Post the release of US ADP employment numbers, the price of BTC, which had tried but failed to break above the resistance of $31,500 earlier on Thursday, succumbed to a relative dollar strength and fell around 1.5%, breaking below $30,000 at one juncture. The abrupt fall in the price of BTC after looking dangerously close to breaking above $31,500 took the crypto market on an about-turn as the bullish sentiment quickly turned into a bearish one in mere hours. The two-way move caught some traders in the headwinds and liquidated around $100 million worth of longs and $50 million worth of shorts within the first 12 hours.

Even after the dollar declined slightly post Friday’s release of weaker-than-expected non-farm payrolls data, the price of BTC did not manage to reclaim its losses, however, price did manage to keep above $30,000, giving altcoins a chance to slowly start finding their footing again after falling by around 10% on Thursday.

While it was unknown what caused the initial surge in BTC’s price to test $31,500, traders attributed it to comments made by BlackRock CEO Larry Fink that he viewed BTC as having the role of “digital gold” and is an international asset. These comments may have led some traders to presume that the Blackrock spot BTC ETF would be approved, which caused them to FOMO into the market, thus giving a chance for earlier BTC buyers to take profit.

BTC pullback caused by short-term holders

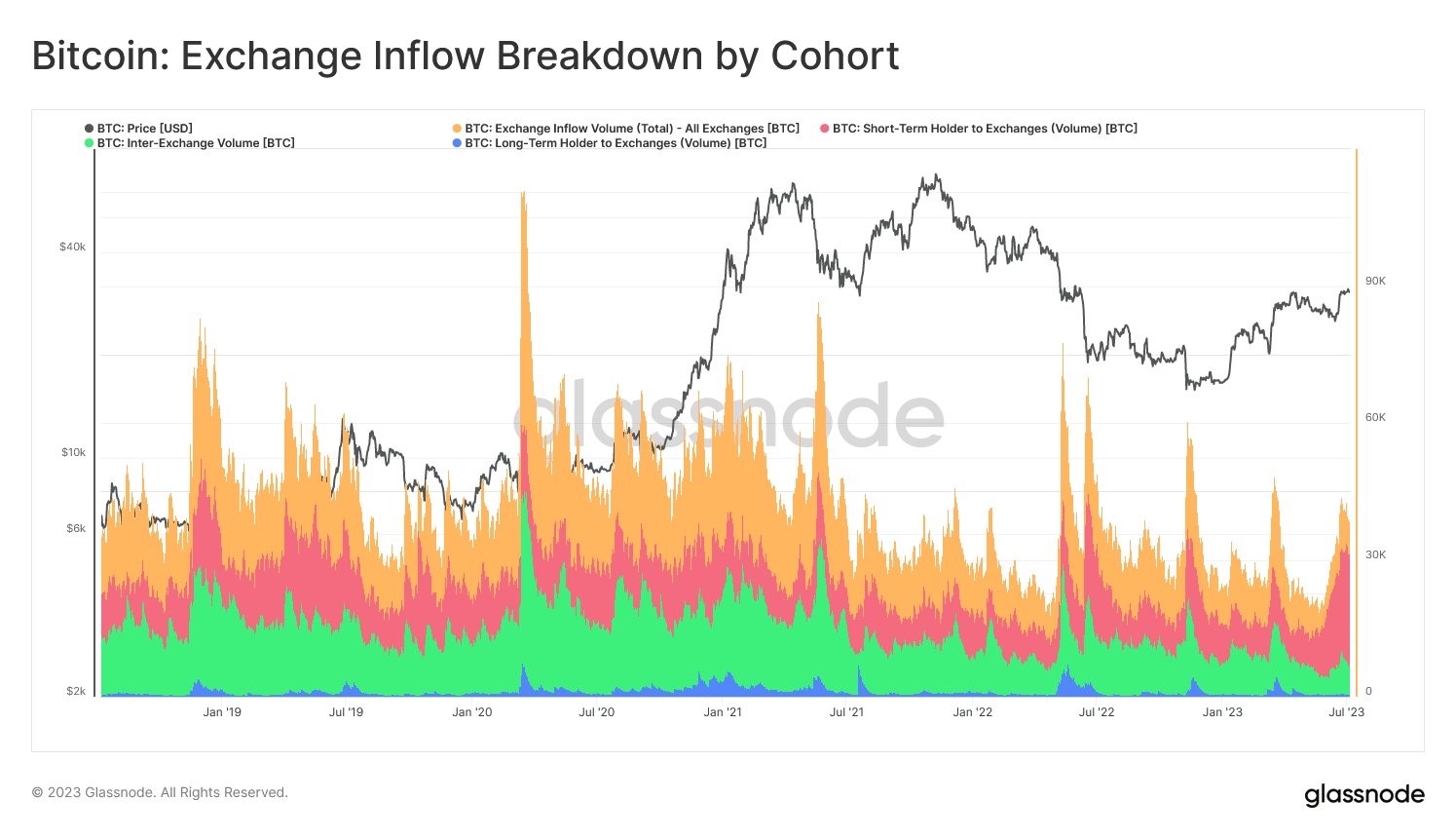

Data has shown that the major sellers of BTC last week as its price moved into $31,500 were short-term holders. A look at BTC exchange inflows from different holder cohort groups shows that the bulk of the selling last week came from short-term holders (1 to 3 months), who contributed to around 75% of the selling pressure on BTC. These are likely to be traders who were taking profit after buying the dip at around $26,000. It is likely that should the price of BTC correct by another couple of percentage points, that these traders could re-enter the market to buy and wait for opportunities to take small percentage gains again. Such scalping activities by short-term traders actually improve the liquidity and market depth of BTC, which is actually good for the efficiency of the market.

Another take away from observing the above holder cohort diagram is that long-term holders of BTC have barely sold any BTC at all even as its price touched $31,500.

