Bitcoin booked gains of over 2.5% last week in a choppy trading week. The cryptocurrency started the week at 67,000 before quickly falling to a low below 66k. Bitcoin then surged 7.5% on Monday, May 20, to a peak of 71,900 before trending lower to current levels around 69k.

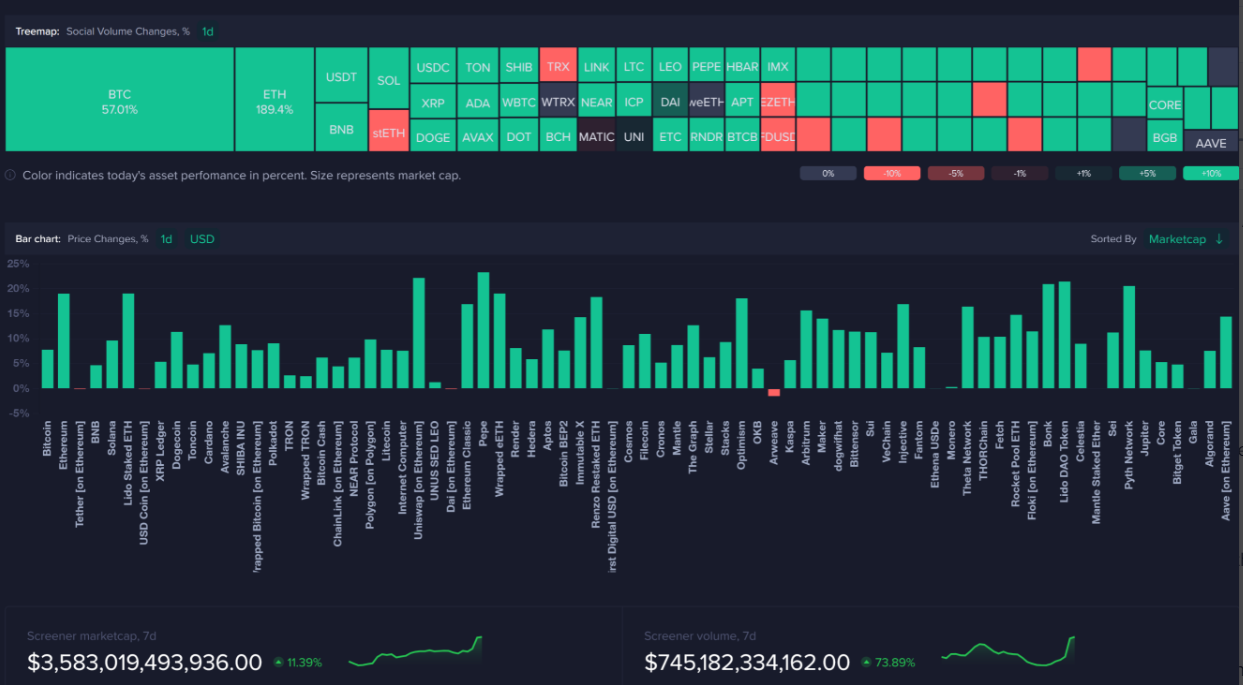

Altcoin performed mixed across the week, with Ether leading the charge, surging 20% on Monday alone and 25% across the week. Meanwhile, XRP rose 3%, and BNB rose 3.5%. Other coins fell, including Solana, which dropped 6%.

The SEC approves ETH ETF

Ether’s outperformance came as the Securities and Exchange Commission, after days of anticipation, approved the 19b-4 filings for eight spot Ether ETFs. News of the SEC asking exchanges to update their 19b-4 filings ahead of the VanEck application sent the ETH price soaring 20%. The hype surrounding Ethereum spot ETF was a catalyst for one of crypto’s best days this year. ETH, SUNI, PEPE, and BONK all surged over 20% in 24 hours, and Bitcoin rose to 71,400 for the first time in 6 weeks. Social volumes for Ether also roared higher.

However, this is not simply a case of the SEC approving the spot ETH ETFs and starting trading. The issuers must wait until the S1 Registration statements are approved by the regulator’s Corporate Finance Division before the ETFs are launched. Depending on the complexity of the filings, this could take days, weeks, or even months.

The delay in launching the ETH ETFs, due to the need for the regulator’s Corporate Finance Division to approve the S1 Registration statements, is expected to impact market flows in the near term. While the SEC’s decision last week was undoubtedly positive for Ether and is likely to support its overall performance, there is a possibility that flows could fall short of expectations, particularly considering the relative market size of Ether compared to Bitcoin. For instance, the Hong Kong spot Bitcoin and spot Ether ETFs have a significant disparity in AUM, with the former at approximately $239 million and the latter at just $41 million, indicating a 6:1 ratio.

