The week in the traditional markets started with a bang after some welcoming news. First, on Monday, the UK scrapped the hugely unpopular tax cuts, which sent the pound recovering more than 4% to trade back to $1.15 before some retracement.

Later the same day, the United Nations (UN) reportedly asked the Fed and other central banks to halt their rate increases to prevent world economies from sinking into recession. While such a request coming from the UN is somewhat strange, from the events occurring over the past years, experts can no longer rule anything out as it has been proven that anything is possible in this market.

Regardless, the moves by England and the UN sent global stock markets higher as traders anticipated that the Fed would be coerced into either stopping its rate hikes, or to hike less aggressively. While the Fed had not given any official response to the UN’s request, Fed Chair Powell did reveal in a subsequent news conference that the Fed does consider the impact its policies have on the rest of the world, however, it would continue to lift interest rates to bring inflation under control. Other Fed representatives echoed the same sentiment throughout the week, reiterating that the Fed would not ease tightening until inflation is under control.

Despite those assertions from Fed representatives, traders seemed determined to think that the Fed would reconsider their rate hike path. US bond yields started to drop early last week, with the benchmark 10-year Treasury yield falling from its height of 4% to 3.6% by mid-week.

Some central banks appeared to be heeding the UN advice, as the RBA, which was expected to hike interest rates by 50-bps in its Tuesday meeting, only hiked 25-bps, while the RBNZ hiked 500-bps as anticipated.

The US dollar dropped sharply early in the week, with the DXY falling from 114 to 110 by the middle of the week.

The fall in the US dollar caused everything else to surge in tandem. Silver soared over 8% as the return of optimism sent traders clamouring for the industrial metal trade.

However, the stock market reversed course after the release of US non-farm payrolls on Friday, as it showed that the US labour market was still strong, dashing hopes for the Fed to pivot. The US economy added 263,000 jobs in September, beating analysts’ estimate of 255,000. More importantly, the unemployment rate dropped in the month of September, coming in at 3.5%, down from the 3.7% in the previous month in a sign that the job market continues to strengthen, which will give the Fed a reason to continue its aggressive rate hike path, which traders do not like.

As a result, everything began to unwind as what started out as a big comeback week soon fizzled into the weekend. US stock averages, however, still ended the week higher, with the Dow gaining 2%, the S&P rising 1.5% and the Nasdaq eking out a small gain of 0.7%.

The USD rebounded on the strong jobs number, taking the DXY bouncing off its low of 110 to close the week at 112.5, while the 10-year Treasury yield rose back to 3.89%.

Silver gave up some of its early week gains but was still higher for the week, rising 6%, while gains in Gold were more muted at 2%. Rumours of supply shortage may continue to support silver price in the days ahead even with a strong USD, even though Silver is starting the new week retracing about 1.5% while Gold is largely flat.

In another interesting twist of rising commodity prices, Oil staged a fantastic rebound after OPEC+ agreed to a historic production cut of 2 million barrels per day at its October 5 meeting. This is the cartel’s biggest cut since reducing its collective quota by 9.7 million barrels per day during the early stages of COVID in 2020.

It was gains upon gains for the price of oil since the start of the week as traders already got wind of the proposed supply cut. However, the actual cut was even higher than what the rumours suggested. As a result, Brent rose 12.3% while WTI surged 13.5% in what was their biggest weekly advance in seven months. The new week has so far been seeing oil taking a bit of a breather in early Asian trading.

OPEC+ pushes oil up. Use it!BTC Barely Moved but Altcoins Saw Selective Pump

While the other markets either staged solid moves or swung wildly, volatility was strangely absent from crypto, supposedly the most volatile asset class. Bitcoin kept within a 2% range, trading between $20,000 and $19,000. Altcoins however, had a better week, with ETH finally displaying some sign of stability after losing more than 30% since the Merge. Other altcoins fared largely better, as some odd names still managed to eke out strong gains over the week.

DOGE rose on the back of Elon Musk’s decision to buy Twitter again, gaining 10% by mid-week. MATIC also saw notable gains of around 15% after more new partnerships were announced, while the best performer of the top coins was XRP, which gained 20% to trade back above $0.50.

XRP Jumps on Flare Network Update

The Flare Network project, which had been a long time coming and anticipated by the XRP community, finally released news of its roadmap, including the timeline of its FLR (formerly known as Spark) airdrop which was promised to holders of XRP in December 2020.

Building on its previous momentum which started when both Ripple and the SEC filed for summary judgement on the lawsuit, XRP continues to see strength even as the broad crypto market retreated on Friday, showing a mild decoupling from the rest of the market, and seemingly unaffected by the strength in the USD.