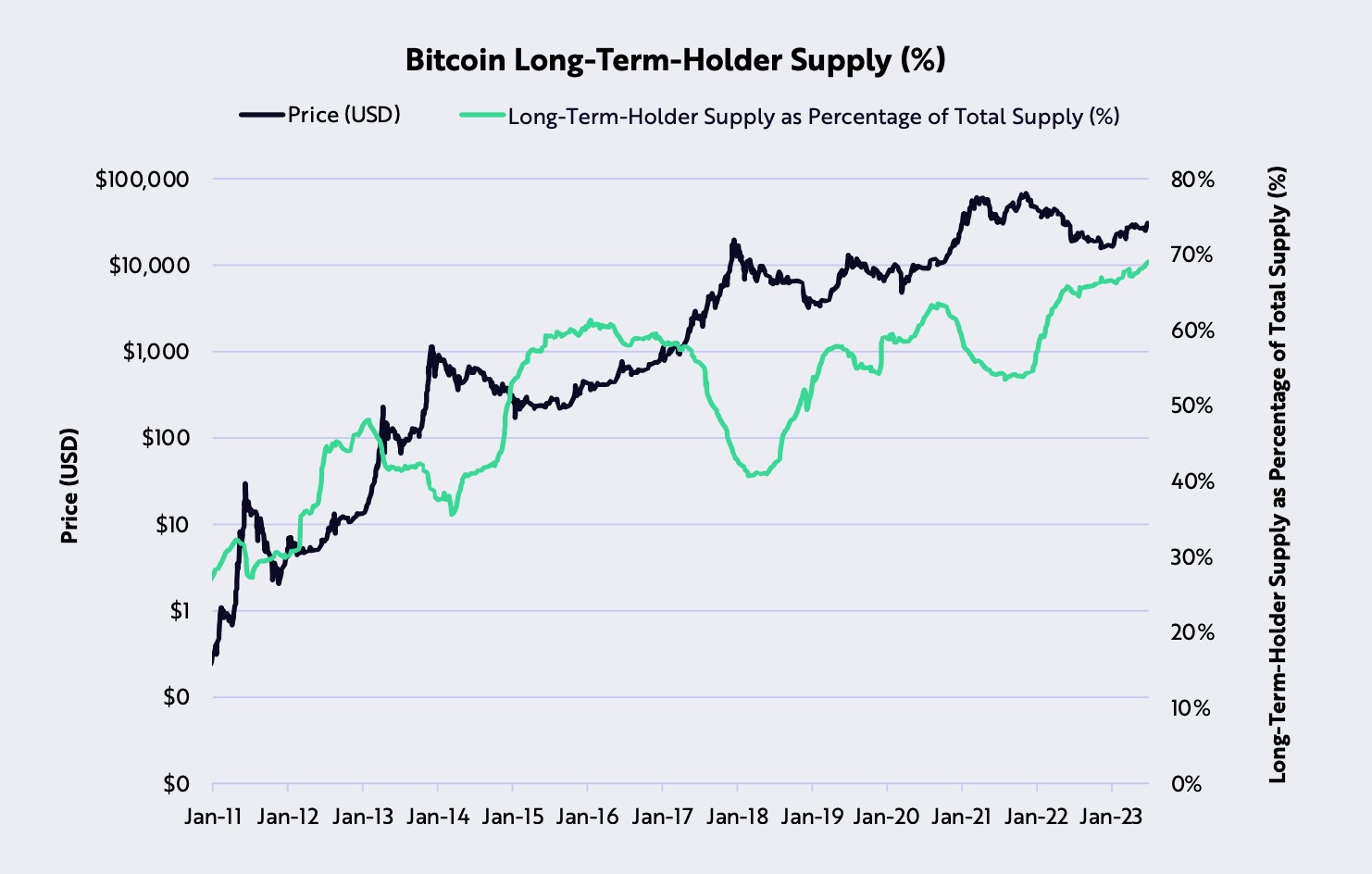

In fact, according to data from Ark Investment, the supply of BTC held by long-term holders has recently surged to 70%, which is an all-time-high. This shows the level of faith that this most important group of holders have in the future price of BTC.

