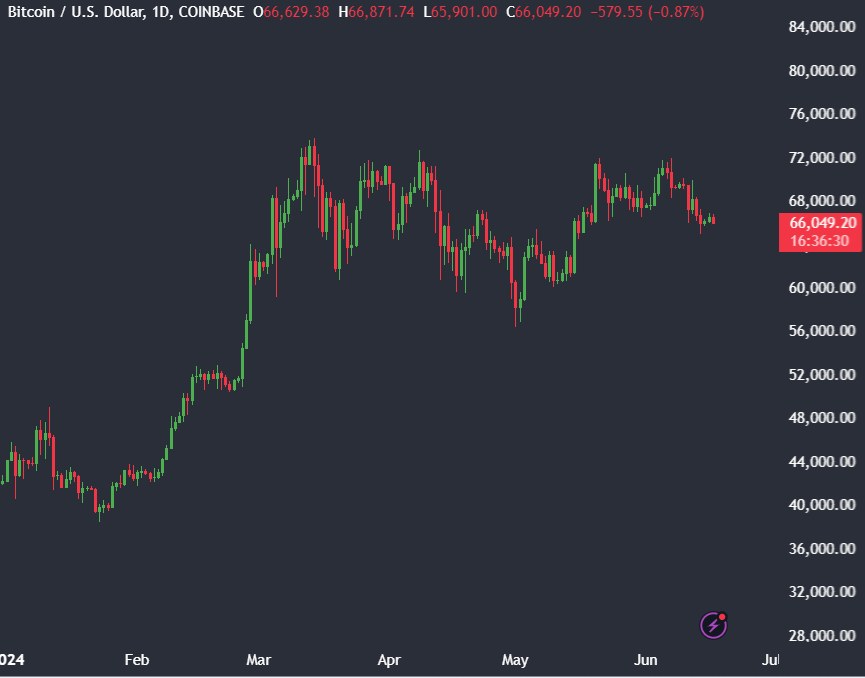

Bitcoin fell 4.5% last week, marking its worst weekly performance since the start of May. Bitcoin started the previous week at 69,30 before briefly pushing above 70,000 on Monday. The Bitcoin price then tumbled to a low below 65,000 on Friday. The total market capitalisation was down around $100 billion, falling to $2.57 trillion. After a choppy trade last week, the price plateaued over the weekend, and BTC/USD trades at 66k at the start of the new week.

The selloff wasn’t confined to Bitcoin, with altcoin also falling sharply. BNB fell almost 10%, dropping away from record highs reached earlier in the month. Solana tumbled 8% across the week, and Ethereum dropped a more moderate 3%.

Meme coins were a sea of red, with Shiba Inu down 10% across the week and Dodge down 7.7%. However, there were pockets of positivity, with UNI up 17% and TON rising to a record high.

The Fed leaves rates unchanged & warned of fewer rate cuts

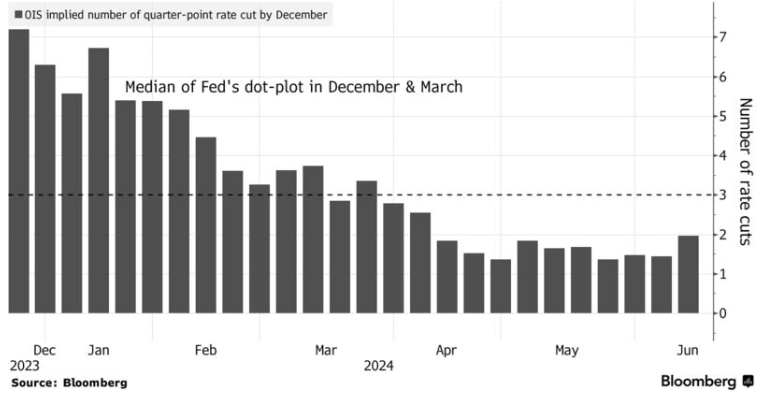

Last week was a big week for fresh information hitting the market. The key focus was on the Federal Reserve, which, as expected, left interest rates unchanged at a 22-year high. However, the Fed also raised its inflation forecast for this year and downwardly revised its dot plot, signaling just one rate cut in 2024, down from three rate cuts previously forecast.

The meeting came after US inflation data showed that core inflation, which excludes more volatile items such as food and fuel, cooled by more than expected to 3.3% annually, and headline inflation held steady at 3.4% annually.

Despite the Fed warning of one rate cut this year, the market Fed Funds pricing implies the market is expecting two rate cuts this year, in November and December. However, the Fed’s longer-term outlook for interest rates has also increased, with a median projection of 4.1% at the end of 2025 compared to market pricing of 3.625 terminal rate.

The market reaction to the week’s events was mixed across asset classes. While the S&P500 and the Nasdaq100 rose to record highs, boosted by an outsized move in Apple, the Dow Jones fell across the week. Gold also rose 1.7%, marking the first weekly gain after three weeks of losses, rising even as the USD rose 0.6%, suggesting some safe-haven flows. Meanwhile, cryptocurrencies were broadly lower as the risk asset often struggles against a stronger USD.

