Despite US lawmakers’ pressure on the SEC to approve spot BTC ETFs immediately, the SEC did not relent last week. Instead, the commission moved to delay its decision on several proposed spot BTC ETFs. In summary, ARK, Global X, BlackRock, Valkyrie and Bitwise all had their spot BTC ETF applications postponed. These moves suggest that the SEC is highly likely to also not approve but instead, delay the application results for all the other pending spot BTC ETFs that will be due in mid-October. As expected, the SEC has also delayed the decision on VanEck and ARK’s spot ETH ETFs.

Furthermore, in remarks made before the House Financial Services Committee on Wednesday, SEC Chief Gensler maintained his consistent criticism of the way crypto companies manage customers’ funds, saying that commingling assets “is a recipe that has not led to good results.”

The SEC also said it is launching additional proceedings to determine whether applications for spot BTC ETFs proposed by BlackRock, Invesco, Valkyrie and Bitwise should be approved or denied, which could further delay the ongoing review process for the above-mentioned applications.

Despite the disappointing news, the price of BTC remained strong and bounced higher, even in the midst of a stock market selloff, as we had correctly predicted in our previous week’s report. This strong showing of BTC could be a result of dollar-cost-averaging (DCA) by regular BTC buyers who continued to acquire more BTC. For instance, MicroStrategy revealed that it had acquired an additional 5,445 BTC for $147.3 million at an average price of $27,053 per coin. As of 24 September 2023, MicroStrategy holds 158,245 BTC acquired for $4.68 billion at an average price of $29,582 per coin.

