Bitcoin gained 2.3% last week, recouping losses from the previous week. After starting the week at 67,750, Bitcoin climbed to a high of almost 72k on Friday before tumbling over 2% to a low of 68,300 the same day. The pair has steadily edged higher and traded above 69k at the start of this week.

The broader crypto market was more downbeat last week. Altcoins such as Ethereum, Solana, and Ripple posted losses of 1.7%, 0.7%, and 2.7%, respectively. Meanwhile, meme coins such as PEPE, Link, and Dodge saw losses ranging from 6% to 13%. However, there were pockets of positivity, with BNB and Toncoin reaching record highs.

Macro data and rate cuts in focus

US economic data surprised to the downside across the start of last week, raising optimism that the Federal Reserve could start to cut interest rates sooner this year, as the bad news is good news narrative played out. This was further supported by interest rate cuts from the European Central Bank (ECB) and the Bank of Canada (BoC), which helped risk assets gain ahead of Friday’s non-farm payroll report. Bitcoin rose to just below 72,000, a level that was last seen in early April. The S&P 500 and the tech-heavy Nasdaq 100 rose to fresh record highs.

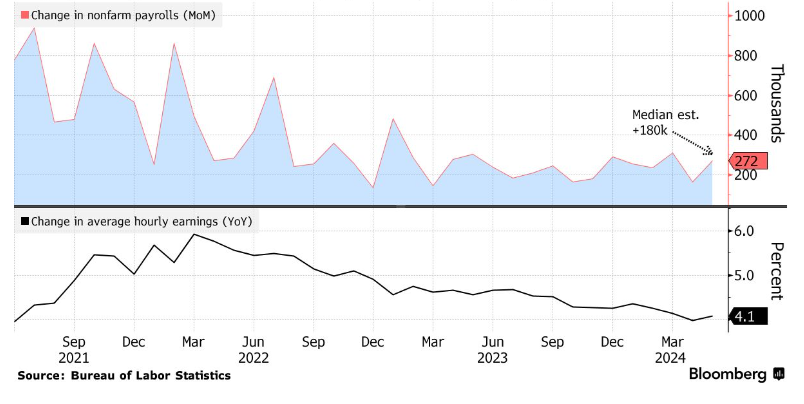

NFP smashed forecasts

However, Friday’s non-farm payroll report jolted the market mood and quickly reversed the upbeat risk sentiment, casting doubt over the prospect of a rate cut this year. The closely watched report showed that 272k jobs were added in May, beating economists’ expectations of 185k and up from 165k in April. Average earnings also climbed 0.4% compared to April and rose 4.1% from a year ago, an increase from the previous report. This overshadowed a rise in the unemployment rate, which ticked higher to 4% from 3.9%.

The data highlights a strong US labour market that continues to defy expectations despite interest rates sitting at a 22 year high. A strong labour market keeps inflationary pressure stubborn, reinforcing the Federal Reserve’s cautious stance on monetary policy as the central bank continues assessing when to start cutting interest rates. Following the data, the market pushed back Fed rate cut expectations. The market is now pricing in under a 50% probability of the Fed cutting rates in the September meeting, down from 70% ahead of the report.

The prospect of US interest rates remaining higher for longer bodes poorly for risk assets. The main indices of Wall Street closed lower, Gold fell, and Bitcoin tumbled over 2%, dropping below $70k.

