Despite a challenging start to May, with Bitcoin dropping to a two-month low of 56,500 on May 1, the cryptocurrency demonstrated its resilience. It rebounded throughout the second part of the week, climbing for four straight days and rising to a weekend high of over 64,500. This recovery from the bear market could suggest that the bottom is in for now.

While Bitcoin sold off amid a broad derisking in the early part of the week, before recouping those losses in the second part of the week, the performance of other coins was also mixed. Ethereum fell 5%, Litecoin fell 3.5%, and Uni dropped 6.5%. Meanwhile, several coins outperformed Bitcoin, with Doge and Toncoin rising 7% across the week.

A more dovish Fed supports BTC

The macro-environment, particularly the speculation surrounding the Federal Reserve’s rate cuts, has significantly influenced the recent performance of the Crypto market. The unexpected strength of the US dollar due to higher-than-expected inflation and a robust jobs market in Q1 has raised expectations of a more hawkish stance from the US central bank.

However, the Federal Reserve’s more dovish-than-expected statement calmed concerns over a possible rate hike, affirming that it’s unlikely that the central bank’s next move will be a rate hike. The comments supported riskier assets such as Crypto, even though rates will likely stay high for some time.

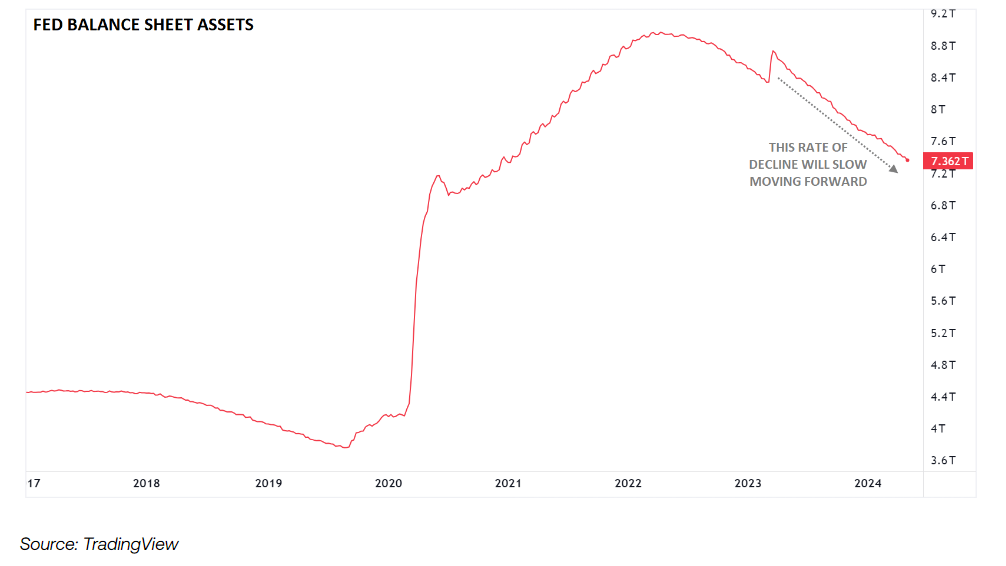

The Fed added that it would amend the tapering speed of its balance sheet runoff from $60 billion a month to $25 billion per month as of June 1, marking a larger reduction than many had expected. The lower cap of the Fed’s QT program could help improve liquidity in the market by moderating the withdrawal of funds from the financial system.

While concerns about a more hawkish Fed lifted the USD 1.75% across April, the more dovish stance from the Fed and signs of a softening in the US jobs market have pulled the USD over 1% lower so far in May. According to CFTC data, USD long positions are weighty, so unwinding these positions could lift Crypto in the near term.

Softer NFP boosts demand for risk assets

US job creation slowed to 175,000 in April, down from 315,000 in March. The unemployment rate unexpectedly rose to 3.9%, up from 3.8%, and average earnings slowed to 3.9% annually, down from 4.1%. The data suggest that the jobs market is slowing sufficiently for the Fed’s next move to be a rate cut but is by no means collapsing.

Following the data, the market raised rate cut expectations, pricing in two rate cuts this year, up from one rate cut before the data. As a result, risk sentiment surged following the report, with BTC/USD rising 6.3% on Friday alone. Meanwhile, the tech-heavy Nasdaq 100 closed 2% higher, and the USD fell to a 3-week low.