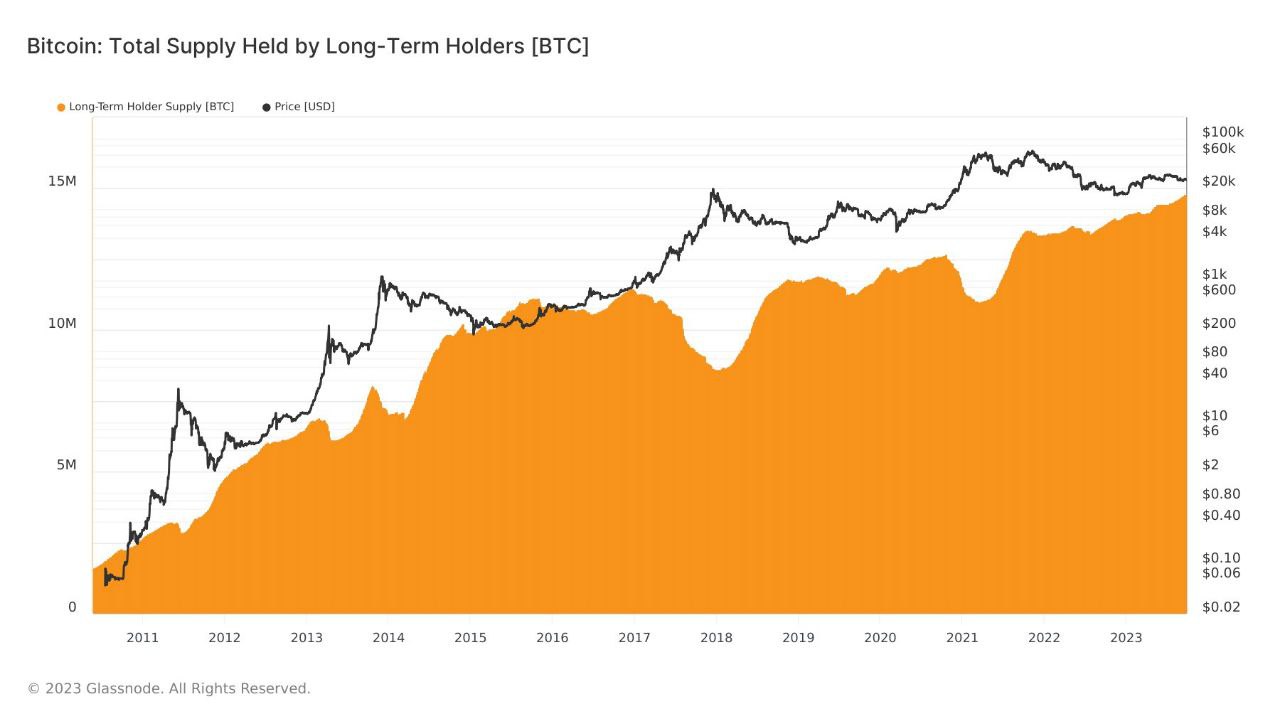

Other than regular DCA buyers, holders’ persistence to hold on to their BTC stash also contributed to its resilience as we had mentioned before in our previous report. This has resulted in a lack of BTC supply in the market to push its price lower.

As we can see from the below diagram, the supply of BTC held by long-term-holders (LTH) has continued to climb irrespective of BTC’s price. This group of LTH now holds an aggregate of almost 15 million units of BTC, which is around 75% of BTC’s circulating supply.