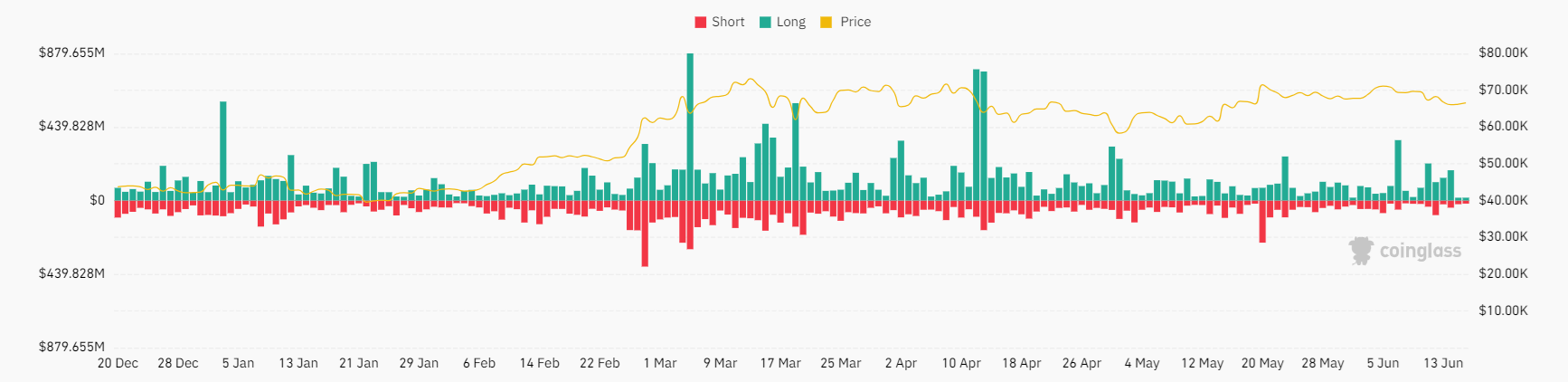

Bitcoin liquidations

The considerable downturn in the entire crypto market caused hundreds of millions of liquidations, sparking some fears of a prolonged correction.

According to data from Coinglass, a massive $207 million crypto was liquidated on Friday as the price fell to 65k. Long positions accounted for most of the wipeout, at $184 million.

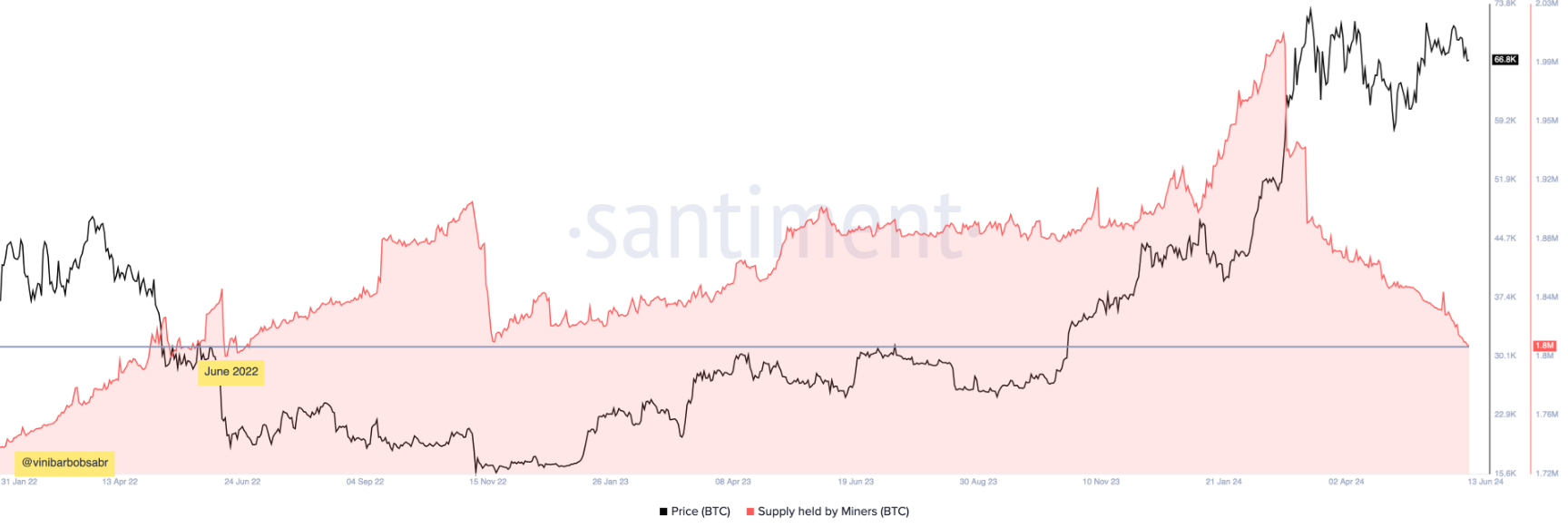

Miner selling hits a 2-year high & reserves drop to a 2-year low

The recent selloff in Bitcoin could also be linked to increased selling from miners. According to data from CryptoQuant, the number of Bitcoins sent from Bitcoin miners to exchanges has risen to a 2-month high amid a decline in revenue owing to lower transaction fees.

