The price of BTC punched above its recent high of $35,500 and hit a new yearly high of $36,000 after the FED decided not to raise rates last Wednesday. It was the first time in 16 months the price of BTC broke above this level.

The bullishness was further extended after yet another new spot BTC ETF entered the DTCC’s roster. Following BlackRock and Ark’s spot BTC ETF, the Invesco & Galaxy Spot BTC ETF had also been added to the DTCC list last week, building up the anticipation that perhaps more than one spot BTC ETF would be approved soon.

MicroStrategy also revealed that it had acquired an additional 155 BTC for $5.3 million in October and now holds a total of 158,400 BTC.

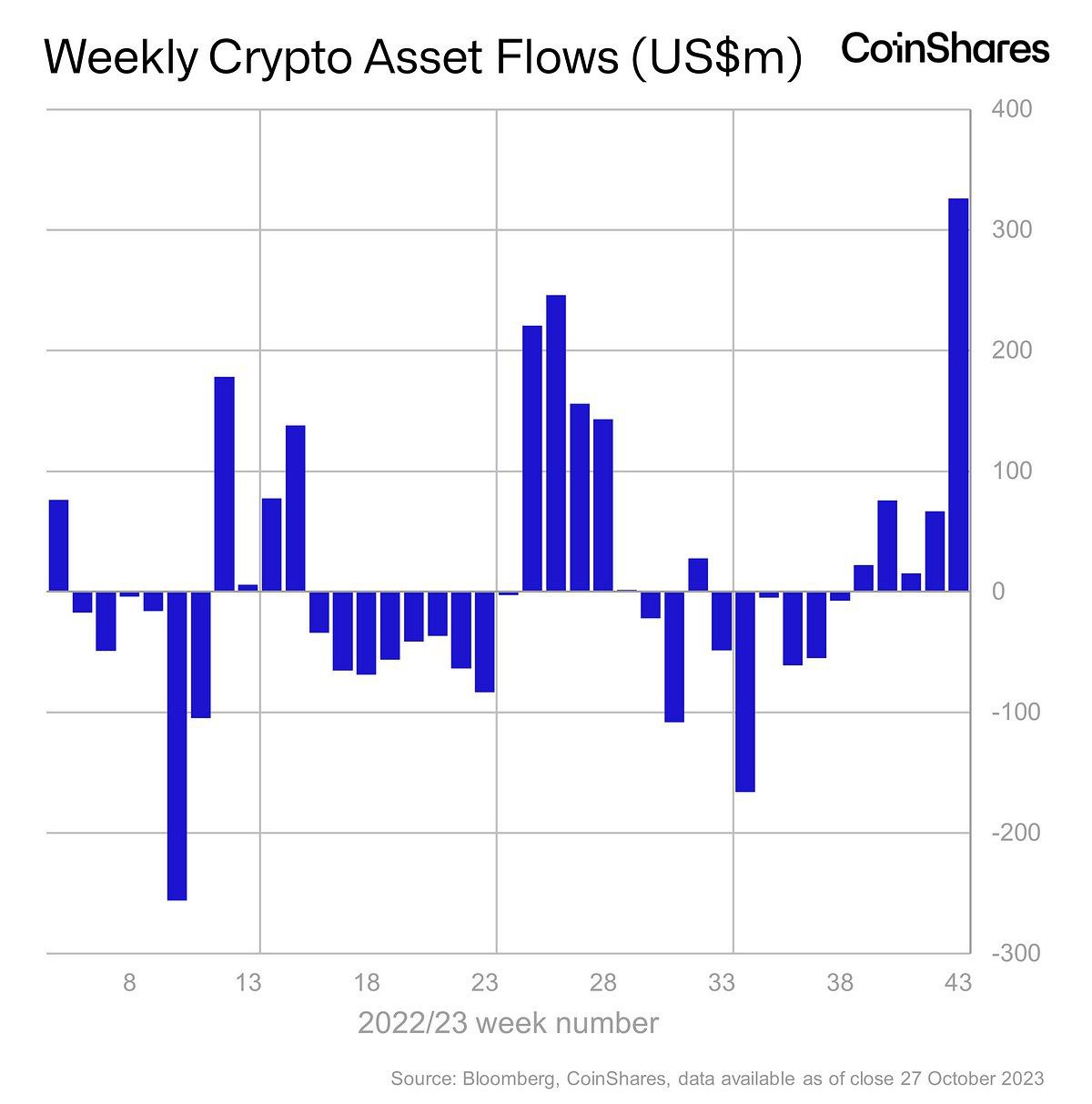

Furthermore, the week also saw a report that mentioned that investment flows into crypto funds rebounded strongly the week before. Digital asset investment products saw inflows of $326 million, the largest single week of inflows since July 2022. As expected, 90% of the inflows went to BTC as expectations of a spot ETF grew, while in the altcoin space, SOL saw the biggest inflow of $24 million.

All the positive news, coupled with the unstopping price increases in many altcoins caused FOMO to ensue amongst retail traders as the funding rate started climbing by midweek. As a result, a pullback came eventually after prices of many coins made new yearly highs but could not keep up with their quick price ascensions.

