As the initial shock of the US SEC’s latest move waned, crypto prices started recovering early last week. Crypto prices were given a boost initially after it was revealed that a new legislation was filed by US legislators that if passed, would rework how the SEC functions and, as an added effect, give current Chairman Gary Gensler, who is the mastermind of the recent witch hunt on crypto, the boot. While this bill has only a small possibility of being passed, it nonetheless reveals the displeasure that some legislators have regarding the SEC’s current tough stance against crypto, giving crypto investors some hope that things may not turn out as bad as they looked, which stabilized prices for a brief moment.

However, after the FED meeting on Wednesday, crypto prices started retreating, with the price of BTC falling through $25,000. ETH also fell 5% immediately after FED Chairman Powell signaled more rate hikes to come this year and no chance of a rate cut anytime in the coming year. With a hawkish FED and the US clampdown on cryptos, the outlook for crypto this year appears to be bleak, as is usually the case historically during the early stages of a new bull market.

Furthermore, yet another attempt to depeg the USDT stablecoin and unsubstantiated rumour about Binance being investigated by French authorities soured sentiment further, even as rumor that the Curve protocol founding team was trying to cash out hit the market.

With so much negative happening within a short span of time, trader sentiment on crypto dived to its most bearish since the COVID dip in 2020.

Typically, such extreme pessimism could increase the chances of a contrarian rally and indeed, prices bounced into the weekend, with BTC and ETH recovering about 5% and altcoins about 7%. The bounce came about after Blackrock Capital filed an application to launch a Spot BTC ETF, which negated some of the bad news.

However, it remains to be seen if the rally is able to last through this week, as it will take some time before the outcome of Blackrock’s application is known. In the meantime, the crypto market has still to navigate through the current period of unfavourable regulatory and macro environment.

Celsius To Sell Altcoins into BTC and ETH

Amid the many news headlines that hit the market last week was one about defunct crypto firm Celsius. The firm announced that it will be selling all altcoins from all customers (except Custody and Withhold accounts) starting 01 July and will be converting them into BTC and ETH. While the amount of altcoins Celsius still holds is not significant, this happening at a time when market depth is bad and liquidity is low could amplify the already weak price action in altcoins, further strengthening the case of a BTC outperformance as we had mentioned before in the breakout of BTC Dominance.