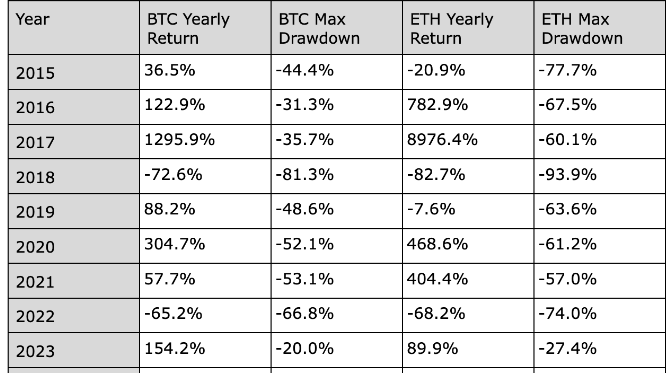

It’s important to note that the April selloff in Bitcoin was not specific to the Cryptocurrency market, with stocks also experiencing the first monthly loss in six months. This tells us that it is not a sector-specific capitulation, while the strong rebound hints that the recent pullback to a 23% fall from its ATH is below its historical range. While 2023 saw a 20% drawdown, 2016 was the next smallest intra-year drawdown, 32%.

Hong Kong BTC ETF flows outperform US flows

The trend of smaller drawdowns is likely owing to the spot ETF approvals, which have helped legitimise the asset. This includes not only the US spot BTC approval in January but also the Hong Kong spot BTC and ETH ETFs launched on April 30 and applications in Australia.

Hong Kong spot ETFs finally started trading through three service providers: Harvest Global Investments, the local unit of China Asset Management, and a partnership between HashKey Capital and Bosera Asset Management.

While trading started sluggishly with just $12 million recorded trading volume, things quickly ramped up. Hong Kong quickly overtook the US in weekly inflows, underscoring the progression of the Hong Kong Bitcoin landscape.

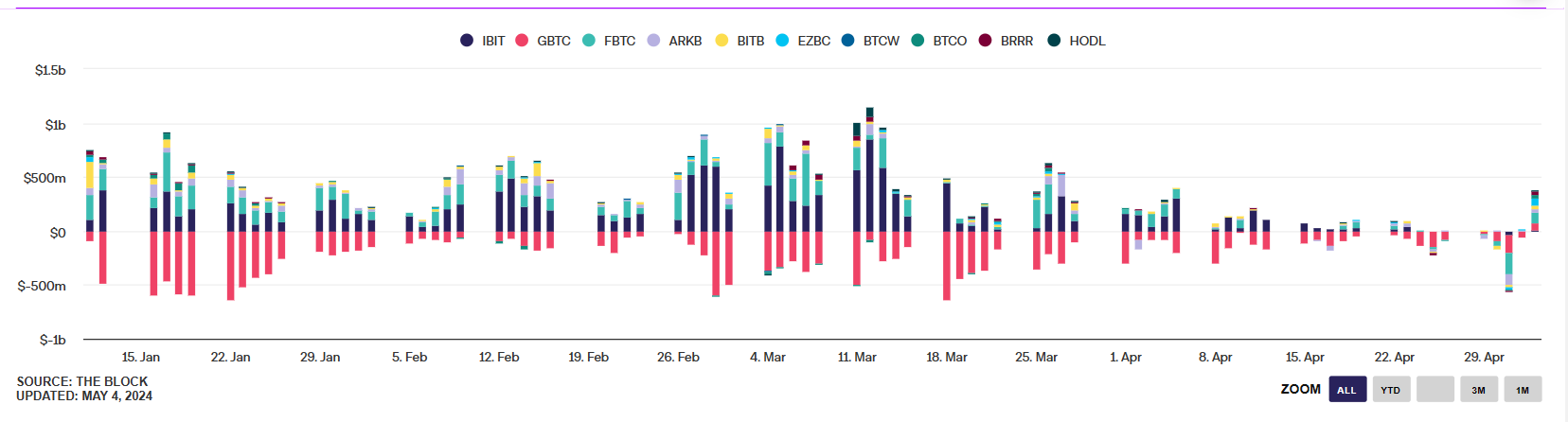

Attention has been on recent outflows from US spot ETFs. The iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF by volume, ended its 71-day inflow streak and experienced its first-ever outflow on May 1. The 11 US Bitcoin ETFs have recorded over $871 million in negative net outflows this week, marking the largest week of net outflows since launch. While 0 ETF inflows and outflows aren’t that notable, they could point to declining interest in the asset.

Whales accumulate supporting BTC

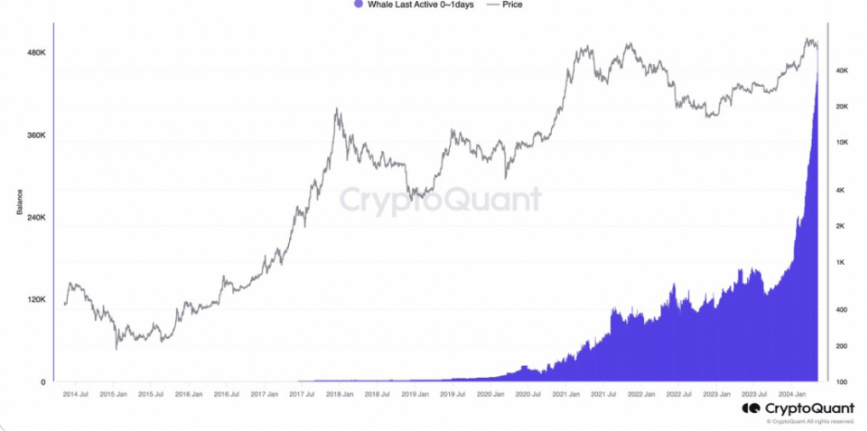

On Friday, data from CryptoQuant showed that Bitcoin Whales acquired over 47k Bitcoin worth over $2.9 billion. CryptoQuant’s statistics exclude wallets related to mining first and centralised exchanges. It does include spot Bitcoin ETFs.

