Following more evident developments that the spot BTC ETFs would be approved, the price of BTC shot higher by almost 10% on Monday to trade above $47,000 for the first time since 2022. Applicants were seen to be putting in the final touches like fixing fees for their final submissions to the SEC, which greatly bolstered hopes of an approval.

Altcoins too recovered from their early week selloff, with notable coins that were on an airdrop campaigns performing better than others. However, the bulk of the altcoin market was still a tad lower than before the large liquidation hunt that happened the week before.

Regardless, the market recovery still managed to liquidate around $250 million worth of short positions early week.

Drama breaks out at the SEC

However, as tensions mounted with the deadline for ARK’s application on 10 January approached, a tweet from the SEC’s X account announced that the SEC had approved all applications, sending the price of BTC rocketing to $48,000 before plummeting to $44,500 as rumors that the tweet was fake circulated, liquidating yet another $300 million worth of positions.

Indeed, SEC chairman Gensler clarified around 15 minutes later that their X account was compromised, and another tweet another 12 minutes later that clarified that no spot BTC ETF approval had been given yet. This caused the quick two-way movement that caused a bigger dip in altcoins than it did for BTC.

Regardless, the price of BTC started stabilizing as investors who still expected an approval to transpire took the dip opportunity to load up their trucks after observing that the price of BTC had shot higher after the initial “approval news”.

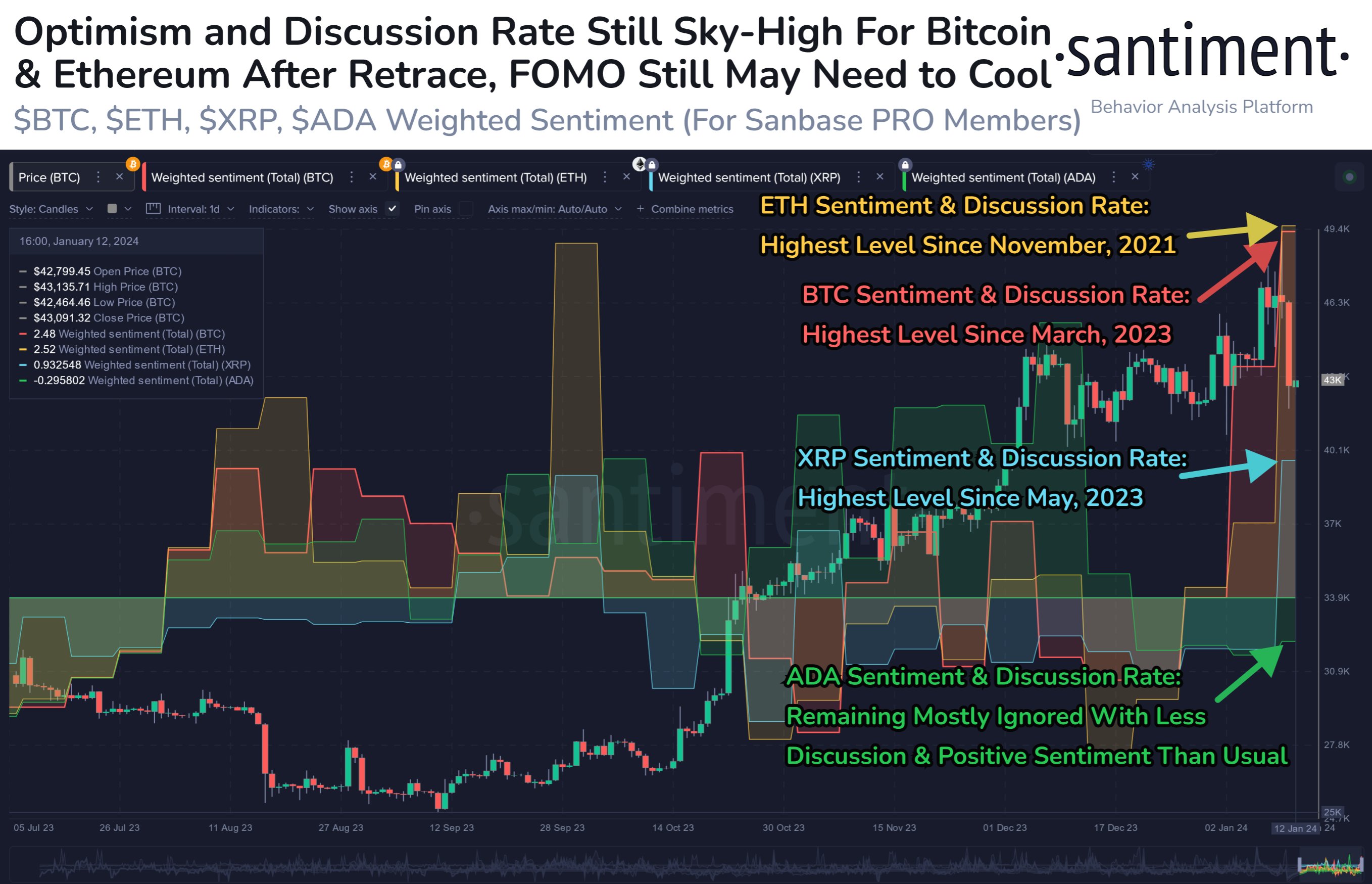

After the saga however, traders began to fade the BTC trade and piled into ETH, which would be the next coin that the SEC would have to consider for a spot ETF.