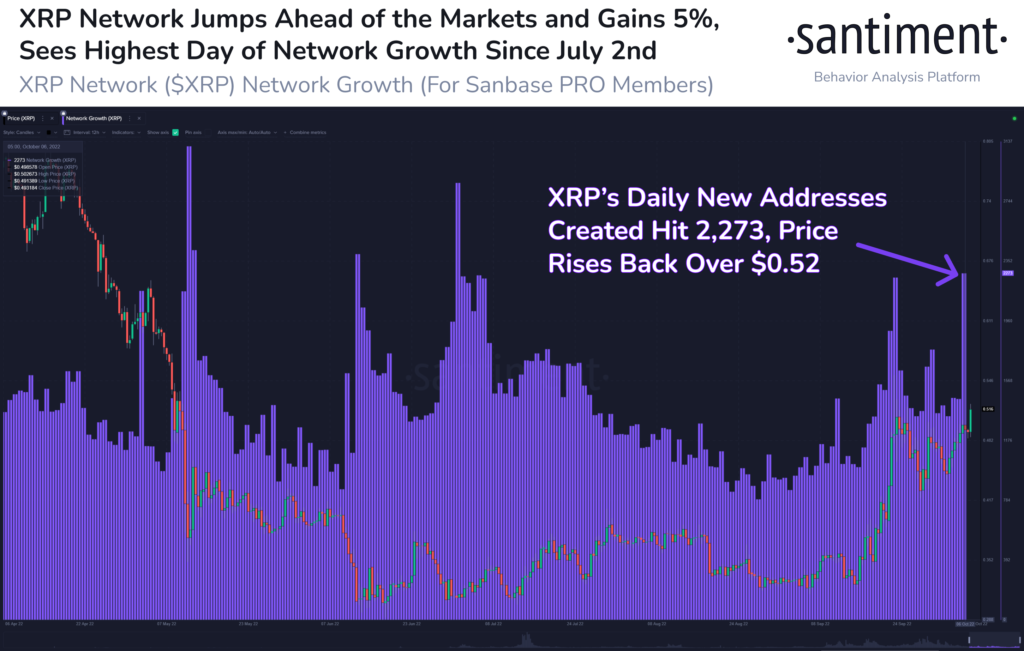

Friday saw a surge in network activity, which was its biggest growth on the XRP network in three months, with over 2,773 new addresses created.

The price of XRP has continued to move higher over the weekend as its price succeeds a bullish crossover against the downtrend that has been capping it since November 2021. This could mean that XRP may see better times ahead even if the broad crypto market retraces, as it has fundamental reasons like the outcome of the SEC lawsuit that could help it decouple from the main market trend.

This is a good sign for the overall crypto market as it shows that altcoins can hold their own as BTC continues to coil and not lean onto any direction, giving traders opportunity to earn from other coins even as BTC consolidates. By itself, BTC has also been displaying signs of grit in that it is not crumbling under the weight of the USD, being still able to hold on to the $19,000 level when other fiat currencies are crumbling. This strength could be partly attributed to the strong will of crypto whales, who have been buying BTC on every dip.

