to buy on the early week market dip at a time when extreme bearishness caused funding rates to be at a negative, as we had highlighted in our previous week’s report.

Another piece of good news was that Digital Currency Group (DCG) has proposed a new creditor agreement in its subsidiary Genesis’s bankruptcy, which would allow Gemini Earn users to recover all their crypto that had been stuck.

FTX also obtained the greenlight by a US district judge to dispose of its $3.4 billion worth of crypto holdings, however, they will be given an option to stake, or even hedge these holdings to maximize what they can repay creditors. This could mean that the selling pressure may not be as intense as what the market was anticipating.

On top of that, €1.34 trillion asset manager Deutsche Bank, also announced that it would offer BTC & crypto custody services to institutional clients.

As a result of the many positives, BTC bounced higher last week, jumping back near $27,000, and altcoins followed the move higher, reducing their losses incurred in the weeks before.

Another reason for the jump in crypto prices in spite of an equally strong move in the dollar could be related to China, which cut its lending rate by 25-bps once again to support their economy, as trading in the Asia time zone has been rather buoyant last week.

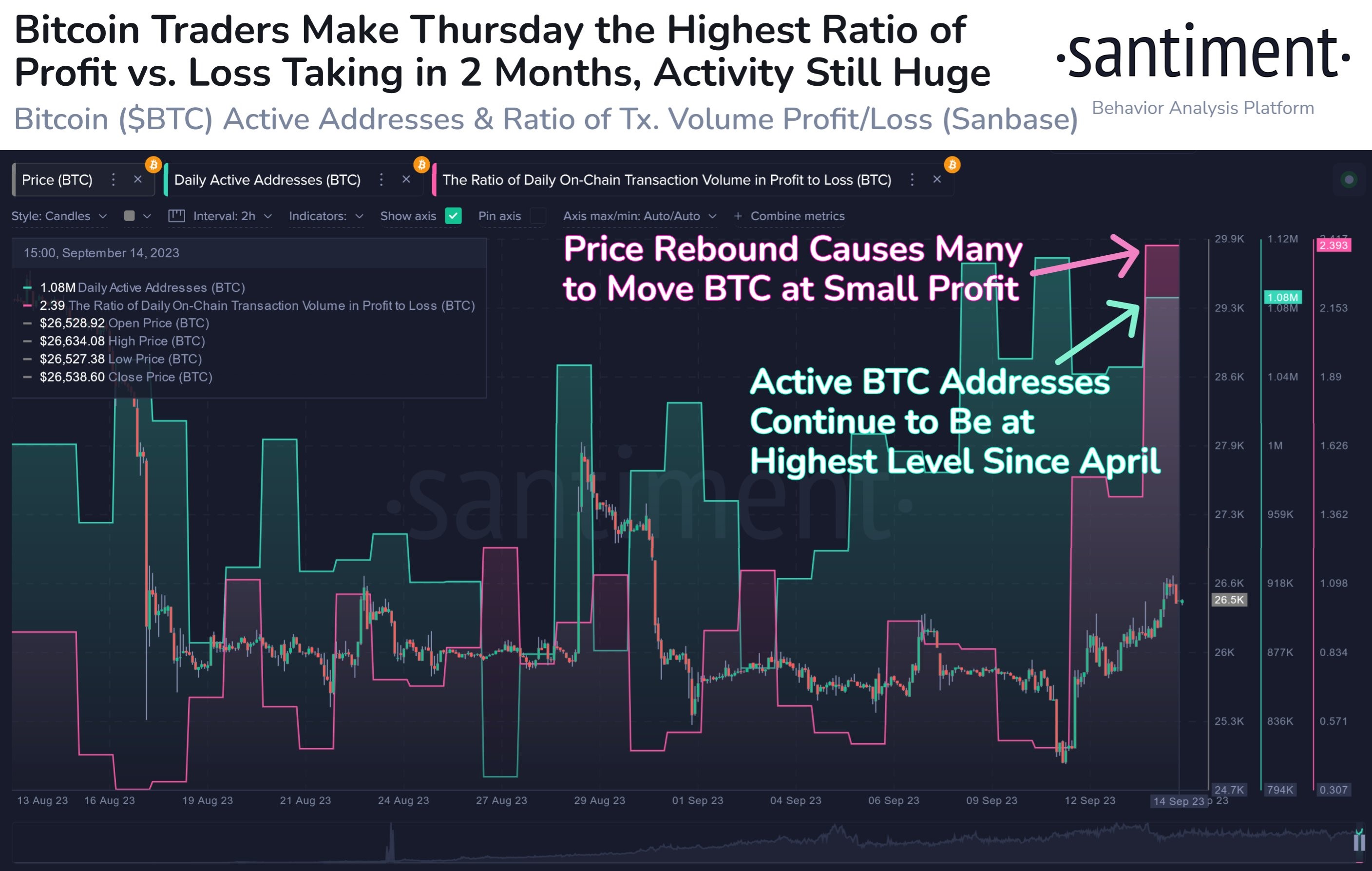

Traders taking profit was a contrarian signal

As most traders were not convinced that the bounce was sustainable, many have started to take profit mid-week. Profit-taking trades rose to a 2-month high, even as the number of unique transactions on the BTC network rose to 5-month highs, clocking an impressive 1.1 million transactions on Thursday.

With the price of BTC maintaining around $26,500 even after a substantial amount of profit-taking and a stronger dollar, the shift in dynamics may be able to sustain the short-term rebound for a while longer. However, as funding rates have started to turn positive again, some caution is warranted as this could mean that the majority of retail traders have begun to pile into long positions over the weekend after the price of BTC did not retreat. However, since the funding rate is still a low positive, the market could continue to stay elevated for a while. Should the funding rate continue to increase, the price of BTC could retreat and drag the rest of the market down with it.

Furthermore, an overhang is still expected to hover over the markets, as FTX would eventually still be required to dispose of its holdings, which at current market rate, is around $3.4 billion worth of crypto. Notably, according to the court filings, FTX holds $1.16 billion worth, or 16% of the supply of SOL and $560 million worth of BTC. Thus, once any announcement that the first tranche of sale has begun, the markets could react negatively once again.