However, the amount of liquidations both ways, from BTC’s magnificent breakout early week to its retracement late week, were not unusually high, at only around $100 million each way. This low amount of liquidation means that market leverage is still low despite the large price increases, and the mid-week pullback was merely a cool off from a short-term overbought condition.

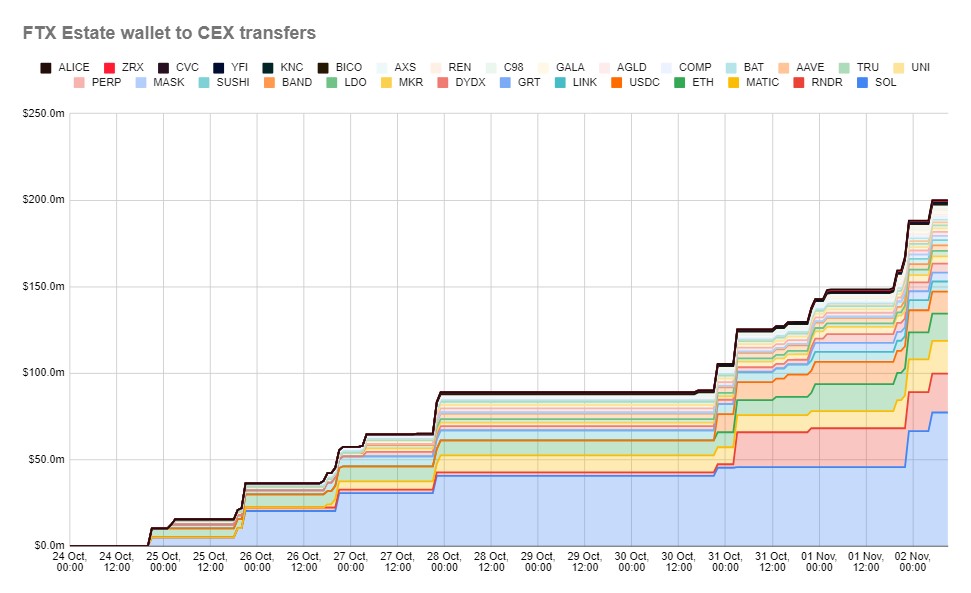

FTX sale of assets may have caused pullback

At the height of the market euphoria, FTX was seen to have sent a basket of crypto assets worth around $200 million to exchanges for sale. While the amount was not a large sum that could shift market dynamics, news of this development going around the market may have influenced some traders to sell or even open short positions to try to capitalize on the situation, which caused the market correction. The basket of assets FTX sold are in the chart below.

However, as the amount FTX is selling or planning to sell is not a big sum by the market’s standard, the impact is not likely to be long lasting and the fundamentals driving the recent market rally could quickly return to drive the market higher.

Recent rally may have legs

To find out if the recent price surge is driven by leveraged trades or spot market, one can check out BTC’s open interest relative to its market cap (OI/MC). As can be seen in the diagram below, this ratio has remained near its yearly low levels even after the price of BTC has rallied by more than 10% last week. This lack of increase in OI relative to MC shows that the recent rally in the market has primarily been spot driven and not due to speculative trading. Spot driven flows have a much longer staying power, which implies that this recent rally may still have room to grow.