Tether supply growth bullish for prices

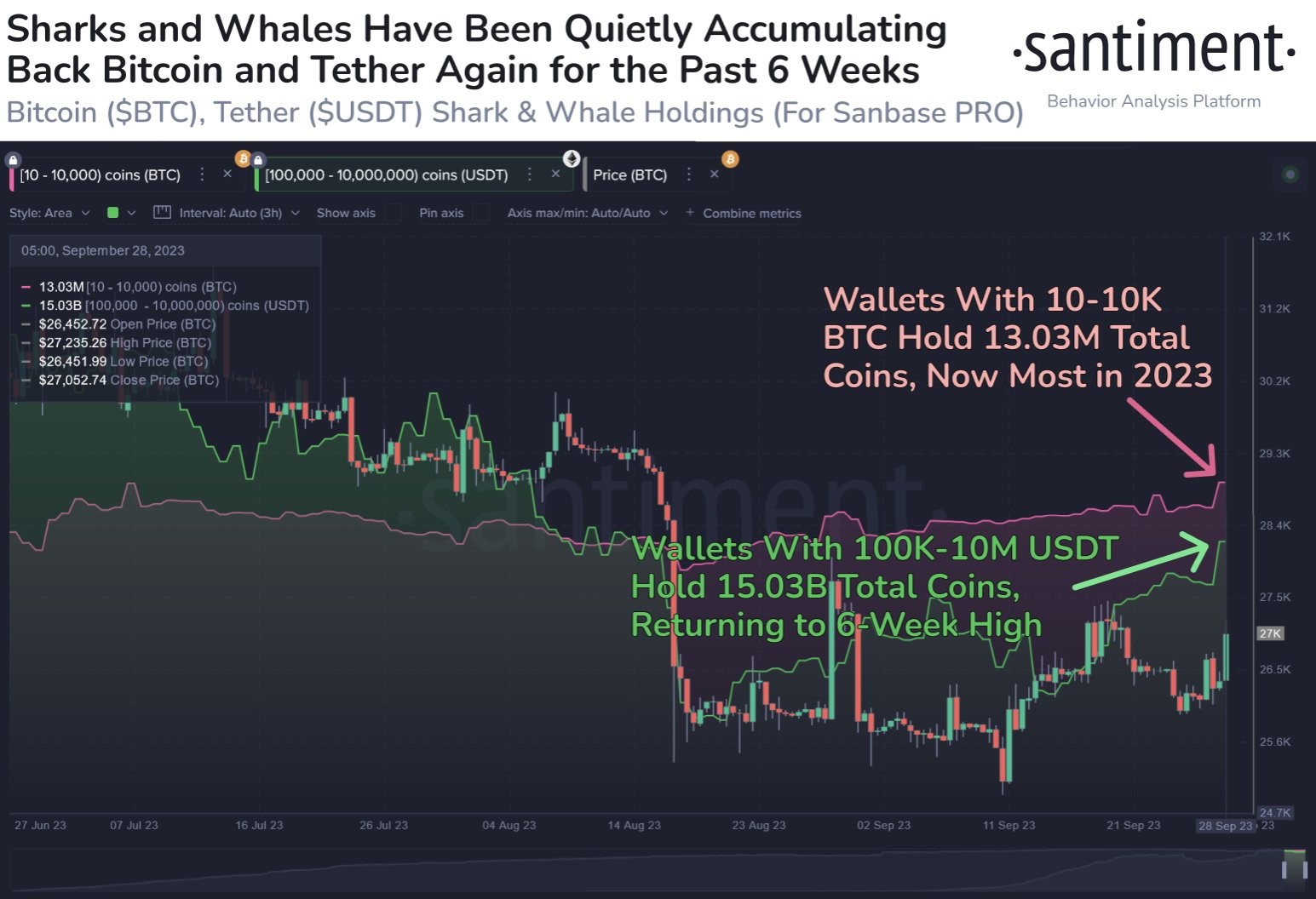

Taking a closer look at the growth of BTC supply held, we can see from the below chart that the holdings of BTC wallets with between 10 to 10,000 BTC have grown to their highest level so far this year, locking up around 13 million units of BTC. Additionally, the amount of USDT held by tether whales have also increased significantly last week, growing to a 6-week high of $15 billion. While it is unknown if the quick uptick in USDT reserves could be related to fears of an impending US government shutdown, more USDT sitting on the sidelines nonetheless suggests that there is an increase in available buying power out there that may continue to give crypto prices a lift.

ETH leads altcoins higher after futures approval

Even though most of the spot BTC ETFs were not approved, the SEC approved the listing of the first ETH futures ETF by Valkyrie. With the expectation that the SEC is also expected to approve a couple more ETH futures ETF in the coming days, the price of ETH has seen one of its best positive moves in recent times, jumping by around 10% since the announcement.