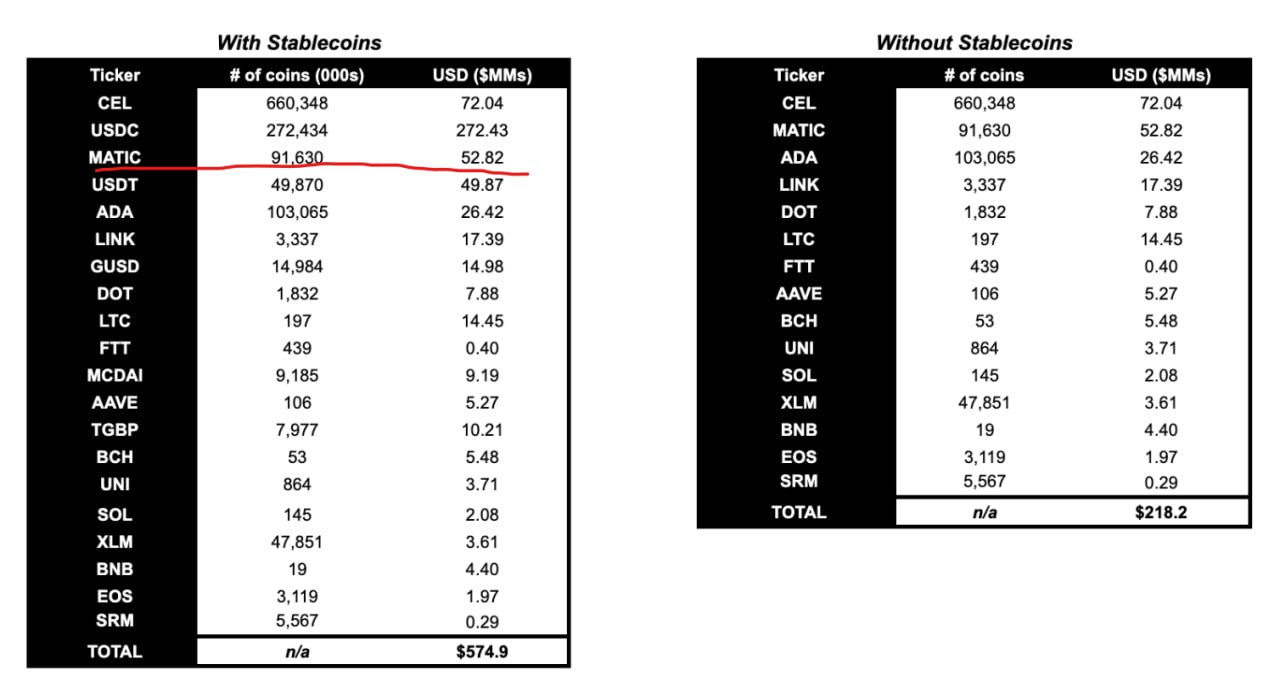

In particular, Celsius still holds around 91,630,000 units or $53 million worth of MATIC that it will have to dispose of. Other than MATIC, Celsius also holds a significant amount of ADA, totalling around 103 million units or $26 million worth.

Below is a list of the current altcoin holdings of Celsius that it has to dispose of. Note that the list could be non-exhaustive and has not been verified with the company.

Long-term investors could take the opportunity to accumulate these tokens should the sale contribute to a dip in price.