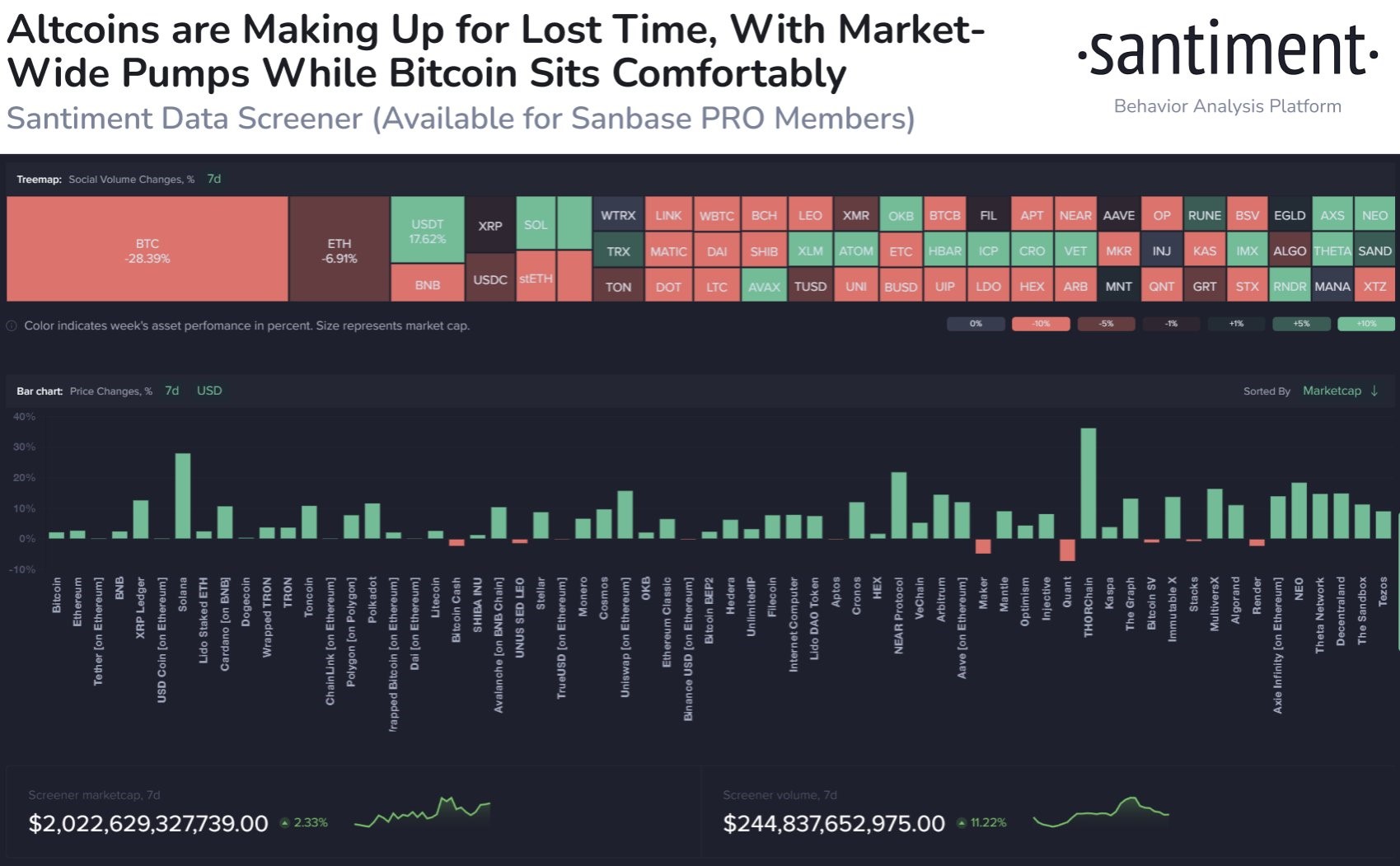

Altcoins take the limelight as BTC consolidates

Meanwhile, as BTC takes a breather, altcoins have been shining brightly, with rotational plays ongoing which has given traders a lot of trading opportunities as profits from BTC continue to funnel into the larger cap altcoins. Notable names which saw magnificent price increases include RUNE, SOL and NEAR, while the DeFi coins like UNI, SUSHI and CAKE have made a comeback after being in the doldrums for more than a year. The price of almost every altcoin has seen commendable gains last week, which is encouraging.