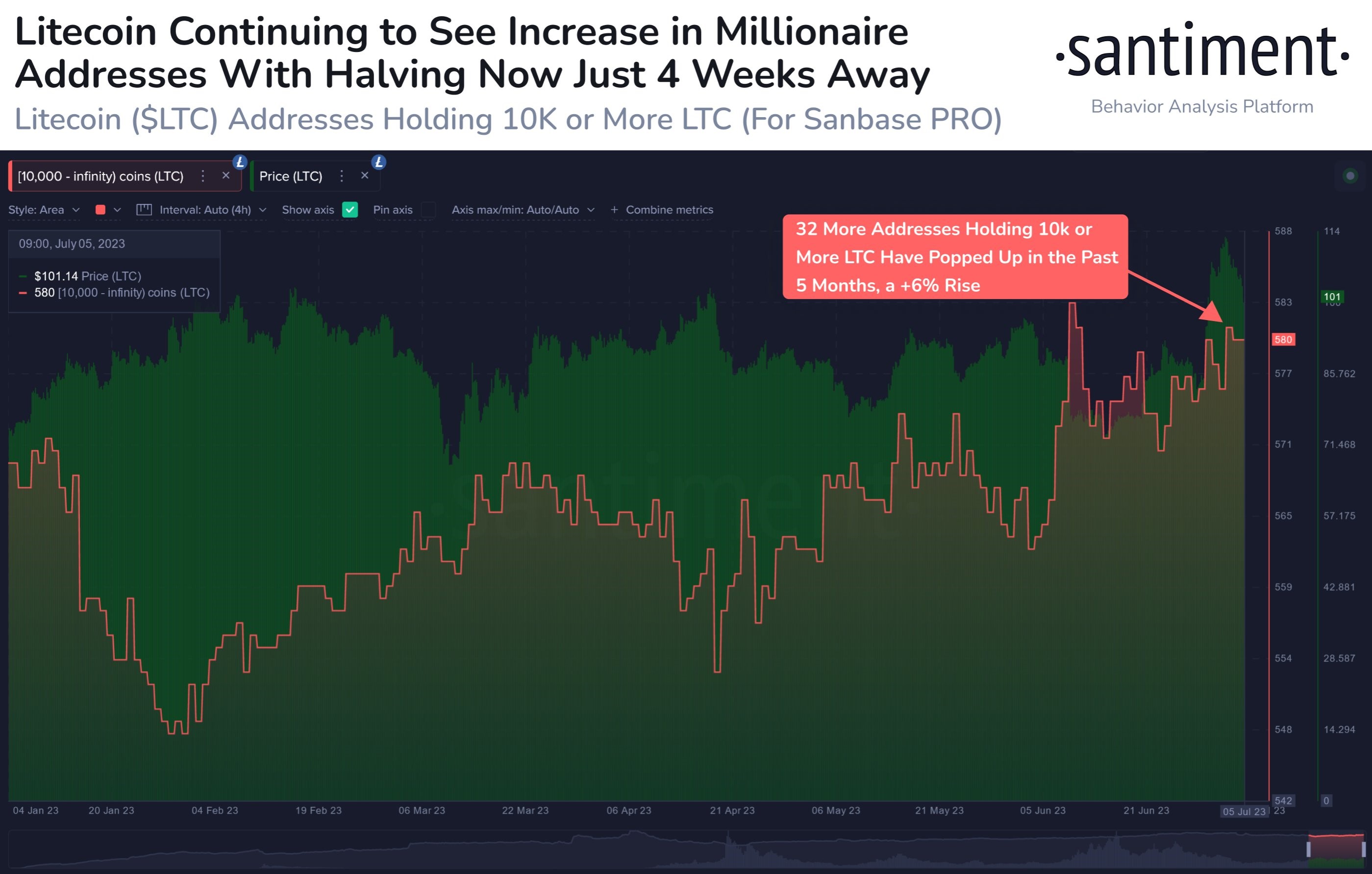

LTC whales continue to buy the dip

BTC holders are not the only bullish investors, or should we say, investors are not just bullish on BTC, but are also bullish on LTC. Even during last week’s decline in price, LTC’s millionaire addresses have continued to increase in number. With the halving of LTC’s block reward merely three weeks away, do not be surprised if another rally happens with whale accumulation continuing to increase in spite of LTC’s recent price correction.

ETH demand lagging but network shows growth

With the recent attention on PoW coins, the fundamental picture of ETH, which has gone PoS, appears to be weaker in relative terms when compared with the improving dynamics of PoW coins like LTC.