Even so, the approval may help to narrow the gap in ETH’s underperformance to that of its peers so far this year. This is particularly the case because, until Monday last week, the market was pricing in a low probability of ETH ETF approval, which could have kept capital sidelined.

ETH profitability & whales return

According to IntotheBlock data, 95% of current ETH positions are now profitable after the price rose 30% over the past seven days. This high level of profitability was last seen in November 2021, when the Ether price soared to an all-time high.

As a result, there could be minimal resistance to further gains, with 3.57 million ETH bought in the price range of $3,800 to $4,800 compared to 53.54 million Ether bought between $2,160 and $2,650.

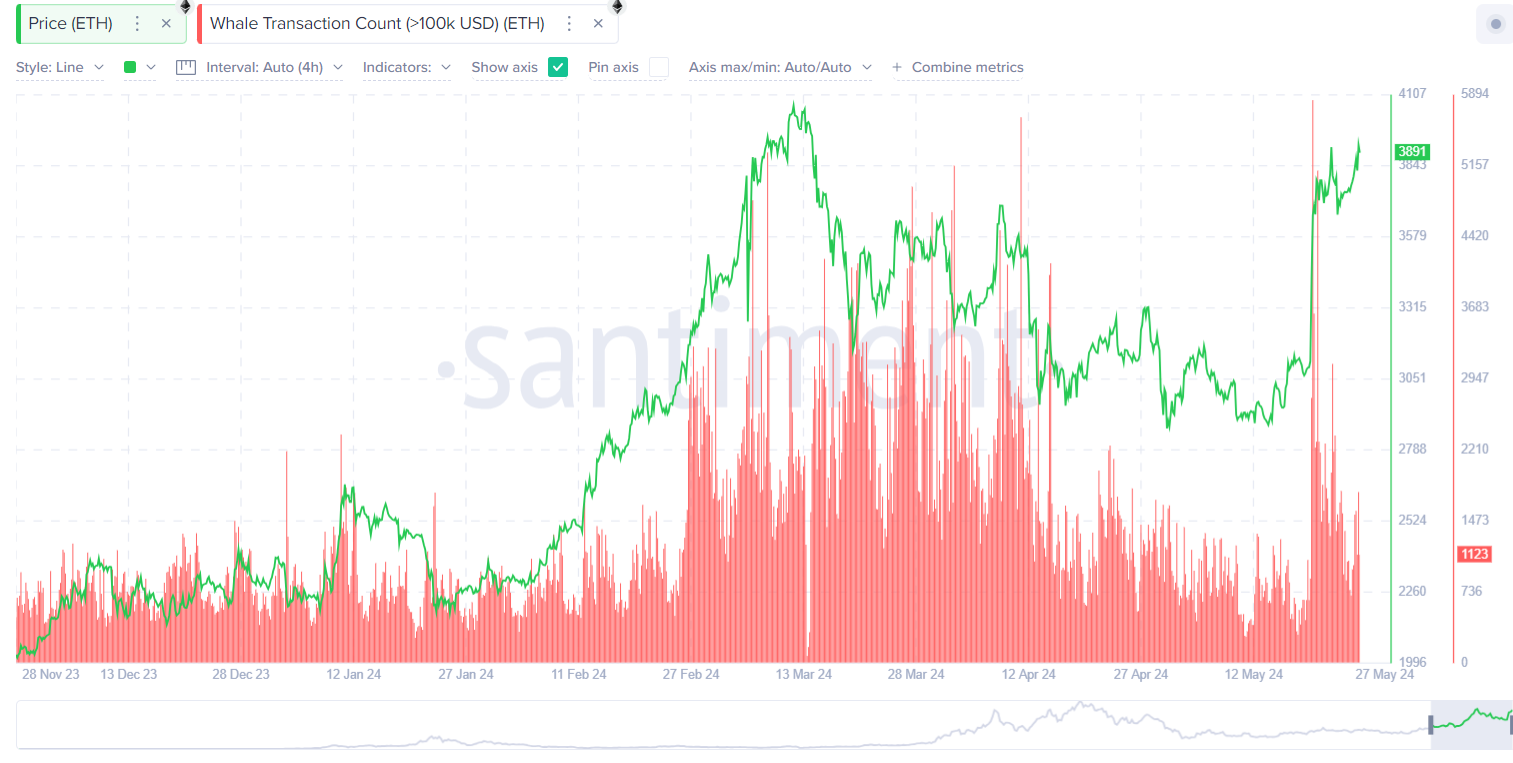

ETH whales have also begun to make noticeable moves. On Tuesday, the 21st, ETH recorded an on-chain trading volume of $15.98 billion, the highest level in almost a year. Of that, $15.98 billion and $14.33 billion came from transactions exceeding $100,000, typically done by whales. The substantial on-chain trading volume suggests a growing institutional and investor confidence in Ethereum.