BTC falls amid spot ETF listing – miners sold

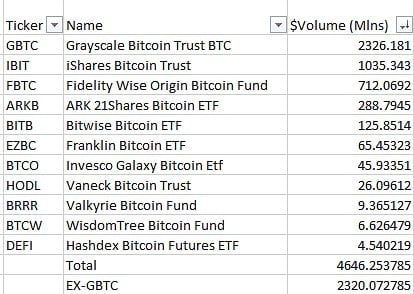

Eventually, the SEC indeed approved all 11 BTC spot ETFs on Wednesday and their trading started on Thursday, with around $4.6 billion worth of the asset traded on the first day alone. However, around half of the volume was attributed to GBTC, which some market experts assumed were redemptions, since the fund had been unredeemable for the last 3 years until it got converted into a spot ETF on Thursday.

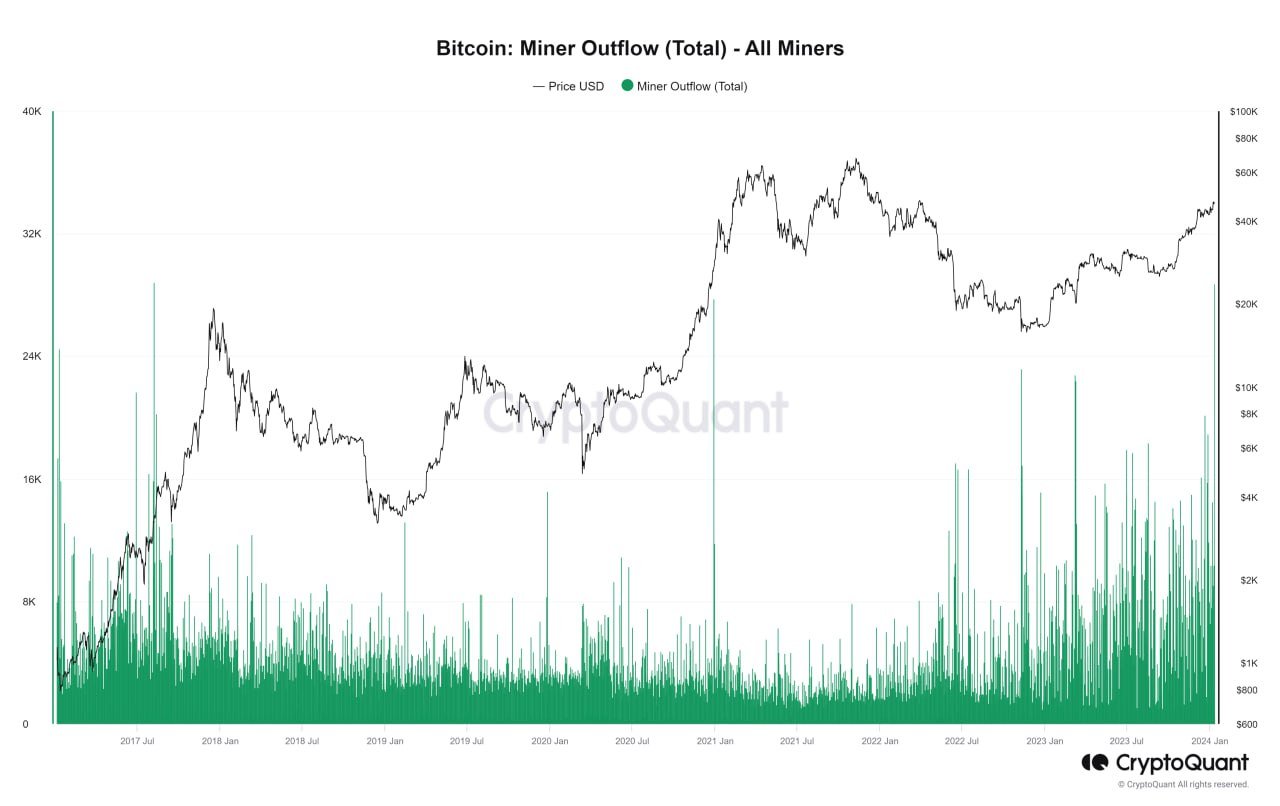

The price of BTC fell sharply after hitting a high of $49,000, beginning a series of declines over the rest of Thursday and Friday, losing almost 20% from its peak in the process, liquidating around $400 million worth of longs in BTC over the two days, which perplexed some retail traders who thought the price would continue rising. However, whales may have taken the opportunity to offload their BTC at the peak of the ETF hype, one group being the BTC miners.