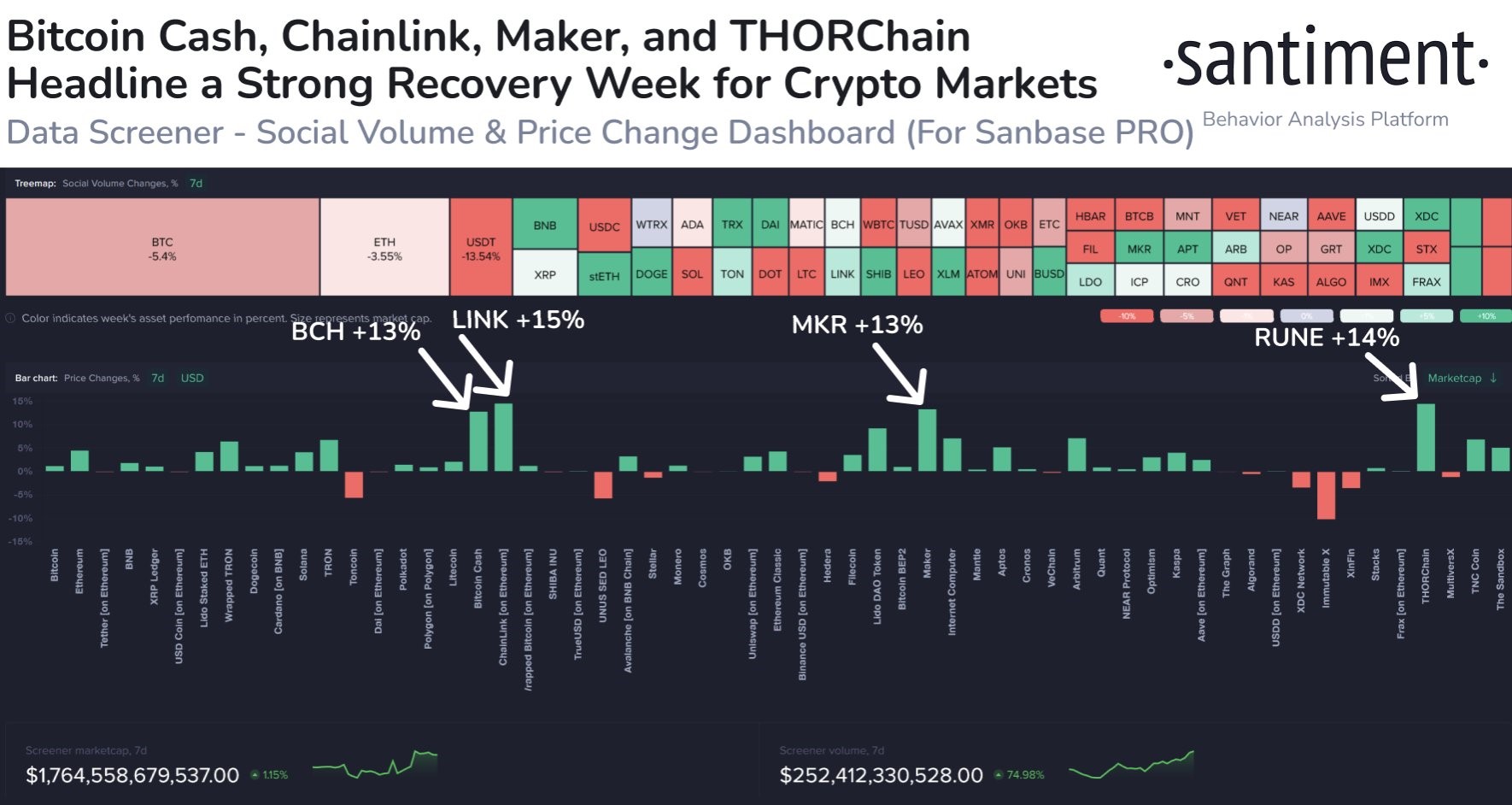

The altcoin universe cheered in tandem with ETH, with the positivity spilling over into many large cap coins like BCH, LINK, MKR and RUNE. Recently, there has been consistent accumulation of these coins by large wallets, which could indicate that the outlook for the above coins may be turning around.

XRP also jumped 20% ahead of its “Proper Party” event organised by Ripple. However, whether this jump is sustainable could depend on whether Ripple would make any positive announcement after the event.