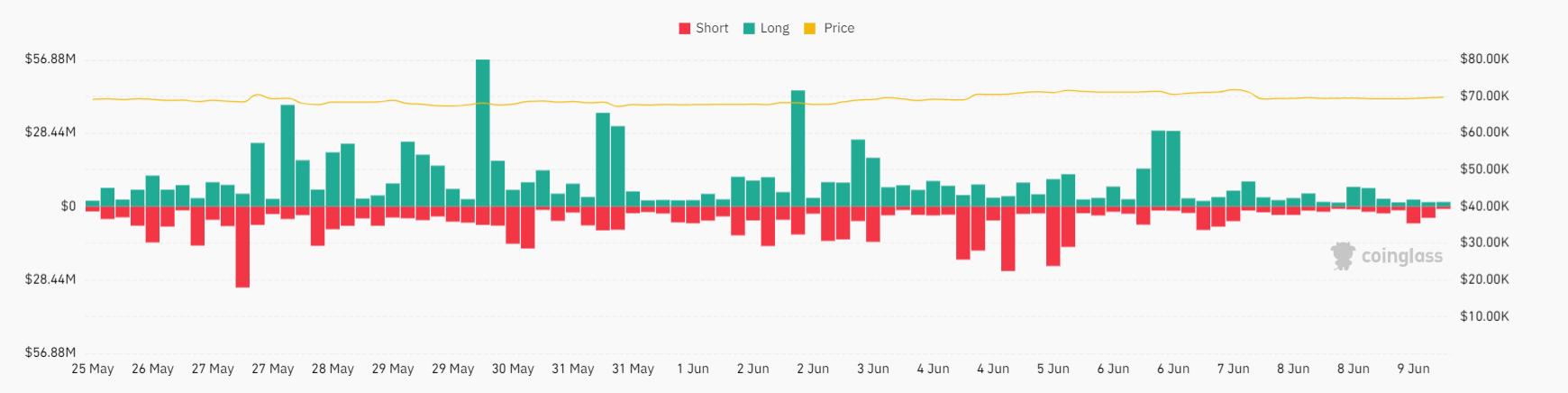

Bitcoin liquidations

As the price fell, Bitcoin liquidations surged on Friday, with data from Coinglass showing that total liquidations were $410.42 million. Out of this, Bitcoin contracts accounted for $70.73 million. A large part of these liquidations were long positions. This showed that many Bitcoin traders were optimistic about Bitcoin’s price since it started trading above 71k on June 7.

ETF flows reach record 19-day streak

While Bitcoin liquidations rose significantly on Friday and the price dropped, the losses may have been limited by spot Bitcoin ETF inflows. Spot Bitcoin exchange-traded funds posted a record 19th straight day of positive inflows, with net inflows of $131 million just for Friday, June 7th, which equates to 1,901 Bitcoin.

According to the inflow distribution, BlackRock saw the highest inflows, with $169.2 million, equivalent to 2450 Bitcoin. Meanwhile, Grayscale recorded an outflow of $36.3 million.

Despite the record 19 days of inflows, Bitcoin price hasn’t risen to a record high. This is because while ETS inflows offer support, they are not yet strong enough to exceed the entire ecosystem selling.

ETFs are important, but the price of Bitcoin is currently more heavily influenced by macroeconomic factors, geopolitical events, and sector-specific narratives.

