“Uptober” isn’t disappointing so far! Bitcoin roared higher last week, gaining 11% marking its strongest weekly gain since April 20. The largest cryptocurrency started the week at 112.3K, extending to a fresh record high of 125.6K over the weekend. The price is trading at 123.5k at the start of the new week.

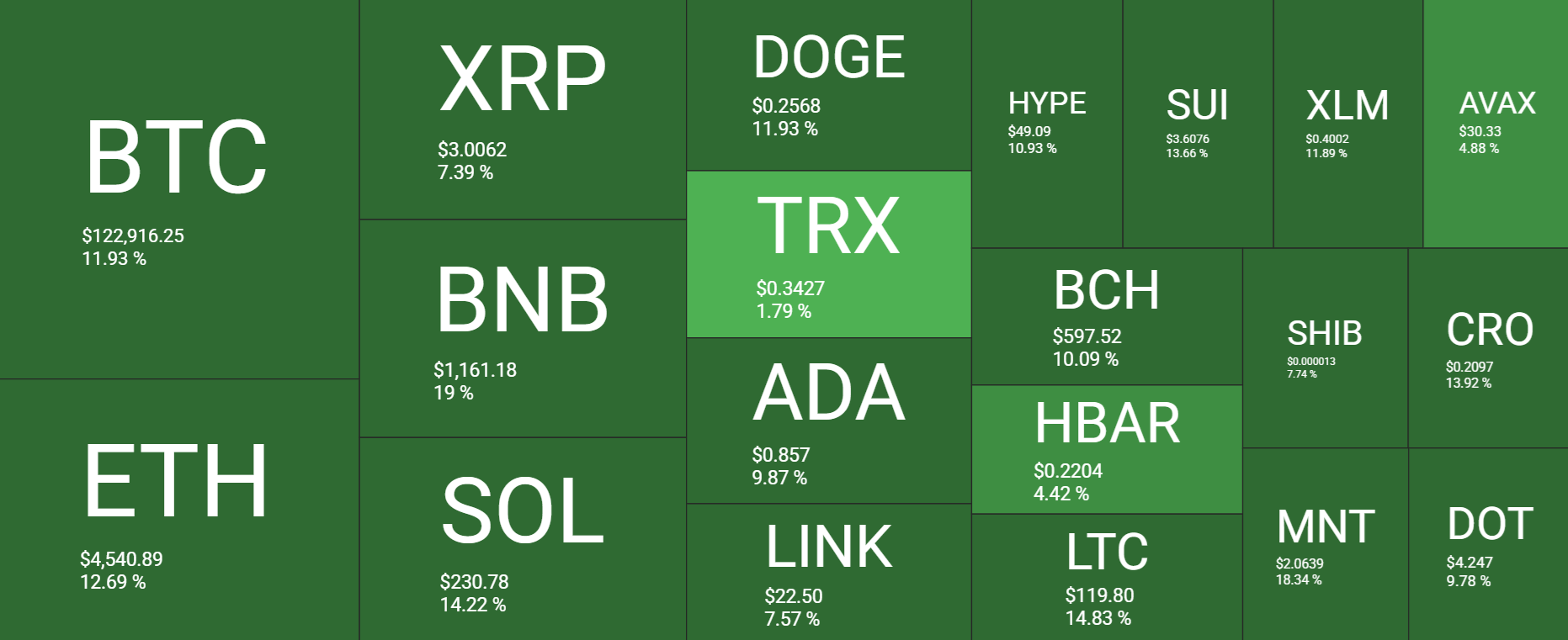

Strong gains were not limited to Bitcoin. The crypto space was a sea of green. Among the major altcoins, BNB outperformed, gaining 19% over the past week. Ethereum rallied 12.6% and Solana gained 14%. Meanwhile, XRP has risen 7% over the past seven days.