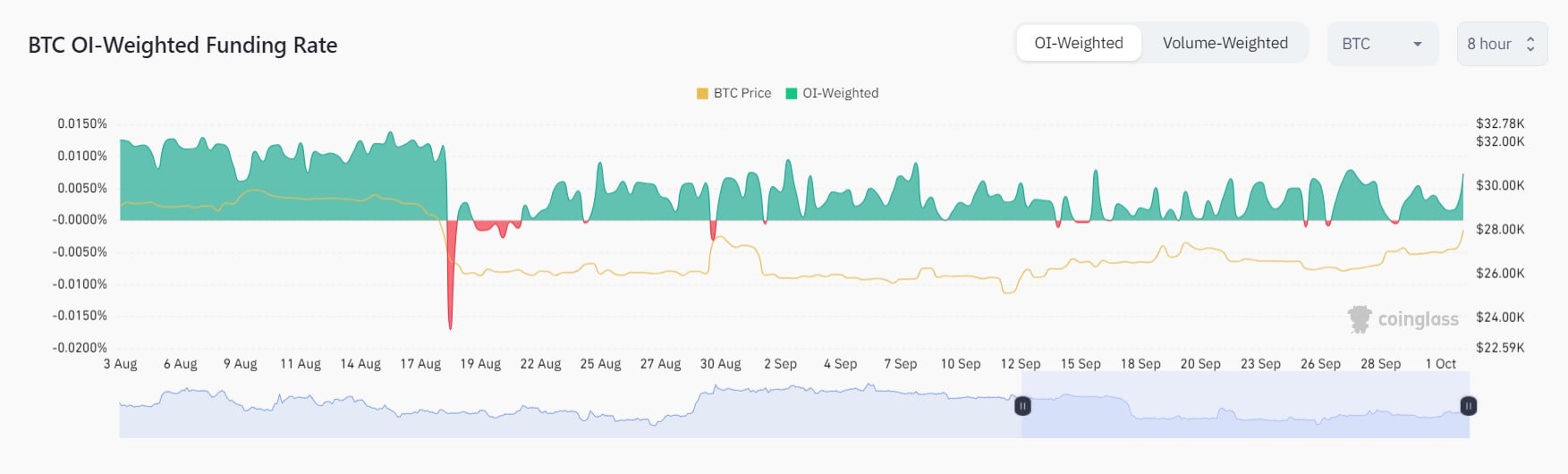

Funding rate rise suggests a cooler week

As traders get enthusiastic about rising prices over the weekend, funding rates have started to climb again to a level that historically saw a period of consolidation. While the availability of excess buying power could continue to support prices, the immediate outlook could be that the optimism may need to cool off a little and prices consolidate for a number of days. This is especially important as the price of BTC has reached the critical $28,000 where it failed to break through at the end of August.

However, as the price of BTC has effectively formed a higher high on the daily timeframe having broken through $27,500 which contained BTC’s price in mid-September, BTC could be trading in an uptrend for at least the first few weeks of October, which would inevitably also prop up the prices of altcoins.

Stocks battered as economic numbers worsen

Stocks retreated again last week as fears of a hard landing gripped markets after the latest home sales and consumer confidence reports stoked concern over the state of the US economy.

The reports released on Tuesday showed a deteriorating picture, as August new home sales missed expectations. Homes under contract totaled 675,000 for the month, down 8.7% from July. Economists anticipated a total of 695,000. Then, the consumer confidence index also reportedly fell to 103 in September, down from 108.7 in August, while the expectations index tumbled to 73.7, which indicates that the US consumers expect that they will be in a recession.

The final GDP figure released was also a tad lower than what was projected, coming in at 2.1%. Even though Chairman Powell did not say anything out of the ordinary during his Thursday speech, the stock markets continued to fall as US yields remained persistently high.

Even though Friday’s release of a less than expected core PCE inflation index gave investors a bit of consolation, coming in at 0.1% vs expectation of 0.2%, the fear of an impending government shutdown after lawmakers failed to pass a short-term spending bill continued to weigh on stock prices.

By the end of the week, the Dow had lost about 1.3% while the S&P gave up 0.7%. The Nasdaq however, ended flat as investors took stock of how the markets had fared over the month and over the quarter, as Friday was the last trading day of not just September, but also for the third quarter.

For the month of September, the S&P finished down 4.9% and was lower by 3.7% for 3Q. The Nasdaq lost 5.8% in September and was down by 4.1% for the quarter. The Dow notched a 3.5% decline this month and a 2.6% fall for the quarter. To put things into perspective, the performance of the stock market this month has been the poorest this year.

As for the commodities market, precious metal prices declined rather significantly, with the increase in intensity possibly caused by an unwinding of positions in the quarter-end. Gold lost a good 4.1% while Silver dropped 5.7%, showing that investors did not seem to think that there is safety in gold even with the prospects of an impending US government shutdown. The dollar remained very well-bid, gaining 0.57% amongst its peers last week.

Oil prices closed flat, with traders possibly not willing to place any big bets ahead of the upcoming OPEC+ meeting on 4 October, this coming Wednesday. As a result, Brent lost 0.3% but the WTI eked out a 0.2% gain.

This week, the China markets will be closed for the Golden Week holiday, while the latest news out of America is that the government has managed to avert a shutdown with a new measure that will temporarily allow the US government to stay open. The new bill allows the government to stay open for another 45 days until 18 November, giving the House and Senate more time to finish their funding legislation. At the moment, US stock futures are reacting positively to the news. However, whether this extension will have a lasting positive impact on the traditional financial markets is to be seen.

Datawise, this week is an activity filled week as we not only have important employment data out in the US on Wednesday and Friday, we also have monetary policy meetings by both the Australia as well as New Zealand central banks on Tuesday Asia time.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.