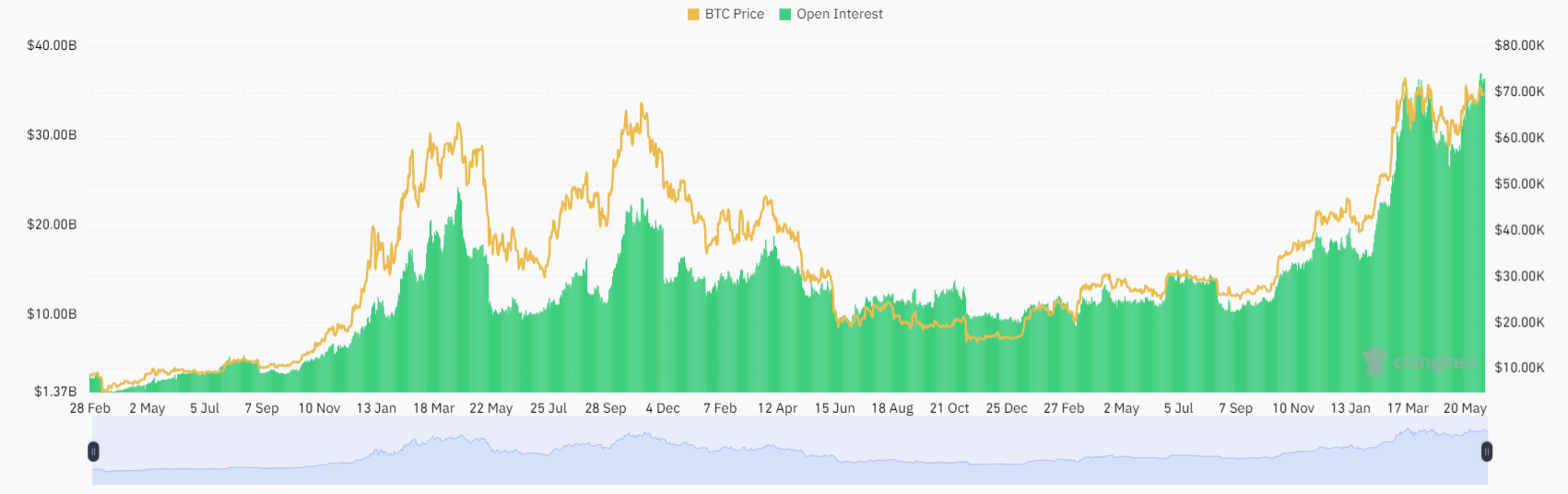

Open interest in Bitcoin futures has also increased significantly over the past few weeks, from $28 billion at the start of May to $36 as of June 6, according to Coinglass data. This 17% rise could indicate more institutional participation, which could also explain the discrepancy between the sharp increase in flow and the more muted BTC performance.

On-chain indicators point to a new ATH

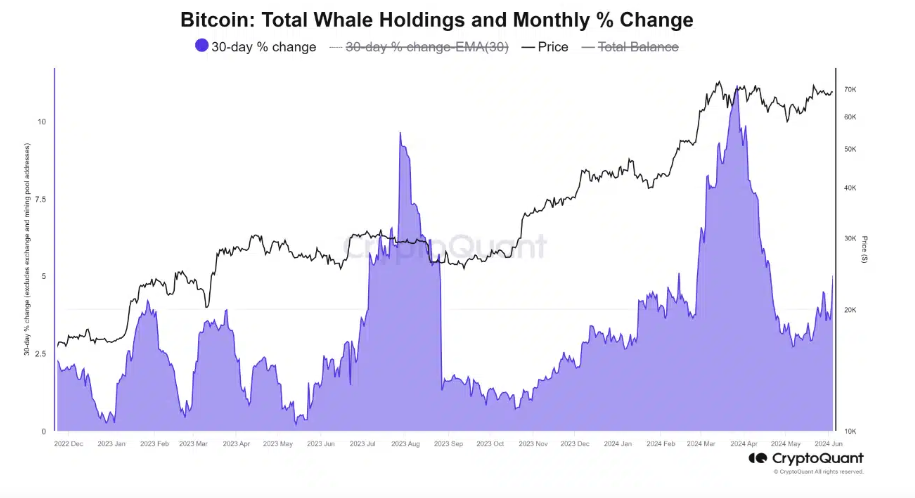

While Bitcoin fell on Friday, it still gained across the week, and several on-chain indicators suggest that the bullish momentum could continue.

Data from CryptoQuant points to institutional investors returning to a re-accumulation phase over recent weeks after a distribution phase in March. Renewed buying activity has already influenced the price and could strengthen in the coming weeks. If this happens, Bitcoin could enter a new price discovery zone and fresh ATHs.