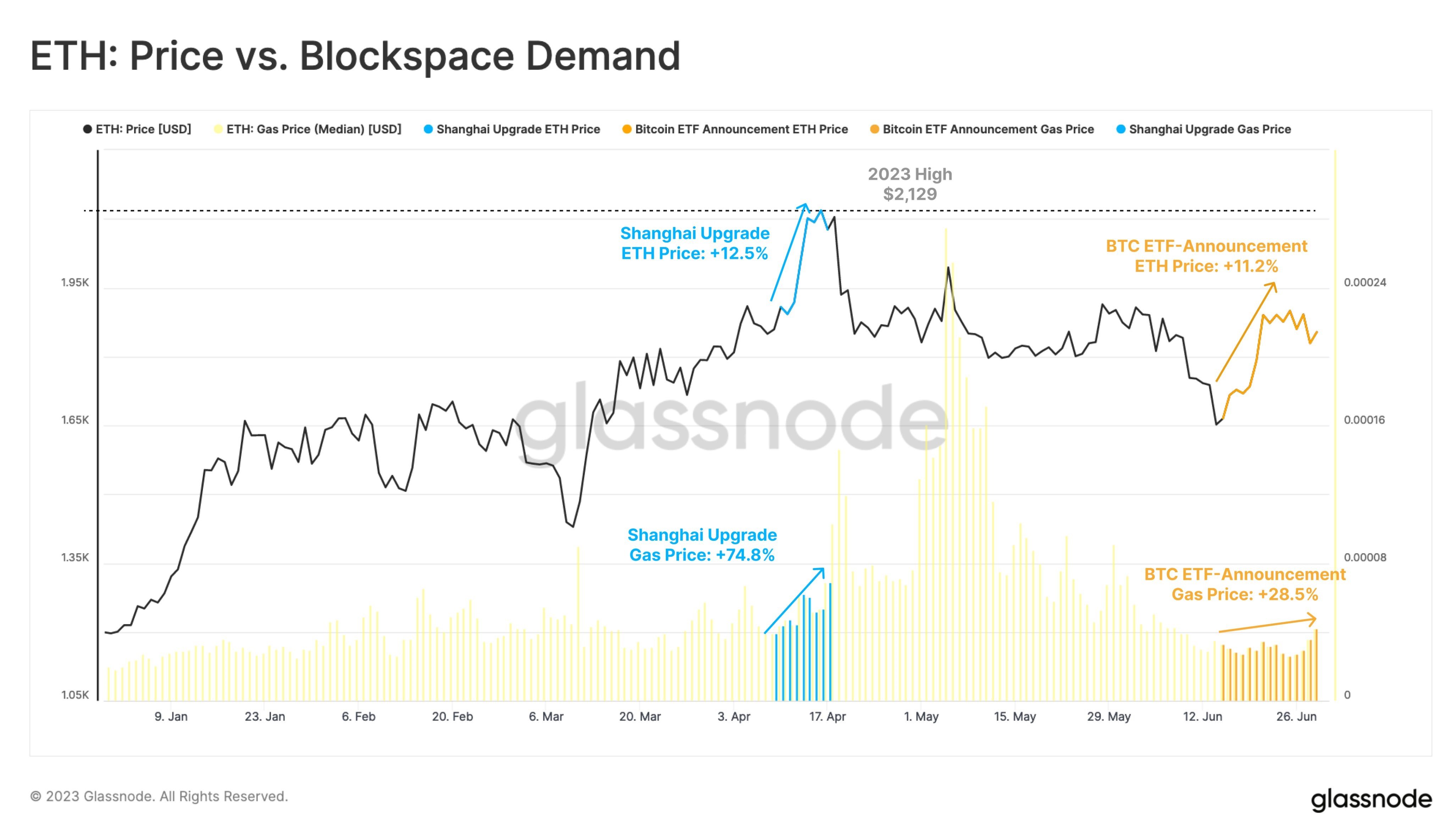

Despite its gradual rise in price since June, ETH’s network activity has not experienced a significant boost with gas prices remaining relatively low. For comparison, during the Shanghai upgrade in April, which preceded a similar rally in ETH price, gas prices rose by 78%, compared to only 28% last week. This could imply that the recent rise is merely trade driven and is not supported by a real demand for ETH.

As such, ETH’s recent rise appears to be simply a phenomenon of “a rising tide lifting all boats”. Whether such a rise can be sustained would depend on how well the overall crypto market performs and may also mean that ETH could underperform other cryptos in terms of returns in the immediate future.

However, despite a general lack of usership, ETH’s network growth is beginning to show signs of picking up even as its price continues to find difficulty breaking the $1,900 barrier. New addresses being created is gradually rising at an increased pace, which is a signal for an eventual market cap growth. Should this new address growth momentum be sustainable, the price of ETH would still eventually rise to reflect this growth.