USDT-BTC Supply Change Shows Whales Adding BTC

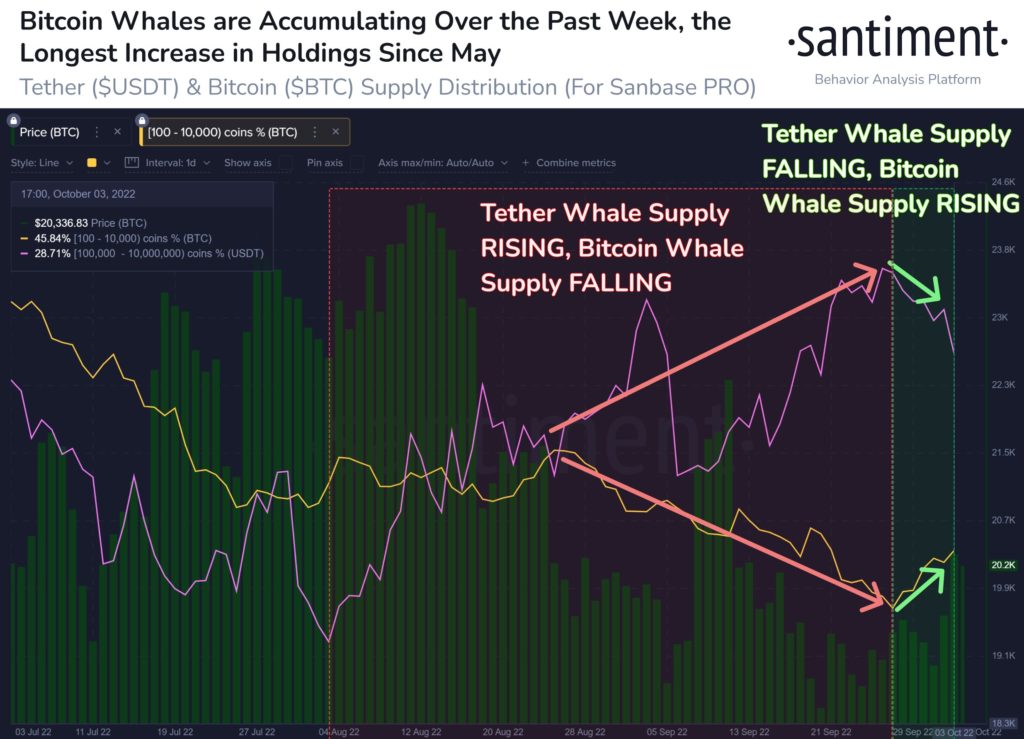

BTC whales have been showing signs of sustained accumulation, which has been a rarity in 2022, and perhaps the reason why despite the USD strength, BTC has not dropped beyond the last Fed meeting on September 21.

Since September 27, addresses holding 100 to 10,000 BTC have collectively added 46,173 BTC to their wallets as large USDT holdings have dropped.

How much further such accumulation could continue to support BTC remains to be seen, especially in the face of rising interest rates. However, one point to note is that in the previous Fed meeting on September 21, BTC only moved around 9% and did not break the May low of $17,500.

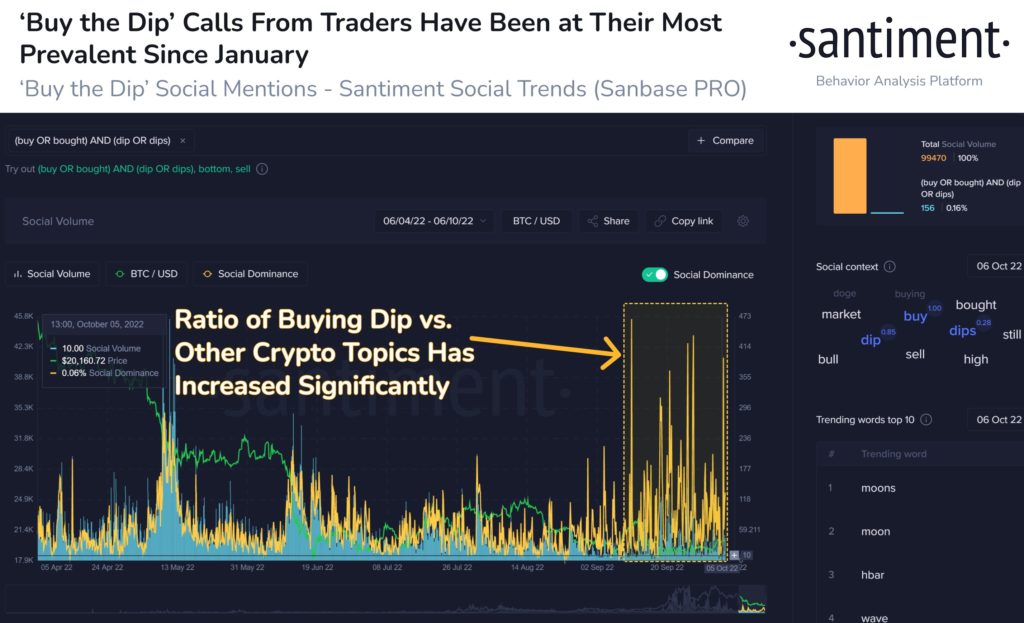

With the lack of volatility in BTC, traders have been getting more impatient and opinions have gotten more polarized, with the mix of “buy dip” and “sell high” at their highest levels.

This polarization of opinions, assuming they translated into trades, could mean that when BTC has finished its coiling, its next move may be violent and swift.