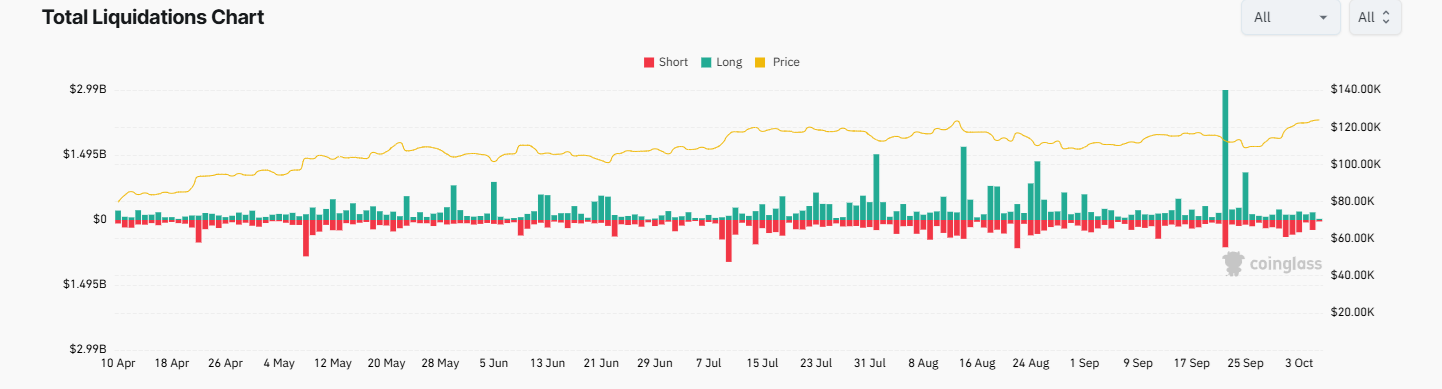

Crypto liquidations were muted over the past week, after heavy liquidations in recent weeks cleared out overleveraged positions. This week, the bias was tilted towards more short positions being wiped out as the crypto price rose.

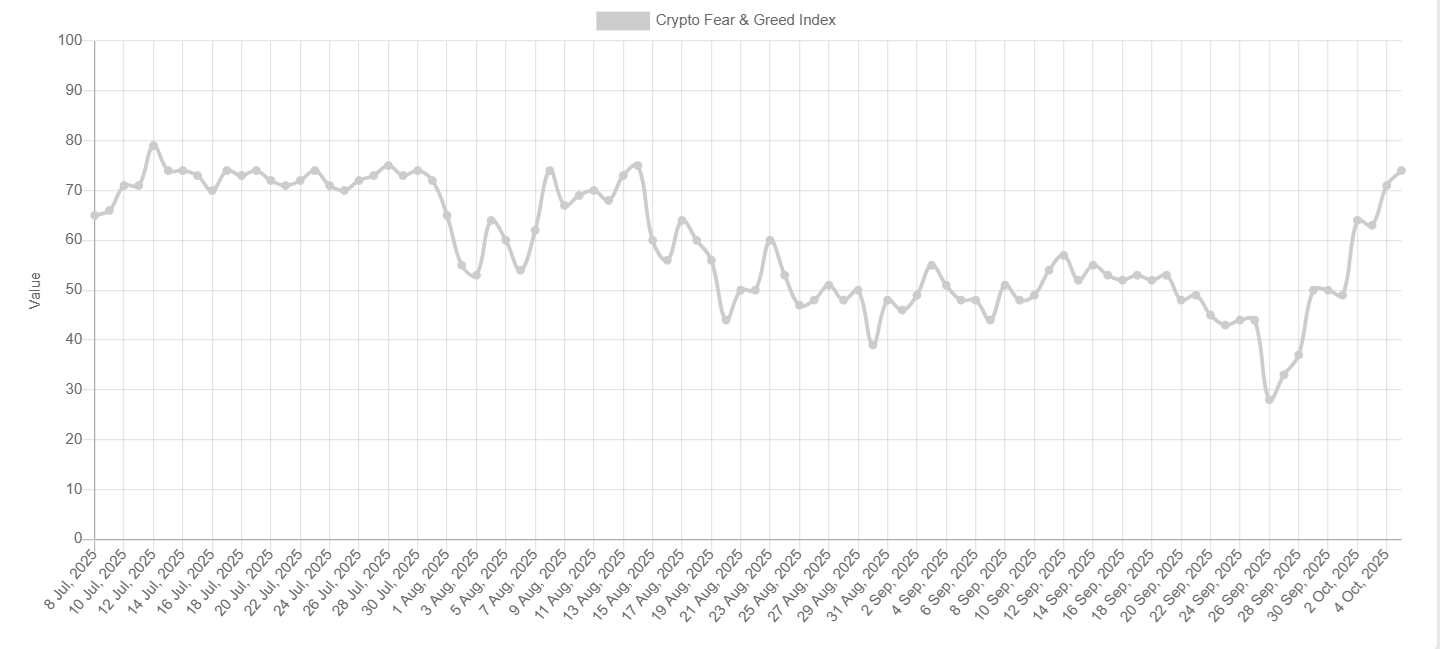

Meanwhile, sentiment analysis shows that the mood has turned to Greed, recovering sharply from Fear a week ago. The Fear and Greed index has jumped to 74, up from 37 last week, marking the highest level since mid-August when Bitcoin reached its previous record high. Greed territory is optimistic but measured, supporting BTC’s uptrend without the volatility associated with Extreme Greed, which kicks in at 80. This means that there is still room for further gains before sentiment overheats.