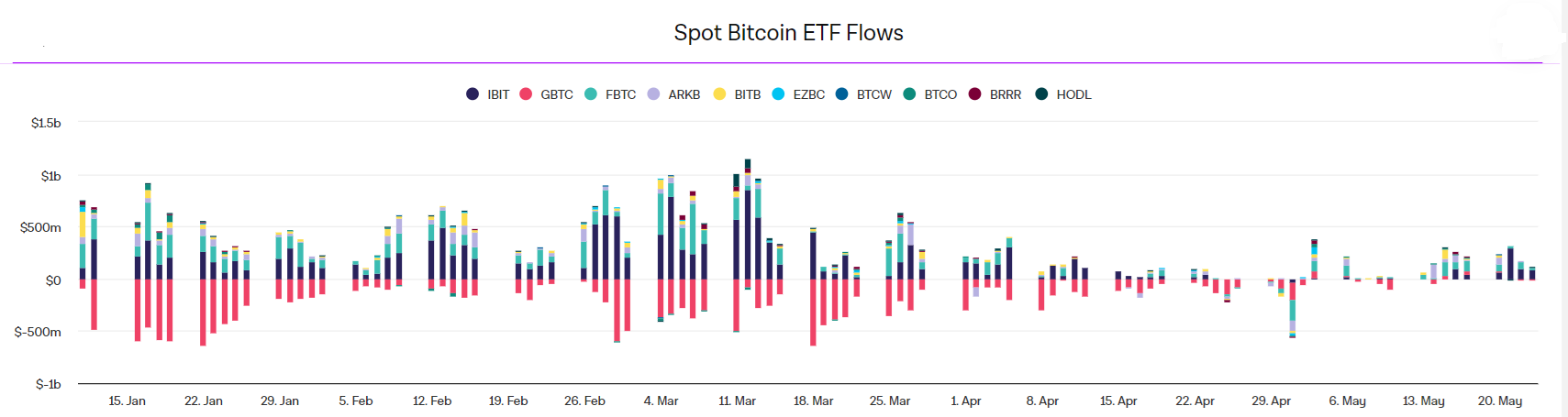

Bitcoin ETF flows equal the March record

With the ETH ETF approved this week, Bitcoin ETF flows were under the spotlight. Spot Bitcoin ETFs experienced challenging times at the end of April, particularly on May 1. However, the negative trend appears to have turned a corner, with ten consecutive days of positive flows. The Bitcoin ETFs have seen an impressive streak, equaling the 10-day record from March of inflows. May 15 and 21 saw inflows of over $300 million, while inflows on May 24 exceeded $250 million inflows.

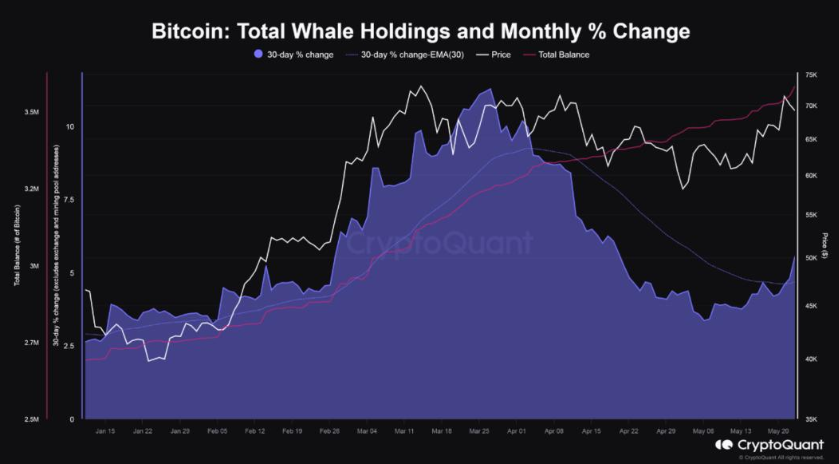

Bitcoin Whales are buying – is a new high coming?

While the Bitcoin price eased from 71,000 last week, Bitcoin whales appeared to be waking up and loading up with significant amounts of BTC the previous week, raising the question of whether returning whales can drive the Bitcoin price to new record highs.

According to CryptoQuant, whales are showing increased buying appetite and are becoming more active. Whales are individuals or organizations that own at least 1000 BTC, meaning they can often influence price movements and market dynamics.