Long-Term Holders Continue to Add BTC

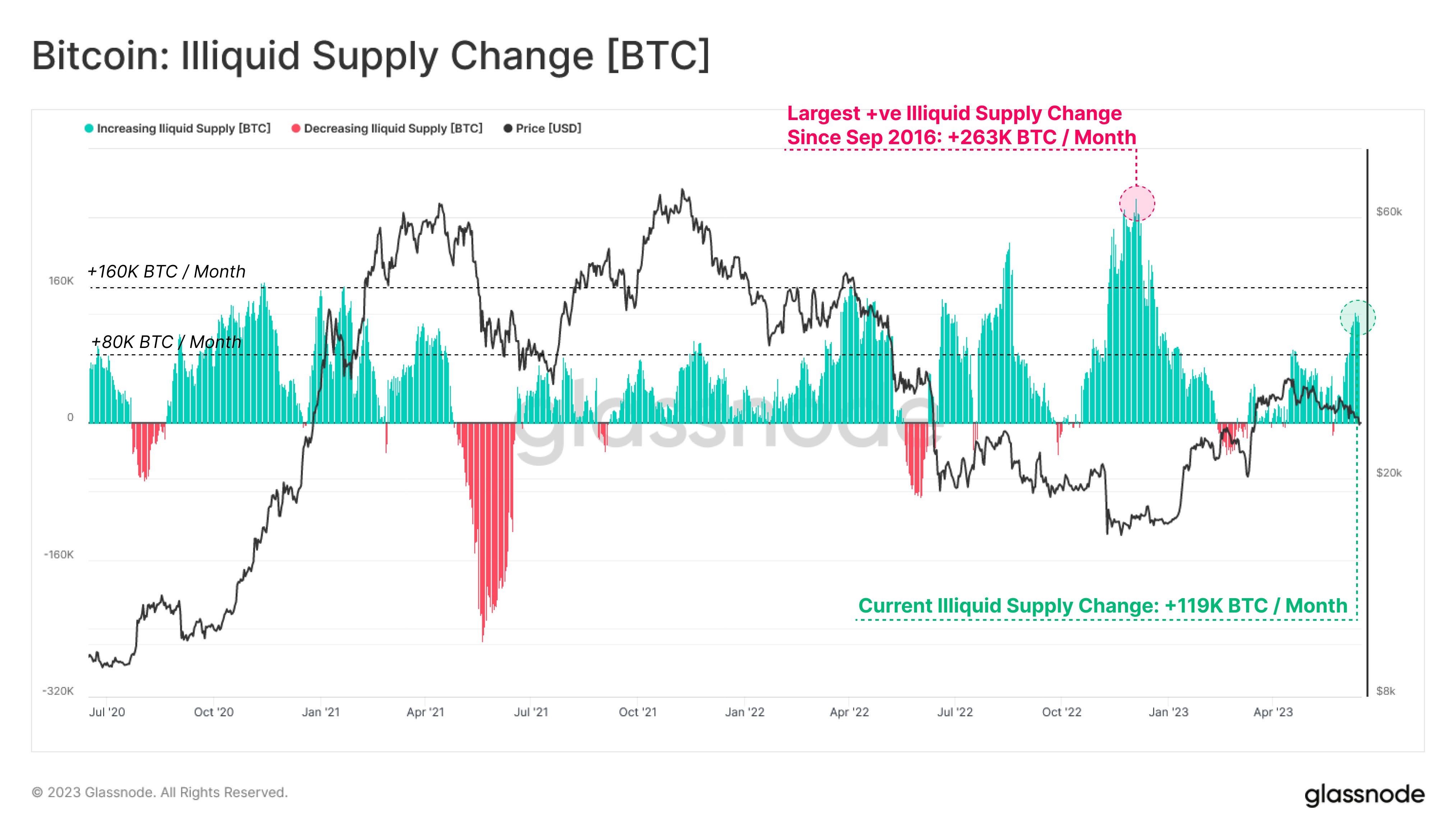

While not representative of the entire market, the move by Celsius is echoed by many long-term crypto investors who have been adding to their BTC holdings as the prices and volume of altcoins continue to fall. Holders have bought another 119,000 units of BTC this month even as its price dips.

Investors hiding in the safety of BTC is not necessarily a bad report for altcoins as this phenomenon has typically happened at every end of a bear market. Hence, it is not game over for altcoins but dips could be a good opportunity to pick up some good quality altcoins which are still witnessing positive developments and improvements. One such blockchain could be Polygon.

Polygon 2.0 Unveiled But MATIC Slumped On Delisting

The price of MATIC started to recover early last week after the Polygon team indirectly challenged the US SEC claim that MATIC was a security. Team Polygon had stated that Polygon was neither developed nor run from the USA, which was a quiet show of confident defiance very welcomed by the crypto market.