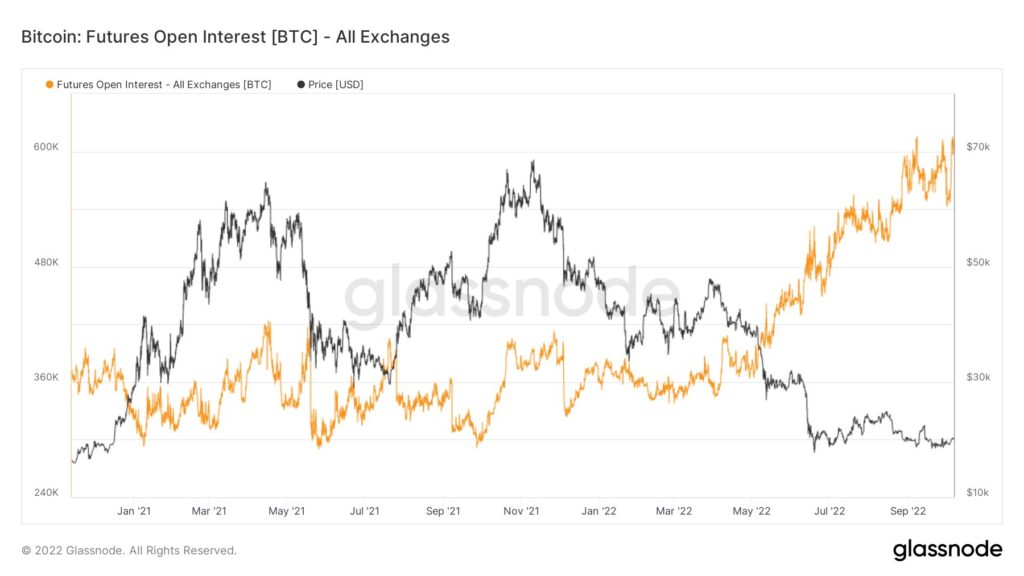

This is evidenced by the Open Interest in the BTC futures market, which is moving higher even when the price of BTC has remained flat, a sign that traders have been piling into the futures market to place bets. We are not able to ascertain if these are bullish or bearish bets as funding rates have remained somewhat flat – we can only conclude that a big move may be in store but are not sure if it will be to the upside or downside.

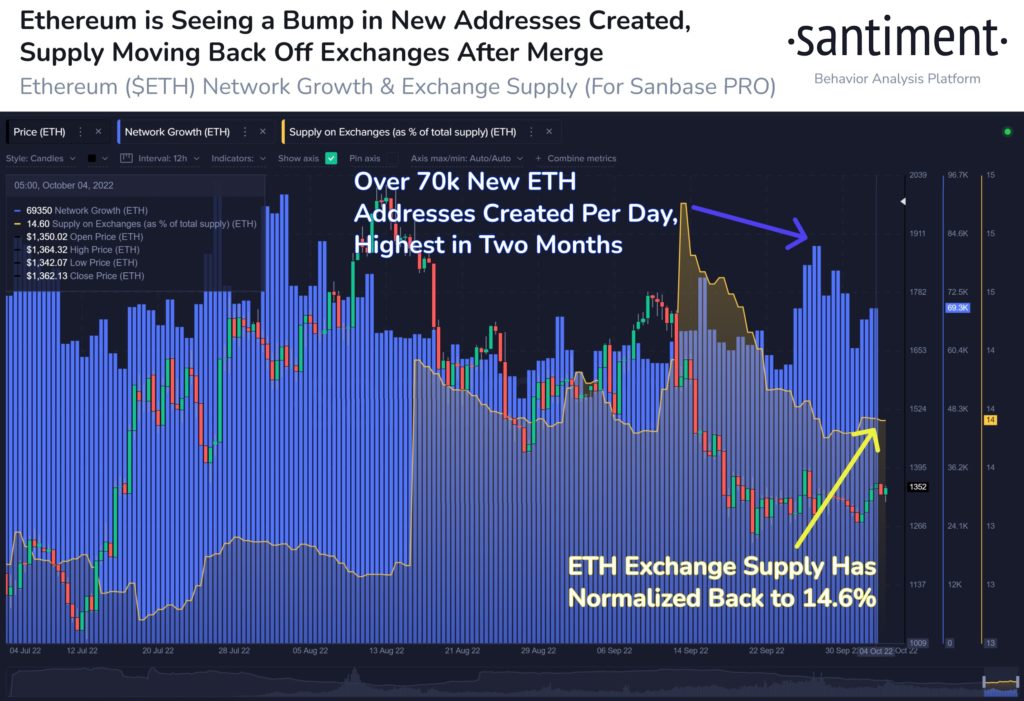

ETH Metrics Back to Normal Post Merge

As for ETH, which had been left out in the cold lately, appears to be settling down well post-Merge. After the initial hoopla from miners, confidence is returning to ETH as the number of new addresses being created is back to its normal level of around 70,000 per day, the highest level since August.

After a series of miner inflows which dumped the price of ETH lower by more than 30%, the supply of ETH on exchanges has dropped back to the pre-Merge level of around 14.6%.

With metrics back to what it used to be, the negativity around ETH appears to have subsided, at least for now.

Big US CPI Data on October 13

As US banks will be closed in observance of Columbus Day on Monday, trading activity could be slow even when the US stock market remains open as traders may prefer to wait for the key CPI data to be released on Thursday before placing large bets.

Now that the job numbers have come in better-than-expected, market participants would be paying even more attention to this CPI release as it could determine if the Fed would raise more than 75-bps in its upcoming November 2 meeting.

Consensus is for the year-over-year CPI reading to ease to +8.1% from +8.3% last month, and for the preferred Fed inflation gauge, the month-over-month core CPI change, to weaken to +0.4% from +0.6% last month. No prizes for correctly guessing what will happen should these numbers also come in higher than consensus expectation.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.