CryptoQuant on-chain analysis showed an increase in the monthly percentage change in whale address holdings and a steady rise in whale balances.

Whales increased their holding by over 11% in March when Bitcoin rose to an ATH. The Bitcoin accumulation rate steadied in April, with the 30-day percentage change falling 3%. However, accumulation is increasing again in May, with the monthly percentage change returning to above 5% as of May 24. Should whale accumulation levels return to March levels, there is a higher probability that the Bitcoin price could return to or surpass its current ATH.

FIT21 Crypto Bill approved by the House of Representatives

The US House of Representatives passed the Financial Innovation and Technology for 21st Century Act (FIT21) by 279 to 136, as 71 democrats crossed party lines to vote for the act. This approval marks the first step towards a regulatory framework for digital assets nationwide and could be considered very constructive for regulation over the medium term. Furthermore, the bill sets more precise guidelines for the separation of SEC and CFTC jurisdictions in digital assets. This could be a game changer for the Ripple vs SEC lawsuit. XRP whales moved almost 300 million coins amid relief following the clearance of the FIT21.

Macro picture – hawkish FOMC minutes, strong PMIs

While the ETH ETF approval and the FIT21 bill have been significant developments, the macro picture was less supportive of cryptocurrencies.

The FOMC minutes of the latest Fed meeting were more hawkish than expected. The minutes showed that Fed officials were increasingly concerned over the lack of progress in cooling inflation back to the Fed’s 2% target. Policymakers lacked the confidence to move forward with rate cuts despite consumer prices cooling in April for the first time this year. Some policymakers even showed a willingness to hike interest rates further if necessary.

The minutes came after a string of Federal Reserve officials warned that interest rates would need to stay high for longer to tame inflation.

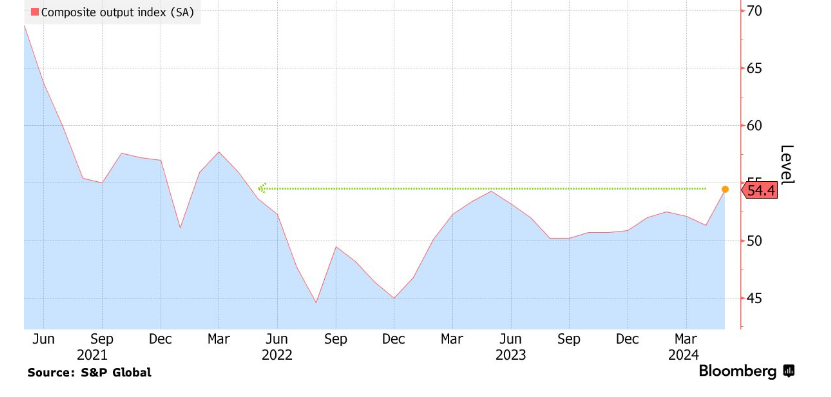

Meanwhile, data showed that business activity accelerated in May at the quickest pace in two years, mainly owing to stronger growth in the service sector, which also saw a pickup in inflation. The composite PMI rose to 54.4, the highest level since April 2022.

Service sector activity grew at the fastest pace in a year, while the measure of services input prices rose to the second highest level since September last year. Resilient demand is making it difficult to cool inflation.

High interest rates for longer bode poorly for Bitcoin, cryptocurrencies, and, more broadly, risk assets. Meanwhile, lower interest rates improve liquidity in the financial system, which benefits crypto and other risk assets.

Nvidia earnings help drive record highs in S&P500, Nasdaq 100

While the macro climate continued pressuring stocks and crypto, Nvidia earnings helped the tech-heavy Nasdaq 100 and the S&P 500 rise to ATHs. Nvidia, the AI darling of Wall Street, smashed analysts’ expectations with sales tripling as demand stays strong for the company’s chip. Earnings signaled that the AI boom has staying power. The earnings sent tech stocks soaring, with the Nasdaq reaching an ATH of 18,947 and the S&P 500 hitting 5,349. However, the Dow Jones, which has less exposure to tech and chip stocks, booked 2.3% losses across the week.

Looking ahead – US core PCE

This week will be a key week for gaining further insight into the global picture of inflation, with inflation data from the eurozone, Australia, and the US. The US core PCE, the Fed’s preferred gauge for inflation, is expected to hold steady at 2.8% YoY in April, which is in line with March. However, on a monthly basis, the core PCE is expected to rise by 0.2%, which marks its smallest increase this year and suggests an improved picture of underlying inflation. Signs of cooling inflation could boost risk sentiment and lift Cryptocurrencies, Stocks, and Gold.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.