Huge drop in altcoins opens possibility of bounce

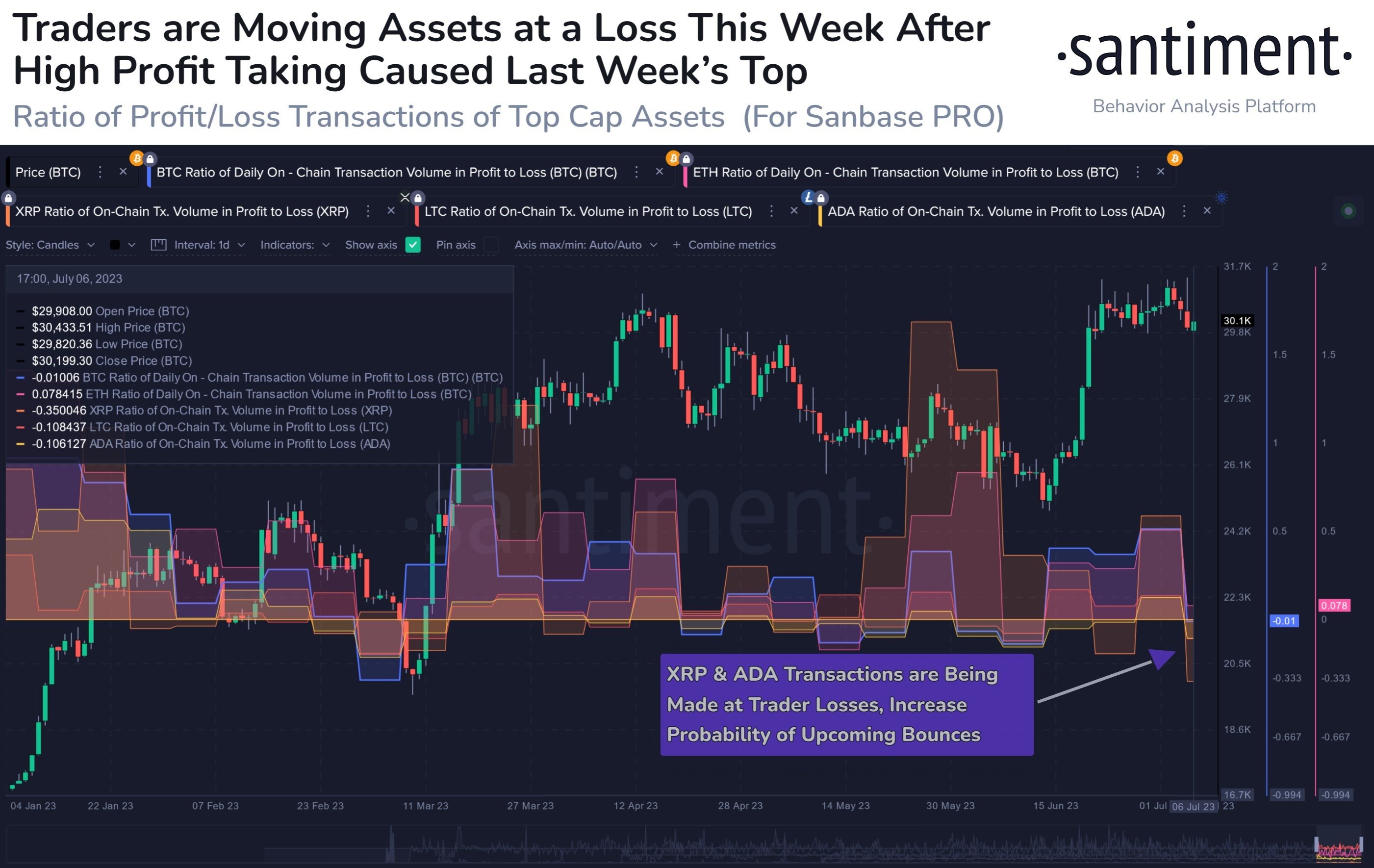

With the large fall in prices of altcoins last week, some altcoins have hit the oversold zone. Data from analytics firm Santiment suggests that XRP and ADA are looking increasingly likely to stage a rebound after traders started selling these tokens at a loss last week. Traditionally, traders selling at a loss signalled a capitulation event and often resulted in a rebound in price thereafter, even if it may be temporary.

Stocks fall as fear of rate hikes return

The FED minutes released last week showed that officials decided to hold off on raising interest rates, opting for a pause to assess the impact of its 10 previous hikes. However, minutes also showed that there was disagreement among FED officials, with some saying that rates should go higher as inflation remains elevated, which means that it is unlikely for the FED to be able to adopt a dovish position in the foreseeable future.

The more hawkish-than-expected tone caused stocks to retreat, with the fall intensifying after the release of the ADP employment numbers which showed a far stronger labour market than analysts anticipated. Even the weaker-than-expected non-farm payrolls numbers released on Friday did not manage to contain the stock market’s decline, with all three major US indices clocking losses for the week. The S&P dropped 1.16%, while the Nasdaq declined 0.92%. The Dow shed 1.96% for its worst weekly performance since March.

Although traders are starting to fear a possible third hike by the FED, the dollar fell by 0.5% last week as the fear of an economic slowdown overshadowed the rise in US yields. With the BRICS nations coming closer to getting their common currency plans to fruition, and US Treasury Secretary Yellen’s visit to China not yielding any positive outcome, the dollar came under some selling pressure as traders pivoted to the safety of precious metals. As a result, Gold gained 0.4% while Silver rose by 1.4%.

Oil finally managed to break higher after top oil exporters Saudi Arabia and Russia announced fresh output cuts during their OPEC+ meeting last week, bringing total reductions to around 5 million barrels per day, or about 5% of global oil demand. Brent Crude gained 4.2% while the WTI rose by 4.7% in response as both distillates closed at a nine-week high.

In this new week however, commodity prices are taking a small step back as the dollar has found a fresh bid in early Asian trading on Monday. On the data front, Wednesday could bring about the highest volatility as the closely watched US CPI number gets released. With the probability of a 25-bps rate hike at the FED’s July 26 meeting at 95%, any higher-than-expected reading in the CPI could unnerve traders and bring about more selling in risky assets, while a weaker reading could send the markets back into rally mode.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.