However, given that spot BTC net flows have turned negative, they can’t be the reason behind the uptick. Whale accumulation on a large scale tends to have a positive effect on the price of any Cryptocurrency.

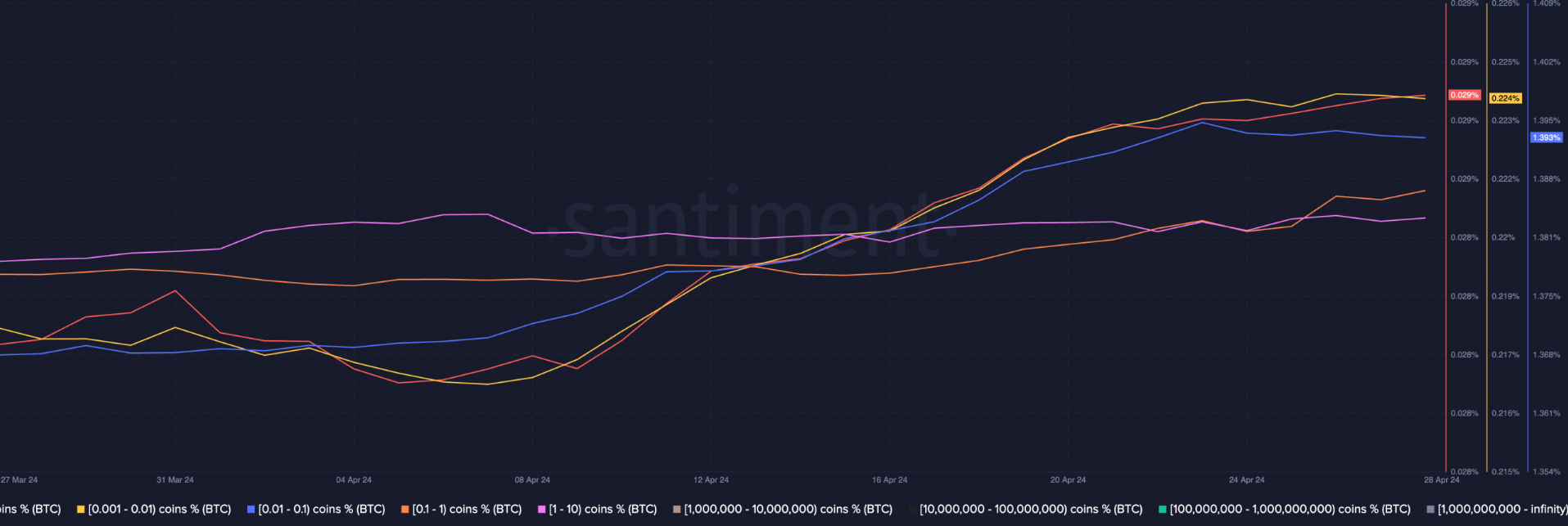

While high interest from whales means that more BTC is in the hands of a few, making the price more vulnerable to manipulation, interestingly, it hasn’t just been whales accumulating. Those addresses holding between 0.001 and 1 BTC also showed interest in buying the coin.

Should sentiment remain positive for both whales and smaller traders, Bitcoin price could rally further.

Looking Ahead to a quieter week, Gold rebounds

US and global indices had a wild ride last week owing to changes in the outlook for the Fed’s monetary policy. The Fed meeting, combined with a softer-than-expected jobs report, saw the market bring forward rate cut expectations.

After last week’s fireworks, this week’s US economic calendar is much quieter, with just Friday’s University of Michigan consumer sentiment survey, which could influence the US markets or USD. Earnings will also be calming down after a broadly solid earnings season so far.

Elsewhere in the markets, USD/JPY plunged to 152.00 after two rounds of intervention by Japanese authorities in a matter of weeks and after the selloff in the USD.

Gold prices are recovering after falling 1.5% last week and reaching a one-month low despite a weaker USD and a more dovish Federal Reserve. Chinese premiums slipped for a second straight week due to sluggish holiday demand, and physical demand in India was also subdued.

This week, the US economic calendar is light. The market will look to Fed speakers for further clues about when the Fed will start cutting rates. Lower rates reduce the opportunity cost of holding non-yielding gold, boosting its appeal.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.