The data showed that miners sold 1,200 BTC via over-the-counter desks, marking the highest level since the daily volume reached 1,600 BTC in late March. Large Bitcoin mining companies have also increased their selling activity. Marathon Digital has loaded 1,400 so far in June, representing 8% of its total holding, a significant increase from 390 BTC sold in May.

The increase in sales from Bitcoin miners comes as revenues remain low after the halving event. Daily miner revenues have plunged to $35 million, a 55% decline from $78 million in March.

Data from Santiment shows that Bitcoin miners’ reserves dropped to June 2022 lows when Bitcoin traded below $20k. Miners hold 1.8 million Bitcoin, down from 2.01 million held just ahead of March’s record high of $73k.

Daily Bitcoin transaction fees are around 65, a considerable drop from 117 just before halving. Meanwhile, the median transaction fees have stayed low despite the record-high number of transactions seen on the network in recent weeks.

Is 65k a bottom? BTC derivatives show resilience

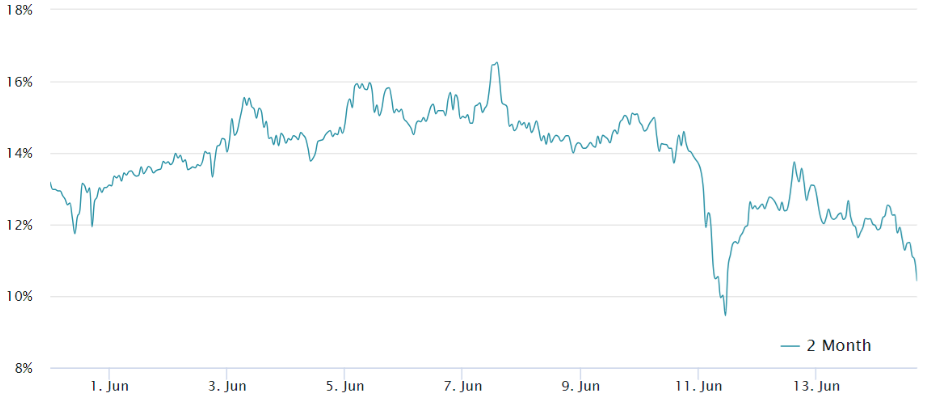

Despite Bitcoin falling 8.5% between June 6 and 14, its primary derivative metric showed little change. The Bitcoin futures premium reflects the difference between the monthly contract in the derivatives market and the spot level on the regular exchanges.

A 5% to 10% annualised premium is expected. Bitcoin’s 2-month futures premium held above 10%, the threshold for a bullish market. The Bitcoin derivatives market was slightly less optimistic than the previous week but showed no signs of stress or strong demand for short leverage. This could support the view that $65k could be a bottom for now.

MicroStrategy to buy more Bitcoin

MicroStrategy plans to add more Bitcoin to its holdings and is raising $700 million in debt to facilitate the purchase. The largest publicly traded corporate holder of Bitcoin announced that notes maturing in 2032 will be priced to yield at 2.25%.

MicroStrategy started buying Bitcoin in 2020 as a hedge against inflation and an alternative to holding cash. MicroStrategy now holds $12.7 billion of Bitcoin, which equates to more than 1% of all the cryptocurrency ever created. Bitcoin has risen 60% this year, while MicroSytatregy’s share price has increased 135% across the same period.

Look Ahead

With US inflation data and the Federal Reserve interest rate decision behind us, attention will turn to US retail sales data for further clues over the strength of the US economy and the timing of Federal Reserve rate cuts, which are not expected until later in the year.

Economists expect retail sales to rise 0.3% after coming in unexpectedly flat in April. Consumer spending is an area of focus for investors as they assess the impact of high rates on the economy. The market will also hear from several Fed speakers across the week, including New York Fed President John Williams, Minneapolis Fed President Neel Kashkari, and San Francisco Fed President Mat Daly.

A stronger retail sales report or hawkish-sounding Fed speakers could lift the USD and lower risk assets such as Bitcoin and stocks.

Away from the US, China will release a deluge of data at the start of the week as investors look for signs of recovery in the world’s second-largest economy. Recent data has supported the view that more stimulus may be needed from Beijing.

Last week, Gold and the USD experienced gains on safe-haven flows amid rising concerns over political uncertainty in France after President Macron called a snap election. The market is fretting that the next French government will spend heavily, pushing France’s debt to dangerous levels. These concerns are likely to extend across the coming week.

Elsewhere, the BoE, RBA, and SNB are due to announce their rate decisions. No change to policy is expected. The BoE could prepare the market for an August rate cut.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.