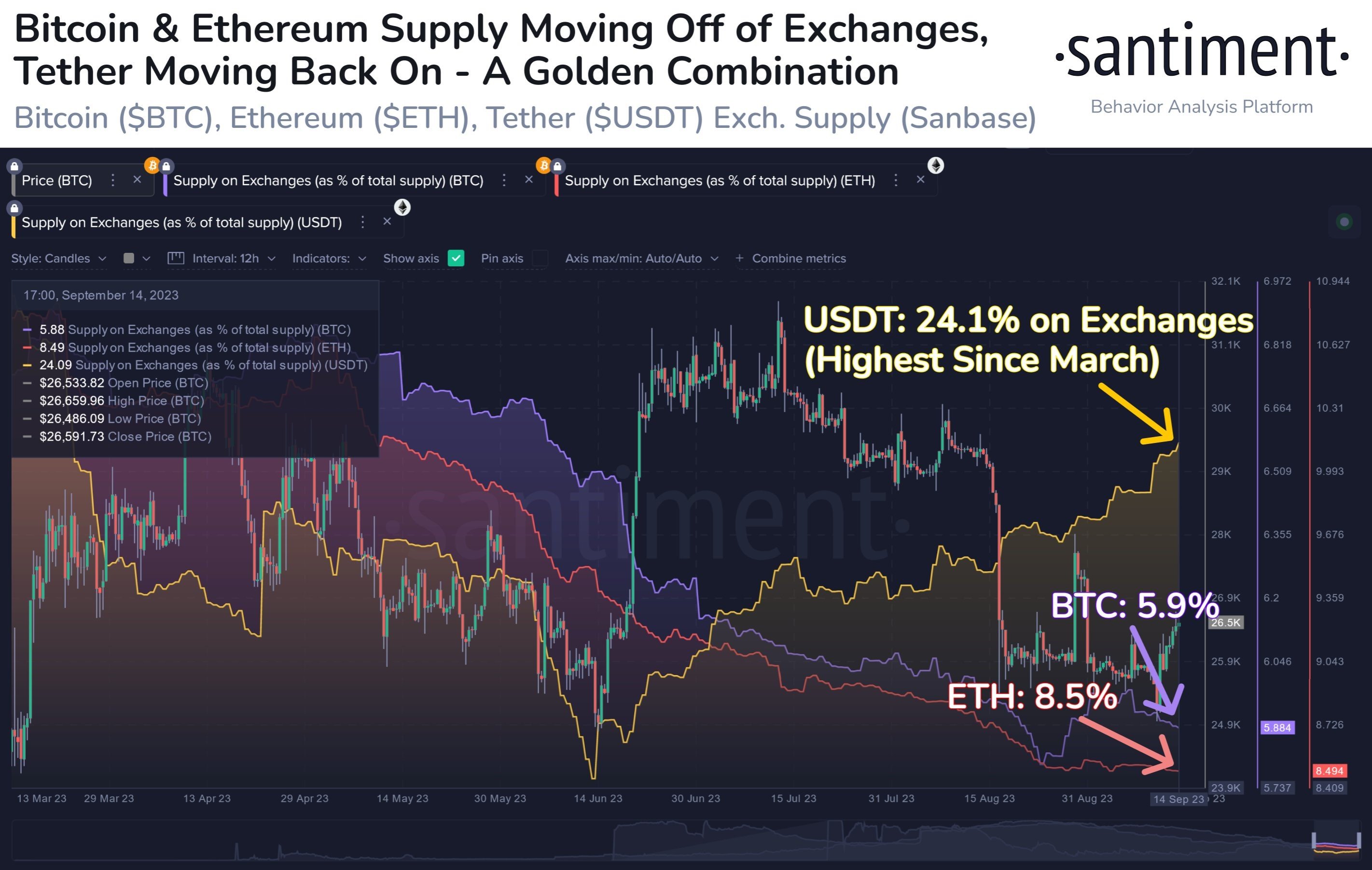

Exchange reserve hints at short-term recovery

However, for now, it seems that the positivity may last for a while longer, perhaps at least until the Fed meeting as over the course of last week, the exchange supplies of both BTC and ETH have fallen, which implies that there has been active buying of these two coins last week. Furthermore, an increase in the flow of USDT into exchanges suggests that there could still be ammunition left behind in the markets to make more purchases.