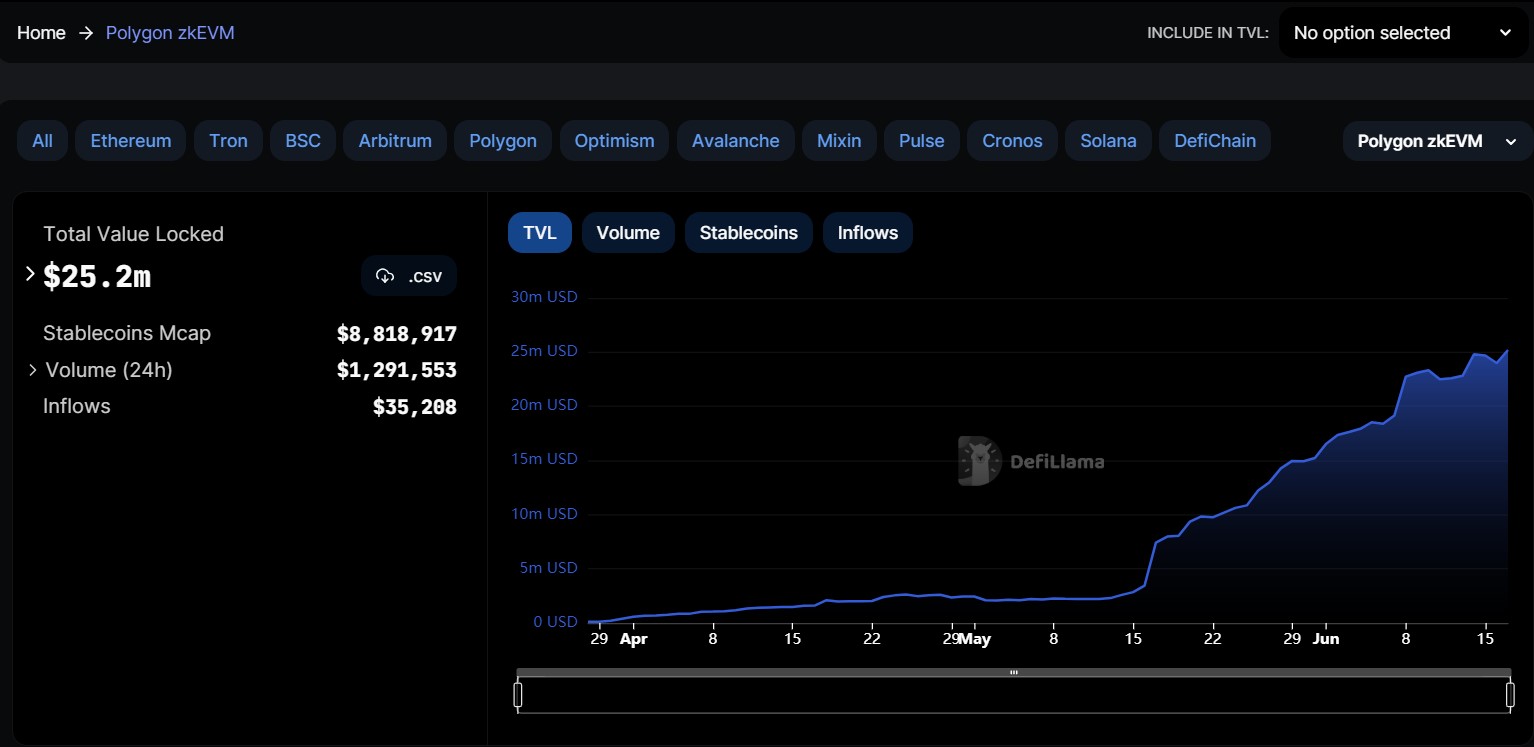

Furthermore, on 12 June, Team Polygon unveiled Polygon 2.0, which will lay out a roadmap in a few weeks for how Polygon will become the Value Layer of the Internet, offering unlimited scalability and unified liquidity via ZK technology. Already, Polygon’s ZK rollup which has only gone live in late April has seen its TVL quietly growing steadily, which shows user confidence in the network’s offering.

However, the price of MATIC pulled back after the FED meeting, and more so after institutional exchange Bakkt decided to delist MATIC, SOL and ADA. While Polygon 2.0 is a good thing, the MATIC token nevertheless still traded lower for the week. As we have indicated above, MATIC will still have to ride through the Celsius disposal in July, which may add to its already negative short-term outlook, unless an OTC deal could be struck with any potential buyer.

In the weeks to come, Polygon will be unveiling more information about Polygon 2.0, and the TVL is expected to continue to climb as long-term investors would likely stake the token and wait for the market to turn. In time to come, the new update would be beneficial to MATIC’s price once this unfavorable season blows over.

Stocks Rose Despite Hawkish FED As Inflation Cools

Tuesday’s release of the May CPI data showed that on a YoY basis, inflation dropped to 4%, its slowest increase in 2 years, beating analysts’ expectation of 4.1%, while the PPI released on Wednesday just hours ahead of the FED interest rate decision was also cooler than expected, coming in at 1.1%, against expectation of 1.5%.

However, despite the cooler inflation data, the FED was still more hawkish than market expectations. While not raising rates at Wednesday’s meeting as everyone had expected, FED Chair Powell delivered a more hawkish speech than was expected, telling the market that not only was a rate cut still years away, two more rate hikes would be coming this year. Even then, stocks continued to move higher as traders brushed off the threat of more rate hikes. US bond yields moved lower after weekly jobless claims came in slightly above estimates at 262,000 on Thursday, compared to expectation of 245,000, while retail sales ticked up 0.3%.

As a result of the bullish sentiment on stocks, the S&P 500 closed up 2.6% and the Nasdaq gained about 3.3% on the week. The Dow also rose nearly 1.3% to finish its third positive week in a row, while the S&P and Nasdaq had their best week since March.