Prior to the ETF listings, miners were observed to have sent more than 30,000 units of BTC, the highest volume in 77-months, to exchanges. The BTC outflow from all miners’ wallets managed to track this movement, which forewarned about the impending selling pressure.

Celsius selling could pressure ETH and MATIC

As we had reminded in our previous reports, the incoming Celsius and Mt Gox redemptions may also have prompted some investors to take the opportunity to take some money off the table.

After a Friday filled with FUD, the investment sentiment has reverted back to that of positivity, with social media posts reverting back to an optimistic bias during the weekend, especially with regards to ETH as investors now shift their attention to the ETH spot ETF.

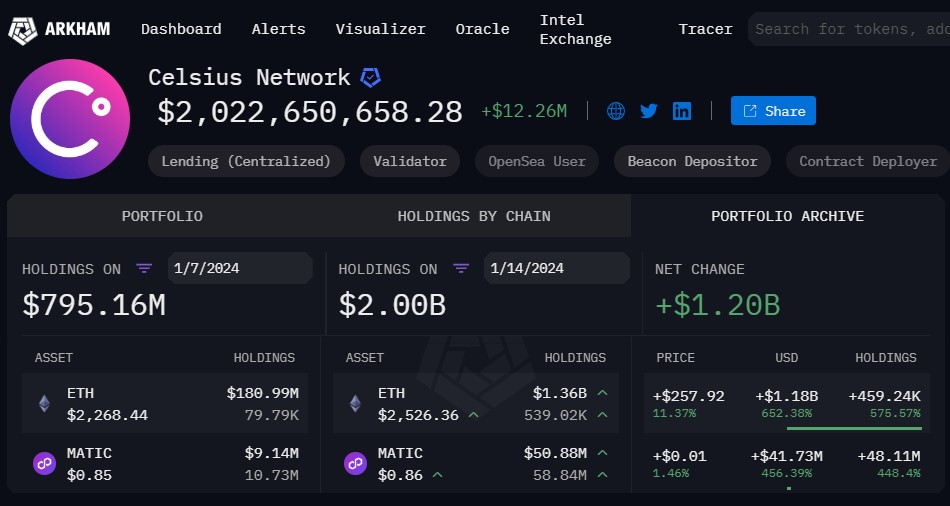

However, it is worth noting that the deadline for a spot ETH ETF is at the end of May, more than four months away. Until then, ETH may have to navigate through the Celsius redemption that has begun and could pick up pace sometime this week as the latest batch of more than 500,000 unstaked ETH has been deposited into its wallet, where the ETH will be available for either an in-kind return to some investors, or for the most part, be sold in the market to return as cash repayment to creditors.

According to data, Celsius has already begun its ETH disposal last week, having transferred more than 70,000 units of ETH to exchanges. This week, Celsius has available another 539,000 units of ETH that has just been unstaked, and another 50.88 million units of MATIC, together with some other insignificant smaller bags of other tokens that it could sell.

Other than the above, Celsius is also currently sitting on around 9,800 units of BTC that it is supposed to return to investors, but has not yet done so or sold. However, 9,800 units of BTC is not a particularly large number that cannot be absorbed by the market. Hence, the more concerning disposals that could impact prices are likely to be ETH and MATIC.

Inflation crawling back spooks investors

After a week of sell off, tech stocks led the markets higher initially after US yields cooled off their highs. However, upon the release of the US CPI number on Wednesday which showed that the inflation rate had climbed up more than anticipated, the risk-off sentiment resumed as stocks continued on a falling spree.

The CPI had increased 0.3% in December and 3.4% from a year ago, higher than estimates of 0.2% and 3.2% respectively. The core CPI also rose 0.3% for the month and 3.9% from a year ago, compared with respective estimates of 0.3% and 3.8%. With oil prices expected to rise due to intensifying tensions between the US and the Houthis Group fighters in the middle east, investors are bracing themselves for a more difficult first half of 2024. As a result, heavy profit-taking has been occurring in the stock market front.

However, the PPI number came in slightly less than expected on Friday, declining by 0.1% in December, giving investors some room to cheer. As a result, US stocks still managed to end the week on a good note, with the Dow adding 0.34%, the S&P advancing 1.84%, and the Nasdaq rising 3.09%.

Oil prices rose late last week after tensions intensified in the Middle East after US-led strikes on the Houthis Group in Yemen, however, prices were still a tad lower than at the beginning of the week, with the WTI lower by about 1.3% and Brent slipping by 0.6%.

Gold and Silver gained around 0.2% each as the dollar retraced by about 0.07%.

This week, as Monday is a US public holiday, trading on traditional markets is expected to be thin early in the week, with only the retail sales number on Wednesday that will be the more important number.

As for the crypto market, due to the oversold state of the broad market, some bounce was seen over the US long weekend where institutional investors were on a break. Where the market could be headed in the near-term may hinge on the flow of funds in or out of the newly listed BTC spot ETFs when the traditional markets return for trading.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.