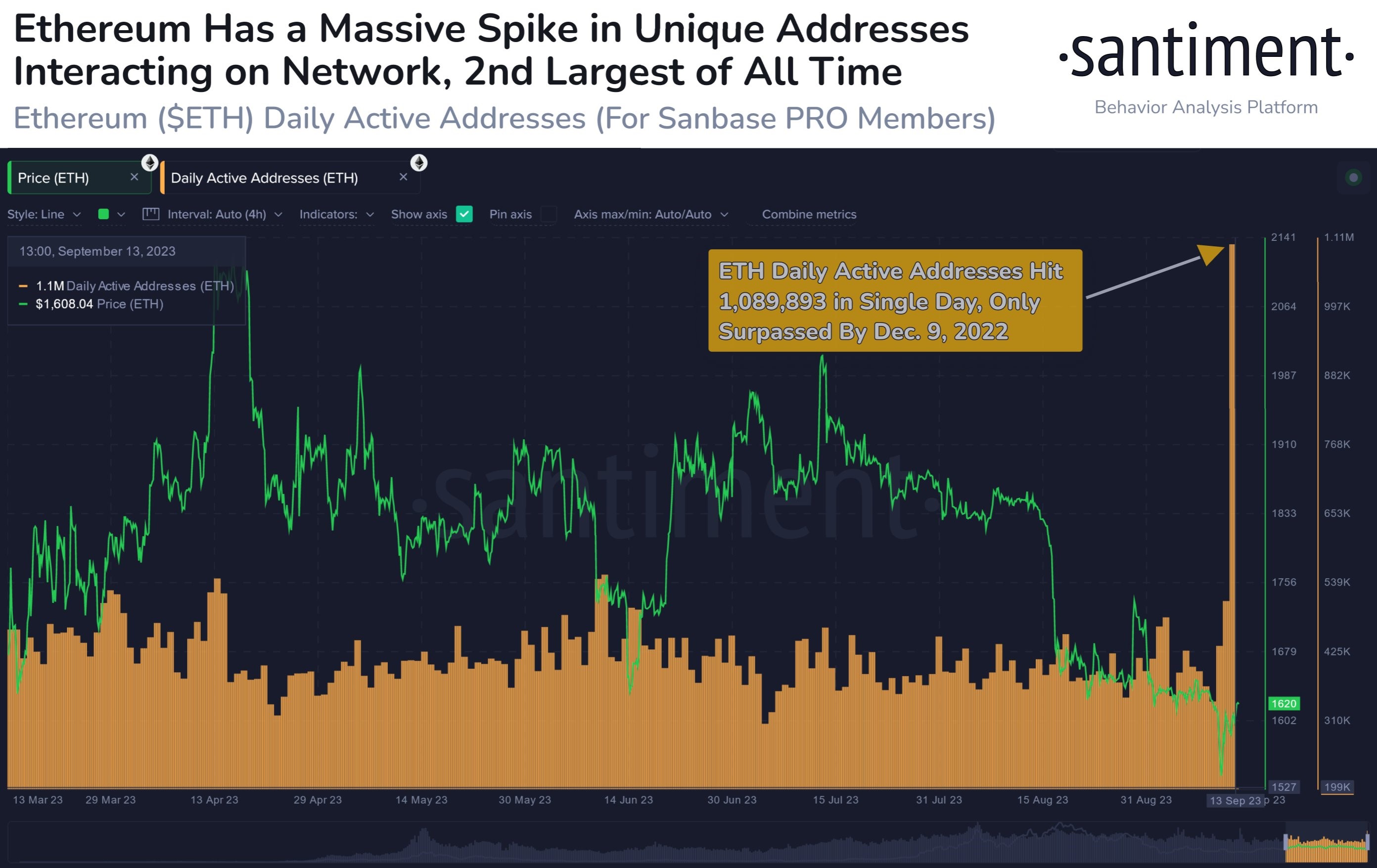

ETH sees abnormally high volume

Similar to the BTC network, last week, the ETH network also saw its second highest number of unique wallet movements in history. While we are still not sure of what this could mean, both BTC and ETH displaying such sudden spikes in transaction volume is a notable phenomenon that ought to be further investigated. Some speculation is that these could be transfers from FTX wallets, although nothing has been confirmed as at the time of writing.

Other possible reasons for the sudden surge in ETH transactions could be the anniversary of The Merge, which took ETH from PoW to PoS last year. It might even be related to the introduction of a third testnet environment named Holesky, which has been rumored to be replacing the Goerli testnet next year. Whatever the real reason was, no one knows for sure, but a surge in transaction volume in the leading altcoin turned out to be a good thing for other altcoins as that brought about a recovery of liquidity into the broad crypto market.

Increasing rotational play on altcoins

The sudden jump in activities on BTC and ETH spilled over to the altcoin market where the market saw a marked increase in the rotation of funds into altcoins. Various popular altcoins started showing an increase in price and trading volume as old favorites like LTC, BCH, AAVE and RUNE made commendable double digit gains. SOL, which was supposed to be the biggest victim of the upcoming FTX dump, even rose almost 20%. Some newer coins like TRB and WLD rose more than 100% as the rotational play on altcoins heated up.

Were all these pumps a case of liquidity grab where experienced whales lure unbeknownst retail investors to buy so as to provide exit liquidity? Regardless of whether these moves were genuine or fake, the decent percentage moves means that a nimble trader will be able to obtain good profits by actively trading and not being greedy.

Stocks cautious ahead of central bank meetings

Following a mixed set of economic numbers, US stocks returned a mixed set of results last week, with the Dow gaining 0.12%, while the Nasdaq and S&P lost 0.39% and 0.16% respectively.