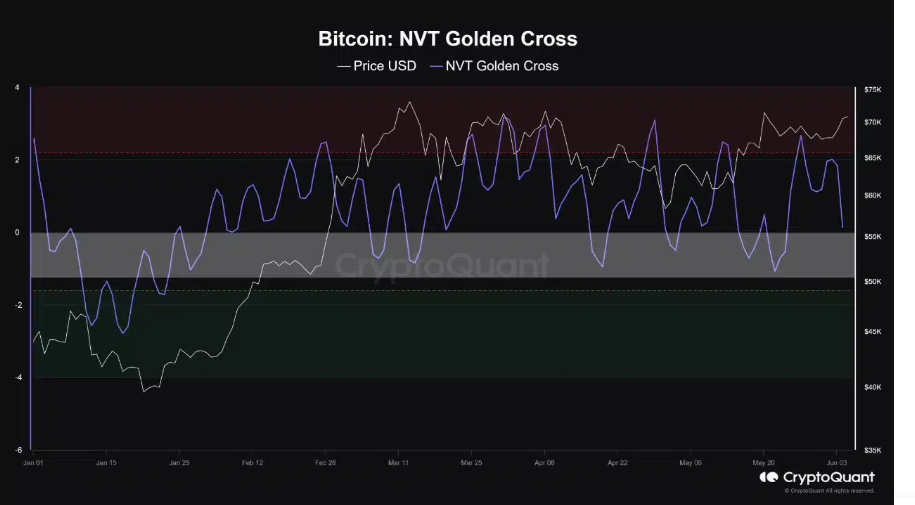

Meanwhile, CrytoQuat data has also noted that since February 2024, the NVT Golden Cross indicator, which helps to detect whether a coin is overvalued or undervalued, has been consistently hitting lows of 0.00- 1.00 points and currently stands at 0.14, which suggests that the bottom of the $69-$70k region could have been reached.

BNB hits a record-high

BNB, the native taken for the BNB chain, reached an all-time high of $723 on June 6th but has since corrected back below $700. Even so, the BNB coin has seen an impressive 9% gain at the start of June, outperforming the total crypto market.

The timing of the BNB rally was rather particular, given that it started as former CEO Changpeng Zhao started his four-month jail sentence for charges related to money laundering. The relief rally in BNB comes after the coin underperformed its peers across the 2024 bull run so far. However, the sharp sell-off at the start of this week means fresh ATHs in the coming sessions look unlikely.

Toncoin reaches a record high

Tocoin was another currency that rose to a record high in the previous week after further developments announced by Telegram CEO and as whale activity surged with a 237.5% increase in large transactions. Toncoin rose to a record high of $7.86 after a noteworthy increase in Toncoin transactions exceeding $100k on the Toncoin network.

Data from IntotheBlock revealed 27 large transactions, a spike from the 7-day low of 5 transactions on May 27. The increase suggests that large investors are making strategic moves, which could mark a shift in investment positions or strategies. While the Toncoin has slipped off that high, it is finding support around the $7 region.

Toncoin could enter a period of consolidation after rising over 220% so far this year and securing a spot in the top 10 cryptocurrencies according to the market cap.

Week Ahead: US inflation and FOMC meeting, Gold weakness

US inflation data will be pasted a few hours before the FOMC meeting on Wednesday, which could result in volatile swings leading into the week’s headline event. While the Federal Reserve is not expected to cut interest rates, it will update staff forecasts and the dot plot and release its usual statement.

Markets will want to see further softening in US inflation data (CPI). Last month, CPI data came broadly as expected, although the market focused on the softer-than-expected monthly print of 0.3% below the expected 0.4%, which led to a repricing over the September cut. However, this was reversed after Friday’s nonfarm payroll report.

If the CPI inflation rate is higher than expected, it could spark last-minute panic ahead of the Fed meeting.

Still, the broad expectation is that there will be no change in Federal Reserve policy at this meeting, so it all comes down to how the Fed shape expectations surrounding a potential September cut. After the stronger-than-expected US nonfarm payroll report, the market is less convinced that the Fed will cut rates in September. It’s difficult to see how the Fed will continue to support three rate cuts in the dot plot, potentially opening the door to a more hawkish meeting that could be bad news for risk assets such as Bitcoin.

Gold prices could also take a hit after falling 3.5% on Friday. Gold tanked after the stronger-than-expected US nonfarm payroll report resulted in the repricing of September rate cuts and on news that China’s central banks had stopped buying the precious metal for the first time in 18 months. At the start of the week, the precious metal was below $2300.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.