Moving forward, it appears that as long as the price of BTC does not take a major dive, this “alt season” will likely continue and rotate into other coins as traders who take profit on one coin funnel their gains into another which have had a chance to consolidate after a rise, or into laggard coins that have not yet made significant gains.

One possible beneficiary from this rotation could be ETH, especially after so-called China’s Ethereum, NEO, had pumped drastically over the weekend.

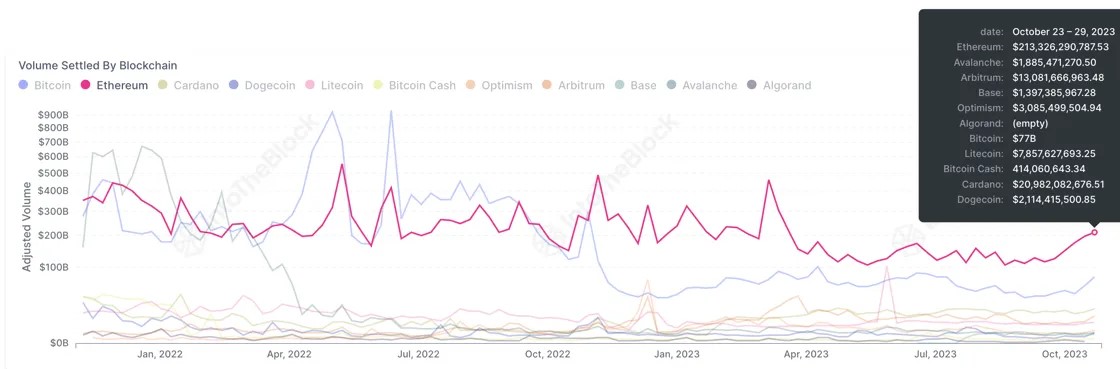

As the market picks up with BTC and other altcoins leading the pack with headlines of large percentage increases, ETH, the de facto King of altcoins have seemingly been left in the dust as the coin had seen a relatively larger amount of selling pressure over the past month, obstructing its ability to put in the usual double digit percentage movements that we have seen in the past, and even underperforming BTC.

However, as other coins start to become more overbought, ETH appears to be getting ready for a catchup as its onchain metrics have started to improve immensely. Towards the end of October, the value of assets settled on the ETH mainnet reached its highest since March during the Silicon Valley Bank collapse. Volume settled last week on the ETH mainnet alone surpassed $213 billion, with an additional $16 billion being transacted between Arbitrum, Optimism and Base, the L2 networks built on ETH.

This recovery of the usage of the ETH ecosystem and the resurgence of DeFi could possibly become a catalyst for a better price performance from ETH in November.

Stocks post best gains in a year as US yield eases

US stocks had their best week in long time after the FED left interest rates unchanged in their meeting on Wednesday. Important job numbers released over the week also showed a slowdown in the labour market, which caused investors to believe that the FED’s rate hiking cycle may be over.

First, the ADP private sector payrolls came in less than expected, coming in at 113,000 new private sector jobs created vs expectations of 149,000. The non-farm payrolls also came in weaker than expectations on Friday, showing that the FED’s attempt to cool the economy might finally be working.

The non-farm employment last month added 150,000 jobs, below the 170,000 expected, and lower than September’s blowout of 297,000 jobs added. The unemployment rate also rose to 3.9%, compared to expectations that it would hold steady at 3.8%. Average hourly earnings also missed expectations on a monthly basis, rising 0.2% in October, below the anticipated 0.3% increase.

In a case where bad news is good news, stocks rallied to the best week in a year, with the Dow gaining 5.07% in its best week since October 2022. The S&P rose by 5.85% and the Nasdaq added a resounding 6.61%, the best week for both indices since November 2022.