The dollar fell around 1.3%, but that did not benefit precious metal prices as Gold fell 0.12%. Silver lost 0.3% as traders put on a risk-on cap and left the anti-dollar trade to move into equities. Oil was another beneficiary from the risk-on trade, with the WTI and Brent both gaining around 2.4%. However, as the new week started in Asia, the dollar advanced slightly, dragging precious metals and oil lower as the US market pauses on Monday for the Juneteenth holiday.

While the FED chose to pause in June, the ECB went ahead to raise rates by another 25-bps on Thursday, taking its key interest rates to 3.5% even as inflation in the Eurozone is showing signs of easing. Friday came the BoJ, which as expected, maintained its accommodative monetary stance once again.

Any Chance For a Crypto Bounce As Q2 Ends?

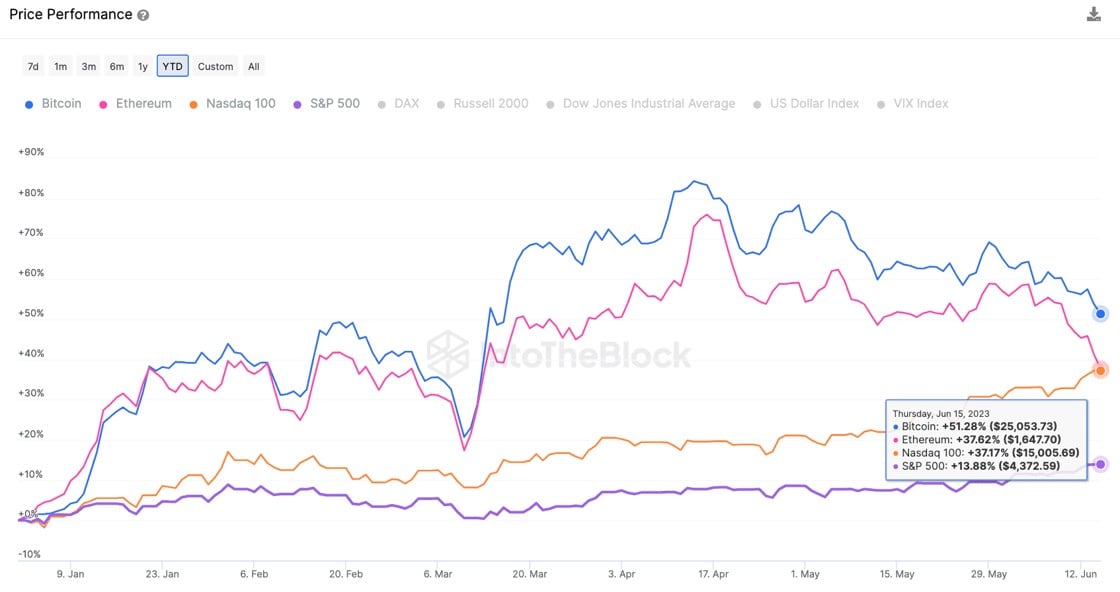

Since early June, regulatory headwinds have put crypto in a backseat, and as the risk-on sentiment continues pushing stock prices higher, crypto prices have lagged that of stocks as we move towards the end of Q2.

However, as we can see in the diagram below, the second half of Q1 also displayed a similar trend, where crypto prices underperformed stock prices for the most part of the entire quarter, only to catch up in the final two weeks. Will we see a repeat of this phenomenon this time, or will stocks continue to build on their current strong momentum to outrun crypto even if the price of BTC and ETH recover?

Furthermore, there has been an increase in the market cap of stablecoins of around $1 billion last Friday just prior to the crypto market bounce. A large jump in the market cap of stablecoins in the middle of March led to the huge price upswing in crypto which brought about the outperformance to stocks in the final two weeks of Q1. Hence, it will be worth watching the market cap of stablecoins in the coming days to see if a similar thing could occur, more increase in stablecoin market cap will be needed for this bounce in crypto price to last.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.