Even though the CPI numbers released mid-week were a tad higher than expectations, subsequent economic data released were better-than-anticipated, with both retail sales and unemployment claims beating expectations. This resulted in a lack of conviction by investors on both sides ahead of the Fed meeting this coming Wednesday.

However, the dollar remained well-bid, as the DXY continued to inch higher, rising by 0.26% last week. Geopolitical tensions heating up between China and the USA due to escalation of military display around Taiwan and Japan have led investors into Gold, as the shiny metal gained 0.23% in spite of the dollar’s rise. Silver similarly gained 0.6% over the week.

Oil was the top gainer again, rising to their highest level of the year as the WTI broke above $90 per barrel for the first time this year after gaining 4.46% last week. Brent too gained by 4.1% to close the week at around $94.20. The International Energy Agency warned on Wednesday that Saudi Arabia and Russia’s production constraints would likely result in a “substantial market deficit” through the fourth quarter. Understandably, with their magnificent run over the past month, chatter of a $100 oil is back in vogue again.

Unless something unexpected happens in the early part of this week, action in the traditional markets could be quiet until after the Fed meeting on Wednesday as investors may want to know what the Fed’s current expectation with regards to inflation is since the price of oil is heating up again. As at the start of this new week, the dollar is seeing slight profit-taking, causing the price of precious metals and oil to move higher.

Other than the Fed, both the Swiss National Bank as well as the Bank of England will also be having their policy meeting a day after, on Thursday. Friday in the Asian timezone will see the Bank of Japan having their meeting. This meeting by the BoJ could be important as Japanese financial ministers have recently hinted at a potential move towards normalizing their negative interest rates policy which has been in place since 2014. Should Japan start to raise rates, the impact on the global financial markets could be huge as the yen has been the de facto funding currency for at least the past decade.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.