Macro backdrop – Why did BTC reach a record high?

The outlook for October is bullish amid USD softness and a Federal Reserve bias towards more rate cuts. This is even though the US government remains shut down.

The US government officially shut down last week after the Democrats and the Republicans failed to reach an agreement regarding additional federal funding.

What does the shutdown mean for crypto? The government shutdown means there is a delay in the release of some key economic data, which the Fed relies on for its monetary policy decisions. For example, last week’s US nonfarm payroll report was not released, and this week’s CPI inflation data is also unlikely to be released.

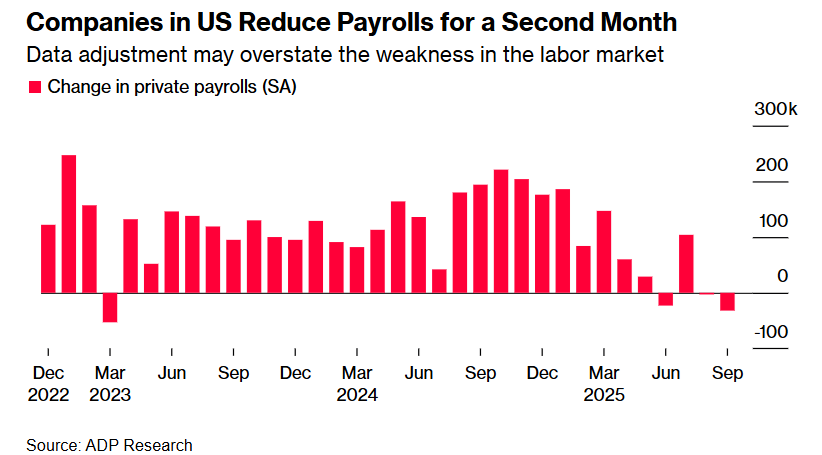

As a result, the market is leaning on other private gauges such as ADP private payrolls. Last week, the ADP private payrolls report, which was expected to show a rise of 50,000, actually fell by 32,000. The August figure was also downwardly revised to -3000 from 54,000.

This data cemented market expectations that the Federal Reserve will cut interest rates by 25 basis points in October and raised expectations of a further 25 basis point reduction in December. Fed fund futures price in an 87% chance of two 25-bps rate cuts by the end of the year. Bitcoin and other risk assets tend to perform well in low-interest-rate environments due to increased liquidity. US stocks also reached fresh record highs.

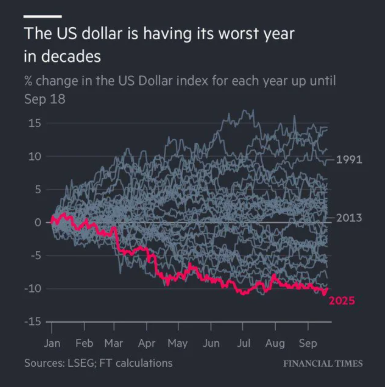

The USD dollar has weakened; last week, it had its worst-performing week in a month. The USD is on track for its worst year since 1973, down over 10% year-to-date. At the same time, Gold soared to fresh record highs. This was a sign of easing rate expectations and a store of value bid. These same factors benefit crypto as investors lose faith in traditional institutions.