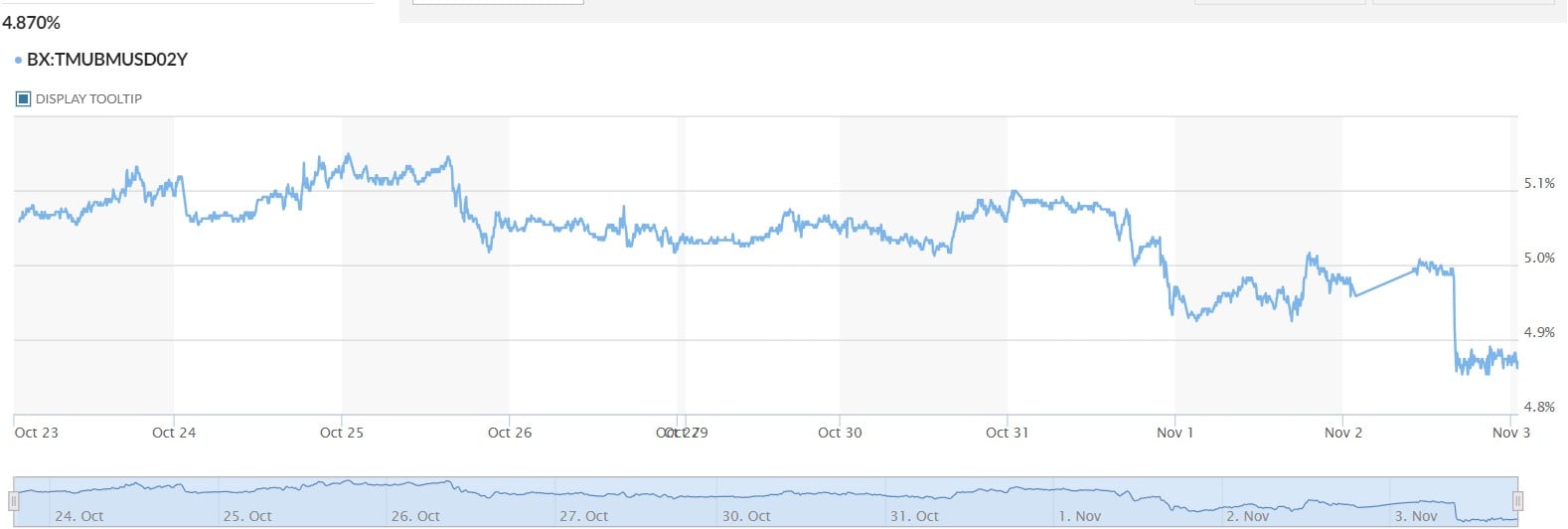

The market is now pricing in a more than 80% chance that the FED will continue to keep rates unchanged in its last meeting of the year in December. With this, US yields finally fell, with the 10-year Treasury yield losing more than 9 bps to 4.57%, down from the 5% high it hit last month. The 2-year Treasury yield also lost 13 bps to 4.8%, down from its high of over 5.1% just prior to the FED meeting.

The drop in yields sent the dollar to one of its largest losses since the banking crisis in March, with the DXY easing by 1.42%.

The USD/JPY, which was highly watched by most forex traders, finally dipped from its high of 152 made earlier in the week after the BoJ meeting to close the week at 149.35. The BoJ, which was anticipated to tweak its ultra loose monetary policy in last week’s meeting, did nothing of that sort again, which drove the yen to weaken by 2%. The BoE, which met on Thursday, also kept rates unchanged.

With the dollar in the backseat, Silver gained some 0.64%. However, Gold still put in a loss for the week, dipping by 0.7% as a big escalation in the middle east conflict, which was dreaded yet anticipated by most investors, had not yet materialized. As a result, oil prices also declined. The WTI lost 4.9% and Brent Crude was weaker by 4%. Despite the temporary setback, as the situation in the middle east is still very fluid, things could change very fast and affect the price of these commodities.

On the economic front, this week is quieter, with only the Australian central bank meeting late Monday. While FED Chair Powell is slated to be giving speeches in Washington on Wednesday and Thursday, the market is not expecting him to deliver anything that has not already been made known. The major data releases will be unemployment claims for the week prior on Thursday and consumer sentiment on Friday.

As for trading, the start to this new week in Asian trading has largely been that of a risk-on mode, with Gold and Silver taking a backseat while Oil is higher by around 0.5%. The dollar has continued to weaken, and so is the yen, causing stocks to move higher in the Asian session. However, whether this trend will persist depends on how the larger markets like Europe and America react when they start trading later.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.