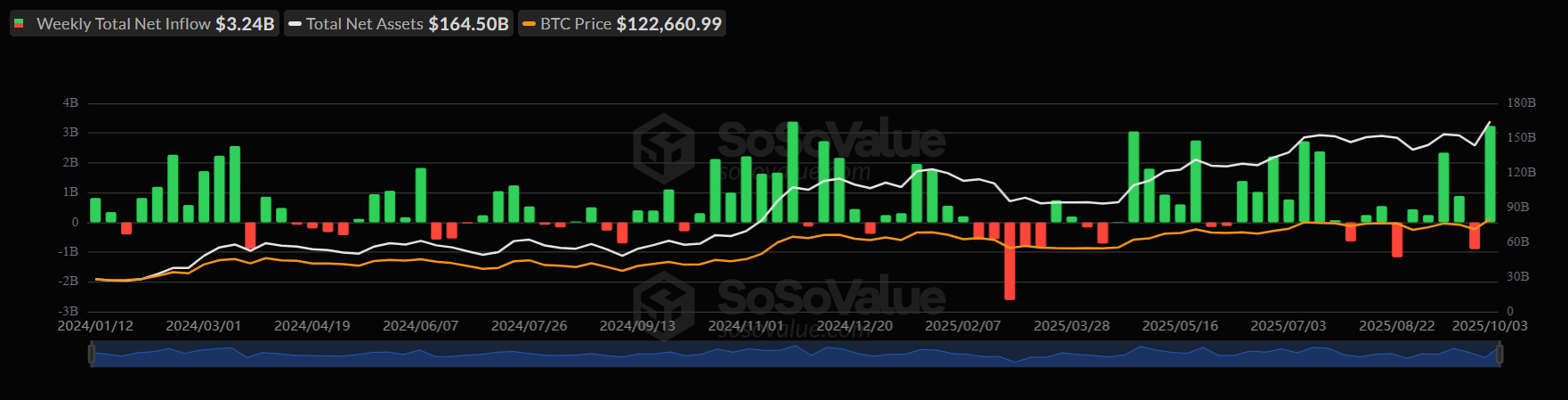

ETF demand soars back

Bitcoin ETFs started the historically strong month of October on a strong note, signaling improved investor optimism. Spot BTC recorded $3.24 billion in net inflows over the past week, almost matching the record $3.38 billion in the week ending November 22, 2024, according to data from SoSoValue. This marks a sharp rebound from the $902 million in outflows seen in the previous week.

The macro backdrop and growing expectations of additional Federal Reserve rate cuts have triggered a shift in sentiment, attracting renewed institutional investor demand and bringing BTC ETF inflows over the past 4 weeks to nearly $4 billion. At these levels, this could result in 100,000 BTC being pulled from circulation in Q4, more than double the issuance, creating a supply squeeze.

Citigroup projects that BTC will end the fourth quarter of this year around the 133k level, an all-time high. This would result in approximately 7% gains from its current price. Citibank sees the case for steady growth led by strong inflows into Bitcoin ETFs and rising allocation from treasuries.

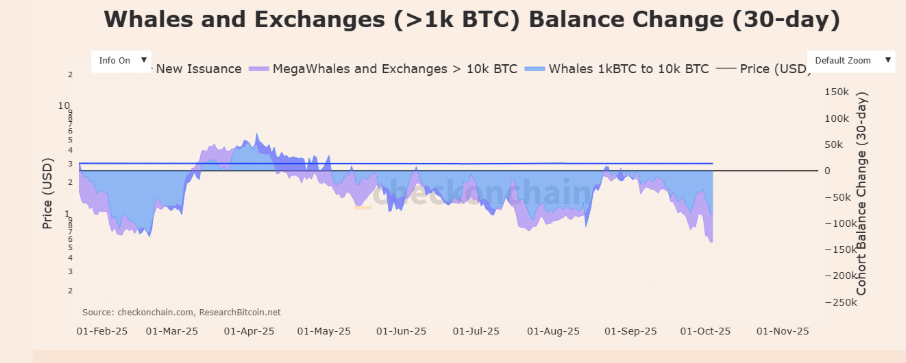

Whales are moving again

Whales are on the move again, aligning with one of the largest ETF buying weeks of the year for both Bitcoin and Ethereum.

On-chain tracker Lookonchain reported that newly created wallets have withdrawn massive amounts of BTC and ETH from major exchanges, indicating large-scale accumulation by whales. Checkonchain data showed MegaWhales Exchange Balance Change dropped to -54k BTC on October 4, and overall whale balances fell by 80BTC.

This signals that whales are withdrawing large amounts in a strong signal of accumulation and conviction. Historically, whale buying pressure has preceded intense upward pressure on the price.

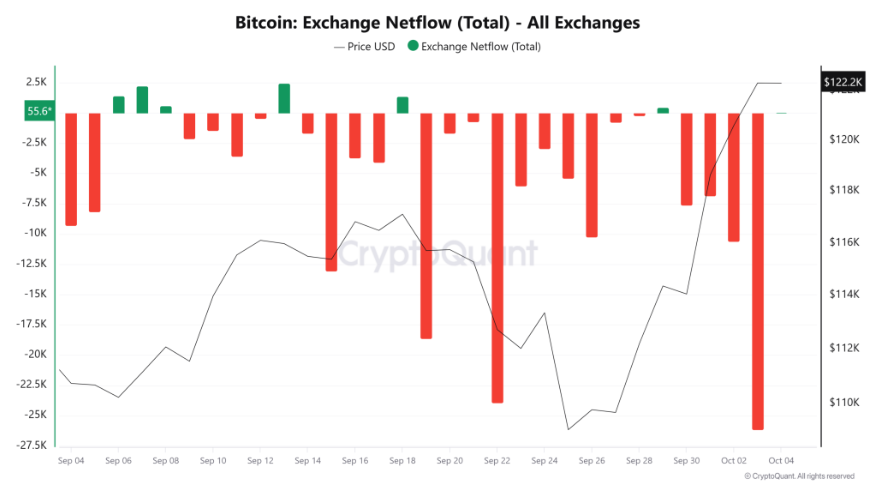

Bitcoin exchange balance falls to a 5-year low

Bitcoin exchange balances have declined to a 5-year low. Almost 170,000 BTC were removed from crypto exchanges over the past 30 days, with most of that activity coming in the last week. BTC exchange balance has fallen below 2.85 million for the first time since January 2021.

Historically, BTC inflows into exchanges have spiked when prices rebound as holders turn to profit-taking. However, this shift in behavior signals a change in market dynamics.

Over the past month, Exchange Netflow has remained mainly negative, with a notable drop of -26k BTC on 3rd October.

Consequently, the amount of BTC available for immediate selling has declined, reducing overall selling pressure.

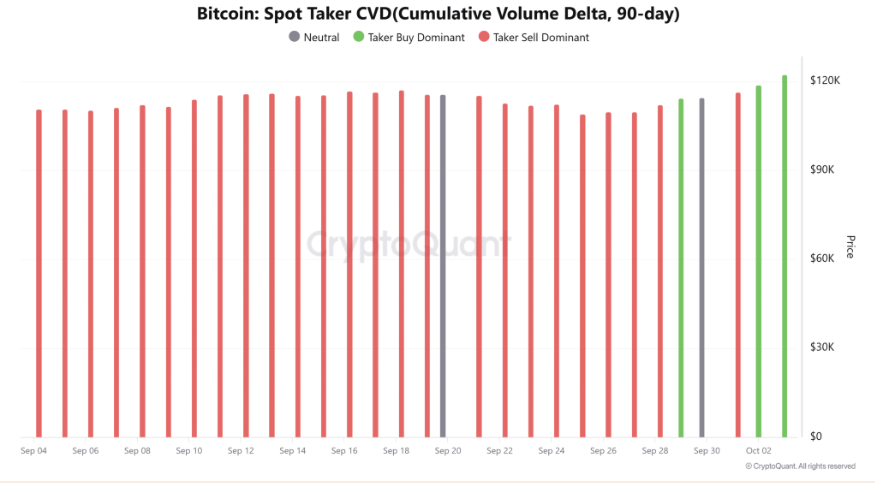

Furthermore, according to CryptoQuant data, for the first time in the past 30 days, Bitcoin Taker CVD has held a green position for two consecutive days. This suggests that buyers are dominating the spot market. When buyers dominate, they tend to withdraw assets and store them in private wallets or cold storage.

Over 99% of the Bitcoin supply is in profit

In just over a week, as a year, BTC climbed from 110k to 122k at the time of writing, and the supply in profit rose from 84% to over 99.5%, while also pushing above the short-term holder’s on-chain cost basis of 111k.

This represents the overwhelming profitability of holders across the network, and historically, this rare event has preceded a short-term correction. This could also be considered a cooling phase after a steep rise, followed by prices resetting to resume the upward trend.

Despite this potential for a pullback and the RSI also tipping into overbought territory, October is historically a bullish month for BTC, with typical gains of around 20%. Meanwhile, Q4 is typically the strongest quarter of the year. Bitcoin has gained in eight of the past 12 Q4s and 10 of the past 12 Octobers.

A meaningful rise above 125k could open the door to 150k round number. A break below 107k could create a lower low, altering the chart’s structure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.